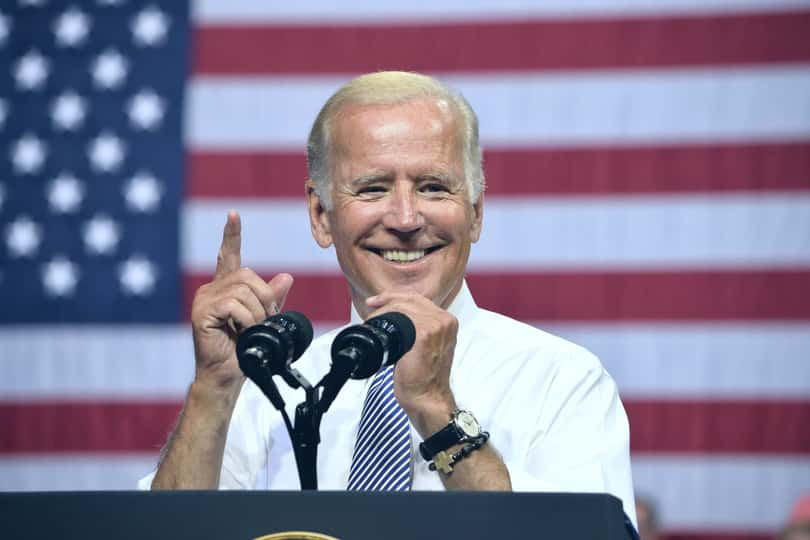

President Biden’s ambitious $2.25 trillion infrastructure bill proposal has kicked conventional infrastructure stocks into the spotlight. Unveiled last week, the plan sent a wave of optimism through investors. The plan doesn’t just aim at a massive overhaul of the nation’s roads, bridges, and pipelines, it also promises to create nearly 19 million jobs.

According to Goldman Sachs, the plan’s total expenditure would be in the range of $2 trillion to $4 trillion over the next decade. Consequently, companies with exposure to construction, water infrastructure, and road building will have significant growth opportunities. Furthermore, Biden’s ‘Build Back Better’ plan includes proposed investments in high-speed internet and green energy, among other investment proposals. Hence, in the near term, some ‘alternative infrastructure’ companies could also be beneficiaries of the proposed spending. .

Thus, adding core infrastructure stocks Eaton Corporation, Plc (ETN), Jacobs Engineering Group Inc. (J), Herc Holdings Inc. (HRI), and MasTec, Inc. (MTZ) will position investors for substantial gains in the long run. These stocks are fundamentally strong, and we think the proposed infrastructure package will be a major growth catalyst for them.

Click here to check out our Infrastructure Sector Report for 2021

Eaton Corporation, Plc (ETN)

ETN is an Irish company that manufactures engineered products for the industrial, vehicle, construction, commercial, and aerospace markets. Hydraulic products, control equipment, fluid connectors, electrical power distribution, and engine components are some of the products it produces .

During the fourth quarter, ended December 31, 2020, ETN’s net sales declined 10.9% year-over-year to $4.7 billion. Its organic sales fell 5%, while its divestitures of Lighting and Automotive Fluid Conveyance businesses lowered its sales by 8%. Its EPS for the quarter rose to $1.19 from $1.09 posted in the same period last year. Its operating cash flow at the end of the quarter was $943 million.

Analysts expect ETN’s revenue for the quarter ending March 31, 2021 to be $1.6 billion, representing a 13.9% year-over-year increase. Its EPS is expected to grow at the rate of 57.7% per annum over the next five years.

ETN climbed 90.7% over the year to close Thursday’s trading session at $139.49. Over the past six months, the stock has gained 38.7%.

It’s no surprise that ETN has an overall B rating, which equates to Buy in our POWR Ratings system. The POWR Ratings are calculated by considering 118 different factors with each factor weighted to an optimal degree.

ETN has a Momentum rating of A and Sentiment and Quality ratings of B. In the A-rated Industrial – Machinery industry, it is ranked #10 of 87 stocks.

In addition to the POWR Ratings grades we’ve just highlighted, one can see the ETN ratings for Growth, Stability, and Value.

Jacobs Engineering Group Inc. (J)

J is an engineering company that offers technical, professional, and construction services to various industrial, commercial, and governmental clients.

J’s revenue for the first quarter ended January 1, 2021 rose 0.6% year-over-year to $3.4 billion. Its EPS for the quarter climbed to $1.96, indicating 47% year-over-year growth. The company’s backlog increased to $25.1 billion, up 11% from the same period last year. J ended the quarter with $95.9 million in free cash flow and $112.6 million in cash flow from operations.

