Shares of Dorian LPG Ltd. (LPG - Get Rating) have demonstrated solid momentum over the past several months and are currently trading above their 50-day and 200-day moving averages of $21.26 and $18.46, respectively. LPG’s share price gain is also aligned with its steady growth rates in its top and bottom line, indicating that the business is strengthening.

Let’s look at some key financial metrics that support the bullish case of LPG.

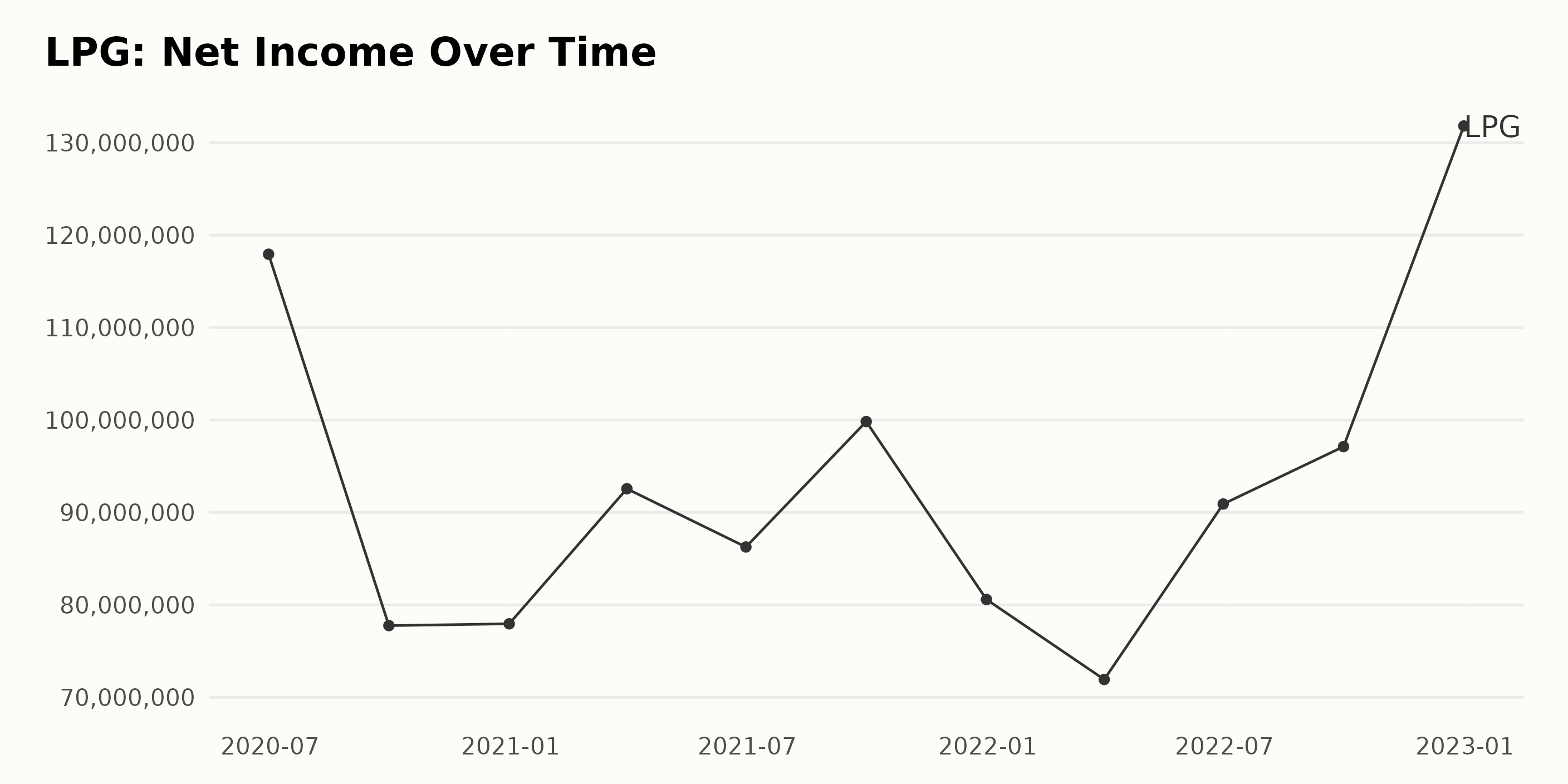

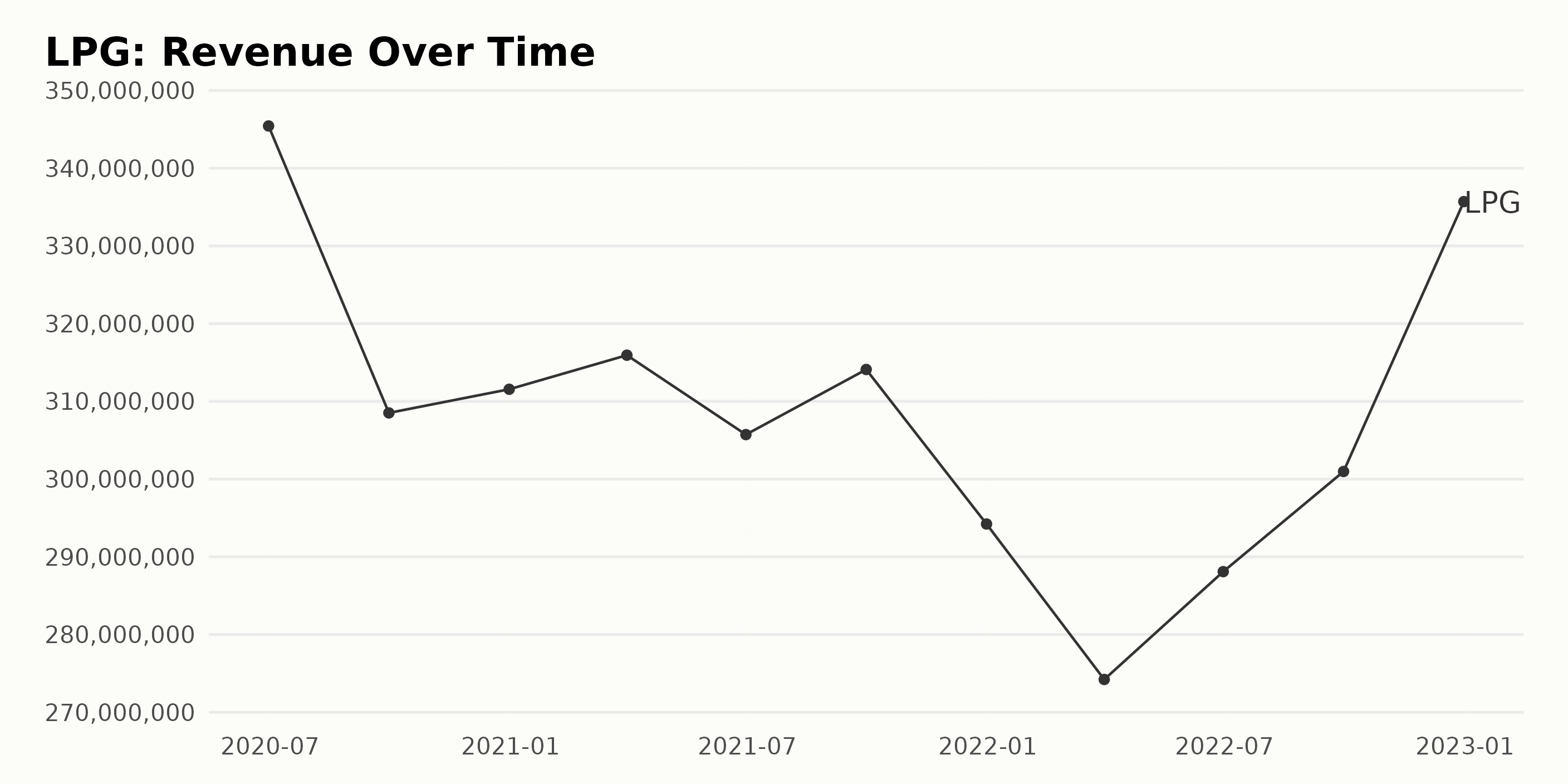

