Based in Zurich, Switzerland, Credit Suisse Group AG (CS - Get Rating) operates as a provider of various financial services in Europe, the Middle East, Africa, the Americas, and Asia-Pacific. The company’s offerings include wealth management solutions, risk management solutions, and wealth planning.

According to the law firm Pomerantz LLP, a group has filed a lawsuit against CS in a New York district court, alleging that the bank misled investors over its business dealings with Russian oligarchs. Furthermore, a Rhode Island pension fund has sued CS’ directors and executives for allegedly mismanaging risk that impaired the bank’s prime brokerage business with the collapse of Archegos Capital, which had $36 billion in assets.

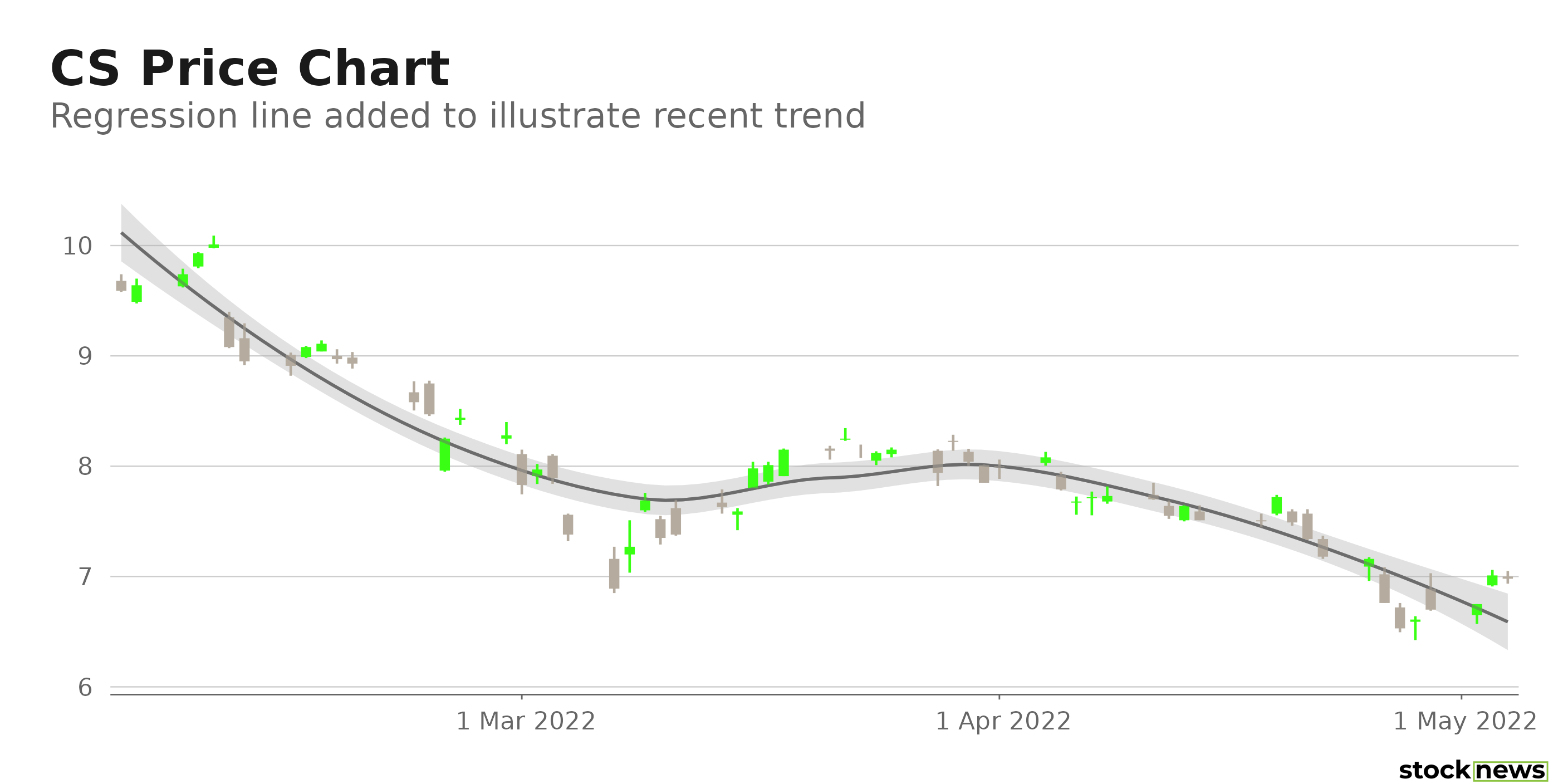

CS’ stock has declined 27.3% in price year-to-date and 12.3% over the past month to close yesterday’s trading session at $7.01. But the stock has gained 7% over the past five days and 3.9% intraday.

Here are the factors that could shape CS’ performance in the near term.

Mixed Analyst Sentiments

The $0.60 consensus EPS estimate for its fiscal year 2022 indicates a 13.3% year-over-year decrease. Likewise, the $19.17 billion consensus revenue estimate for the same year reflects a decline of 27.8% from the prior year.

However, the Street’s $1.05 EPS estimate for its fiscal 2023 indicates an improvement of 75.2% from the prior year, while the Street’s $21.17 billion revenue estimate for the same period reflects a 10.5% year-over-year rise.

Mixed Trailing 12-Month Financials

The company’s trailing 12-month revenue, gross profit, and cash from operations stood at $21.27 billion, $19.95 billion, and $40.49 billion, respectively. But its trailing 12-month net income and EPS came in at a negative $1.81 billion and $0.72.

Mixed Valuations

In terms of its forward P/E, CS is currently trading at 13.56x, which is 29% higher than the 10.51x industry average. In contrast, its 0.94 forward Price/Sales multiple is 68% lower than the 2.94 industry average.

Mixed Profit Margins

