In 2023, technology stocks witnessed a remarkable surge, with the Nasdaq exhibiting an impressive rally largely attributed to the stellar performance of the megacap technology companies.

Among these trailblazers was Meta Platforms, Inc. (META - Get Rating), whose stock experienced a significant uptick, catching the eye of savvy investors. This resurgence can be largely accredited to META’s robust growth throughout the year, driven by the increasing adoption of artificial intelligence (AI). The company has seen a robust 194.2% year-to-date increase, with its stock presently trading near its 52-week pinnacle.

Meta’s impressive rebound corroborates CEO Mark Zuckerberg’s assertion at the beginning of February that 2023 would prove to be the company’s “year of efficiency,” especially in light of the drastic decline in the company’s stocks last year.

The company’s core digital advertising business saw healthy growth this year as clients rebounded from a challenging 2022. The lion’s share of this growth in advertising revenue is credited to online commerce, augmented by consumer packaged goods and gaming sectors.

Furthermore, META has continually marked AI as its key investment area, significantly contributing to its success in procuring partnerships with retailers eager to offer clients targeted promotions. META is expected to continue to prioritize AI as a major investment axis for 2024.

Considering how the stock is projected to sustain its momentum into year-end, it emerges as a potentially sound investment option. Below is a comprehensive examination of the key metrics underpinning this optimistic perspective.

Analyzing META’s Financial Performance (2020-2023)

