Aspen Technology (AZPN - Get Rating) in Bedford, Mass., is the leading global provider of asset optimization software. Its solutions address complex industrial situations where asset design, operation, and maintenance lifecycles must be optimized. The firm is well-positioned to benefit from its diverse product range, particularly its asset optimization and management software solutions, and Asset Performance Management suite.

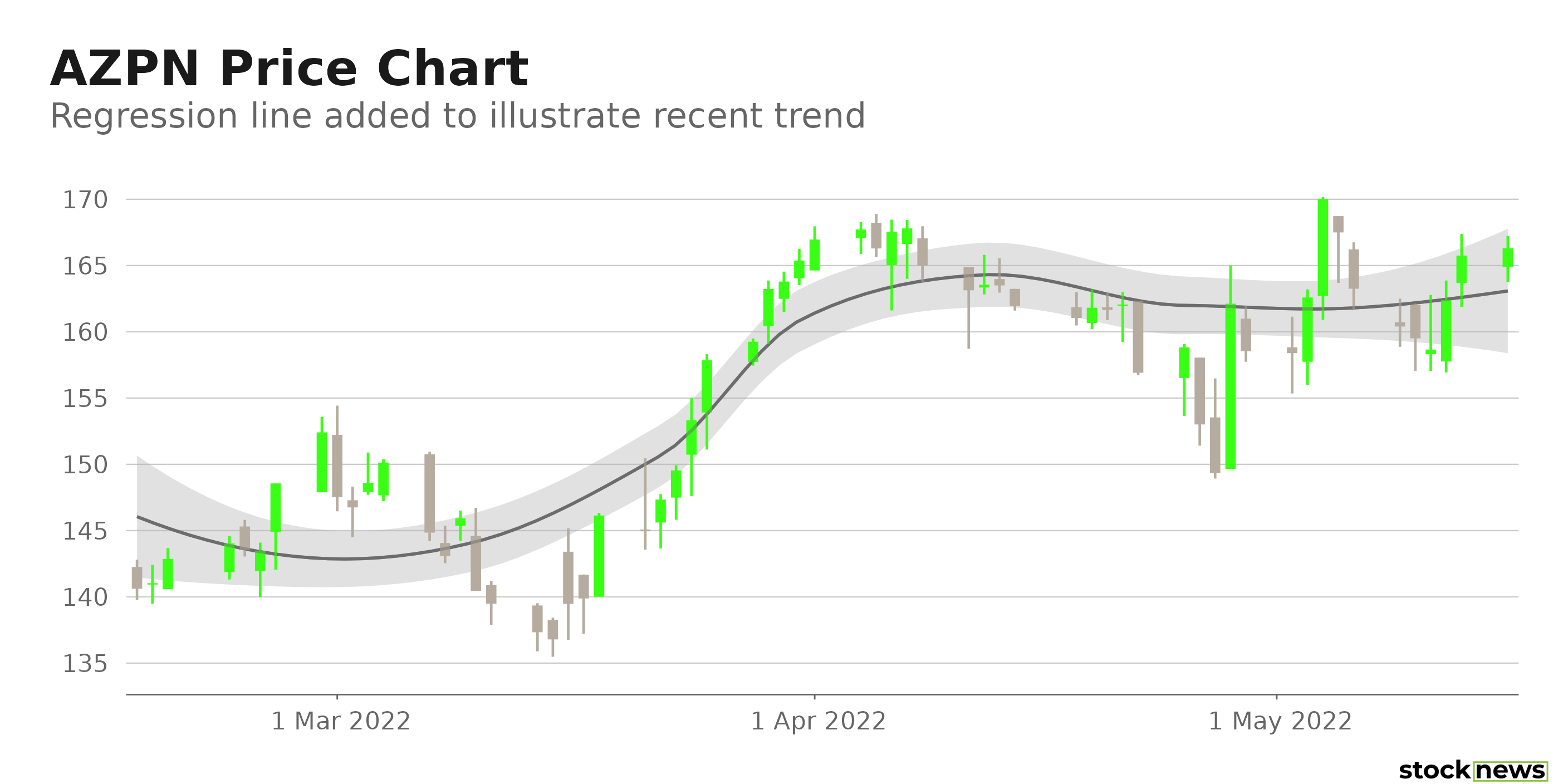

The stock has gained 13.9% in price over the past year and 18.3% over the past three months to close yesterday’s trading session at $166.30.

AZPN has raised its fiscal year 2022 projection due to its satisfactory performance in the first half of the year and strengthening demand patterns in key business segments.

