Donaldson Company, Inc. (DCI - Get Rating) produces and sells filtration systems and replacement parts worldwide. The company recently announced the acquisition of Isolere Bio, Inc., an early-stage biotechnology company that produces filtration processes used to purify and manufacture pharmaceuticals.

Wall Street analysts are bullish on the stock. The consensus revenue and EPS estimates of $3.45 billion and $3.05 for the current year (ending July 2023) indicate 4.3% and 13.8% year-over-year increases, respectively. Moreover, the 12-month median price target of $68 indicates a 6.9% potential upside.

Let’s look at the trends of some of its key financial metrics:

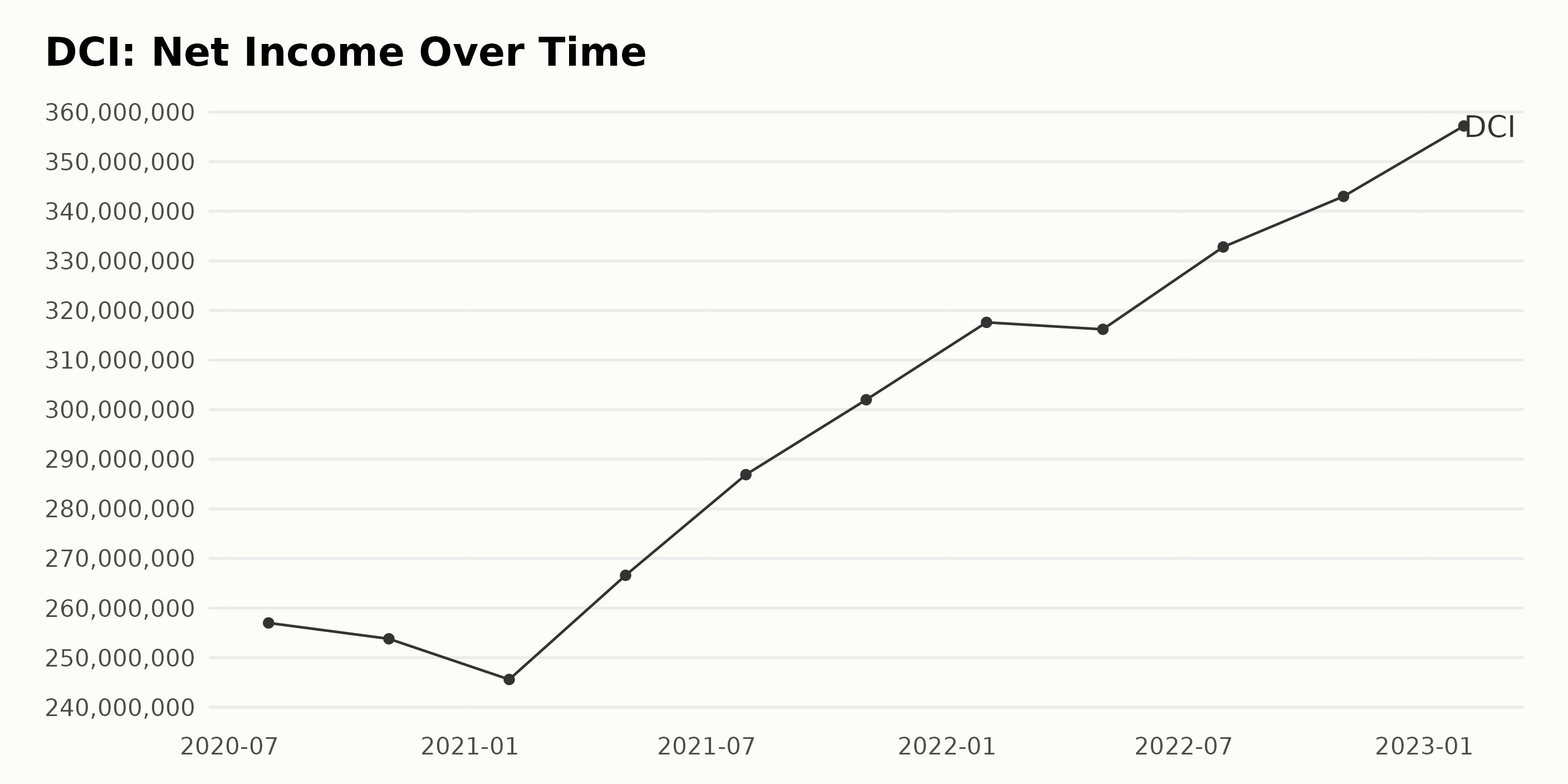

Tracking Donaldson Company, Inc.’s (DCI) Steady Increase in Net Income & ROA

DCI’s net income has experienced an overall trend of growth over the past 2+ years, increasing from $257 million in July 2020 to its most recent quarterly net income of $357.2 million in January 2023, an increase of 36%.

There have been fluctuations, such as a decline in October 2020 from $253.8 million to $245.6 million, but DCI’s net income has risen steadily overall.

