Biopharmaceutical company Catalyst Pharmaceuticals, Inc. (CPRX - Get Rating) develops and commercializes therapies for people with rare debilitating, chronic neuromuscular and neurological diseases. The company’s offerings include Firdapse to treat Lambert-Eaton Myasthenic Syndrome (LEMS) patients.

For the fiscal first quarter (ended March 31, 2023), CPRX’s EPS increased by a robust 117% year-over-year to $0.26. However, it missed the consensus EPS estimate by 19.3%.

Moreover, the company’s shares declined 31.7% over the past month to close the last trading session at $11.86, below the 50-day moving average of $15.04 and 200-day moving average of $15.39.

Let’s look at the trends of some of its key financial metrics to understand why it could be wise to wait for a better entry point in the stock.

Analysis of CPRX’s Financials

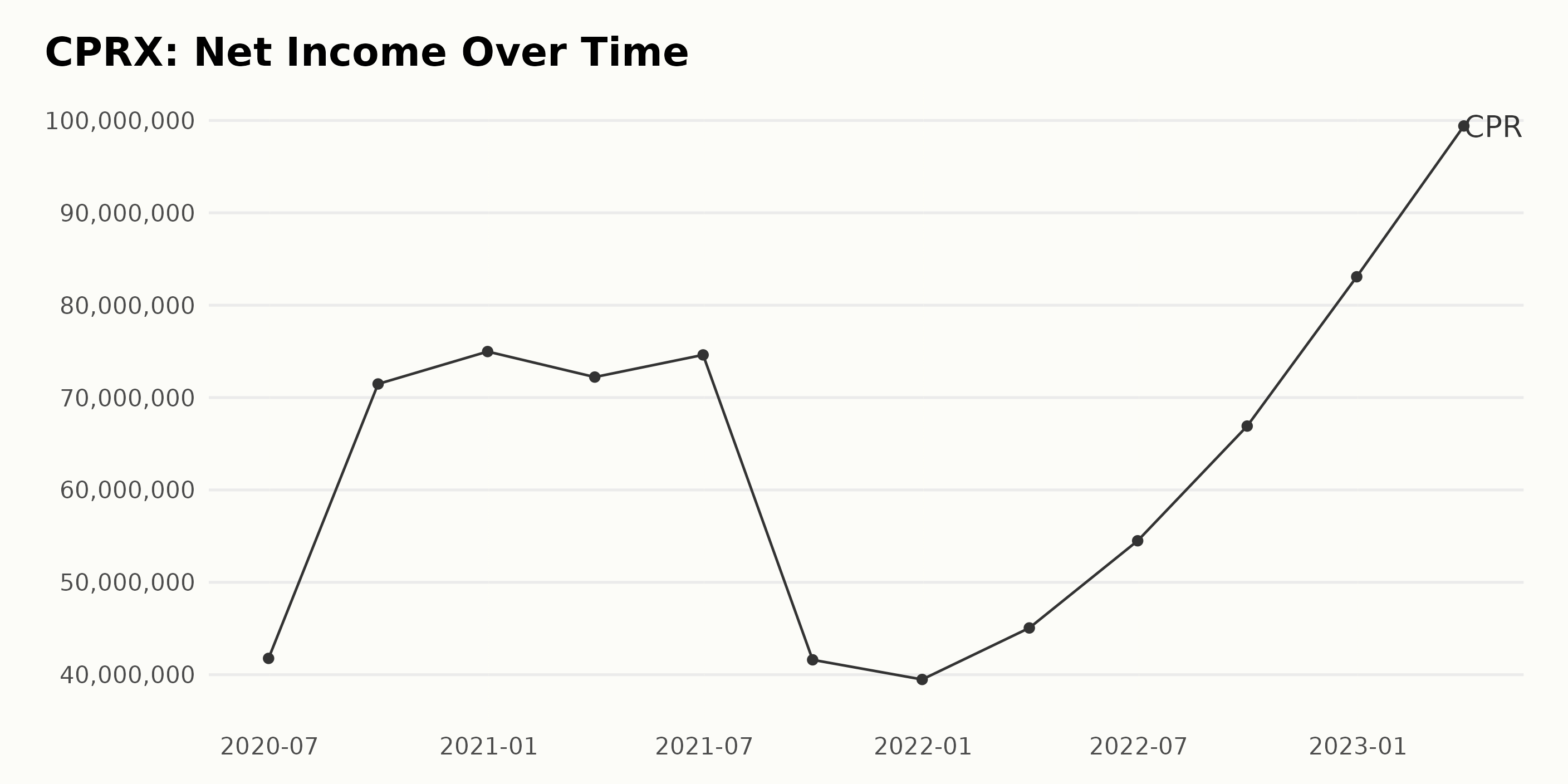

CPRX’s net income increased from June 2020 to March 2023, with a peak of $99.41 million in March 2023. From June 2020 to March 2021, net income rose from $4.18 million to $7.49 million, or an increase of 79%.

Additionally, there was a brief dip in September 2021, with net income falling to $4.16 million but increasing again in December 2021 and reaching $9.95 million by March 2023.

