Johnson Outdoors Inc. (JOUT - Get Rating) reported impressive fiscal second-quarter results. The company’s sales and net income increased year-over-year thanks to steady demand and improving supply chain issues.

The stock has surged despite the macro uncertainties, trading above its 50-day and 200-day moving averages of $60.10 and $60.50, respectively. Moreover, JOUT’s stable dividend yields make it an attractive buy for investors seeking to maximize profits.

Let’s examine how some of JOUT’s key metrics are trending.

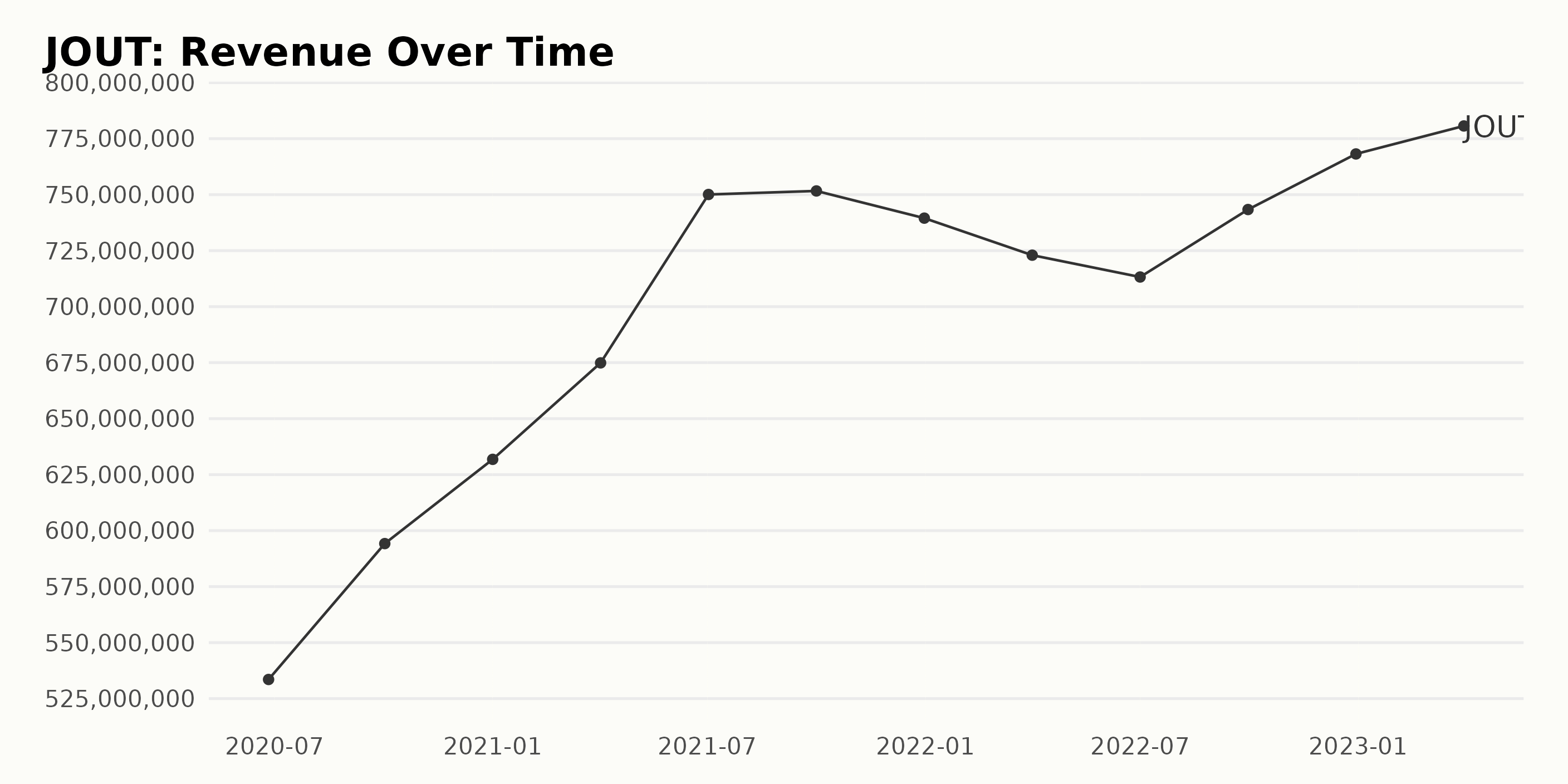

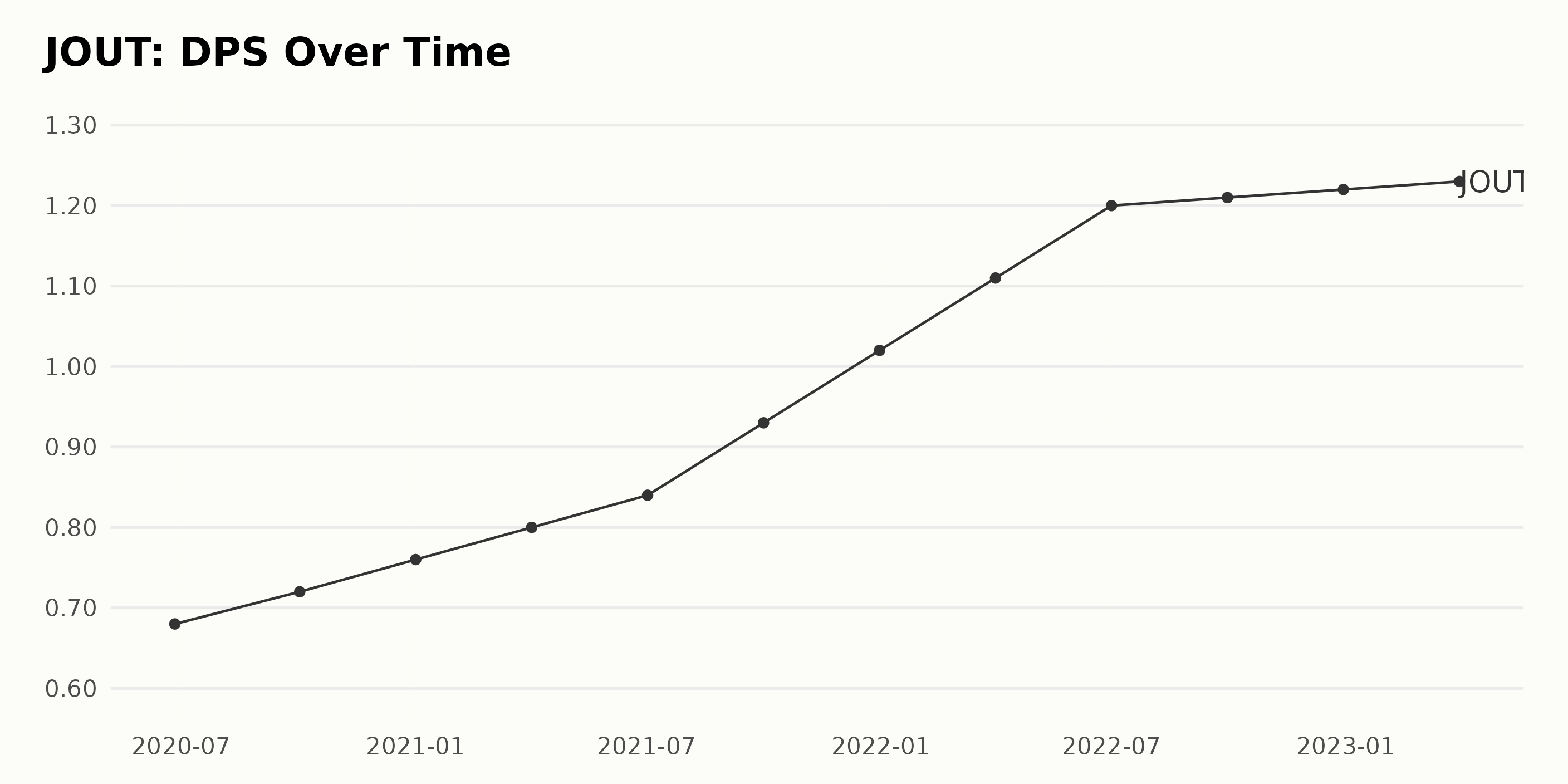

Tracking JOUT’s Revenue and DPS

JOUT’s revenue has fluctuated over the past three years, starting from $533.5 million in June 2020 to $780.7 million in March 2023, representing a growth rate of 45%. In 2020, the revenue decreased from June to October before increasing from $594.2 million to $631.8 million between October and January 2021.

The revenue then increased again to $674.9 million by April 2021, followed by a further increase to $750.1 million by July 2021. There was minimal change from July to October 2021, with revenue reaching $751.7 million. In the following year, from October 2021 to April 2022, the reported revenue decreased from $739.5 million to $722.9 million.

Later in the year, the revenue decreased again to $713.2 million by July before increasing to $743.4 million in September and finally reaching $768.2 million in December. By March 2023, the revenue had increased to $780.7 million.

JOUT’s Dividend Per Share (DPS) had an upward trend since June 2020, when it was at $0.68. The most recent value of the DPS, as of March 2023, is $1.23, demonstrating a growth rate of 81%. In this time period, there have been fluctuations in the price, including a peak of $1.22 at the end of December 2022.

