Headquartered in Westborough, Mass., BJ’s Wholesale Club Holdings Inc. (BJ - Get Rating) is a major operator of membership warehouse clubs in the Eastern United States. The company currently operates 227 clubs and 156 BJ’s Gas locations in 17 states.

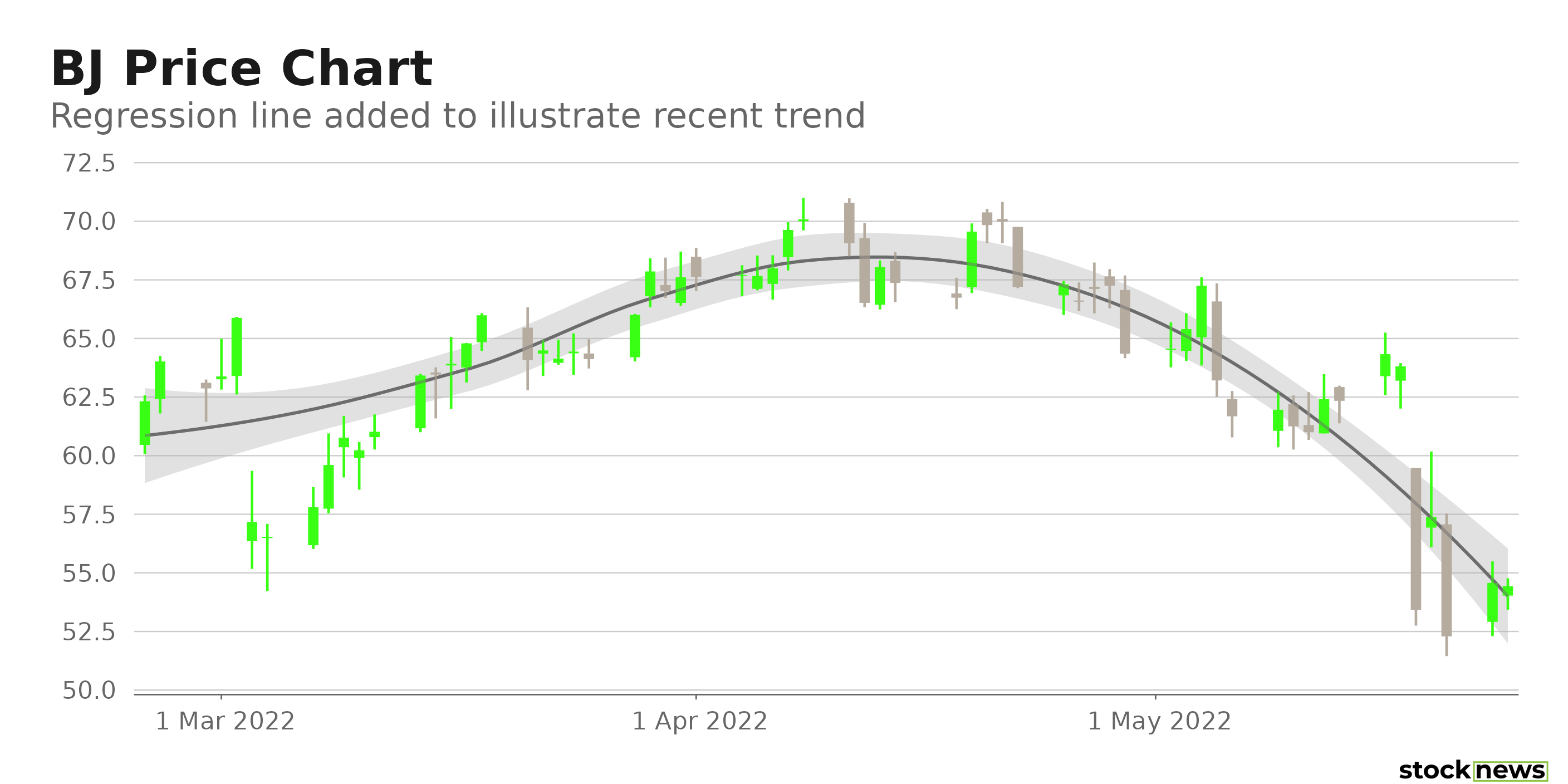

The company’s shares have gained 22.2% in price over the past year to close its last trading session at $54.43.

Gasoline costs are skyrocketing. And with inflation increasing the cost of everything, consumers are becoming more selective about where and how they spend their money. This is a favorable economic environment for warehouse clubs like BJ, which offer users discounted prices on larger-scale purchases and gasoline for their automobiles in exchange for membership fees.

