Home improvement company Acuity Brands, Inc. (AYI) provides lighting and building management solutions through its two broad segments of Acuity Brands Lighting and Lighting Controls (ABL); and the Intelligent Spaces Group (ISG).

In April, the company announced a definitive agreement to acquire refrigeration control solutions provider KE2 Therm Solutions, Inc. The transaction is set to close this spring. The acquisition is expected to integrate into AYI’s Distech Controls and expand the company’s addressable market into commercial refrigeration.

Moreover, remodeling demand is brightening the prospects of the global home improvement services market, which is expected to grow from $324.8 billion in 2022 to $343.8 billion in 2023 at a more than 5% CAGR. Furthermore, the market is expected to grow to $423.9 billion in 2027.

Let’s look at the trend of some of its key financial metrics.

Analysis of Acuity Brands, Inc.’s Financial Growth

AYI’s net income had an overall positive trend, from $270.7 million on May 31, 2020, to $379.2 million on February 28, 2023. However, there were some fluctuations along the way.

Between May 2020 and August 2020, net income decreased from $270.7 million to $248.3 million; between November 2021 and February 2022, it increased from $250.9 million to $256.6 million; and between August 2022 and November 2022, it decreased from $380.4 million to $371.3 million. The growth rate of the series was roughly 40%.

