- A bearish trend since late October

- Where is Jack Ma?

- China feels empowered- No superstars other than President Xi

- Nationalization could be on the horizon

- BABA’s future transcends earnings and market share

Alibaba Group Holdings Limited (BABA) is the Amazon.com (AMZN) for the People’s Republic of China with a footprint worldwide. The company operates through four segments: Core Commerce, the e-commerce segment, Cloud Computing, Digital Media, Entertainment and Innovation Initiatives, and “Other.” As of the end of last week, BABA had a market cap of $672.804 billion. The stock trades on the NYSE and was trading at $243.46. AMZN had a $1.558 trillion market cap and was at $3,104.25 per share.

BABA faces unique problems as we head into 2021, and the trend in the shares has been bearish. BABA hit an all-time high in late October 2020 at $319.32. The shares were 23.8% below the high as of January 15. AMZN’s high was at $3,552.25 in early September and was trading 12.6% below its record high as of the end of last week. AMZN has outperformed BABA, and that trend is likely to continue for political rather than economic reasons.

A bearish trend since late October

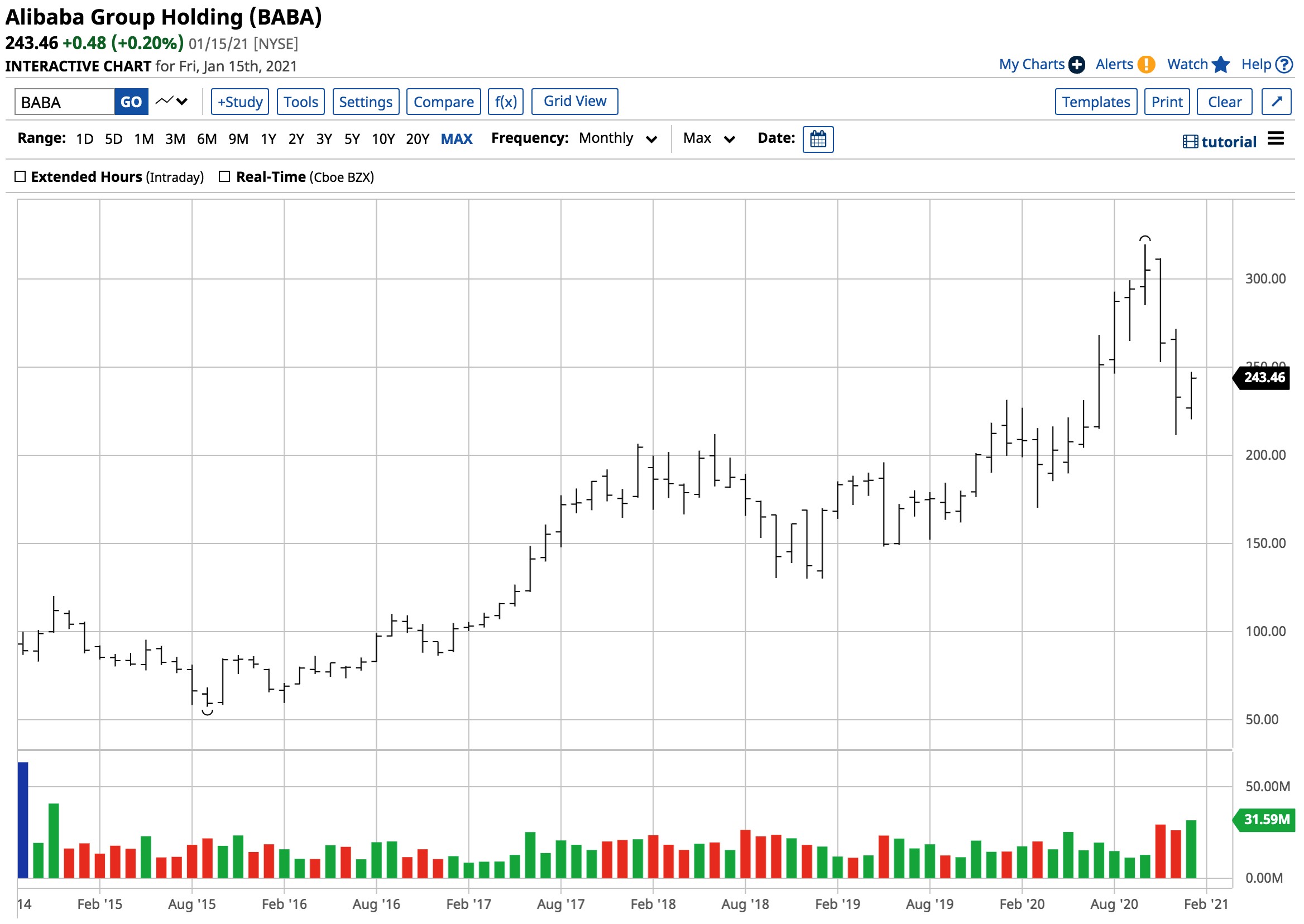

The bullish trend in BABA shares lasted from September 2015 through October 2020. The stock had an impressive run over the five years.

