Johnson & Johnson (JNJ - Get Rating) in New Brunswick, N.J., researches and develops, manufactures, and sells a range of products in the healthcare field. It operates through the Consumer, Pharmaceutical, and Medical Devices segments. On Feb. 1, 2022, JNJ’s Janssen Pharmaceutical Companies announced that the U.S. FDA had approved an expanded label for CABENUVA to be administered every two months to treat HIV-1 in virologically suppressed adults. Candice Long, President, Infectious Diseases & Vaccines, Janssen Therapeutics, said, “With this milestone, adults living with HIV have a treatment option that further reduces the frequency of medication.”

The COVID-19 pandemic has highlighted the limitations of the global healthcare sector. Pharmaceutical stocks have garnered significant investor interest since the onset of the pandemic due to their role in developing treatments and vaccines to protect against the deadly virus. This, along with increased lifestyle-related ailments, has helped pharmaceutical companies increase their revenues considerably. Healthcare expenditure per capita growth has exceeded personal consumption growth in the U.S. since 1980. Despite current inflationary pressure, it is difficult for people to reduce their healthcare expenditures. The rapidly aging population is also expected to increase the demand for medicines, which bodes well for pharmaceutical companies.

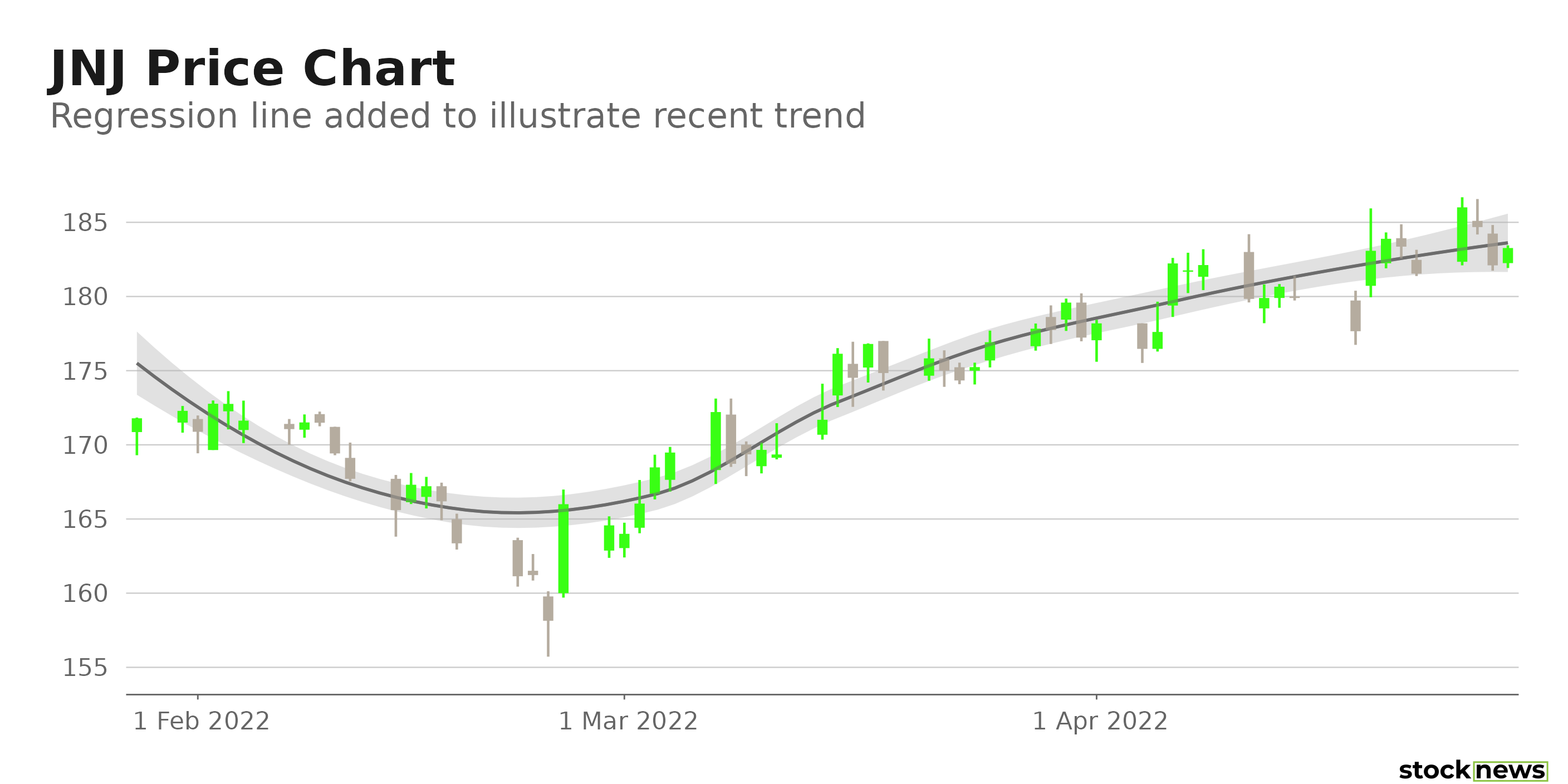

JNJ stock has gained 11.2% in price over the past six months and 11.5% over the past year to close the last trading session at $182.10.

Here is what could influence JNJ’s performance in the coming months:

Robust Financials

JNJ’s reported sales increased 4.9% year-over-year to $23.42 billion for the first quarter ended March 31, 2022. The company’s adjusted net earnings rose 2.9% year-over-year to $7.12 billion. Also, its adjusted EPS came in at $2.67, representing a 3% increase year-over-year.

Favorable Analyst Estimates

Analysts expect JNJ’s EPS and revenue for its fiscal year 2023 to increase 6.6% and 4.3%, respectively, year-over-year to $10.94 and $100.45 billion. It surpassed the Street’s EPS estimates in each of the trailing four quarters. In addition, its EPS is expected to grow at 5.4% per annum over the next five years.

High Profitability