A consensus revenue estimate for J for the quarter ending March 31, 2021 is $3.5 billion, representing a 1.6% year-over-year rise. Its EPS is expected to grow at the rate of 9.8% per annum over the next five years.

J ended Thursday’s trading session at $129.95, surging 64% over the past year. During the past six months, the stock has plunged 42.1%.

Due to its bright prospects, J has an overall B rating, which translates to a Buy. J has a Growth, Stability, and Sentiment grade of B. In the 87-stock Industrial – Services industry, it is ranked #29 of 87 stocks.

Click here to see the additional POWR Ratings for J (Momentum, Quality, and Value).

Herc Holdings Inc. (HRI)

HRI engages in the rental and lease of cars and trucks of various models globally. It operates through four segments: Car Rental, International Car Rental, Worldwide Equipment Rental, and All Other Operations. The company offers its products under the brands Hertz, Dollar, Thrifty, and Firefly car

HRI’s revenue for the fourth quarter, ended December 31, 2020, declined 9.6% year-over-year to $5.2 billion, to which equipment rental revenue contributed $4.3 billion. Its EPS for the quarter rose to $29.8 from $29.3 posted in the same period last year. HRI is confident in seeing healthy momentum in 2021. The company’s President and CEO, Larry Silber, said, “During the year, we adjusted the fleet to respond to the declines in volume related to the impact of COVID-19 on our customers and focused on controlling costs.”

Analysts expect HRI’s revenue for the quarter ending March 31, 2021 to be $415.6 million, representing a 4.7% decline year-over-year. Its EPS is expected to grow at a rate of 31.1% per annum over the next five years.

HRI ended Thursday’s trading session at $102.27, rallying 439.4% over the past year. During the past six months, the stock soared 153.3% higher.

HRI’s strong fundamentals are reflected in its POWR Ratings. The stock has an overall B rating, which equates to Buy in our POWR Ratings system. HRI also has Sentiment and Growth grades of B. In the Industrial – Services industry, it is ranked #17.

To see additional POWR Ratings for Momentum, Quality, Value, and Stability for HRI, Click here.

MasTec, Inc. (MTZ)

MTZ offers engineering, building, installation, maintenance, and upgrade services for energy, utility, and communications infrastructure, primarily in the United States.

During the fourth quarter, ended December 31, 2020, MTZ’s revenue fell 5.9% year-over-year to $1.6 billion. Its EPS climbed to $1.54 from $1.33 posted in the same period last year. Its 18- month backlog at the end of the quarter was $7.9 billion compared to $8 billion at the end of the prior year period. The company’s CEO, Joe Mas, stated, “Our initial 2021 guidance reflects strong 24% revenue growth, with all of our segments expected to approach double digit top line increases when compared to last year.”

Wall Street expects MTZ’s revenue for the quarter ending March 31, 2021 to be $1.6 billion, representing a 13.9% year-over-year increase. Its EPS is expected to grow at the rate of 57.7% per annum over the next five years.

MTZ ended Thursday’s trading session at $94.79, surging 227.9% over the past year. During the past six months, the stock has climbed 128.4%.

Due to its bright prospects, MTZ has an overall B rating, which equates to Buy in our POWR Ratings system. MTZ also has a Quality and Momentum ratings of B. In the 87-stock Industrial – Services industry, it is ranked #26.

Click here to see the additional POWR Ratings for MTZ (Growth, Value, Stability, and Sentiment).

Click here to check out our Infrastructure Sector Report for 2021

Want More Great Investing Ideas?

9 “MUST OWN” Growth Stocks for 2021

How to Ride the NEW Stock Bubble?

5 WINNING Stocks Chart Patterns

Unlock the POWR in Your Portfolio!

ETN shares were trading at $142.81 per share on Monday morning, up $3.32 (+2.38%). Year-to-date, ETN has gained 19.52%, versus a 9.02% rise in the benchmark S&P 500 index during the same period.

About the Author: Namrata Sen Chanda

Namrata is an accomplished financial journalist, with nearly a decade of experience. She specializes in interpreting news releases and framing investment strategies, and has worked with some of the leading companies in real estate, banking, insurance, mutual funds, financial research, fintech, and investment education. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| ETN | Get Rating | Get Rating | Get Rating |

| J | Get Rating | Get Rating | Get Rating |

| HRI | Get Rating | Get Rating | Get Rating |

| MTZ | Get Rating | Get Rating | Get Rating |