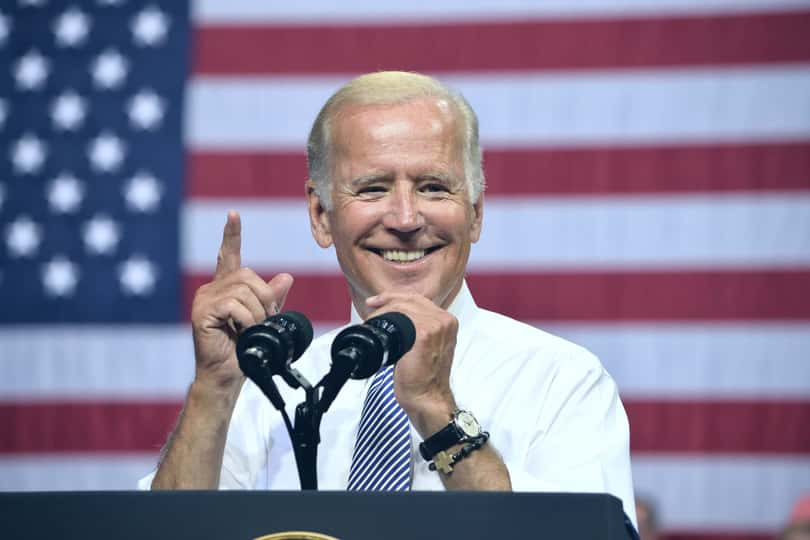

The incoming Biden presidential administration plans to spend $2 trillion on its proposed infrastructure plan that is designed to address climate change while building a new, eco-friendly infrastructure — ranging from transportation to energy. Biden’s policies are expected to incentivize the private sector to accelerate plans to cut carbon emissions and by so doing boost metals prices in the coming months.

According to Moody’s, Biden’s plan — which includes investments in education, social safety net, healthcare, clean energy, and infrastructure — would result in average annual gross domestic product (GDP) growth of 4.2% between 2020 and 2024, and 2.9% between 2020 and 2030. The plan is also expected to achieve an unemployment rate of 4.1% by 2022, significantly lower than the prevailing 6.9% rate.

BHP Group (BHP), Caterpillar Inc. (CAT), Rio Tinto Group (RIO) and United States Steel Corporation (X) have started to see modest improvements in their production volumes amid the growing optimism around the potential of Biden’s proposals. With an expected V-shaped economic recovery this year, these stocks should be solid bets right now we think.

BHP Group (BHP)

BHP is a global resources company and producer of various commodities, including iron ore, metallurgical coal, copper, and uranium. Its businesses include Minerals Australia, Minerals Americas, Petroleum, and Marketing. The Company manages product distribution through its global logistics chain, including freight and pipeline transportation.

Last November BHP completed the acquisition of an additional working interest in Shenzi from Hess Corporation (Hess) for US$505 million, bringing its total interest to 72%. The acquisition is consistent with its strategy of targeting counter-cyclical acquisitions in high-quality producing assets and will add more than approximately 11,000 barrels of oil equivalent production per day.

Earlier this month, BHP and Toyota Australia entered a partnership for a Light Electric Vehicle trial to reduce the emissions intensity of its light vehicle fleet. This partnership will reduce BHP’s dependence on diesel and will help the company achieve its medium-term target of reducing operational emissions by 30% by 2030.

Despite supply chain disruptions, BHP has continued to operate through the pandemic and deliver strong results. The company has started its latest financial year with a strong first quarter of safety and production performance driven by solid results in metallurgical coal and iron ore. Total metallurgical coal production has increased 4% year-over-year to 10 million tons in the first quarter ended September 30, 2020. Its total iron ore production has risen 8% from the year-ago to 66 million tons over the same period.

Analysts expect BHP’s EPS to grow at a rate of 5.3% per year over the next five years. The stock has gained 40% over the past six months.

How does BHP stack up for the POWR Ratings?

A for Trade Grade

A for Buy & Hold Grade

B for Peer Grade

A for Industry Rank

A for Overall POWR Rating

The stock is also ranked #1 of 40 stocks in the Industrial – Metals Industry.

Caterpillar Inc. (CAT)

CAT is a leading manufacturer of construction and mining equipment, diesel and natural gas engines, industrial gas turbines and diesel-electric locomotives. The Company operates through five segments: Construction Industries, Resource Industries, Energy & Transportation, Financial Products, and other operating segments.

CAT signed an agreement to acquire the Oil & Gas Division of the Weir Group PLC in October for $405 million in cash. The acquisition is in sync with CAT’s strategy to invest for long-term, profitable growth and will expand its offerings to one of the broadest product lines in the well service industry.

In November, CAT was named to the 2020 Dow Jones Sustainability Indices (DJSI), including both the World and North America indices, for the 21st time. This recognizes the company’s sustainable business practices in cultivating a comfortable workplace, understanding customer needs, and innovation to develop new and improved products.