In terms of trailing-12-month EBIT margin, JNJ’s 26.38% is significantly higher than the 1.05% industry average. And its 34.12% trailing-12-month EBITDA margin is 634.8% higher than the 4.64% industry average. Furthermore, the stock’s trailing-12-month ROCE, ROC, and ROA came in at 28.36%, 15.02%, and 10.89%, respectively, versus the negative industry averages.

POWR Ratings Show Promise

JNJ has an overall B rating, which equates to a Buy in our POWR Ratings system. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

Our proprietary rating system also evaluates each stock based on eight distinct categories. JNJ has a B grade for Quality. This is justified given its 20.07% trailing-12-month levered FCF margin versus the negative industry average.

JNJ also has an A grade for Stability, which is consistent with its 0.72 beta.

JNJ is ranked #14 of 168 stocks in the Medical – Pharmaceuticals industry. Click here to access JNJ’s ratings for Growth, Value, Momentum, and Sentiment grades.

Click here to checkout our Healthcare Sector Report for 2022

Bottom Line

With an uptick in various lifestyle-related ailments, the pharmaceutical industry is expected to witness rising demand. Given JNJ’s robust financials and higher-than-industry profitability, we think it could continue to trend higher. Thus, it could be wise to buy the stock now.

How Does Johnson & Johnson (JNJ) Stack Up Against its Peers?

JNJ has an overall POWR Rating of B. One could also check out these other stocks within the Medical – Pharmaceuticals industry with an A (Strong Buy) or B (Buy) rating: Novartis AG (NVS - Get Rating), GlaxoSmithKline plc (GSK - Get Rating), and Zoetis Inc. (ZTS - Get Rating).

Want More Great Investing Ideas?

JNJ shares were trading at $183.22 per share on Thursday morning, up $1.12 (+0.62%). Year-to-date, JNJ has gained 7.79%, versus a -11.29% rise in the benchmark S&P 500 index during the same period.

About the Author: Dipanjan Banchur

Since he was in grade school, Dipanjan was interested in the stock market. This led to him obtaining a master’s degree in Finance and Accounting. Currently, as an investment analyst and financial journalist, Dipanjan has a strong interest in reading and analyzing emerging trends in financial markets. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| JNJ | Get Rating | Get Rating | Get Rating |

| NVS | Get Rating | Get Rating | Get Rating |

| GSK | Get Rating | Get Rating | Get Rating |

| ZTS | Get Rating | Get Rating | Get Rating |