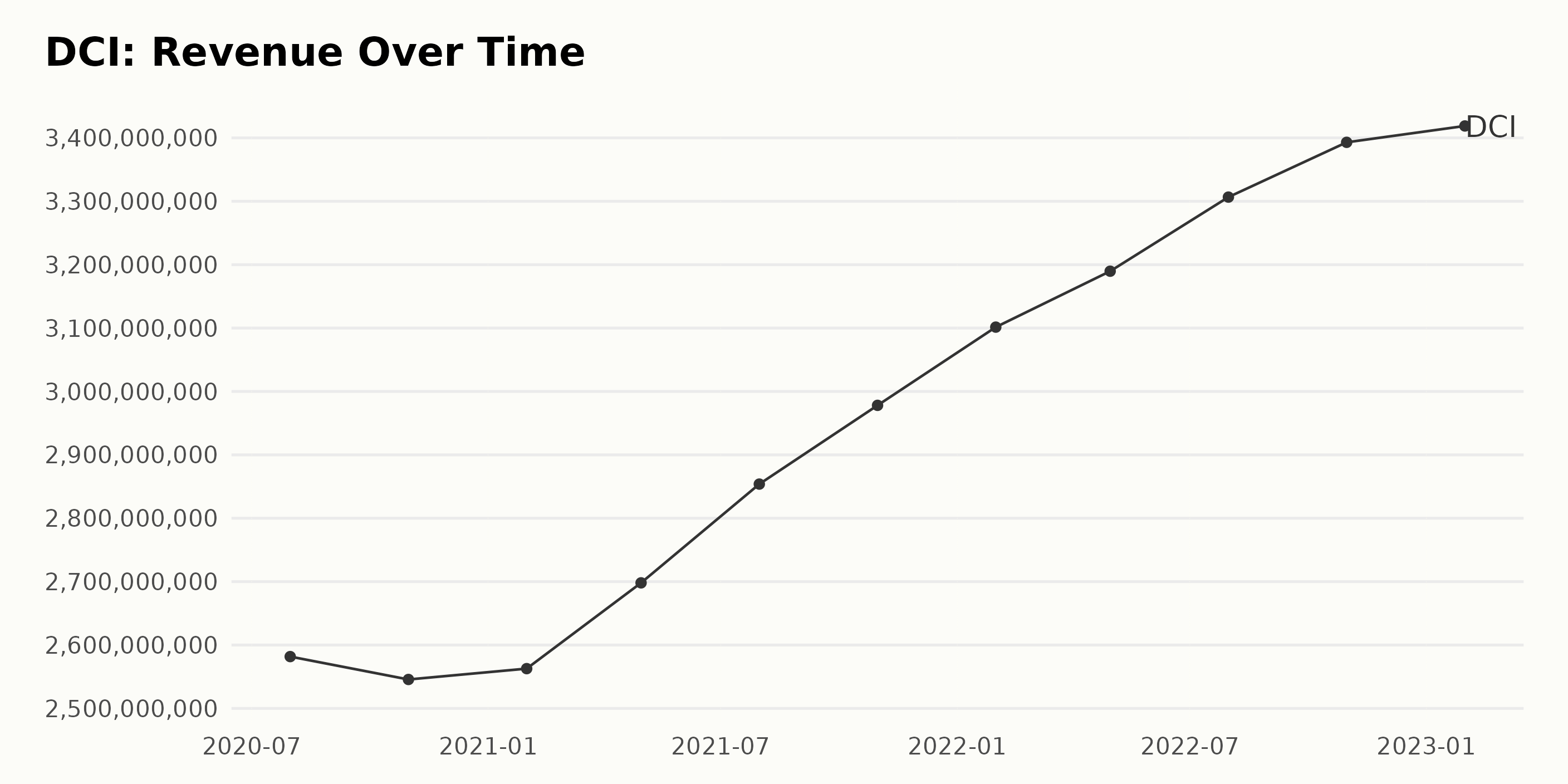

DCI has seen a positive trend in its revenue with two minor fluctuations. From July 2020 to July 2023, revenue increased from $258.18 million to $341.88 million, a growth rate of 8.3%.

The largest dip in revenue occurred between October 2020 and January 2021, when it dropped from $254.57 million to $256.28 million before rebounding to $269.81 million by April 2021 and continuing to increase steadily until the most recent data point in January 2023 of $341.88 million.

