Shares of Booking Holdings Inc. (BKNG - Get Rating) reached a 52-week high of $2,721.85 on April 18, indicating considerable strength in the stock. On top of that, BKNG has been trading well above its 50-day and 200-day moving averages, further indicating an upward trend. The company has had several recent quarters of beating earnings estimates and is projected to follow this trend in its upcoming report on May 4.

BKNG has an overall rating of B, translating to a Buy in our POWR Ratings system. In order to better understand the factors driving BKNG’s success, let’s look at some of its key metrics.

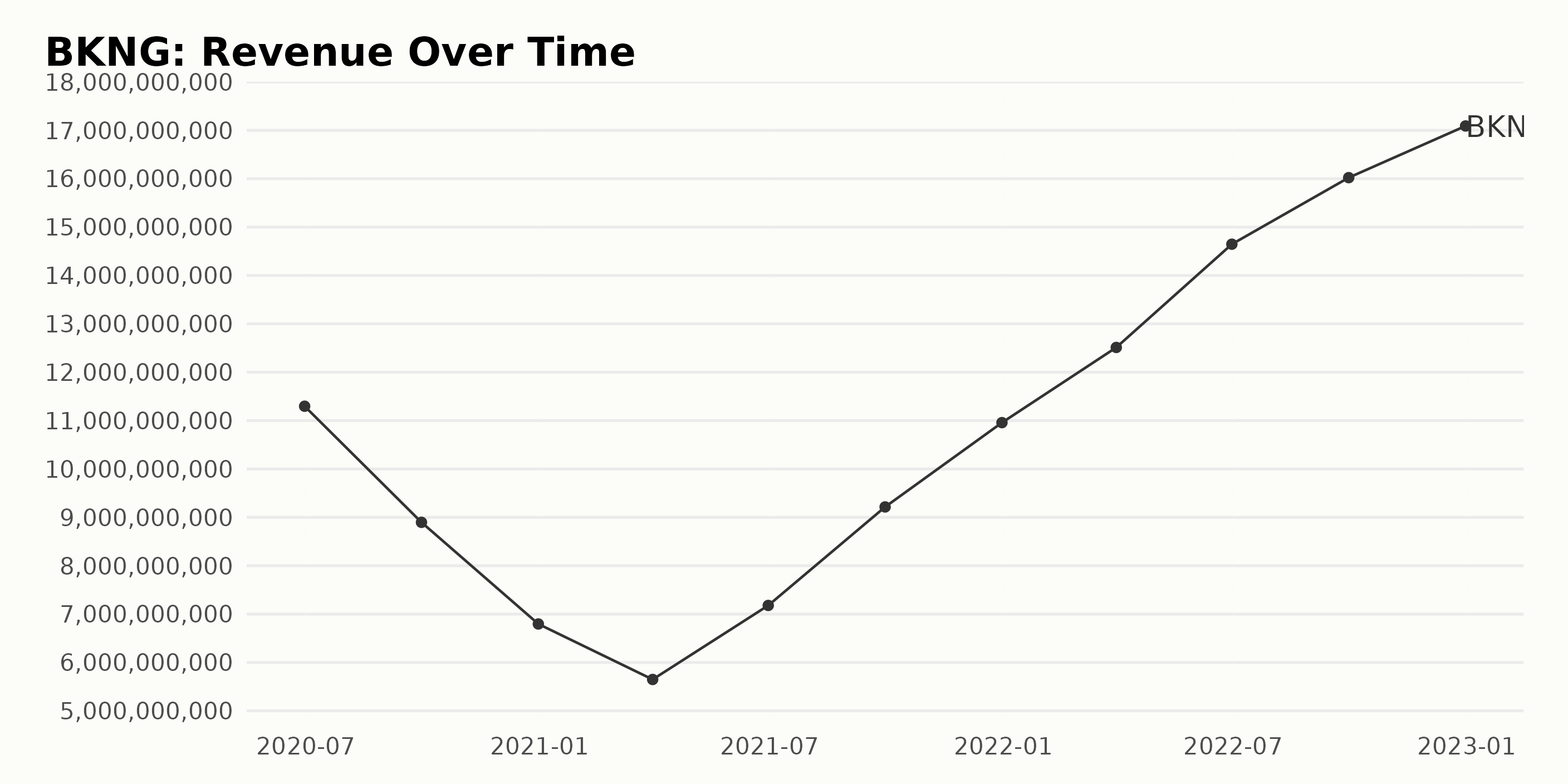

Tracking BKNG’s Growth

The revenue for BKNG has exhibited an overall upward trend from $11.30 billion in June 2020 to $17.09 billion in December 2022, demonstrating an overall growth rate of 52%. In this period, there have been some significant fluctuations in revenue, with a peak of $14.65 billion in June 2022 and a low of $5.65 billion in March 2021.

BKNG Stock Price: Surging Trend Over 180 Days

The share price of BKNG has been increasing over the timespan. Between October 28, 2022, and April 20, 2023, the share price grew by a factor of 1.45, increasing from $1,845.42 to $2,681.46. This is an accelerating trend as the growth rate increases over time. Here is a chart of BKNG’s price over the past 180 days.

