Alphabet Inc. (GOOGL - Get Rating) has witnessed an impressive 11% surge in its third-quarter revenue, buoyed by the revival in advertising, which breached double-digit growth for the first time in over a year. The company has notched up advertising revenue to $59.65 billion, marking a significant leap from last year’s figure of $54.48 billion.

Moreover, Alphabet registered a total quarterly revenue of $76.69 billion, surpassing the consensus estimate of $75.97 billion. The Earnings Per Share (EPS) also stood favorably at $1.55, outpacing analyst projections of $1.45.

Nevertheless, despite exceeding expectations on both top and bottom lines, GOOGL’s shares exhibited a downturn as investors were disappointed with the company’s cloud revenue falling short of analysts’ estimates. Google Cloud yielded $8.41 billion in revenue, lower than the expected $8.64 billion.

Overall, GOOGL maintained robust performance throughout the quarter, marked by a commendable resurgence in advertisement growth. The sell-off solely based on the cloud performance seems shortsighted. Given its immense potential, this tech behemoth is well-placed for steady upside gains for long-term investors and could be worth adding to your portfolios this week. Let’s analyze some of its key financial metrics to gauge its prospects.

Analyzing Alphabet Inc.’s Financial Performance from 2020 to 2023

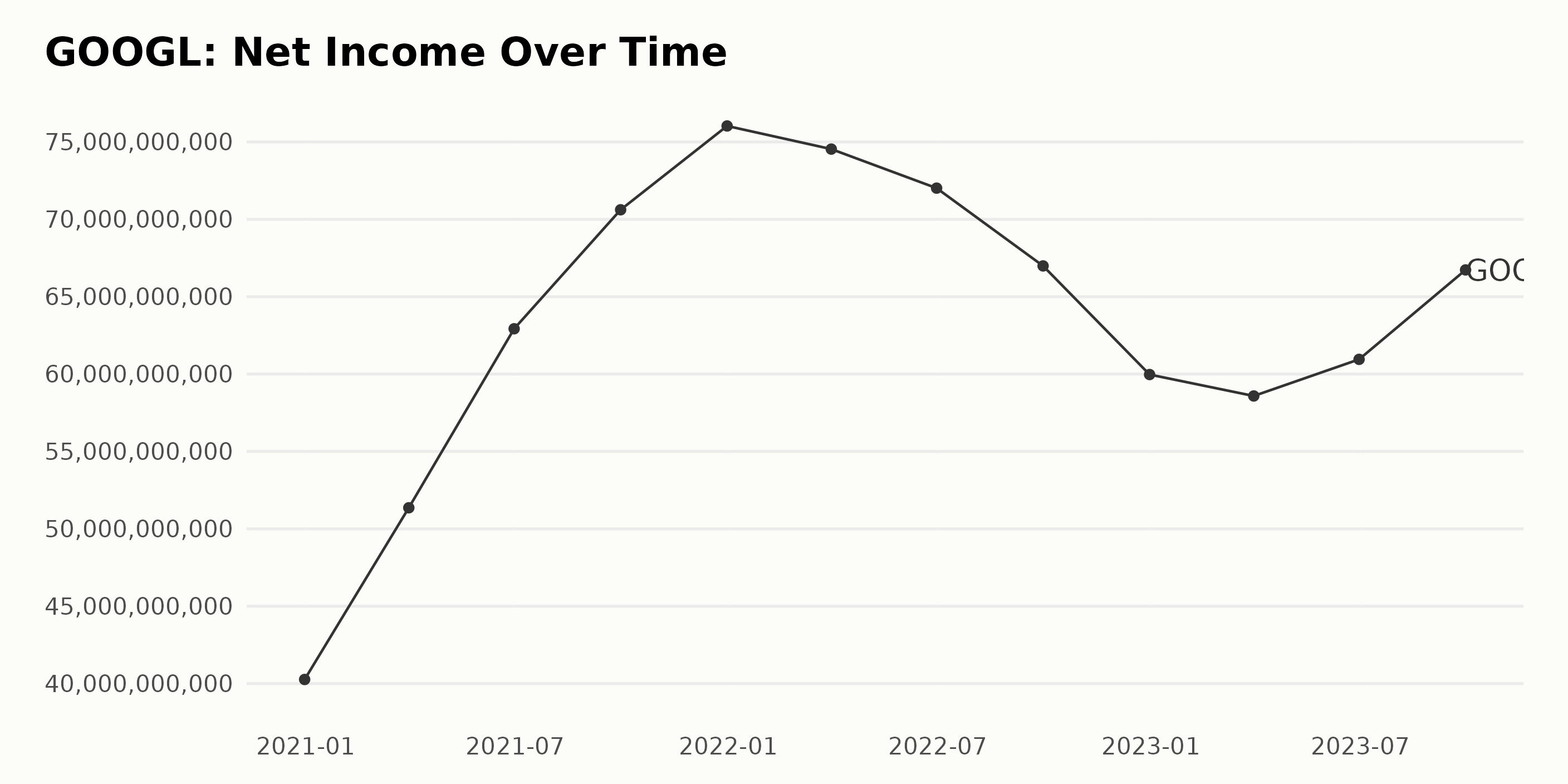

The data presented the trend and fluctuations of Alphabet Inc.’s (GOOGL) trailing-12-month net income from December 31, 2020, to September 30, 2023.

- On December 31, 2020, the net income was at $40.27 billion.

- There was a steady rise in the net income over the next quarters, jumping to $51.36 billion on March 31, 2021, and peaking at $70.62 billion by September 30, 2021.

