San Francisco-based Lyft, Inc. (LYFT - Get Rating) is one of the largest transportation network companies in the United States and Canada. It operates as a transportation-as-a-service platform, offering peer-to-peer on-demand ridesharing. The company provides Ridesharing Marketplace, Express Drive, Lyft Rentals, and Lyft Pink Subscription services, among others. However, LYFT has an ISS Governance QualityScore of 9, indicating high governance risk.

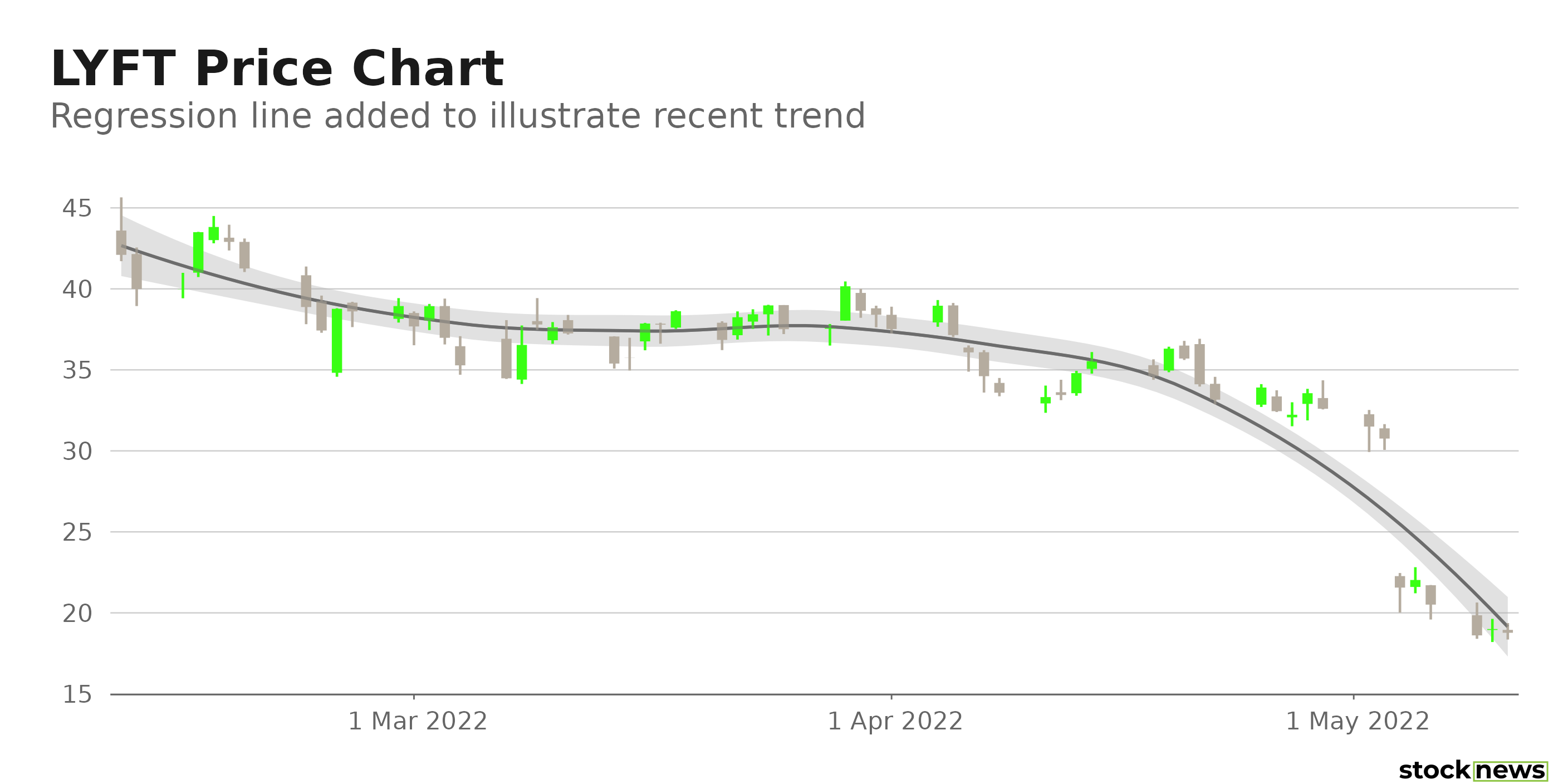

Shares of LYFT have declined 62% in price over the past year and 57.9% year-to-date to close yesterday’s trading session at $19.00.

