- GameStop was a watershed event

- The herd will be looking to punish shorts

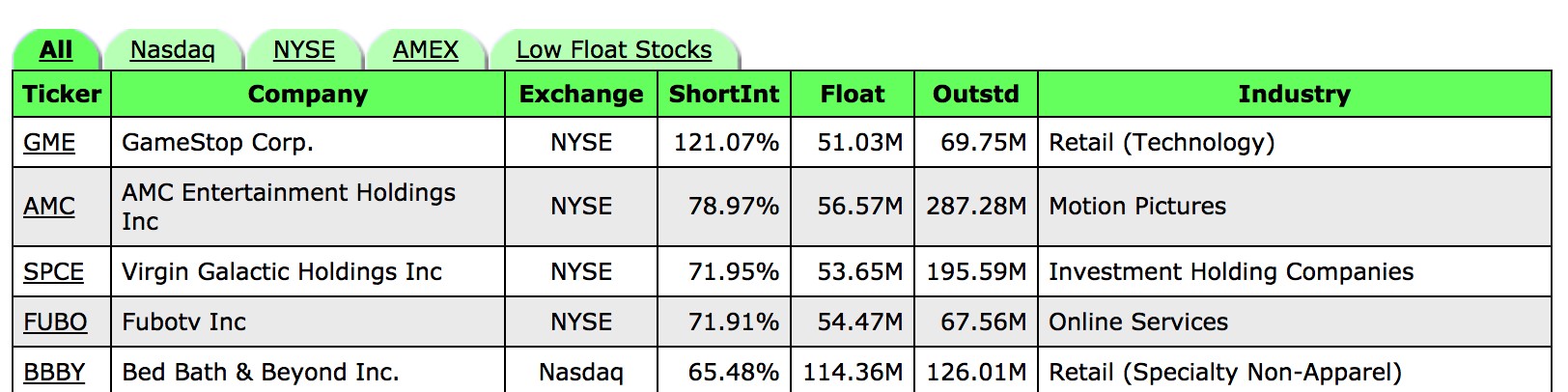

- The top five most shorted stocks as of late January

- Volatility is high; remember to sell options when you buy them via spreads

Did you ever hear the saying lightning never strikes twice in the same place? It turns out the phase many of us have heard throughout our lives is a myth. Lightning strikes the Empire State Building in New York City an average of twenty-five times a year.

In markets, lightning often strikes twice when it comes to price action. While it is rare that one asset gets hit with constant excessive volatility, there are always examples of markets moving to irrational levels on the up and downside.

Over the past couple weeks, an enormous bolt hit GameStop (GME - Get Rating) shares as some members of Wall Street’s elite hedge fund community got toasted on short positions in the stock. A herd of buyers from retail platforms from the social media chat rooms pushed the stock from below $10 to the $500 per share level.

While the company’s fundamentals did not support the price rise, far more buyers than sellers pushed the stock to dizzying levels that made longs giddy and shorts sick to their stomachs.

In the aftermath of the event, traders and investors will be looking for the next lightning strike in various other assets.

GameStop was a watershed event

The rally in GME was nothing short of spectacular.

Source: CQG

As the chart shows, the stock moved from below $10 to a high of $483 during trading hours. GME shares were under $10 on October 8, 2020. Three months later, on January 8, 2021, it over doubled. On January 25, it reached $483 after trading at over $500 in the premarket. Daily historical volatility rose to over 850%, implied volatility, the primary determinate of option premiums, moved even higher.

On February 4, the stock was back down at the $67 level as gravity finally returned to the stock.

Many pundits are saying the price action in the stock reflects a challenge of Wall Street’s elite hedge funds. A herd of traders and investors on social media websites that transact on platforms like Robinhood piled into the stock. Robinhood lived up to its name as it served as the platform to take from Wall Street’s wealthy elite and give to the masses in GME.

Hedge funds and other market participants that had shorted the stock because of fundamentals had to scramble for an exit to their risk positions, forcing the stock to dizzying levels. Some of the trading platforms restricted activity in the stock and others with a high short interest.

Market participants and historians are calling the action in GME a ‘David versus Goliath’ event, causing those shorting stocks to proceed with far more caution. However, there may be more than meets the eye. Another hedge fund reported a $700 million profit in GME in the aftermath of the short squeeze. Meanwhile, a herd of winners will be looking for their next victim in the quest for profits.

The herd will be looking to punish shorts

Fear and greed are powerful forces in life and markets. The emotions that drive humans often result in panic selling at market bottoms or buying at tops.