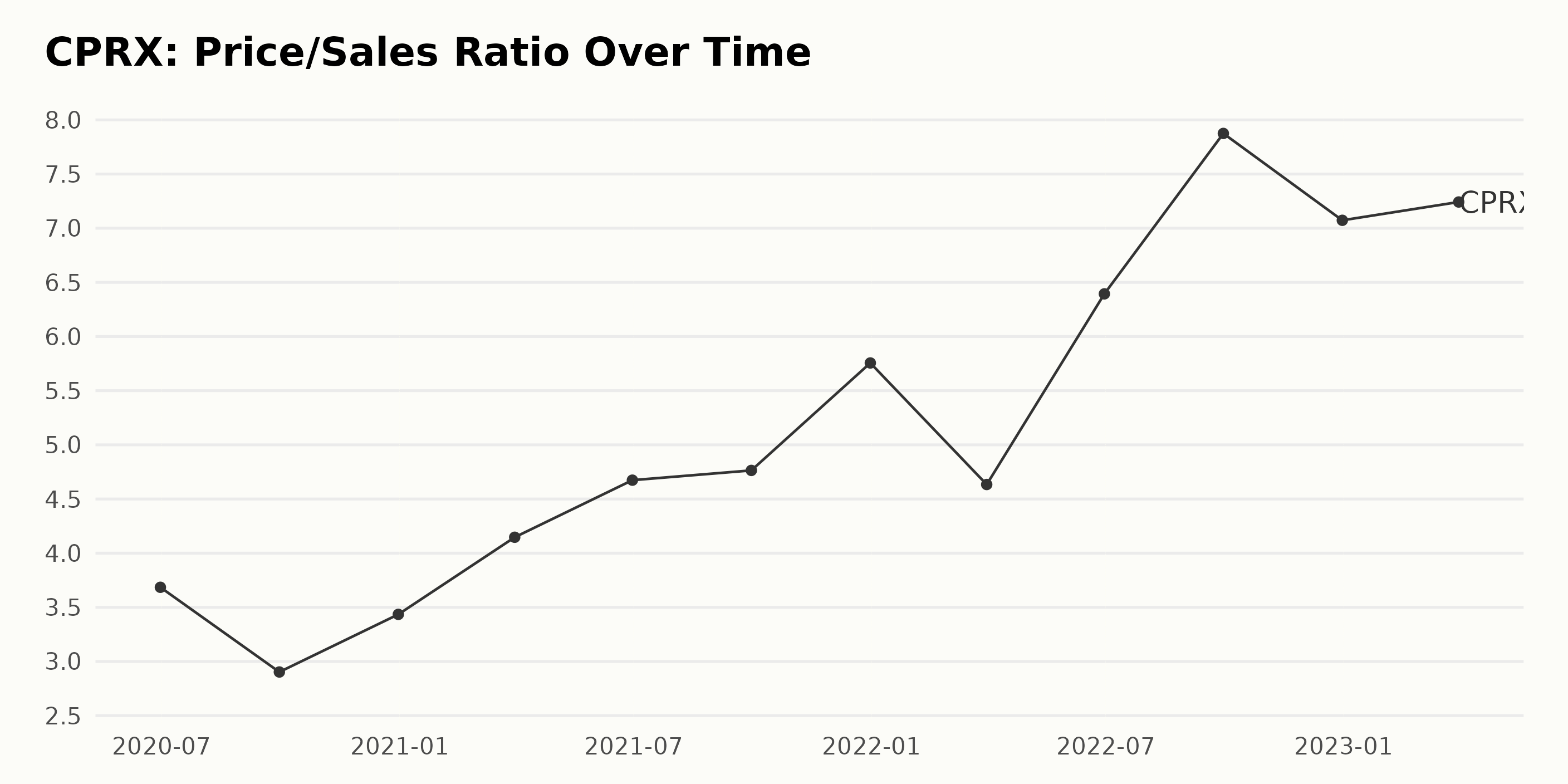

The reported Price/Sales ratio (P/S) of CPRX has been fluctuating primarily since June 2020. The most recent data point revealed a P/S of 7.24 on March 31, 2023, representing an increase of 90% compared to the first value recorded in June 2020 (3.68).

The data series has had numerous fluctuations, with the largest increase occurring in September 2022, from 4.63 to 7.88. However, there have also been decreases, such as the one seen between September 2020 and December 2020, from 2.9 to 3.43. In conclusion, the P/S of CPRX is increasing, however, with fluctuations that vary over time.