- The trend then showed a downturn, with the net income decreasing to $59.97 billion by December 31, 2022, but slightly rising to $60.95 billion on June 30, 2023.

- However, a resurgence was noted on September 30, 2023, where the net income was recorded at $66.73 billion.

From the first recorded value on December 31, 2020, to the last one on September 30, 2023, GOOGL’s net income increased by approximately 66%. It is important to point out the most recent data for September 2023 shows an increase from the previous quarter, indicating a potentially positive start to the new financial year despite the preceding fluctuations.

The trend and fluctuations in the trailing-12-month revenue of GOOGL are as follows:

- The revenue started with a value of $182.53 billion on December 31, 2020.

- It saw a steady rise throughout 2021, hitting an annual peak at $257.64 billion on December 31, 2021.

- This growth continued into 2022, albeit at a slower pace, reaching a high of $282.14 billion on September 30, 2022.

- However, there was a slight increase from September to December 2022, with revenue growing merely by $0.72 billion to reach $282.84 billion.

- The trend continued to stay flat in the first quarter of 2023, with only a minimal increase in revenue of $1.78 billion to record $284.61 billion.

- Thereby showing some signs of recovery in the second quarter of 2023, the value rose to $289.53 billion, demonstrating a little acceleration in the growth rate.

- On the last recorded date, September 30, 2023, the revenue peaked at $297.13 billion.

Considering the growth rate from the first recorded value of $182.53 billion on December 31, 2020, to the last recorded value of $297.13 billion on September 30, 2023, GOOGL witnessed an overall revenue hike of approximately $114.6 billion over this period. This calculates roughly a 62.84% increase when measuring the last value from the first.