Here is what could shape AZPN’s performance in the near term:

Strategic Collaborations

This month, AZPN announced the completion of its merger agreement with Emerson Electric Co. (EMR), which included the inclusion of AspenTech of Emerson’s OSI Inc. and Geological Simulation Software (GSS) businesses. Emerson has provided $6.0 billion in cash to AZPN as part of the transaction’s closure, which AZPN shareholders will receive in exchange for a 55% ownership in AZPN. Furthermore, Emerson and AZPN have formed a stronger commercial partnership, allowing AZPN to expand into new and existing markets.

Also, this month, AZPN announced the renewal of its 12-year partnership with St1 Refinery AB, a subsidiary of St1 Nordic Oy Group. The refinery in Gothenburg, Sweden, is using AspenTech solutions to deliver a vertically integrated set of production optimization solutions, ranging from operational planning to real-time management of essential equipment. This should allow for higher operating profits while improving energy efficiency and lowering CO2 emissions.

Robust Financials

During the third quarter, ended March 31, 2022, AZPN’s total revenue increased 15.4% year-over-year to $187.75 million. Its operating income increased 17.2% year-over-year to $80.76 million. The company’s net income grew 20.2% from its year-ago value to $75.12 million, while its EPS grew 23.1% from the prior-year quarter to $1.12.

Strong Profitability

AZPN’s 39.2% trailing-12-months net income margin is 596.9% higher than the 5.6% industry average. Also, its ROC, EBITDA margin, and ROA are 296.2%, 260.2%, and 459.2% higher than the respective industry averages. And its $258.27 million in cash from operations is 202.7% higher than the $85.32 million industry average.

Impressive Growth Prospects

The Street expects AZPN’s revenues and EPS to rise 5.5% and 4.6%, respectively, year-over-year to $748.06 million and $5.44 in its fiscal 2022. In addition, AZPN’s EPS is expected to rise at a 7.9% CAGR over the next five years. Also, the company has an impressive earnings surprise history; it topped the Street’s EPS estimates in three of the trailing four quarters.

POWR Ratings Reflect Solid Prospects

AZPN has an overall B rating, which equates to a Buy in our proprietary POWR Ratings system. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

Our proprietary rating system also evaluates each stock based on eight distinct categories. AZPN has an A grade for Quality and a B for Growth. Its solid earnings and revenue growth potential is consistent with the Quality and Growth grade.

Among the 157 stocks in the F-rated Software – Application industry, AZPN is ranked #33.

Beyond what I stated above, we have graded AZPN for Sentiment, Stability, Value, and Momentum. Get all AZPN ratings here.

Click here to check out our Software Industry Report for 2022

Bottom Line

AZPN’s merger with Emerson’s OSI Inc and the Geological Simulation Software business has boosted investor optimism surrounding the stock. In addition, given the favorable analysts’ ratings and the company’s strong profitability, the stock could deliver impressive gains in the near term. So, we think the stock could be a great bet now.

How Does Aspen Technology Inc. (AZPN) Stack Up Against its Peers?

AZPN has an overall POWR Rating of B, which equates to a Buy rating. Check out these other stocks within the same industry with A (Strong Buy) ratings: Commvault Systems Inc. (CVLT - Get Rating), Rimini Street Inc. (RMNI - Get Rating), and Enghouse Systems Limited (EGHSF - Get Rating).

What To Do Next?

If you would like to see more top growth stocks, then you should check out our free special report:

What makes them “MUST OWN“?

All 9 picks have strong fundamentals and are experiencing tremendous momentum. They also contain a winning blend of growth and value attributes that generates a catalyst for serious outperformance.

Even more important, each recently earned a Buy rating from our coveted POWR Ratings system where the A rated stocks have gained +48.22% a year.

Click below now to see these top performing stocks with exciting growth prospects:

Want More Great Investing Ideas?

AZPN shares were unchanged in premarket trading Tuesday. Year-to-date, AZPN has gained 9.26%, versus a -14.26% rise in the benchmark S&P 500 index during the same period.

About the Author: Pragya Pandey

Pragya is an equity research analyst and financial journalist with a passion for investing. In college she majored in finance and is currently pursuing the CFA program and is a Level II candidate. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| AZPN | Get Rating | Get Rating | Get Rating |

| CVLT | Get Rating | Get Rating | Get Rating |

| RMNI | Get Rating | Get Rating | Get Rating |

| EGHSF | Get Rating | Get Rating | Get Rating |