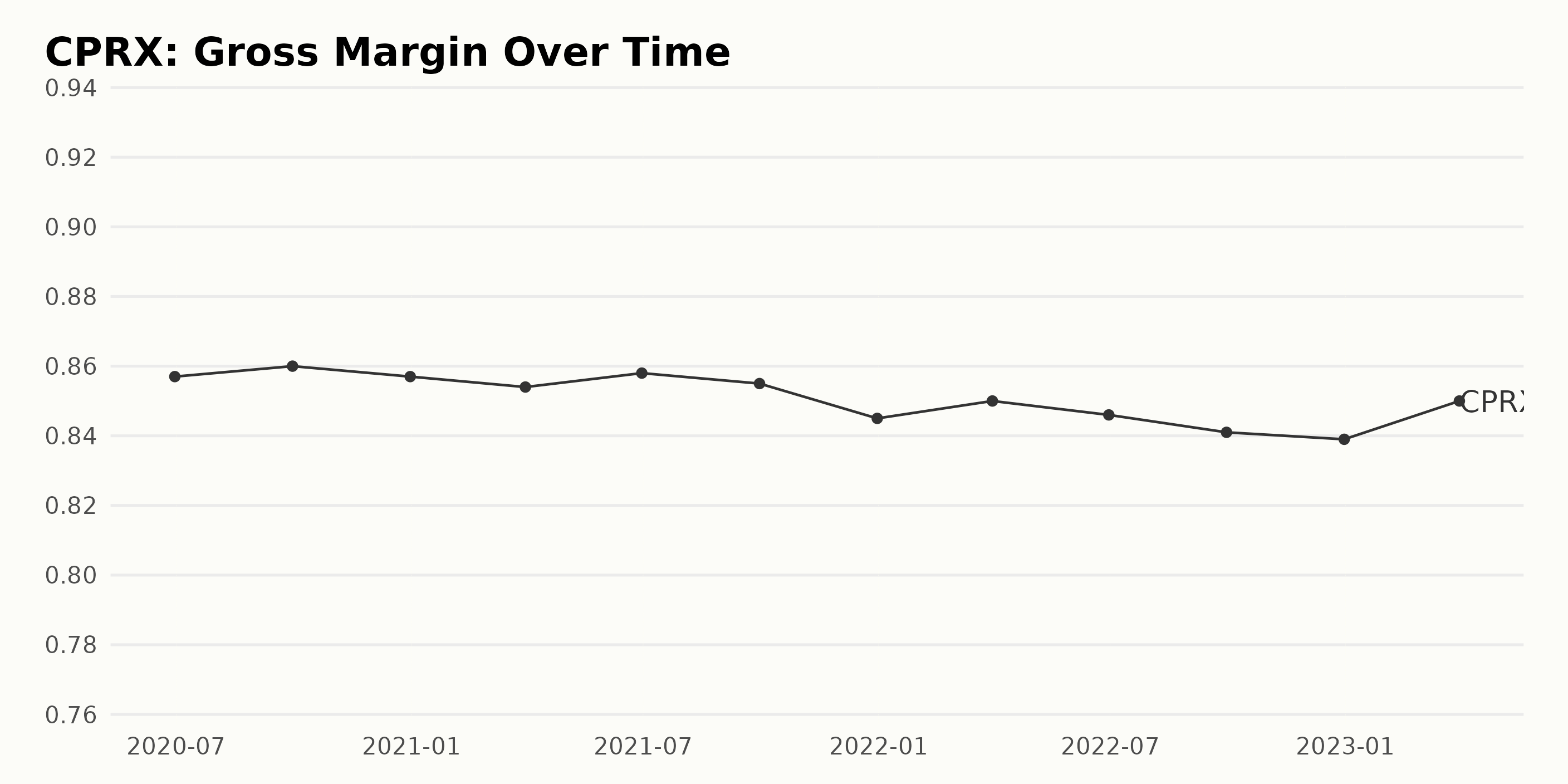

The gross margin of CPRX has fluctuated from 85.7% on June 30, 2020, to 85.9% on June 30, 2021, and decreased to 83.9% on December 31, 2022. The overall trend is a slight decrease, with the growth rate being -2.3%.