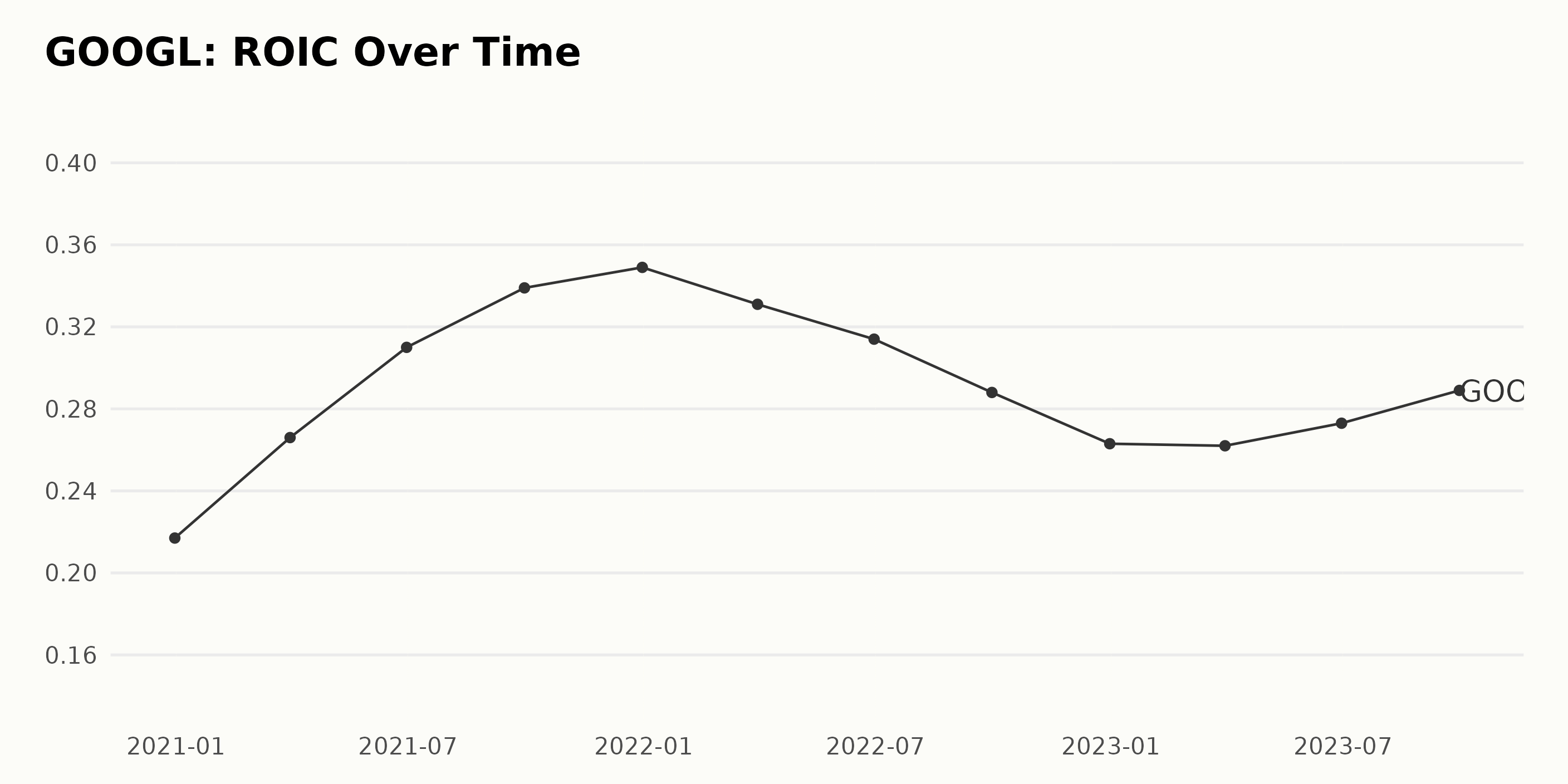

The ROIC (Return on Invested Capital) of GOOGL has shown mixed trends over the period from December 2020 to September 2023, exhibiting growth, fluctuation, and contraction. Primary Observations:

- Starting at a ROIC of 0.22 on December 31, 2020, the performance indicator for Alphabet Inc. witnessed a marked increase through each quarter up until hitting a peak of 0.35 by December 31, 2021.

- Subsequent to this climb, the ROIC experienced a declining trend, curving down to 0.26 by December 31, 2022.

- It’s notable that in the first quarter of 2023, the company’s ROIC virtually held steady, with a marginal dip to 0.26.

- However, the latter half of 2023 signaled a gradual resurgence as the numbers ascended from 0.27 in June to 0.29 by September 2023.

Calculating the growth rate from December 2020 to September 2023 (from 0.22 to 0.29), there is an increase of approximately 32%. This suggests, despite interim fluctuations, a positive overall growth trend during this period. This preliminary observation might need to be contextualized with broader industrial trends or operational specifics of Alphabet Inc. to derive in-depth insights.