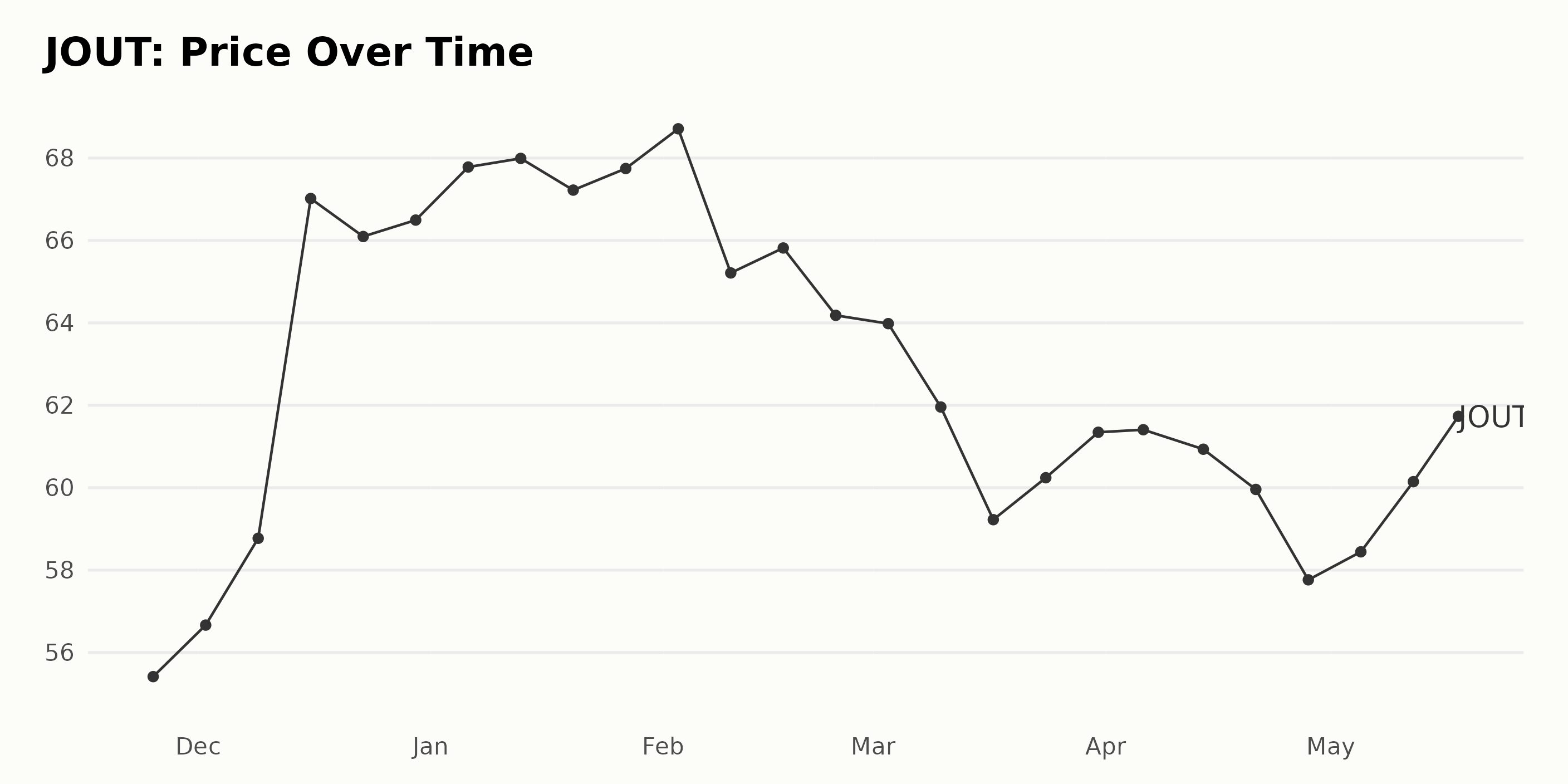

JOUT Share Price: Volatile Peaks and Troughs

JOUT’s share price has increased overall. In November 2022, the share price was $55.41, and by May 2023, it had risen to $61.58, an increase of 11%. However, the growth rate over the period was not steady, with somewhat volatile peaks and troughs. Here is a chart of JOUT’s price over the past 180 days.