The hedge funds short GME watched their assets evaporate. The retail participants watched the value of their accounts swell. Fear will make the losers in the GME event think twice or use market tools to protect future short positions. Greed will drive the winners to look for other opportunities after experiencing incredible success in GME.

Instead of looking for growth stocks, a growing number of market participants will identify other opportunities to punish those holding short positions. At the end of January, the social media platforms were abuzz with the idea of pushing one of the most speculative commodities higher. In 1980, the Hunt Brothers pushed silver futures to a high of $50.32 per ounce. In 2011, the precious metal rose to a lower peak at $49.82.

Silver broke out to the upside in 2020 when the price moved above the $21.095 high from 2016. The silver futures market had been consolidating below the August high at just below $30 per share and closed 2020 at $26.525 per ounce. At the end of January, the nearby precious metals futures settled at $27.06.

Source: CQG

Source: CQG

The chart highlights that silver futures spiked higher to over $30 per ounce on the first day of trading in February. Silver moved to its highest price since February 2013. The rumors translated into buying in early February 2021. Silver came back down after making the higher high and was at the $26 level on February 4.

Meanwhile, a commodity like silver is a far deeper market than a single stock, making it far more difficult to squeeze. However, there are many that believe there is a conspiracy among governments and financial institutions to keep the precious metals’ price down, making it an interesting candidate for the Davids to try to stick it to the Goliaths. Expect lots of volatility in the silver market, the long-term trend may be higher, but an attempt to squeeze the precious metal is a fool’s game. The iShares Silver Trust (SLV - Get Rating) is the most liquid silver ETF product.

The top five most shorted stocks as of late January

Success in markets will cause more participants to look for the next asset to create inflection points leading to profits. Fundamental analysis is likely to take a backseat to technical trading. While some may call the action in GME, AMC Entertainment Holdings (AMC) shares, and even silver manipulation, the case is not clear. Freedom of speech allows market participants to state their opinions.

When a few collude to buy or sell an asset to push a price higher or lower, it is illegal. However, the overall sentiment on a social media platform reflects the wisdom of the crowd. Prices move higher when buyers become more aggressive than sellers and vice versa. The rise of GME and potential volatile price action in other assets raises a challenge to exchanges, regulators, and legislators.

Freedom of speech is at stake. When it comes to access to markets, a cautious balancing act is necessary to allow for participation while preventing manipulation. I do not believe the buying in GME was any more or less manipulative than the selling by hedge funds in the stock.

Meanwhile, stocks with substantial short interest will be in the herd’s crosshairs over the coming days, weeks, months, and even years.

Source: https://www.highshortinterest.com/

The chart highlights the top five stocks with short open interest above 65% as of the end of last week. GME is still at the top of the list. AMC was another stock that the herd went after over the past weeks. Virgin Galactic (SPCE), Fubotv (FUBO), and Bed Bath & Beyond (BBBY), and others on the list through the link are other candidates for the speculative activity that causes shorts to capitulate.

A significant result of the GME event will be that volatility in the stock market will find higher lows. Option prices are likely to remain high as the risk of price variance will remain a clear and present danger.

Volatility is high; remember to sell options when you buy them via spreads

A higher level of historical volatility will likely lead to even higher implied volatility levels. The latter is the market’s perception of future price variance. Implied volatility is the primary determinant of put and call options on assets.

Higher volatility levels will require market participants to alter their investing approach when using derivatives. When implied volatility rises, spreading options or selling one option versus buying another is likely to become far more popular. When volatility is at a high level, selling an option against buying another offset or balances the price risk in option premiums. Vertical call and put spreads are likely to become a lot more popular over the coming weeks and months.

Searching for short interest is a new game in the stock market as well as in markets across all asset classes. With option premiums elevated because of increased risks caused by price variance, it is time to shift the approach to markets to reflect the new environment.

The hedge fund Goliaths wielded their financial muscles for decades. Coming off a big win in GME, the herd of Davids will attempt to challenge the elite in a reflection of a class war that is permeating through the capitalist system. Meanwhile, remember that the hedge funds will alter their approach after the recent events. Make sure to adjust your activities accordingly.

Want More Great Investing Ideas?

9 “MUST OWN” Growth Stocks for 2021

February Stock Outlook & Trading Plan

7 Best ETFs for the NEXT Bull Market

5 WINNING Stocks Chart Patterns

GME shares were trading at $59.90 per share on Thursday afternoon, down $32.51 (-35.18%). Year-to-date, GME has gained 217.94%, versus a 3.05% rise in the benchmark S&P 500 index during the same period.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| GME | Get Rating | Get Rating | Get Rating |

| SLV | Get Rating | Get Rating | Get Rating |