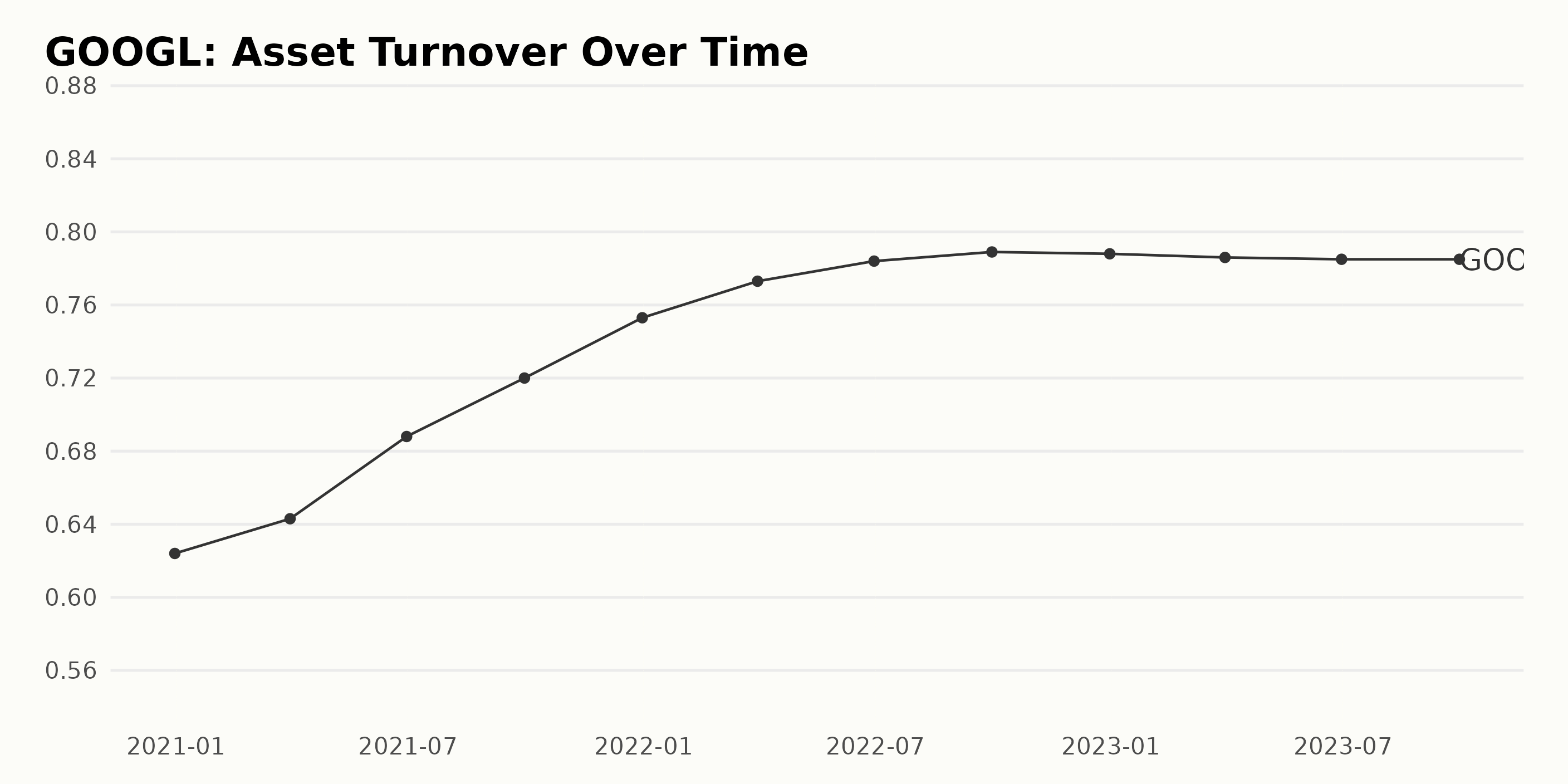

The Asset Turnover of GOOGL has seen a generally increasing trend with some fluctuations over the past three years:

- In December 2020, the Asset Turnover stood at 0.62.

- This figure showed a generally consistent increase over time, reaching 0.64 in March 2021, 0.69 in June 2021, and peaking at about 0.72 in September 2021.

- By the end of 2021, the Asset Turnover continued to increase, registering at 0.75 on December 31st.

