Aurora Innovation, Inc. (AUR - Get Rating) in Pittsburgh, Pa., is a self-driving technology company that operates in the United States. The company is focused on the development of Aurora Driver, a platform that provides self-driving hardware, software, and data services to interoperate passenger and light commercial vehicles and trucks.

AUR signed up its third truckload carrier this year for the potential deployment of its technology. AUR collaborated with Covenant Logistics Group, Inc. (CVLG) after similar partnerships with Werner Enterprises, Inc. (WERN) in April and U.S. Xpress Enterprises, Inc. (USX) in February.

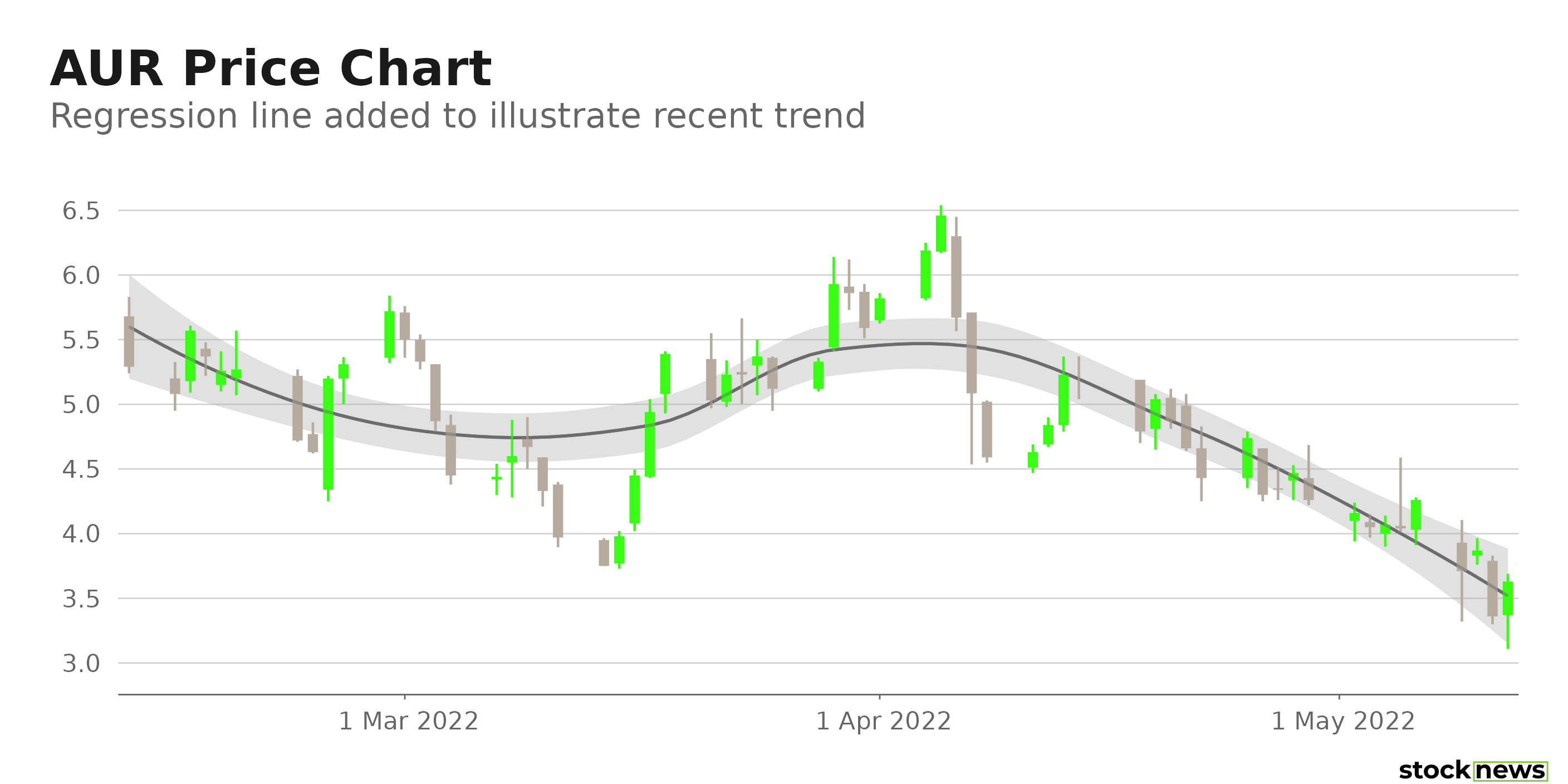

AUR’s stock has declined 70.2% in price year-to-date to close yesterday’s trading session at $3.36. The stock has declined 27.4% in price over the past month and 17.3% over the past five days.

Here are the factors that could affect AUR’s performance in the near term:

Stretched Valuations

In terms of its forward EV/Sales, AUR is currently trading at 64.69x, which is 4,033.1% higher than the 1.57x industry average. The stock’s 80.61 forward Price/Sales multiple is 6,432.3% higher than the 1.23 industry average.

Negative Profit Margins

AUR’s negative 271.61% trailing 12-month levered FCF margin is substantially lower than its 3.88% industry average.

The stock’s respective negative 33.75%, 13.61%, and 18.21% trailing 12-month ROE, ROTC, and ROA compare to their 14.30%, 7.19%, and 5.40% industry averages.

Bleak Analysts Expectations

The $48.62 million consensus revenue estimate for its fiscal year 2022 indicates a 41.1% year-over-year decrease. And the Street’s $2.80 million revenue estimate for its fiscal 2023 reflects a 94.2% decline from the prior year.

Furthermore, analysts expect its EPS to remain negative at least until next year (fiscal 2023).

POWR Ratings Reflect Bleak Prospects

AUR’s POWR Ratings reflect this bleak outlook. The stock has an overall F rating, which equates to a Strong Sell in our proprietary rating system. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

AUR has a Value grade of F, which is in sync with its lofty valuations. The stock has a D grade for Quality, which is consistent with its negative profit margins.

In the 80-stock, C-rated Technological – Services industry, it is ranked #77.

Click here to see the additional POWR Ratings for AUR (Growth, Momentum, Stability, and Sentiment).

View all the top stocks in the Technological – Services industry here.

Click here to checkout our Electric Vehicle Industry Report for 2022

Bottom Line

Its recent logistics partnerships might benefit AUR. However, analysts expect its top line to decline this year. Moreover, the stock looks overvalued at current prices. Also, considering its negative ROE, I think it might be wise to avoid the stock now.

How Does Aurora Innovation, Inc. (AUR) Stack Up Against its Peers?

While AUR has an overall POWR Rating of F, one might consider looking at its industry peers, PC Connection, Inc. (CNXN - Get Rating) and Fujitsu Limited (FJTSY - Get Rating), which have an overall A (Strong Buy) rating, and Serco Group plc (SCGPY - Get Rating) and NetScout Systems, Inc. (NTCT - Get Rating), which have an overall B (Buy) rating.

Want More Great Investing Ideas?

AUR shares were trading at $3.63 per share on Thursday afternoon, up $0.27 (+8.04%). Year-to-date, AUR has declined -67.76%, versus a -17.24% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| AUR | Get Rating | Get Rating | Get Rating |

| CNXN | Get Rating | Get Rating | Get Rating |

| FJTSY | Get Rating | Get Rating | Get Rating |

| SCGPY | Get Rating | Get Rating | Get Rating |

| NTCT | Get Rating | Get Rating | Get Rating |