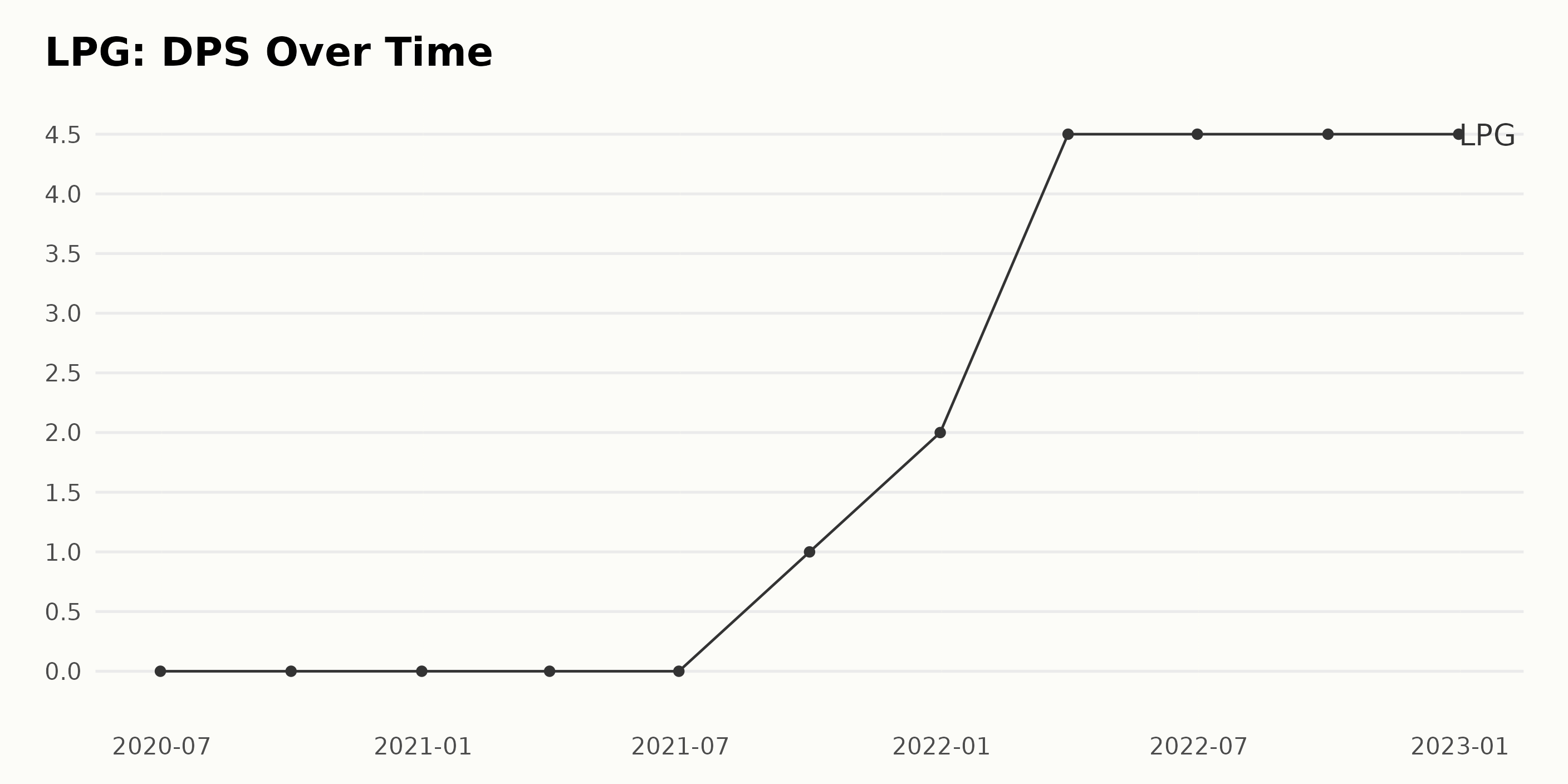

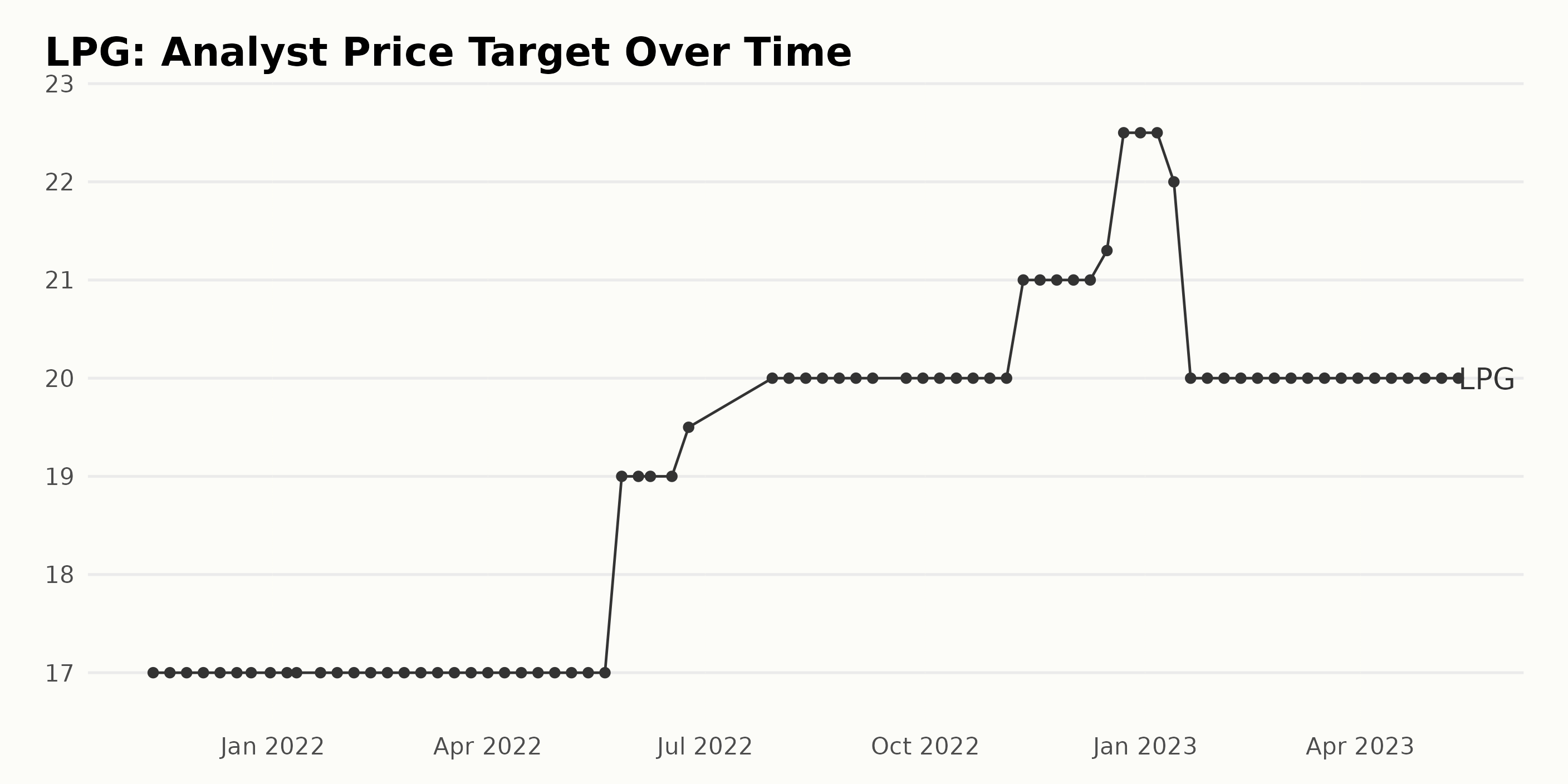

Two-Year Analysis of LPG: Net Income, Revenue, DPS, and Price Target

LPG demonstrated a fluctuating trend in its net income over the last two years. Starting from June 2020 ($117 million), net income sharply dropped to $77 million by September 2020 before recovering to approximately $78 million by December 2020. From December 2020 to March 2021, there was a period of growth, with net income increasing to $92 million.