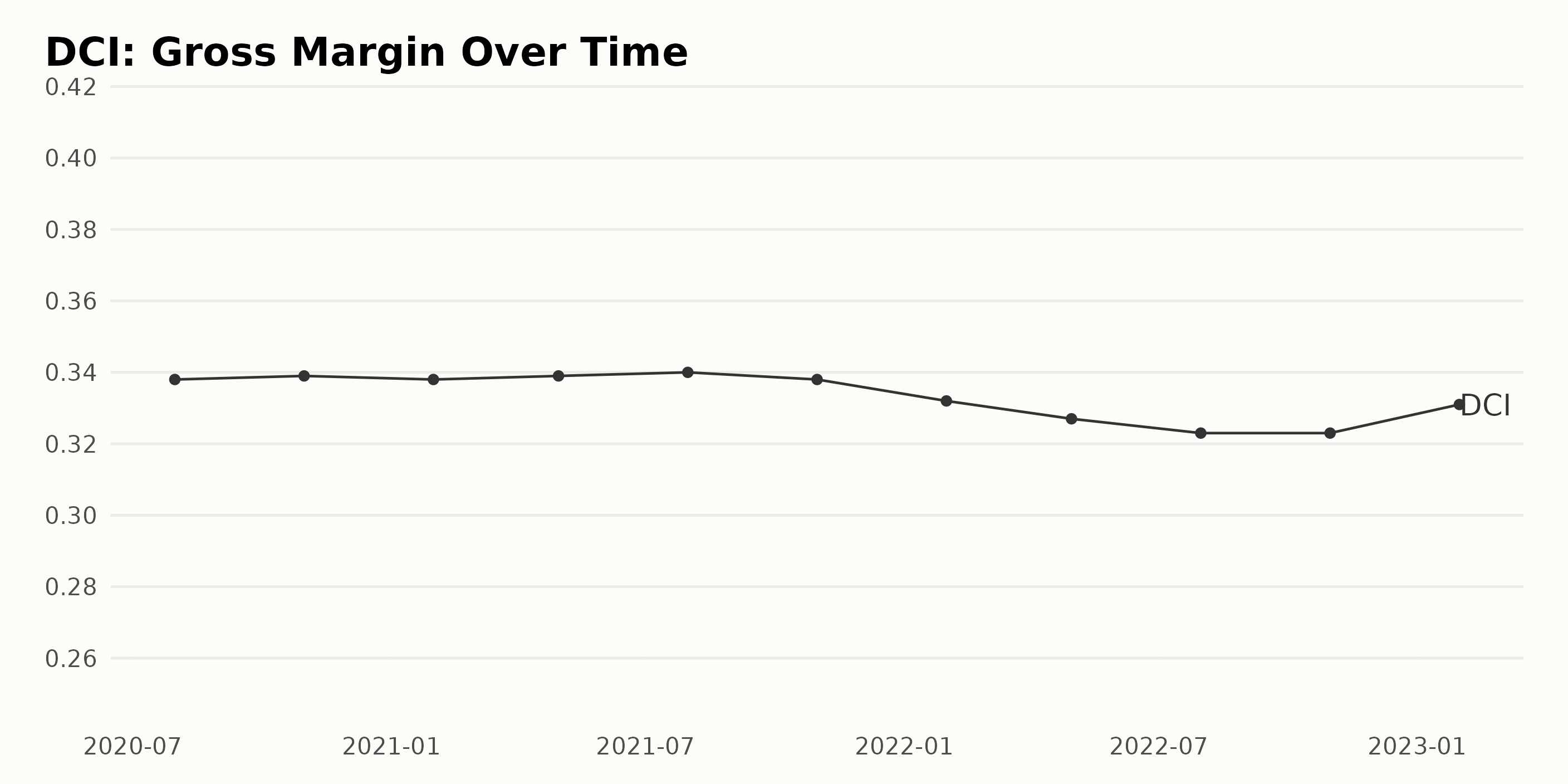

DCI’s gross margin has generally trended upwards from 33.8% in July 2020 to 33.1% in January 2023, increasing at an average rate of 0.2% per quarter. However, there have been fluctuations, with the margin dropping as low as 32.3% in July 2022 before rising back to 33.1% in January 2023.