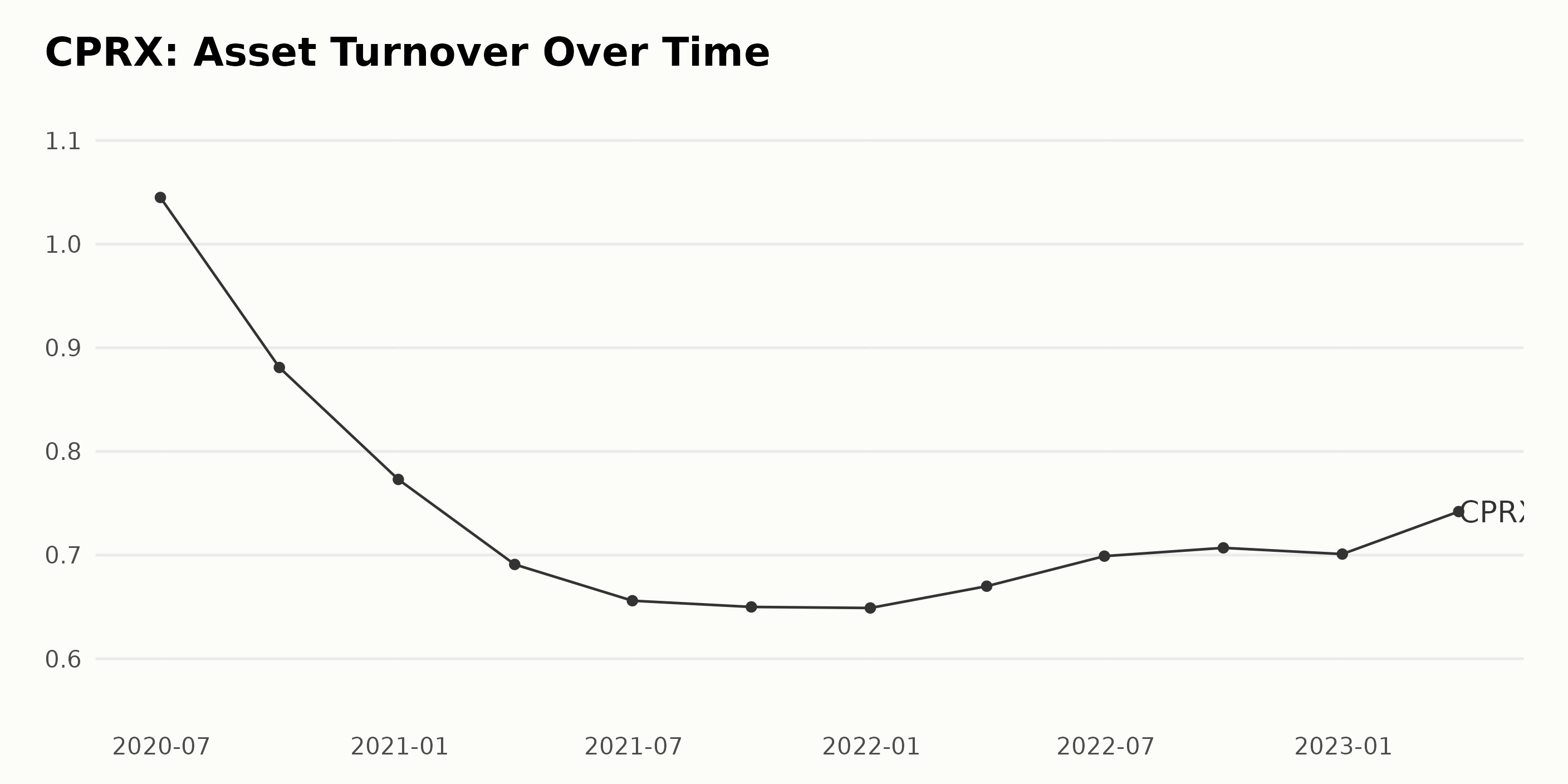

The asset turnover of CPRX shows a decreasing trend from June 2020, when it was 1.05, to March 2021, when it hit its lowest at 0.691. However, the most recent value of 0.742 in March 2023 shows a recovery, with the rate of growth compared to June 2020 being 0.31.

The price target of CPRX has been fluctuating in the range of $8-$22, with the last value being $22, since November 2021. The growth rate from the first value to the last value is 175%. The analyst price target has remained consistent at $22 in the latest period.