However, it fell to $86 million by June 2021, only to reach $99 million by September 2021. The trend displayed a slight rebound, with net income increasing again to $81 million in December 2021 before experiencing a fall to $71 million by March 2022. Net income came in at $91 million at the end of June 2022, a growth rate of 22.4%.

LPG recorded a revenue of $345.4 million on June 30, 2020, and experienced a slight decrease of around 11% at the end of September 2020 to $308.5 million. After that, revenue grew steadily to $311.6 million in December 2020. Afterward, revenue growth accelerated, with revenues of $315.9 million and $305.7 million, respectively, at the end of December 2021 and March 2022. At the end of September 2022, the revenue exceeded the previous peak, reaching $310.1 million. The latest record is $335.7 million on December 31, 2022, reflecting a growth rate of 4.8% over the last two years.

Overall, the dividend per share (DPS) for LPG remained null from June 2020 to September 2021, then increased to $1 in September 2021, $2 in December 2021, and $4.5 in March 2022. The trend is increasing with fluctuations around that maximum $4.5 value.

The analyst price target for LPG stayed consistently around $17.00 from November 2021 – May 2022, with minor fluctuations. The price target has steadily increased to $22.50 on December 23, 2022. Finally, at the last value, the price target is currently $20.00 and has remained steady since April 21, 2023. The overall growth rate of the price target is 15%.