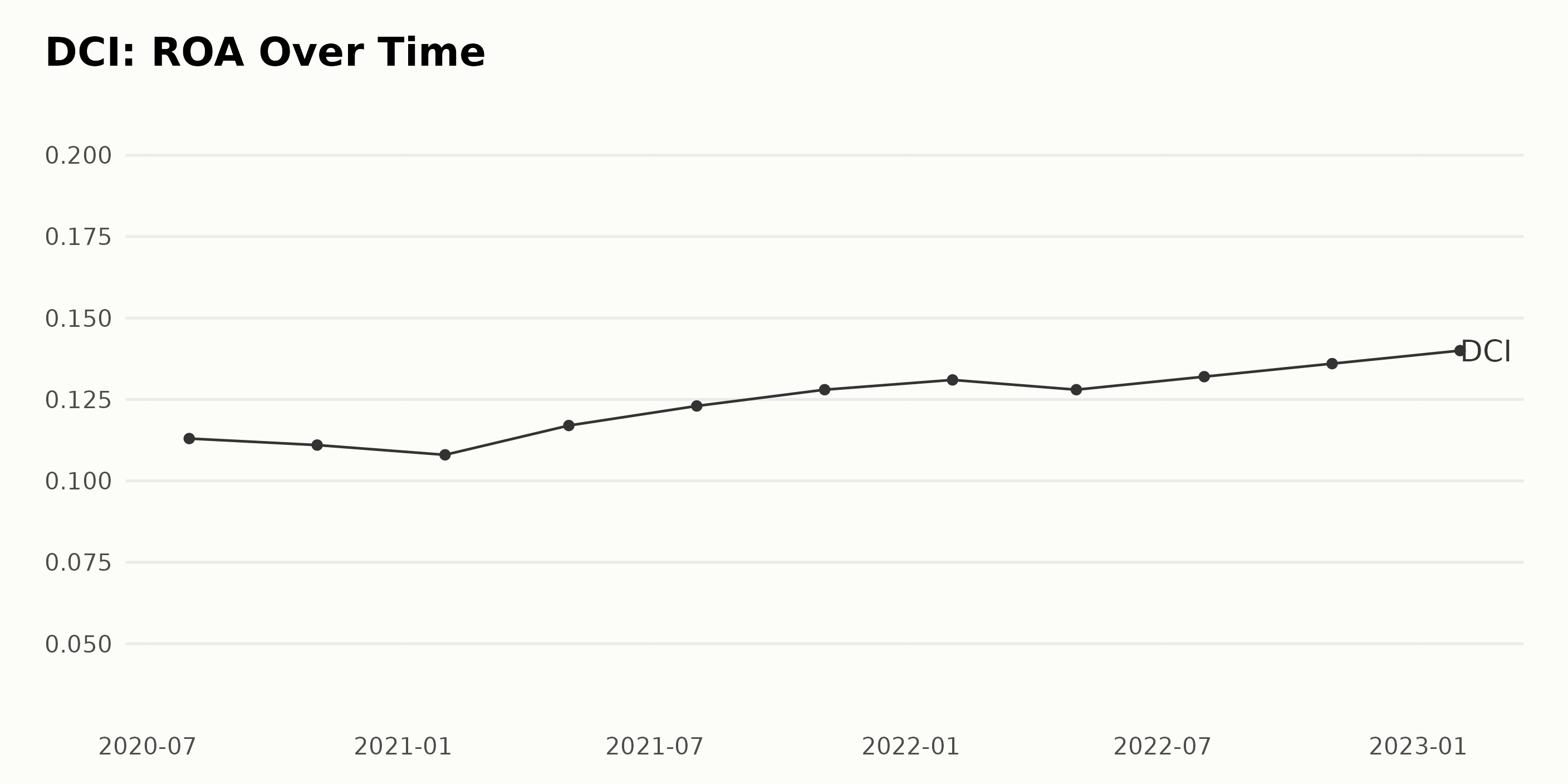

DCI has experienced a steady increase in its Return on Assets (ROA). In July 2020, the ROA was 0.11. This increased to 0.13 by October of 2023, a growth rate of 18%. However, in between this growth, there have been fluctuations in DCI’s ROA, highlighting various up and down periods since July 2020.

The most recent quarter ended in January 2023, shows a ROA of 0.14, representing the high point of this series.