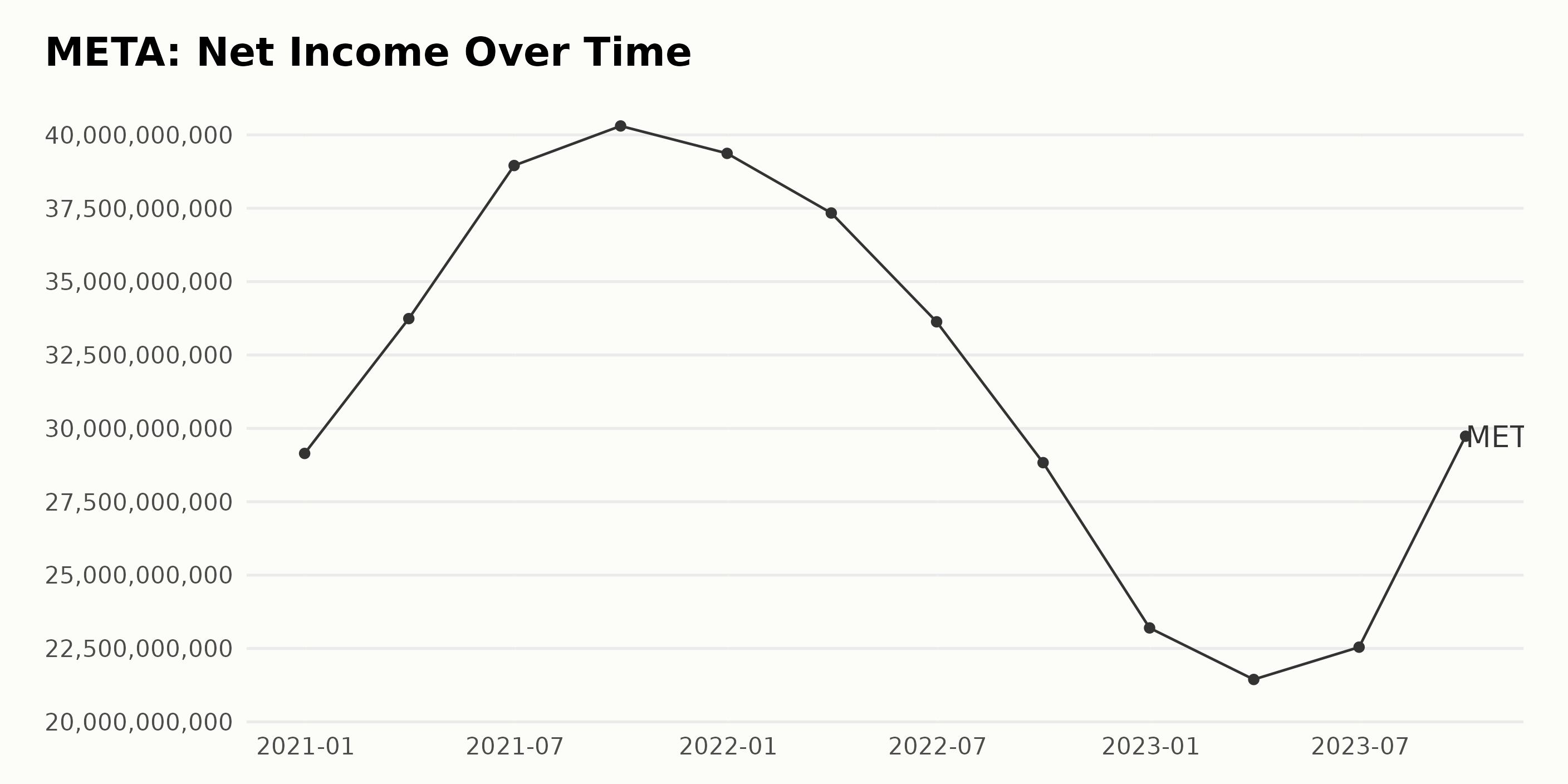

The trailing-12-month Net Income of META demonstrates significant fluctuations over the recorded timeline. Here is a summary of key points:

- Starting with $29.15 billion on December 31, 2020.

- Experienced a rising trend reaching a peak of $40.30 billion on September 30, 2021.

- Post that peak, there was a consistent decrease through 2022 to $23.20 billion by year-end.

- Some recovery began from the low point in early 2023, reaching to $22.54 billion at 2023’s midpoint.

- Then a sharp rise to $29.73 billion was noticed as of September 30, 2023.

Emphasizing recent data, let’s note particularly notable declines in Net Income in 2022, shrinking consistently from $37.34 billion in the first quarter down to $23.20 billion in fourth quarter. This marks a substantial annual fall in Net Income. In 2023, however, after an initial drop during the first quarter to $21.44 billion, META has experienced a recovery with a growth rate of approximately 18.67% for the second and third quarter. The final recorded value in the series is $29.73 billion on September 30, 2023.