- Going into 2022, the asset turnover grew progressively to 0.78 by mid-year but experienced minor fluctuations, seeing a mild dip from its peak value of 0.79 in September 2022 to 0.788 as of December 31, 2022.

- The early part of 2023 saw a slight decrease, with the value falling to 0.786 in March.

- As per the latest available data for 2023, GOOGL’s Asset Turnover remained stable at around 0.785 up until the end of September.

From a broader perspective, we notice a growth rate of approximately 26% in Asset Turnover from December 2020 to September 2023, a testament to the company’s increasing efficiency in using its assets to generate revenue. Despite recent minor dips, the company’s trend demonstrates robust financial health and the ability to effectively leverage its assets.

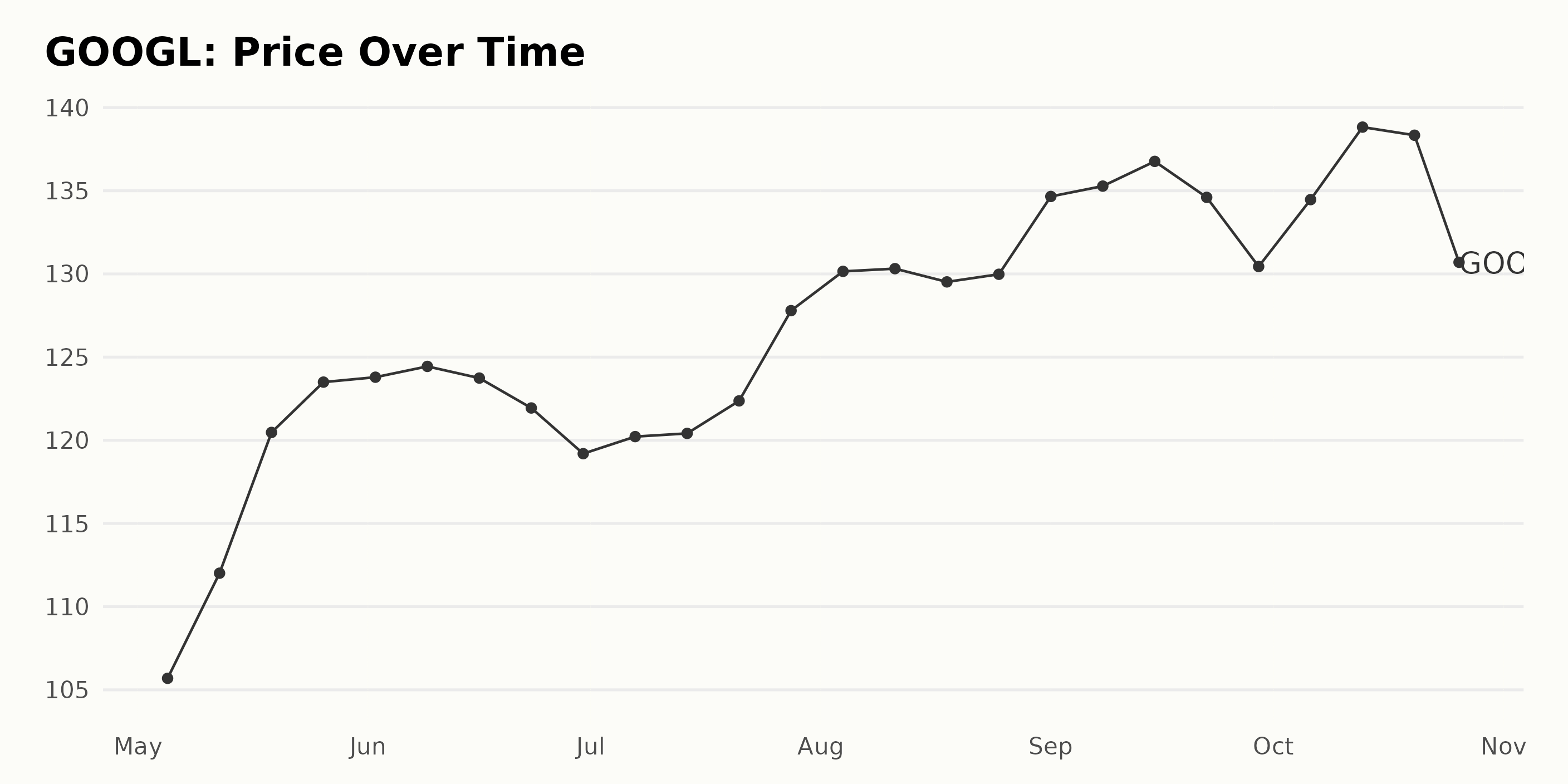

Analyzing Alphabet Inc.’s Six-Month Price Volatility and Growth Trend in 2023

The share price data for GOOGL over the period spans from May to October 2023 shows an overall upward trend. The data points indicate that the growth rate of the price had some fluctuations. Notable observations include:

- The share price opened at $105.69 on May 5, 2023.

- There was a consistent growth throughout May, with the price rising from $105.69 to $123.50 by May 26, 2023.

- The price eased slightly in early June but maintained above the $120 level, peaking at $124.44 on June 9, 2023.

- However, the trend became mildly bearish towards the end of June and the beginning of July, bottoming out at $119.20 on June 30, 2023.

- In August, the prices surged significantly, opening the month at $127.79 and reaching a high of $130.32 by August 11, 2023.

- This uptrend continued into September where it peaked at $136.77 on September 15, 2023 – the highest value in the observed data set.

- After this peak, the price experienced a brief decline towards the end of September, reaching $130.44 by September 29, 2023.

- In October, there was a recovery that saw the price going back up to $138.83 by October 13, 2023, before declining again to $130.70 by October 26, 2023.

It is important to note that while the general trend during this period was bullish, there were periods of deceleration and acceleration in price growth rate, which indicates a substantial amount of price volatility. Yet, by October 2023, Alphabet Inc. has still significantly grown its share price as compared to May 2023. Here is a chart of GOOGL’s price over the past 180 days.