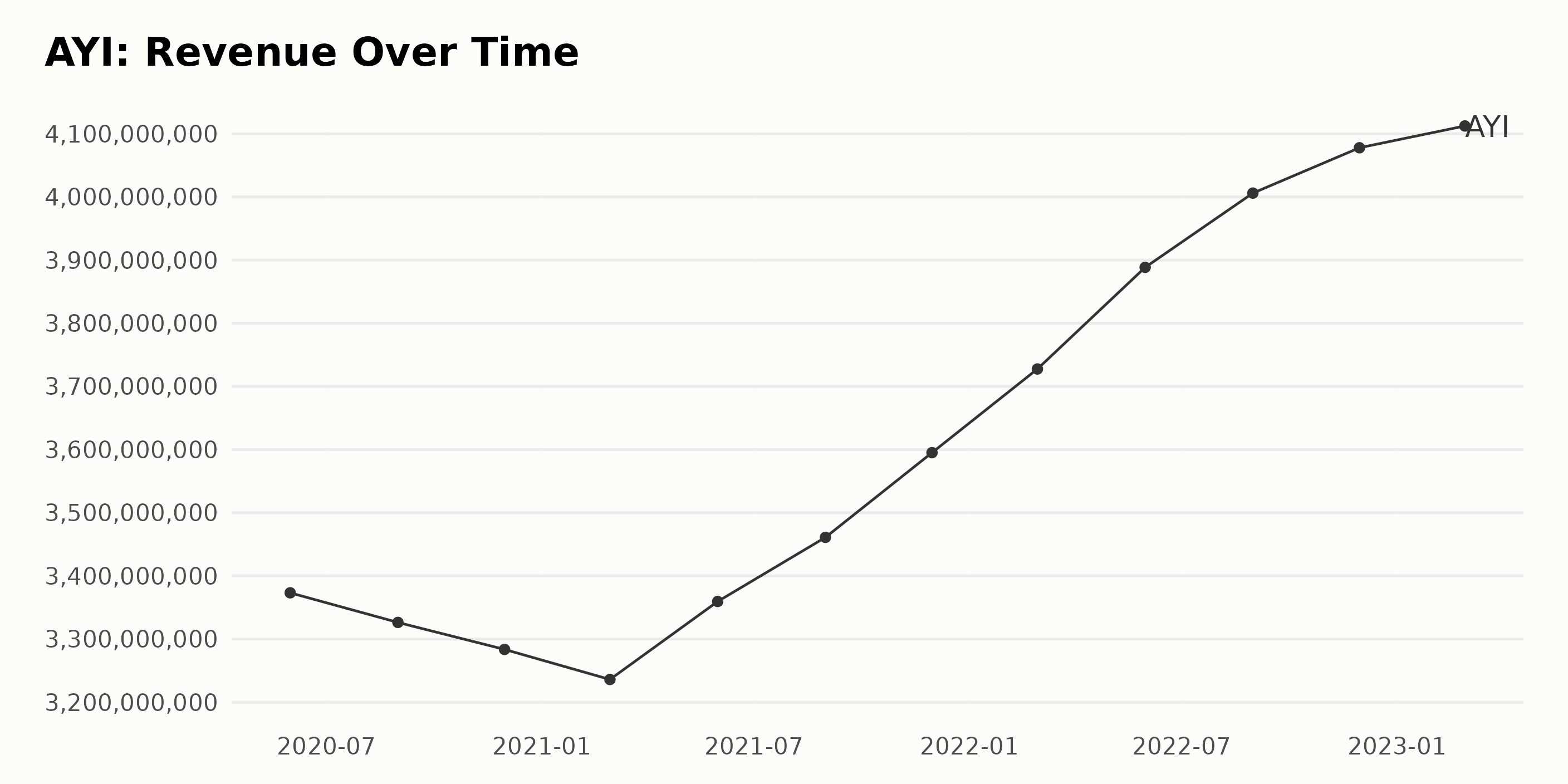

The series shows that AYI’s revenue has fluctuated over the past three years, with the trend being an overall increase. From May 2020 ($337.3 million) to February 2023 ($411.2 million), the total increase was 21.8%, with an average growth rate of 5.4% per year. The most recent value, from February 2023, was $411.2 million.

The gross margin of AYI has generally been trending upwards, increasing from 42.2% in May 2020 to a peak of 42.6% in August 2021. However, there have been some fluctuations along the way, with the value dropping to 41.9% in May 2022 before rising back to 42.1% in February 2023. On average, the gross margin has increased at a rate of 0.3%.

AYI’s ROA has seen an overall growth trend from May 2020 to February 2023. In May 2020, it was 0.081, and in February 2023, it had reached 0.109, a 33.3% increase in that time frame.

There were fluctuations during this period, with the ROA dropping from 0.081 to 0.073 between May 2020 and August 2020 while also increasing from 0.096 to 0.101 between February 2022 and May 2022.

Acuity Brands Inc. (AYI) Share Price Trends Downward

There appears to be a downward trend in the share price of AYI. The share price decreased from $190.22 on November 25, 2022, to $157.48 on May 17, 2023, representing a total decrease of approximately 17.4%. Here is a chart of AYI’s price over the past 180 days.

Evaluating Acuity Brands’ Quality, Value, and Growth

AYI has consistently earned an overall POWR Ratings grade of A, which translates to a Strong Buy, since November 2022. Its latest value is A, with a rank of #1 in the B-rated Home Improvement & Goods industry of stocks out of 56 total stocks.

The three most noteworthy dimensions for AYI are Quality, Value, and Growth. For the dates November 30, 2022, December 31, 2022, January 31, 2023, February 28, 2023, March 31, 2023, April 29, 2023, and May 17, 2023, the Quality rating remained consistently high at 99.

The Value rating rose slightly from 88 in November 2022 to 95 in May 2023, while the Growth rating fluctuated between 58 and 64. Overall, the POWR Ratings suggest strong results for AYI in terms of Quality and Value.

How does Acuity Brands Inc (Holding Company) (AYI) Stack Up Against its Peers?

Other stocks in the Home Improvement & Goods sector that may be worth considering are Bassett Furniture Industries, Incorporated (BSET), National Presto Industries, Inc. (NPK), and Flexsteel Industries, Inc. (FLXS). They also have an overall A (Strong Buy) rating.

The Bear Market is NOT Over…

That is why you need to discover this timely presentation with a trading plan and top picks from 40 year investment veteran Steve Reitmeister:

REVISED: 2023 Stock Market Outlook >

Want More Great Investing Ideas?

AYI shares were trading at $158.68 per share on Thursday afternoon, down $0.41 (-0.26%). Year-to-date, AYI has declined -4.04%, versus a 9.24% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| AYI | Get Rating | Get Rating | Get Rating |

| BSET | Get Rating | Get Rating | Get Rating |

| NPK | Get Rating | Get Rating | Get Rating |

| FLXS | Get Rating | Get Rating | Get Rating |