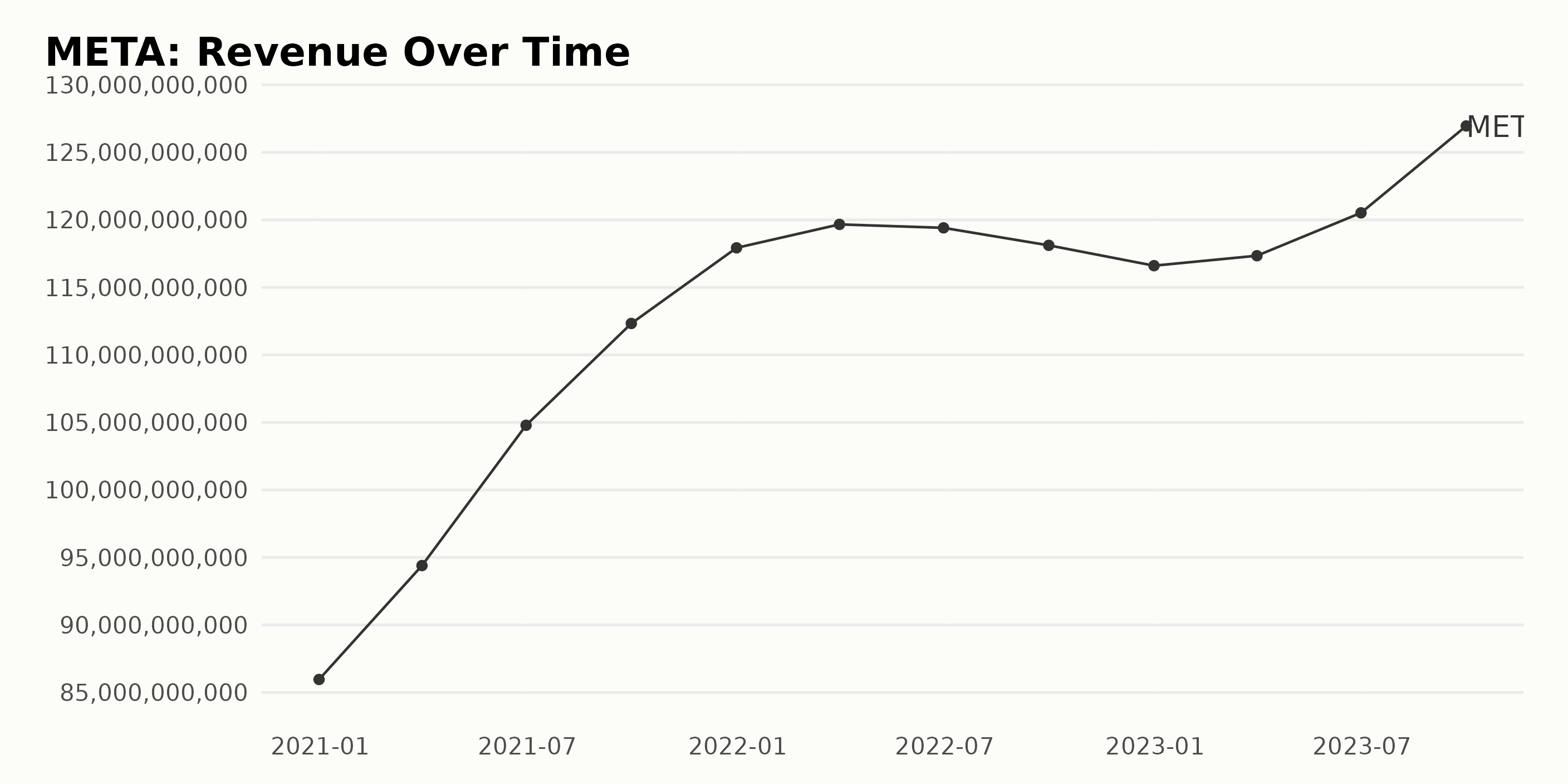

The trailing-12-month Revenue of META has shown a general upward trend over the past three years, albeit with some significant fluctuations. Let’s break down the growth:

- On December 31, 2020, the reported Revenue was $85.97 billion.

- By March 31, 2021, this had increased to $94.4 billion, marking a sharp rise.

- The peak in this period occurred on September 30, 2021, when the Revenue reached its highest point at $112.33 billion.

- In the latter half of 2022, there was a slight drop in Revenue, falling to $116.61 billion by December 31.

- This downward trend reversed into a substantial gain in the first half of 2023, with META posting a robust Revenue growth to reach $120.52 billion by June 30.

- The latest data, as of September 30, 2023, shows that Revenue has further amplified to $126.95 billion, which represents the highest value in the series so far and an impressive climb from the original value in 2020.

On calculation, the growth rate from the first value ($85.97 billion on December 31, 2020) to the last value ($126.95 billion on September 30, 2023) results in an increase of approximately 47.66%. In conclusion, despite some periodic dips, META has successfully managed to increase its Revenue in this time frame. The most recently recorded figures indicate a prevailing positive growth trajectory for the company.

The Gross Margin of META displayed fluctuations over the past few years. Below is a summary of the trend and fluctuations:

- In the fourth quarter of 2020, the Gross Margin clocked at 80.6%.

- Entering into 2021, there was a slight decrease in the first quarter to 80.5%, but it increased marginally in the second quarter to 81%. However, it slightly declined again to 80.9% in the third quarter before further dropping to 80.8% at the end of 2021.

- The year 2022 started with the Gross Margin falling down a tad more to 80.3% in the first quarter. There was a slight rise in the second quarter at 80.5%, but then it dropped again to 80.3% in the third quarter. Significant fluctuation happened at the end of the year as the Gross Margin dropped considerably to 78.3%.

- In 2023, the Gross Margin showed marginal improvement in the first quarter as it increased to 78.4%, remained stable in the second quarter at 78.3%, and then experienced a moderate increase to 79% in the third quarter.

An overall perspective shows that the starting period in the fourth quarter of 2020 and the last recorded period in third quarter of 2023 saw a decrease in Gross Margin from 80.6% to 79%, totaling a fall of 1.6 percentage points.