Despite delivering better-than-expected revenues in its fiscal first quarter (ended March 31, 2022), LYFT shares plunged when management announced its plans to increase spending and investments in drivers. The stock has declined 14.1% in price over the past five days.

Here is what could shape LYFT’s performance in the near term:

Mixed Financials

LYFT’s revenues have increased 44% year-over-year to $875.60 million in its fiscal year 2022 first quarter, ended March 31, 2022.This can be attributed to better-than-expected rideshare ride volumes. Its adjusted EBITDA stood at $54.80 million, compared to a $73 million loss reported in the prior-year quarter.

However, the company’s loss from operations amounted to $194.13 million. Its net loss and loss per share came in at $ 196.93 million and $0.57, respectively. Its net operating cash outflow increased 91.7% from the same period last year to $152.34 million.

Frothy Valuation

In terms of forward non-GAAP P/E, LYFT is currently trading at 73.47x, which is 357.5% higher than the 16.06x industry average. Its 22.48 forward EV/EBITDA multiple is 120.4% higher than the 10.20 industry average. Also, the stock’s 5.72 forward Price/Book ratio is 128.7% higher than the 2.40 industry average.

LYST is currently trading at 1.55 times its forward sales, which is 23.6% higher than the 1.26 industry average. In addition, the stock’s 29.28 forward Price/Cash Flow multiple is 117.4% higher than the 13.49 industry average.

Consensus Rating and Price Target Indicate Potential Upside

Among the 23 Wall Street analysts that rated LYFT, 15 rated it Buy, while eight rated it Hold. The 12-month median price target of $42.95 indicates a 126.1% potential upside from yesterday’s $19 closing price. The price targets range from a low of $25.00 to a high of $65.00.

POWR Ratings Depict Uncertainty

LYFT has an overall C rating, which translates to Neutral in our proprietary POWR Ratings system. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

LYFT has a B grade for Growth but a D for Stability and Momentum. The company’s revenues have increased at an 11.1% CAGR over the past three years, in sync with the Growth grade. However, its relatively high 1.83 beta justifies the Stability grade. Also, LYFT is currently trading below its 50-day and 200-day moving averages of $34.41 and $43.53, respectively, matching the Momentum grade.

Among the 81 stocks in the C-rated Technology – Services industry, LYFT is ranked #47.

Beyond what I have stated above, click here to view LYFT ratings for Value, Sentiment, and Quality.

Bottom Line

LYFT announced its plans to increase spending on drivers’ incentives in the near term, which is expected to negatively impact its profit margins. Following the announcement, Northcoast Research analyst John Healy stated, said “This investment phase was not calibrated into our initial expectations for 2022 and likely caught many off guard.” Thus, we think investors should wait until LYFT’s cost of operations declines and profit margins improve before investing in the stock.

How Does Lyft (LYFT) Stack Up Against its Peers?

While LYFT has a C rating in our proprietary rating system, one might want to consider looking at its industry peers, PC Connection, Inc. (CNXN - Get Rating), Information Services Group, Inc. (III - Get Rating), and Celestica, Inc. (CLS - Get Rating), which have an A (Strong Buy) rating.

Want More Great Investing Ideas?

LYFT shares were trading at $18.88 per share on Wednesday morning, down $0.12 (-0.63%). Year-to-date, LYFT has declined -55.82%, versus a -15.33% rise in the benchmark S&P 500 index during the same period.

About the Author: Aditi Ganguly

Aditi is an experienced content developer and financial writer who is passionate about helping investors understand the do’s and don'ts of investing. She has a keen interest in the stock market and has a fundamental approach when analyzing equities. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| LYFT | Get Rating | Get Rating | Get Rating |

| CNXN | Get Rating | Get Rating | Get Rating |

| III | Get Rating | Get Rating | Get Rating |

| CLS | Get Rating | Get Rating | Get Rating |