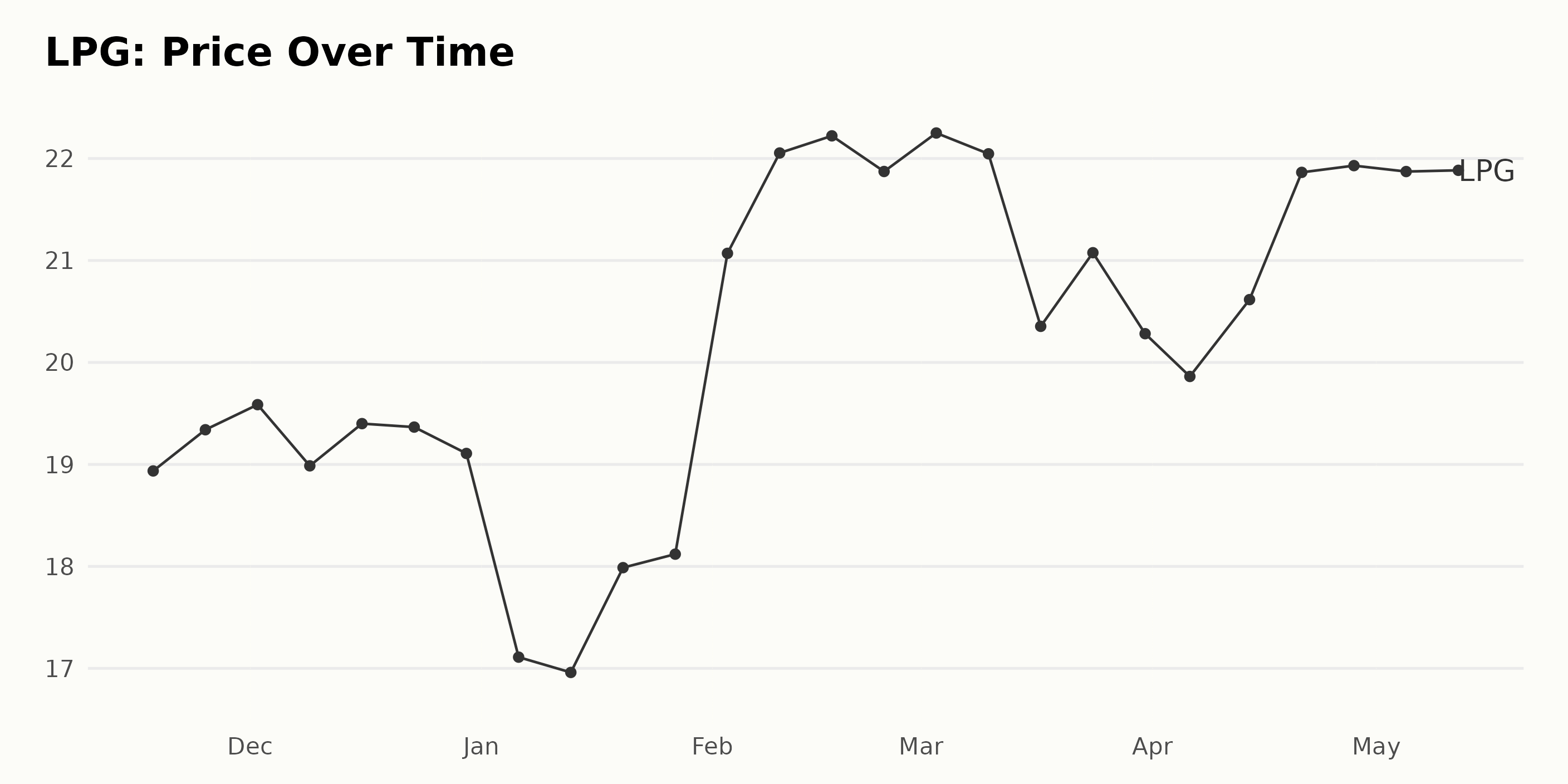

LPG Share Price Increased Over Last 6 Months

There appears to be an overall upward trend in LPG’s share price over this period, with prices increasing from $18.94 on November 18, 2022, to $21.92 on May 11, 2023. The growth rate is approximately 1.1%, with the price increasing by about $0.23 each week. Here is a chart of LPG’s price over the past 180 days.

