Micro Focus International Plc (MFGP - Get Rating) in Newbury, U.K., provides enterprise-level clients with a wide range of software solutions, including back-end business, identity access, security, and operations management capabilities. The firm also offers consulting services to businesses looking to expand their IT infrastructure, upgrade, or transfer to the cloud.

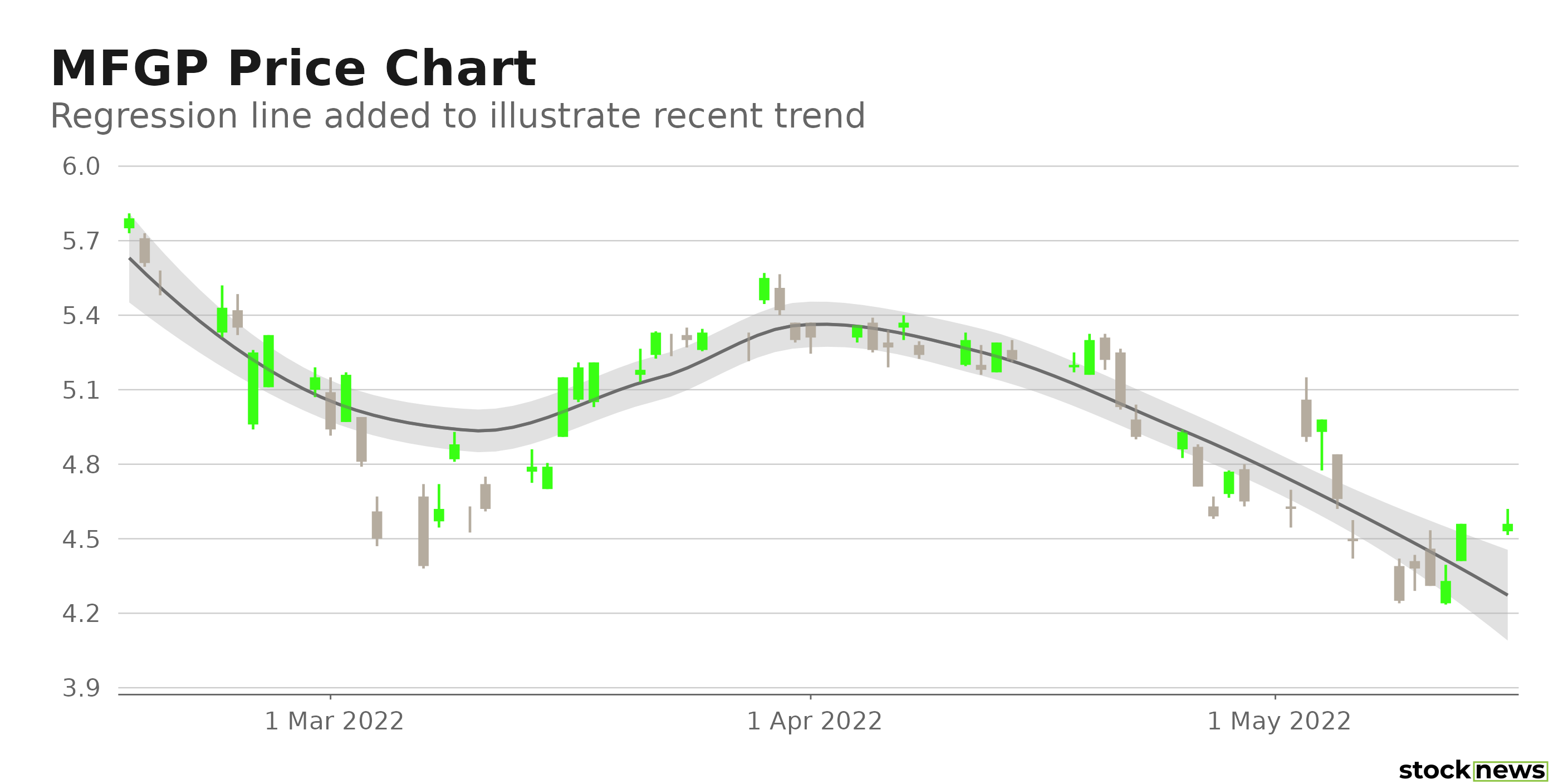

The company’s shares are down 33.1% in price over the past year and 12.6% over the past month to close yesterday’s trading session at $4.56. In addition, it is currently trading below its 52-week high of $7.59, which it hit on June 25, 2021.