Though CAT saw a decrease in revenues in the third quarter (ended September 30, 2020), the company has been successful in addressing key customer challenges from COVID-19 and has seen a modest improvement versus second quarter 2020 for most key business drivers. CAT’s operating profit has increased 25.6% sequentially to $985 million in the third quarter. Its EPS rose 46.4% sequentially to $1.23 over the same period.

Analysts expect CAT’s revenues to grow slightly year-over-year to $10.72 billion in the current quarter ending March 31, 2021. The consensus EPS estimate of $1.70 for the current quarter represents a 6.25% improvement year-over-year. The company has an impressive earnings surprise history; it beat the Street’s EPS estimates in three of the trailing four quarters. The stock has gained 50% over the past six months.

It is no surprise that CAT is rated “Strong Buy” with an “A” for Trade Grade, Buy & Hold Grade, Peer Grade, and Industry Rank. It is currently ranked #2 of 88 stocks in the Industrial – Machinery Industry.

Rio Tinto Group (RIO)

RIO is a company focused on the mining and processing of mineral resources. Its segments include Iron Ore, Aluminum, Copper & Diamonds, Energy & Minerals, and Other Operations.

In mid-December , RIO unveiled a pathway for the ongoing development of the underground project at Oyu Tolgoi in Mongolia, one of the largest known copper and gold deposits in the world. This plan is supposed to bring the underground project into production, following which Oyu Tolgoi is expected to produce 480,000 tons of copper per year.

RIO has entered into a new electricity agreement with Meridian Energy that will allow New Zealand’s Aluminum Smelter (NZAS) (a RIO joint venture) to continue operating the Tiwai Point aluminum smelter until 2024. This agreement improves Tiwai Point’s competitive position and provides RIO and other stakeholders more time to plan.

COVID-19 continues to present additional challenges, which are being proactively managed by RIO’s resilient workforce. Total Bauxite production has increased 5% year-over-year to 14.50 million tons in the third quarter ended September 30, 2020. Total Aluminum production has risen 1% from the year-ago to 0.80 million tons over the same period.

Analysts expect RIO’s revenues to grow slightly year-over-year to $43.73 billion for the about-to-be-reported year ended December 31, 2020. The consensus EPS estimate of $7.18 for the fiscal 2020 indicates a 12.9% improvement. The stock has gained 39.5% over the past six months.

RIO’s POWR Ratings reflect this promising outlook. It has an overall rating of “Strong Buy” with an “A” for Trade Grade, Industry Rank, and Buy & Hold Grade; and a “B” for Peer Grade. Among the 40 stocks in the Industrial – Metals Industry, it is ranked #2.

United States Steel Corporation (X)

X, a Fortune 250 company, and leading integrated steel producer is engaged in producing flat-rolled and tubular products with production operations primarily in North America and Europe. The Company operates through three segments: Flat-Rolled Products (Flat-Rolled), US Steel Europe (USSE), and Tubular Products (Tubular). It also provides railroad and real estate services.

In December, X acquired the remaining equity of Big River Steel for approximately $774 million in cash. This acquisition will provide X with a unique value proposition: differentiated, high-performance, environmentally sustainable steel solutions.

On December 24, X announced the strategic sale of its non-core real estate asset, the Keystone Industrial Port Complex (KIPC) in Pennsylvania, for approximately $160 million in cash. The proceeds from this transaction will further enhance X’s strong cash position and help it offer customers innovative steel products through environmentally sustainable and efficient mini mill processes.

X’s net sales have increased 15.9% sequentially to $2.34 billion in the third quarter (ended September 30, 2020). Its adjusted EBITDA has improved 81.4% sequentially over the same period, while its adjusted EPS has improved 54.7% sequentially.

Analysts expect X’s revenues to grow 5.4% year-over-year to $2.90 billion in the current quarter ending March 31, 2021. The consensus EPS estimate of $0.42 for the current quarter indicates a 157.5% improvement year-over-year. The company has an impressive earnings surprise history; it beat the Street’s EPS estimates in each of the trailing four quarters. The stock has gained 209.6% over the past six months.

X is rated a “Buy” in our POWR Ratings system. It has an “A” for Trade Grade and Industry Rank; and a “B” for Buy & Hold Grade and Peer Grade. In 38-stock Steel Industry, it is ranked #18.

Want More Great Investing Ideas?

9 “MUST OWN” Growth Stocks for 2021

Is This ANOTHER Stock Market Bubble?

7 Best ETFs for the NEXT Bull Market

5 WINNING Stocks Chart Patterns

BHP shares were trading at $70.61 per share on Friday afternoon, down $3.27 (-4.43%). Year-to-date, BHP has gained 8.07%, versus a 0.49% rise in the benchmark S&P 500 index during the same period.

About the Author: Rishab Dugar

Rishab is a financial journalist and investment analyst. His investment approach is to focus on quality stocks, trading at low prices, with business models that he readily understands. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| BHP | Get Rating | Get Rating | Get Rating |

| CAT | Get Rating | Get Rating | Get Rating |

| RIO | Get Rating | Get Rating | Get Rating |

| X | Get Rating | Get Rating | Get Rating |