CS’ 93.83% trailing 12-month gross profit margin is 39.93% higher than the 67.06% industry average. But its trailing 12-month net income margin and ROE of negative 8.50% and 3.75%, respectively, are substantially lower than their industry averages of 29.63% and 12.73%.

POWR Ratings Reflect Uncertain Prospects

CS has an overall C rating, which equates to Neutral in our proprietary POWR Ratings system. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

CS has a Quality grade of C in sync with its mixed profitability.

CS has a Sentiment grade of D. This is justified because Wall Street analysts have rated the stock a Sell. The 12-month median price target of $6.25 indicates a 10.8% potential downside.

In the 95-stock Foreign Banks industry, CS is ranked #51. The industry is rated B.

Click here to see the additional POWR Ratings for CS (Growth, Value, and Momentum).

View all the top-rated stocks in the Foreign Banks industry here.

Bottom Line

Ongoing lawsuits against CS could make investors anxious. Also, for the first fiscal quarter of 2022, the company’s adjusted net revenues came in at CHF4.58 billion ($4.69 billion), up 4.5% sequentially but down 38.3% year-over-year. In addition, its negative ROE is concerning. Hence, we think it might be wise to wait for a better entry point in the stock before investing.

How Does Credit Suisse Group AG (CS) Stack Up Against its Peers?

While CS has an overall POWR Rating of C, one might consider looking at its industry peers, Banco Macro S.A. (BMA - Get Rating) and KB Financial Group Inc. (KB - Get Rating), which have an overall A (Strong Buy) rating, and OFG Bancorp (OFG - Get Rating) and Woori Financial Group (WF - Get Rating), which have an overall B (Buy) rating.

Want More Great Investing Ideas?

CS shares were trading at $6.99 per share on Wednesday afternoon, down $0.02 (-0.29%). Year-to-date, CS has declined -27.49%, versus a -12.35% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| CS | Get Rating | Get Rating | Get Rating |

| BMA | Get Rating | Get Rating | Get Rating |

| KB | Get Rating | Get Rating | Get Rating |

| OFG | Get Rating | Get Rating | Get Rating |

| WF | Get Rating | Get Rating | Get Rating |