MFGP’s revenue has declined 3.4% year-over-year to $2.89 billion in its fiscal year ending Oct. 31, 2021. Its operating loss came in at $265.6 million, and its adjusted EPS from continuing operations amounted to 144.93 cents, down from 154.37 cents in fiscal 2020. In addition, in January, Moody’s issued B1 ratings to Micro Focus’ new term loans with a negative outlook.

Here is what could shape MFGP’s performance in the near term:

Mixed Profitability

MFGP’s $200.60 million in trailing-12-months cash from operations is 135.1% higher than the $85.32 million industry average. Its 73.3% trailing-12-months gross profit margin is 45.5% higher than the 50.4% industry average. However, its trailing-12-months ROA, net income margin, and ROE are negative 4.1%, 14.6%, and 14.4%, respectively, compared to their industry averages. Also, its 0.27% trailing-12-months asset turnover ratio is 57.5% lower than the 0.63% industry average.

Discounted Valuation

In terms of forward Non-GAAP P/E, the stock is currently trading at 3.10x, which is 83.4% lower than the 18.65x industry average. Also, its 1.98x forward EV/Sales is 28.9% lower than the 2.78x industry average. Furthermore, MFGP’s 0.57x forward Price/Sales is 79.8% lower than the 2.81x industry average.

POWR Ratings Reflect Uncertainty

MFGP has an overall C rating, which equates to a Neutral in our proprietary POWR Ratings system. The POWR ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

Our proprietary rating system also evaluates each stock based on eight distinct categories. MFGP has a C for Quality and Stability. The company’s mixed profitability is consistent with the Quality grade. In addition, the stock’s 2.42 beta is in sync with the Stability grade.

Among the 157 stocks in the F-rated Software – Application industry, MFGP is ranked #60.

Beyond what I have stated above, you can view MFGP ratings for Growth, Momentum, Value, and Sentiment here.

Bottom Line

While the company’s long-term strategic collaboration with Amazon’s cloud computing firm and agreements with a few other large cloud companies could bolster its long-term growth, its diminishing revenue is concerning. In addition, the stock is currently trading below its 50-day and 200-day moving averages of $4.97 and $5.30, respectively, indicating bearish sentiment. So, we believe investors should wait for MFGP’s prospects to stabilize before betting on the stock.

How Does Micro Focus International Plc (MFGP) Stack Up Against its Peers?

While MFGP has an overall C rating, one might want to consider its industry peers, Commvault Systems Inc. (CVLT - Get Rating), Rimini Street Inc. (RMNI - Get Rating), and Enghouse Systems Limited (EGHSF - Get Rating), which have an overall A (Strong Buy) rating.

Click here to check out our Software Industry Report for 2022

Want More Great Investing Ideas?

MFGP shares rose $0.06 (+1.32%) in premarket trading Tuesday. Year-to-date, MFGP has declined -13.64%, versus a -14.32% rise in the benchmark S&P 500 index during the same period.

About the Author: Pragya Pandey

Pragya is an equity research analyst and financial journalist with a passion for investing. In college she majored in finance and is currently pursuing the CFA program and is a Level II candidate. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| MFGP | Get Rating | Get Rating | Get Rating |

| CVLT | Get Rating | Get Rating | Get Rating |

| RMNI | Get Rating | Get Rating | Get Rating |

| EGHSF | Get Rating | Get Rating | Get Rating |