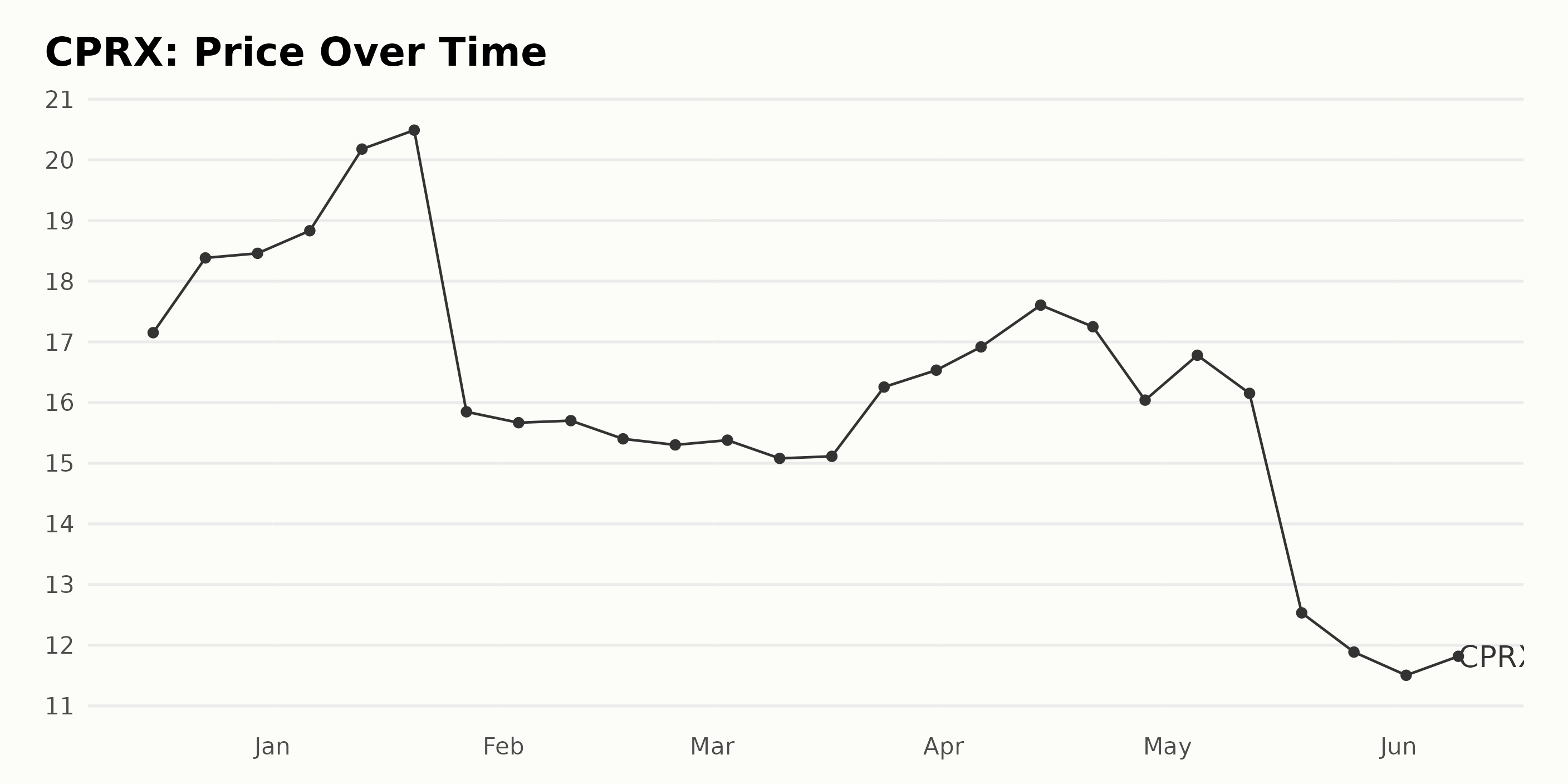

Slow and Steady Rise of CPRX Stock Price

The share price of CPRX started at $17.15 on December 16, 2022, and steadily increased to reach a peak of $20.49 on January 20, 2023. There has been a decrease in the share price afterward, with a low of $11.50 on June 2, 2023.

However, it is steadily increasing again, reaching $11.86 on June 8, 2023. Overall, the share price of CPRX is increasing at a slow rate. Here is a chart of CPRX’s price over the past 180 days.