Here is what could shape BJ’s performance in the near term:

Recent Developments

On April 8, 2022, BJ inaugurated its newest club in Ross Township, Pa., The new club will include a BJ’s Gas station and will provide members with everyday cheap fuel prices and the option to earn additional savings via BJ’s Fuel Saver Program. In the township of Ross, BJ’s Gas facility is the company’s 158th and has 12 fueling stations with normal, premium, and diesel fuels.

In March, BJ announced the implementation of Same-Day Select, a Membership add-on to its famous Same-Day Delivery service, throughout the entire chain. BJ’s Same-Day Select is an upgrade option for BJ’s Wholesale Club members that allows them to pay a one-time charge for either unlimited or a predetermined number of same-day grocery delivery in as little as two hours.

Strategic Partnerships

BJ’s has agreed to a collaboration with DoorDash (DASH), a local commerce platform, to provide on-demand grocery delivery from 226 BJ’s stores in 17 states. BJ is the first wholesale club to join the DoorDash marketplace, giving customers on-demand access to home basics and shopping requirements. With this collaboration, BJ’s products may be ordered directly through the DoorDash app, providing members and non-members alike with on-demand access to thousands of BJ’s items. BJ’s Wholesale Club members can also attach their wholesale club card to enjoy member-only rates.

Robust Financials

During the first quarter, ended March 31, 2022, BJ’s total revenue increased 16.2% year-over-year to $4.49 billion. Its operating income increased 19.1% year-over-year to $150.31 million. And the company’s net income grew 37.8% from its year-ago value to $112.45 million, while its EPS grew 38.9% from the prior-year quarter to $0.82.

Impressive Growth Prospects

The Street expects BJ’s revenues and EPS to rise 9.5% and 1.8%, respectively, year-over-year to $18.25 billion and $3.31 in its fiscal 2022. In addition, BJ’s EPS is expected to rise at a 6.5% CAGR over the next five years. Furthermore, the company has an impressive earnings surprise history; it topped the Street’s EPS estimates in each of the trailing four quarters.

Discounted Valuation

In terms of forward non-GAAP P/E, the stock is currently trading at 16.51x, which is 6.5% lower than the 17.66x industry average. Also, its 0.55x forward EV/Sales is 68.5% lower than the 1.75x industry average. Furthermore, BJ’s 0.40x forward Price/Sales is 65.5% lower than the 1.16x industry average.

Consensus Rating and Price Target Indicate Potential Upside

Among the 18 Wall Street analysts that rated BJ, 11 rated it Buy, and six rated it Hold. The 12-month median price target of $69.25 indicates a 27.2% potential upside. The price targets range from a low of $56.00 to a high of $86.28.

POWR Ratings Reflect Solid Prospects

BJ has an overall B grade, which equates to a Buy rating in our proprietary POWR Ratings system. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

Our proprietary rating system also evaluates each stock based on eight distinct categories. BJ has a B grade for Growth and Value. BJ’s solid earnings and revenue growth potential is consistent with the Growth grade. In addition, the company’s lower-than-industry multiples are in sync with the Value grade.

Of the BJ stocks in the A-rated Grocery/Big Box Retailers industry, BJ is ranked #16.

Beyond what I stated above, we have graded BJ for Sentiment, Stability, Quality, and Momentum. Get all BJ ratings here.

Bottom Line

With robust financial performance in its last reported quarter, BJ is well-positioned to capitalize on growing industry trends and other macroeconomic factors. In addition, given favorable analysts’ price targets and its impressive growth potential, we think the stock could be a great bet now.

How Does BJ’s Wholesale Club Holdings Inc. (BJ) Stack Up Against its Peers?

BJ has an overall POWR Rating of B, which equates to a Buy rating. Check out these other stocks within the same industry with A (Strong Buy) ratings: Natural Grocers by Vitamin Cottage Inc. (HGVC), Ingles Market Inc. (IMKTA - Get Rating), and Albertsons Companies Inc. (ACI - Get Rating).

Want More Great Investing Ideas?

BJ shares fell $0.43 (-0.79%) in premarket trading Wednesday. Year-to-date, BJ has declined -18.72%, versus a -16.81% rise in the benchmark S&P 500 index during the same period.

About the Author: Pragya Pandey

Pragya is an equity research analyst and financial journalist with a passion for investing. In college she majored in finance and is currently pursuing the CFA program and is a Level II candidate. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| BJ | Get Rating | Get Rating | Get Rating |

| Get Rating | Get Rating | Get Rating | |

| IMKTA | Get Rating | Get Rating | Get Rating |

| ACI | Get Rating | Get Rating | Get Rating |