The overview of the Analyst Price Target (APT) for META from June 2022 until December 2023, exhibits a relatively fluctuating trend. Here are some key insights based on the provided data:

Overall Trend: From an initial value of $293.50 in June 2022, the APT of META witnessed a significant dip to $155 by January 2023, marking a decrease of approximately 47%. However, over time, the trend gradually started to recover, with notable spikes observed towards the end of the series, reaching a high of $382 in December 2023. Consequently, implying an overall increase of approximately 30% over the 19 month period.

Notable Fluctuations: – The APT saw stable levels at $225 from August to October 2022 before a significant drop to $160 by December 2022. – After remaining static at $155 for most of January 2023, it made a surprising jump to $215 in February, stabilizing at this figure until late March. – A noticeable gradual increase occurred between April and July 2023, from $231 to $322.60. – The steepest rise was recorded from July to August 2023, where the APT peaked at $377.50. – In the final quarter of 2023, the APT maintained moderate stability around an average of $378, with slight oscillations.

Recent Values: In the recent data recorded during December 2023, the APT showed a gradual increment from $380.8 at the start of the month to $382 by mid-December, maintaining this value till the end of December 2023.

Last Value: As of the last provided entry on December 22, 2023, META’s Analyst Price Target was $382.

Analyzing META’s Share Price: A Six-Month Trend and Growth Rate Study

Looking at the provided data for the META share prices, here is the trend and growth rate: –

- On June 30, 2023, the share price of META was at $284.83.

- In July 2023, the share price increased weekly, peaking at $307.43 before dropping slightly to $306.17 by the end of the month.

- The price continued to increase into August, reaching a high of $316.76 on August 4. However, it then began to decrease for the remainder of the month, closing at $288.96 on August 25.

- September 2023 saw fluctuations in price, with a peak of $305.37 on September 15 and ending at $299.99 on September 29.

- In October, the price trended upwards again, hitting a high of $321.87 on October 13 before closing the month at $302.96.

- November 2023 showed a clear and significant growth acceleration overall, with the share price bouncing back to $307.38 early in the month and reaching a peak of $339.17 by November 24.

- In December, the price experienced a slight decline early in the month but reversed course and closed at a high of $354.09 on December 21.

To summarize, from June 2023 to December 2023, META’s share price displayed a positive upward trend, despite some periods of fluctuation. The growth rate accelerated most noticeably in November and remained strong into December. Here is a chart of META’s price over the past 180 days.

Spotlight on META: Examining Growth, Quality, and Momentum in 2023

META has an overall A rating, translating to a Strong Buy in our POWR Ratings system. It is ranked #2 out of the 55 stocks in the Internet category.

Based on the POWR Ratings for META, the three most noteworthy dimensions are Growth, Quality, and Momentum, showing the highest values and apparent trends over time.

Growth: – In June 2023, the growth dimension for META stood at 32. Over the coming months, a clear upward trend is noticeable with a rating of 79 in August and September 2023, and peaking at 90 in November and December 2023. This represents an impressive growth trajectory for META across this period.

Quality: – The quality dimension of META consistently obtained high ratings, staying largely stable throughout the reporting period. The ratings started at 97 in June 2023, increased just slightly to 98 by August, and maintained this score through December 2023. This suggests that META has met high-quality standards in its operational aspects over this period.

Momentum: – The momentum dimension for META revealed a steady upward trend over the period in question. Starting from a rating of 21 in June 2023, it clocked in at 71 by December 2023, signifying a significant increase in the asset’s momentum over these months.

How does Meta Platforms, Inc. (META) Stack Up Against its Peers?

Other stocks in the Internet sector that may be worth considering are LINE Corporation (LN - Get Rating), Yelp Inc. (YELP - Get Rating), and Alphabet Inc. (GOOGL - Get Rating) — they have better POWR Ratings.

What To Do Next?

43 year investment veteran, Steve Reitmeister, has just released his 2024 market outlook along with trading plan and top 11 picks for the year ahead.

Want More Great Investing Ideas?

META shares were trading at $353.75 per share on Friday afternoon, down $0.34 (-0.10%). Year-to-date, META has gained 193.96%, versus a 26.01% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| META | Get Rating | Get Rating | Get Rating |

| LN | Get Rating | Get Rating | Get Rating |

| YELP | Get Rating | Get Rating | Get Rating |

| GOOGL | Get Rating | Get Rating | Get Rating |