Catalyst Pharmaceuticals, Inc. Ratings: Quality, Sentiment & Value

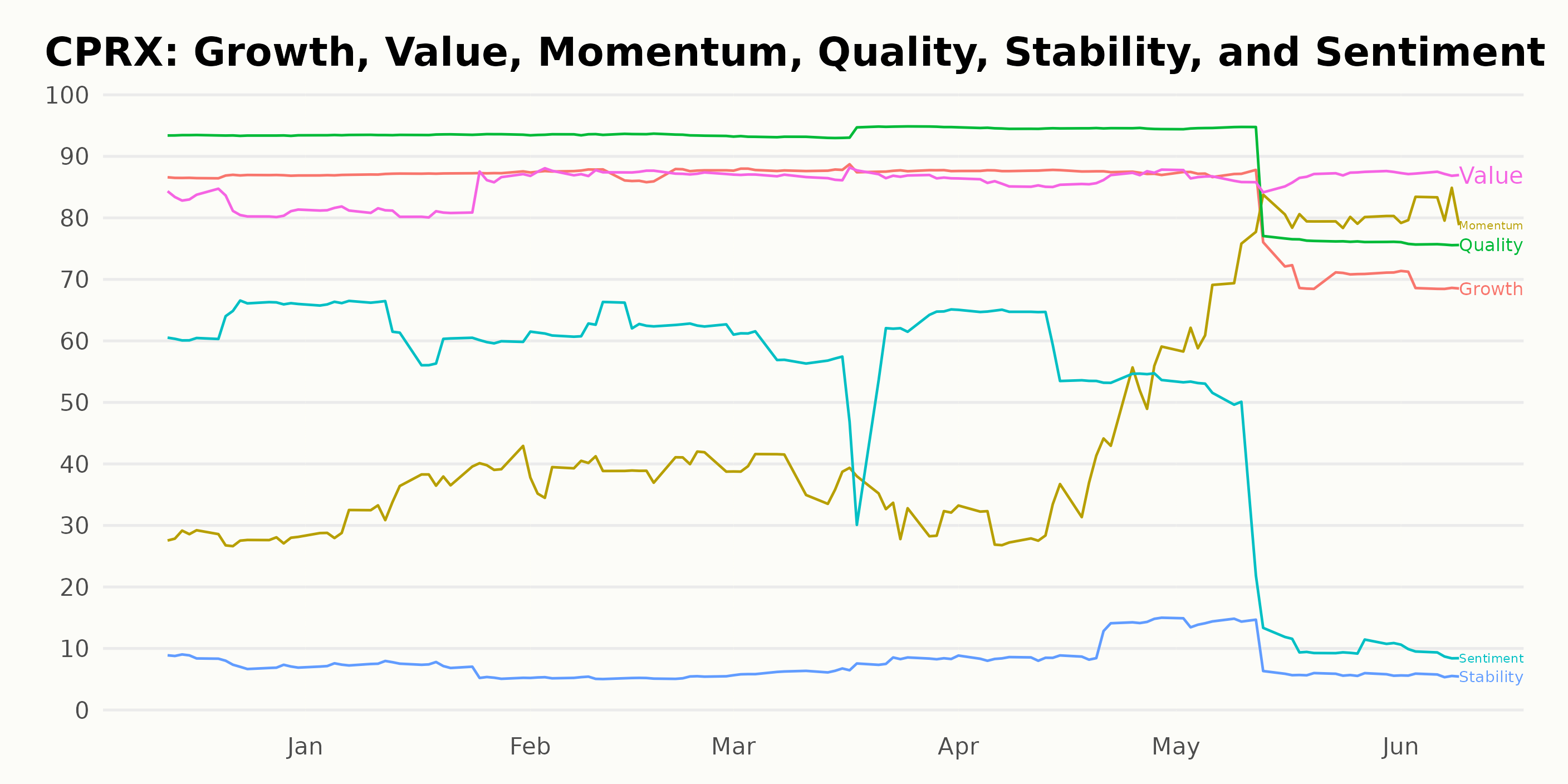

CPRX currently has an overall POWR Ratings grade of C, translating to Neutral, and is ranked #48 out of 169 stocks in the Medical – Pharmaceuticals industry for the week of June 8, 2023.

Out of the POWR Ratings for CPRX, the three most noteworthy dimensions are Quality, Sentiment, and Value. Quality has the highest rating out of all six dimensions, with a rating of 93 in December 2022 and increasing to 95 in April 2023.

Sentiment has been fairly consistent, ranging from a low of 25 in May 2023 to a high of 64 in December 2022. Finally, Value shows a steady trend of increase, with a rating of 82 in December 2022 and 87 in June 2023.

How does Catalyst Pharmaceuticals, Inc. (CPRX) Stack Up Against its Peers?

Other stocks in the Medical – Pharmaceuticals sector that may be worth considering are Novartis AG (NVS - Get Rating), Novo Nordisk A/S (NVO - Get Rating), and AbbVie Inc. (ABBV - Get Rating) — they have better POWR Ratings.

What To Do Next?

Discover 10 widely held stocks that our proprietary model shows have tremendous downside potential. Please make sure none of these “death trap” stocks are lurking in your portfolio:

Want More Great Investing Ideas?

CPRX shares were trading at $11.62 per share on Friday afternoon, down $0.24 (-2.02%). Year-to-date, CPRX has declined -37.53%, versus a 12.97% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| CPRX | Get Rating | Get Rating | Get Rating |

| NVS | Get Rating | Get Rating | Get Rating |

| NVO | Get Rating | Get Rating | Get Rating |

| ABBV | Get Rating | Get Rating | Get Rating |