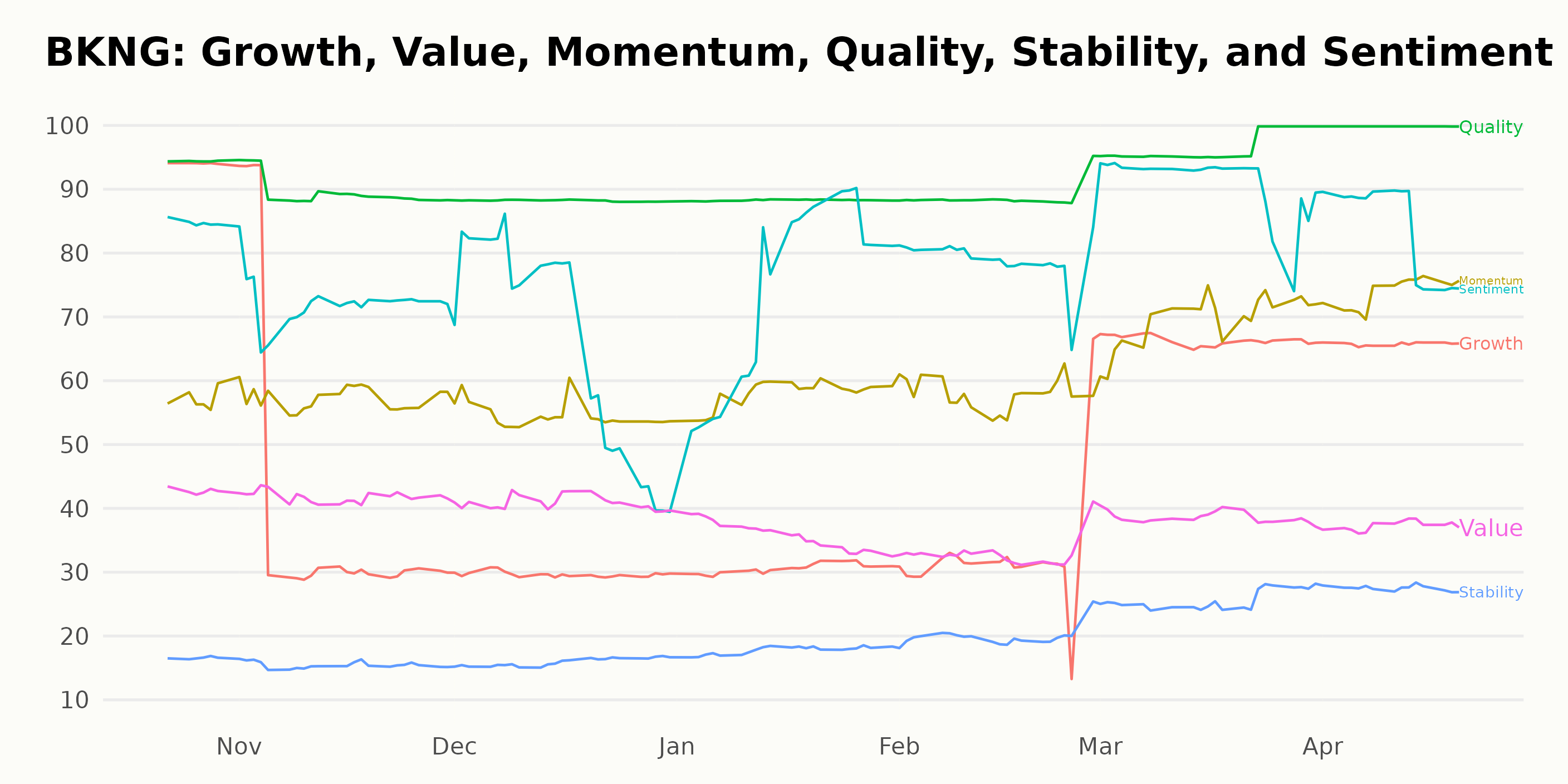

BKNG POWR Ratings: Quality, Growth, and Momentum Rise

The Buy-rated stock ranks well in its category of 60 Internet stocks. Specifically, BKNG ranks 11 within its category, which is considered a relatively good score.

The POWR Ratings for BKNG show that the three highest-rated dimensions were Quality, Growth, and Momentum, with values of 94, 66, and 74, respectively, as of April 20, 2023. All three of these dimensions had a clear upward trend throughout the period observed. Sentiment also showed an upward trend, but with a lower rating at 84, while Value and Stability declined overall during the same period, with Value falling from 43 to 37.

How Does Booking Holdings Inc. (BKNG) Stack Up Against Its Peers?

Other stocks in the Internet sector that may be worth considering are Travelzoo (TZOO - Get Rating), trivago N.V. (TRVG - Get Rating), and Despegar.com Corp. (DESP - Get Rating) — they have better POWR Ratings.

Discover 10 widely held stocks that our proprietary model shows have tremendous downside potential. Please make sure none of these “death trap” stocks are lurking in your portfolio:

Want More Great Investing Ideas?

BKNG shares were trading at $2,689.98 per share on Thursday afternoon, up $13.70 (+0.51%). Year-to-date, BKNG has gained 33.48%, versus a 8.50% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| BKNG | Get Rating | Get Rating | Get Rating |

| TZOO | Get Rating | Get Rating | Get Rating |

| TRVG | Get Rating | Get Rating | Get Rating |

| DESP | Get Rating | Get Rating | Get Rating |