Source: Barchart

Source: Barchart

As the chart shows, after opening at $92.70 in September 2014, BABA shares fell to $57.20 one year later, in September 2015. The stock then made higher lows and higher highs, reaching the all-time peak of $319.32 last October. Since then, the technical trend has been lower.

Source: Barchart

Source: Barchart

The short-term chart shows that all rallies since late October have been selling opportunities at a time when US stocks continued to move to all-time highs.

Source: Barchart

Source: Barchart

The chart of the China Large-Cap iShares ETF product (FXI), which includes a 7.87% exposure to Alibaba Group, has outperformed BABA shares since late October. BABA reached its peak on October 27. FXI was trading at a high of $44.83 on the same day and was higher at the $48.62 level on January 15.

Where is Jack Ma?

Jack Ma is one of the wealthiest people in China. Mr. Ma is the founder of Alibaba Group. For a time, he was the richest man in the People’s Republic. Moreover, Jack Ma became an international superstar. The charismatic billionaire spoke his mind and pushed boundaries. He set an example for the 1.4 billion Chinese people that hard work can lead to success.

In October 2020, after departing BABA to start his next company, Mr. Ma was preparing to IPO Ant Group, a fintech company in what was to be the largest initial public offering in history. Ant Group was ready for a dual listing in Shanghai and Hong Kong. On October 24, 2020, Jack Ma told a group of elites gathered in Shanghai, “This is the largest listing ever priced in the history of the entire human race, and the pricing happened in a place other than New York City.”

In the weeks leading up to the October 24 speech, Jack Ma took on Chinese regulators questioning Ant’s listing. The billionaire accused China’s financial system as operating with a “pawnshop mentality” and said that the regulatory environment was trying to “use the way to manage a railway station to manage an airport.” After October 24, Jack Ma disappeared into thin air.

China feels empowered- No superstars other than President Xi

Jack Ma’s comments and resistance to the Chinese authorities’ regulation led to the Ant IPO suspension. The government cracked down on the activities of Alibaba. In an interview on FOX Business News on January 11, China expert and author of “The Coming Collapse of China,” Gordon Chang opined that Mr. Ma is likely under house arrest or detained in China.

Chang believes that Jack Ma will reappear after “embracing supervision” that includes self-confessions, a Chinese government tactic during the cultural revolution. When Ma emerges, he will likely convey a “reprogrammed message” for China and the world.

While wealthy technology entrepreneurs hold a glamorous status in the world’s most populous nation, the political ideology is that no one person or company is a superstar or as important as the Chinese Communist Party. The only acceptable superstar in China is the President and head of the party, President Xi.

The political discord in the United States is another tool to further the interests of the Chinese government. President Xi can point to the current turmoil in Washington DC and cities across the US as a reason why Democracy is failing, and the Chinese system will survive and thrive over the coming years.

Nationalization could be on the horizon

One of the issues weighing on BABA shares is the potential for the business’s nationalization. In China, ideology comes before individual business success. Moreover, the Chinese government is not blind to the incredible influence of US technology leaders. In many ways, companies like Facebook (FB), Twitter (TWTR), Alphabet (GOOG), Apple (AAPL), and a handful of others have become the fourth branch of government making policy decisions that impact political thought and events.

The Chinese likely view entrepreneurs like Jack Ma as a threat to their power and control for the coming years. Putting a leash on their activities could include ideological regulations that walk a fine line, limiting individual success while encouraging earnings and profitability for the government’s benefit.

BABA’s future transcends earnings and market share

Jack Ma’s disappearance sends a signal about the Chinese government’s intentions. Over the past months, Mr. Ma lost his position as China’s wealthiest person to Zhong Shanshan, a bottled water and vaccine tycoon. China will continue to celebrate individual wealth and success so long as it does not threaten its ideology and plans.

When it comes to BABA shares, the company Jack Ma founded became a Chinese and international superstar. The government of the world’s most populous nation will gladly undercut BABA’s future if it perceives it as a threat to its power. China is going to school on events in the United States. Government intervention is the issue when it comes to Alibaba’s future earnings and market share. Equity holders come last during bankruptcy proceedings. BABA could continue as China’s leading e-commerce business, but that does not guarantee that stockholders will profit, creating a fundamental flaw for the company from a capitalist perspective.

Want More Great Investing Ideas?

9 “MUST OWN” Growth Stocks for 2021

Is This ANOTHER Stock Market Bubble?

7 Best ETFs for the NEXT Bull Market

5 WINNING Stocks Chart Patterns

BABA shares rose $6.53 (+2.68%) in premarket trading Tuesday. Year-to-date, BABA has gained 7.49%, versus a 1.17% rise in the benchmark S&P 500 index during the same period.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| BABA | Get Rating | Get Rating | Get Rating |

| AMZN | Get Rating | Get Rating | Get Rating |

| FXI | Get Rating | Get Rating | Get Rating |