POWR Ratings Highlight Alphabet Inc’s Robust Sentiment, Quality, and Growth Prospects

GOOGL has an overall B rating, translating to a Buy in our POWR Ratings system. It is ranked #4 out of the 57 stocks in the Internet category.

The POWR Ratings for GOOGL along the six dimensions have been evaluated, and here are the three most noteworthy dimensions:

Sentiment: The sentiment rating constantly ranks as one of the highest among all the dimensions for Alphabet Inc. It reveals how positive the news coverage and expert opinion about the company are. The dimension scored a high of 98 in May 2023. Although it decreased to 87 by July 2023, it picked up and remained consistently high, scoring above 90 in the subsequent months until October 2023.

Quality: Quality is another dimension where Alphabet Inc consistently scores high, indicating the level of fiscal soundness and operating efficiency of the company. Except for a slight drop of 1-3 points over the period from May 2023 to October 2023, this dimension was always above 90, exhibiting robustness in the financial health of Alphabet Inc.

Growth: The growth dimension for Alphabet Inc. showed a clear rising trend. From a score of 24 in May 2023, it rose steadily to reach a high of 49 in August 2023. Even though there was a minor dip to 46 in September and October 2023, the overall upward trajectory reflects the strong growth outlook for GOOGL.

These three dimensions reveal Alphabet’s impressive business potential according to the POWR Ratings, particularly in terms of sentiment and quality. Further, its increasing growth prospects can provide investors with an optimistic outlook on its future performance.

How does Alphabet Inc. (GOOGL) Stack Up Against its Peers?

Other stocks in the Internet sector that may be worth considering are Yelp Inc. (YELP - Get Rating), Travelzoo (TZOO - Get Rating), and Despegar.com Corp. (DESP - Get Rating) — they have better POWR Ratings.

What To Do Next?

Get your hands on this special report with 3 low priced companies with tremendous upside potential even in today’s volatile markets:

3 Stocks to DOUBLE This Year >

Want More Great Investing Ideas?

GOOGL shares were trading at $121.68 per share on Friday afternoon, down $0.60 (-0.49%). Year-to-date, GOOGL has gained 37.91%, versus a 8.56% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| GOOGL | Get Rating | Get Rating | Get Rating |

| YELP | Get Rating | Get Rating | Get Rating |

| TZOO | Get Rating | Get Rating | Get Rating |

| DESP | Get Rating | Get Rating | Get Rating |