DCI’s Rally Continues

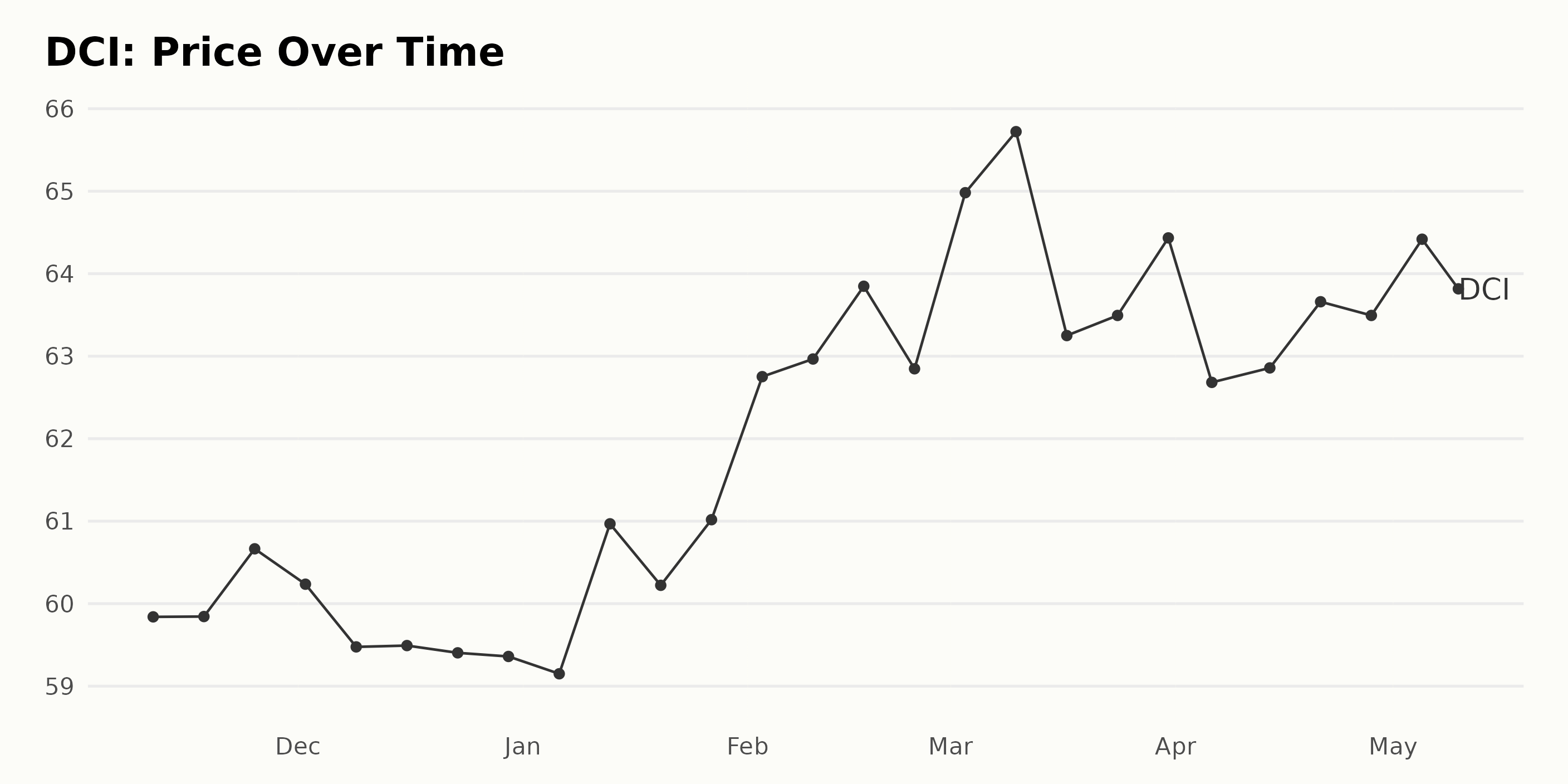

The share price of DCI has been trending upward since November 11, 2022, when it was sitting at $59.84. It has steadily increased with an accelerating growth rate over the past several months, reaching its peak on March 31, 2023, at $64.43.

Since then, it has fluctuated slightly but appears to trend upwards with a more moderate growth rate, currently at $63.87 as of May 9, 2023. Here is a chart of DCI’s price over the past 180 days.