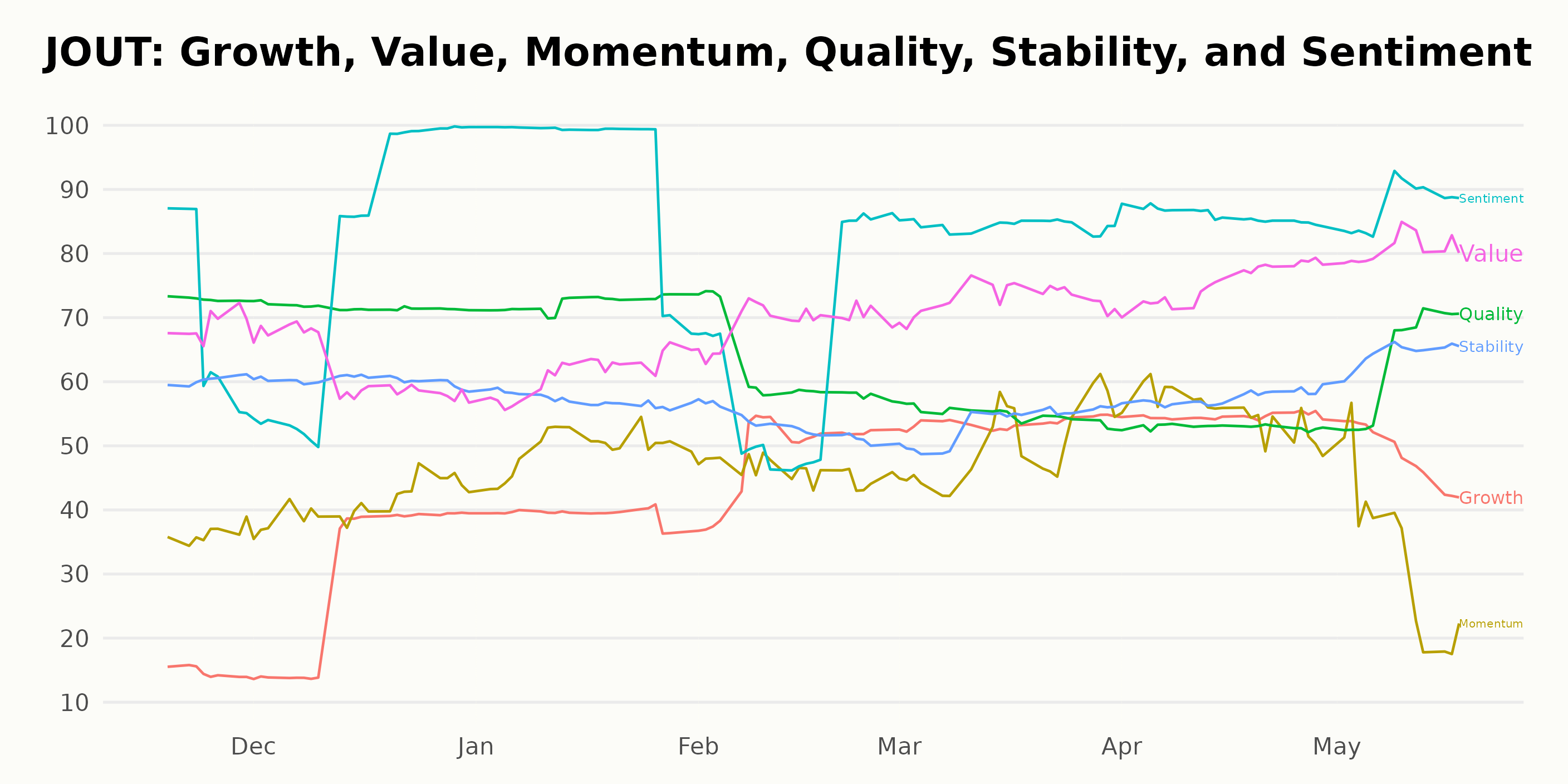

POWR Ratings: 3 Dimensions that Define JOUT

JOUT has an overall B rating, translating to a Buy in our POWR Ratings system. It is ranked #7 out of 37 stocks in the Athletics & Recreation industry.

The three most noteworthy dimensions for JOUT, according to the POWR Ratings, are Sentiment, Value, and Quality. Sentiment has consistently been one of the highest-rated dimensions, ranging from a high of 95 at the end of January 2023 to a low of 63 at the end of February 2023. Value is also highly rated, beginning at 69 at the end of November 2022 and ending at 81 at the end of May 2023. Lastly, Quality has remained relatively consistent, with ratings between 62 and 73.

How does Johnson Outdoors Inc. (JOUT) Stack Up Against its Peers?

Other stocks in the Athletics & Recreation sector that may be worth considering are Marine Products Corporation (MPX - Get Rating), MCBC Holdings Inc. (MCFT - Get Rating), which are A (Strong Buy) rated, and Brunswick Corporation (BC - Get Rating), which is B rated.

The Bear Market is NOT Over…

That is why you need to discover this timely presentation with a trading plan and top picks from 40 year investment veteran Steve Reitmeister:

REVISED: 2023 Stock Market Outlook >

Want More Great Investing Ideas?

JOUT shares were trading at $62.23 per share on Thursday afternoon, down $0.11 (-0.18%). Year-to-date, JOUT has declined -4.98%, versus a 9.20% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| JOUT | Get Rating | Get Rating | Get Rating |

| MPX | Get Rating | Get Rating | Get Rating |

| MCFT | Get Rating | Get Rating | Get Rating |

| BC | Get Rating | Get Rating | Get Rating |