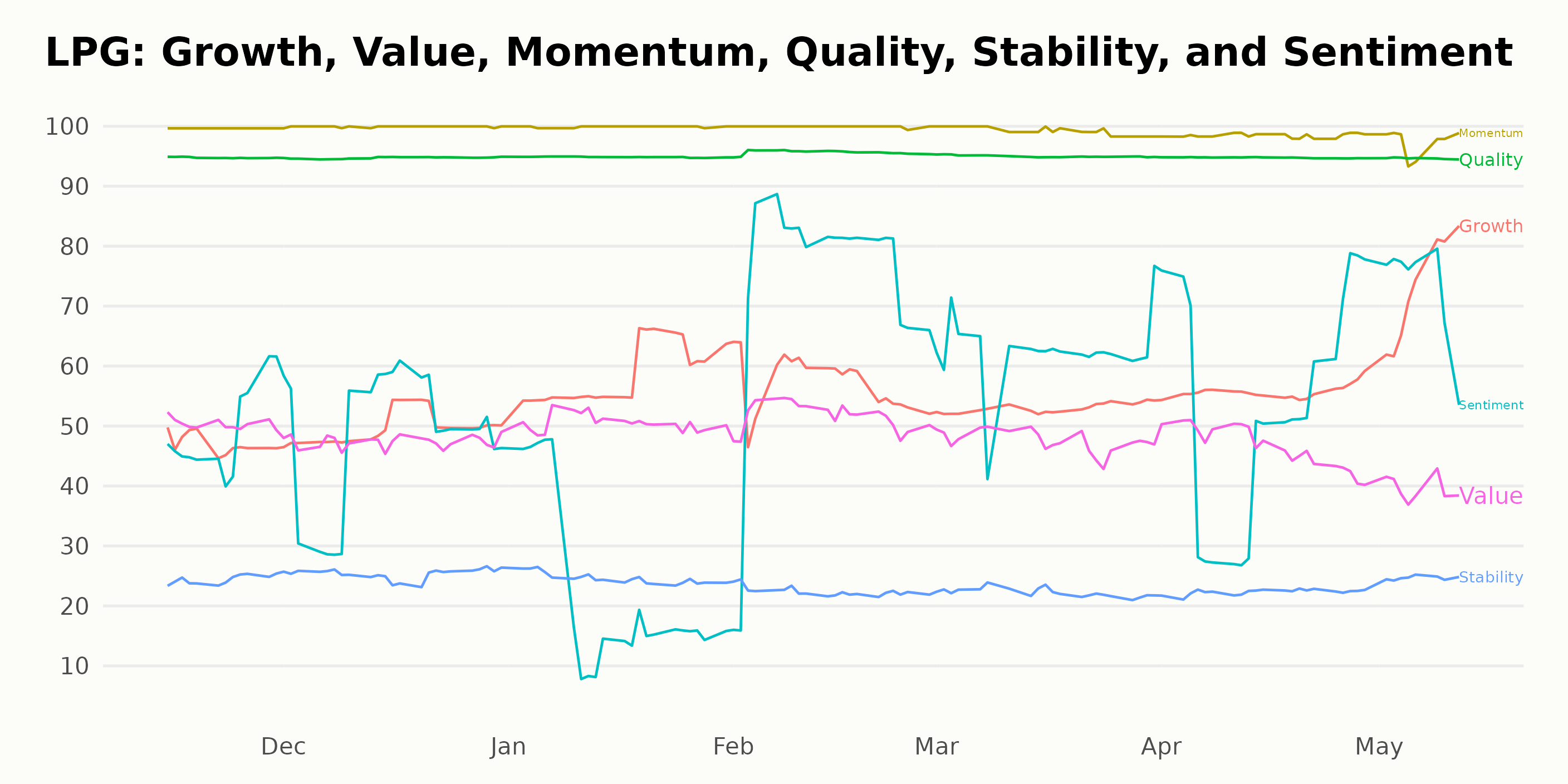

LPG’s POWR Rating Trends

LPG has an overall B rating, translating to a Buy in our POWR Ratings system. It is ranked #13 within 40 stocks in the Shipping category.

LPG’s three most noteworthy POWR Ratings dimensions are Momentum, Quality, and Sentiment. Momentum has consistently rated at 100 points out of 100 each month since November 2022. Quality has fluctuated slightly from 95 to 96 points, while Sentiment has dropped from 49 points in November 2022 and December 2022 to 22 points in January 2023 and then has risen to 73 points in February 2023 and 76 points in May 2023.

How does Dorian LPG Ltd. (LPG) Stack Up Against its Peers?

Other stocks in the Shipping sector that may be worth considering are Overseas Shipholding Group Inc. (OSG - Get Rating), StealthGas Inc. (GASS - Get Rating), and TORM plc (TRMD - Get Rating) — they have better POWR Ratings.

What To Do Next?

Get your hands on this special report with 3 low priced companies with tremendous upside potential even in today’s volatile markets:

3 Stocks to DOUBLE This Year >

Want More Great Investing Ideas?

LPG shares were trading at $21.95 per share on Friday morning, up $0.03 (+0.14%). Year-to-date, LPG has gained 26.81%, versus a 7.96% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| LPG | Get Rating | Get Rating | Get Rating |

| OSG | Get Rating | Get Rating | Get Rating |

| GASS | Get Rating | Get Rating | Get Rating |

| TRMD | Get Rating | Get Rating | Get Rating |