DCI: Analyzing Quality, Stability, and Sentiment

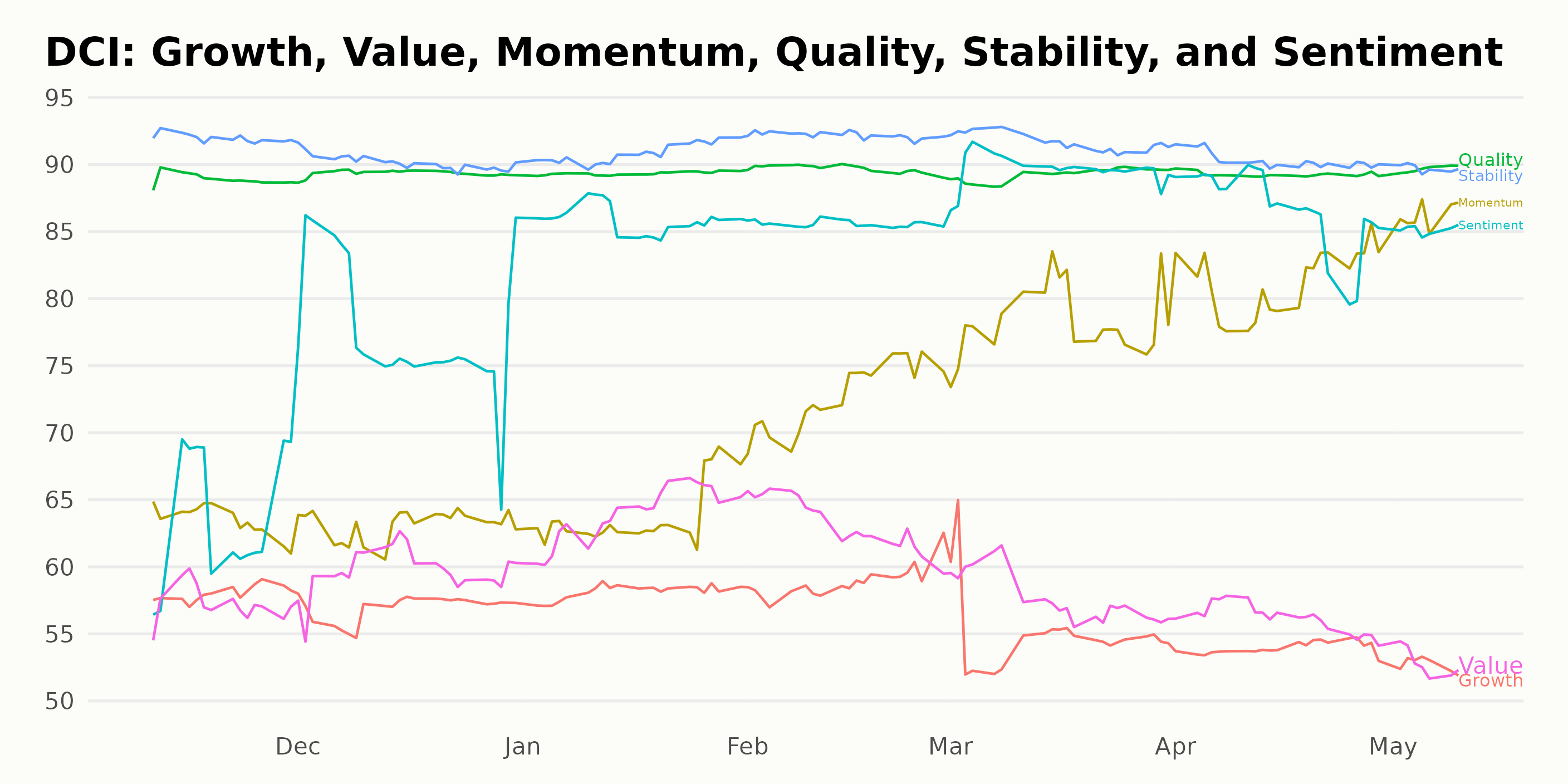

DCI has maintained an overall A POWR Ratings grade, which translates to a Strong Buy, over the past year. It ranks #7 out of 78 stocks in the A-rated Industrial – Machinery industry.

The three most noteworthy dimensions of DCI, according to their POWR Ratings, are Quality, Stability, and Sentiment. Quality has consistently had the highest rating since November 2022, with a value of 89. Stability has remained high but gradually decreased, with a value of 92 in November 2022, 90 in December 2022, 91 in January 2023, and 90 in April 2023.

On the other hand, Sentiment has seen a clear trend of improvement, starting at 64 in November 2022 and increasing to 78 in December 2022, 86 in January 2023, 86 in February 2023, 90 in March 2023, 87 in April 2023, and 85 in May 2023.

How does Donaldson Company Inc. (DCI) Stack Up Against its Peers?

Other stocks in the Industrial – Machinery sector that may be worth considering are ABB Ltd (ABB - Get Rating), Tennant Company (TNC - Get Rating), and Powell Industries, Inc. (POWL - Get Rating). These stocks also have an A (Strong Buy) rating.

The Bear Market is NOT Over…

That is why you need to discover this timely presentation with a trading plan and top picks from 40 year investment veteran Steve Reitmeister:

REVISED: 2023 Stock Market Outlook >

Want More Great Investing Ideas?

DCI shares were trading at $63.63 per share on Wednesday afternoon, down $0.01 (-0.02%). Year-to-date, DCI has gained 8.48%, versus a 7.99% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| DCI | Get Rating | Get Rating | Get Rating |

| ABB | Get Rating | Get Rating | Get Rating |

| TNC | Get Rating | Get Rating | Get Rating |

| POWL | Get Rating | Get Rating | Get Rating |