Headquartered in Dartmouth, Canada, Meta Materials Inc. (MMAT - Get Rating) designs, develops, and manufactures functional materials. Its technology platform enables producers to deliver products to their customers in consumer electronics, fifth-generation (5G) communications, health and wellness, aerospace, automotive, and clean energy. Last year the company began trading under the ticker symbol “MMAT” after closing a reverse takeover deal with the oil and gas producer Torchlight Energy Resources.

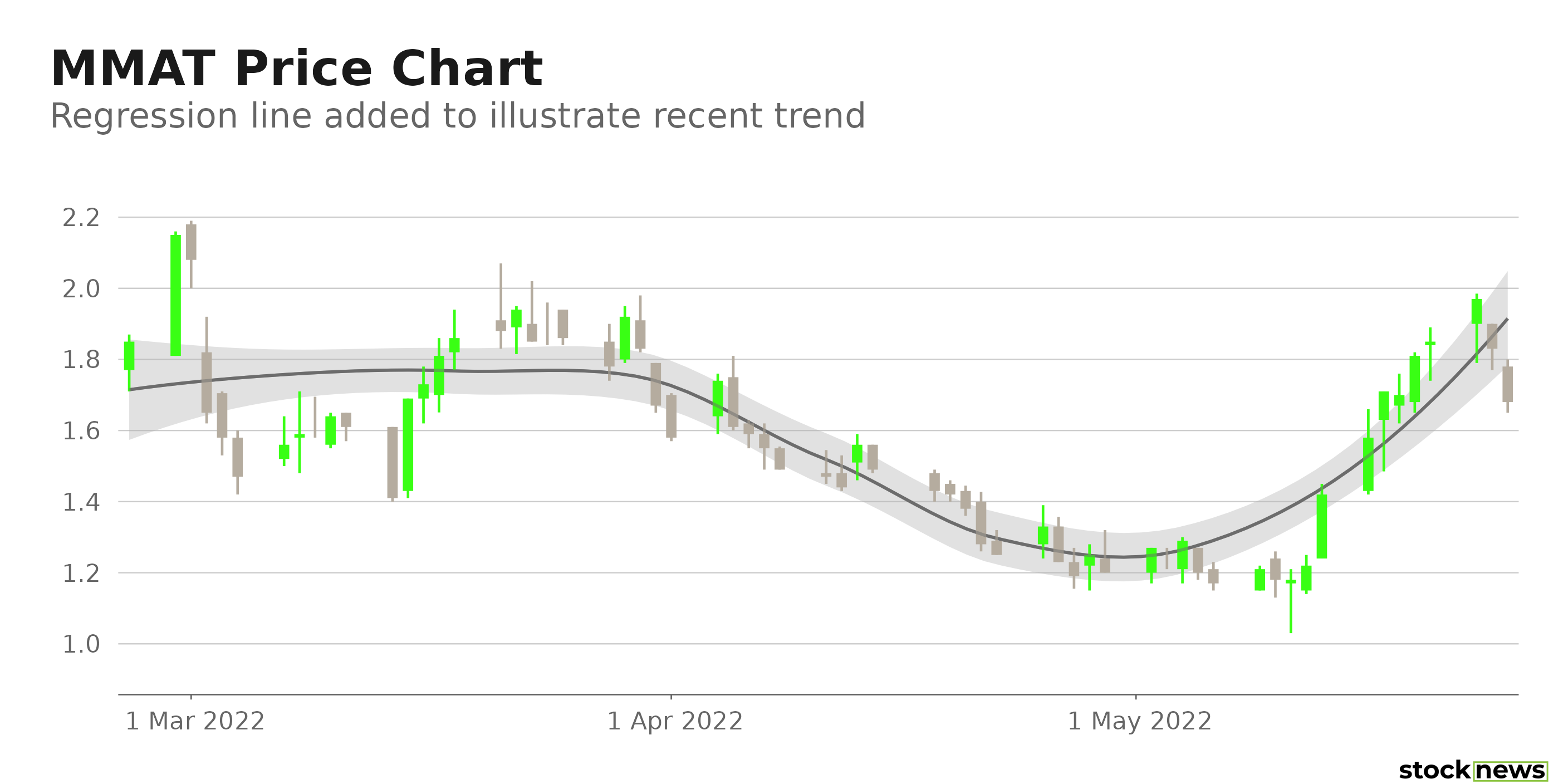

MMAT shares have slumped 63.3% in price over the past year and 31.7% year-to-date to close the last trading session at $1.68. However, the stock has gained 26.3% over the past month, driven, apparently, by optimism around its first granted U.S. patent for a non-invasive glucose sensing system and topline growth in the last reported quarter.

Earlier this month, the company announced that its wholly owned U.K. subsidiary, Medical Wireless Sensing (“MediWise”), had been granted the first U.S. patent for its glucoWISE® non-invasive glucose sensing system and related anti-reflection metamaterial films. This marks a significant milestone in the company’s business trajectory. “META’s broad and rapidly growing intellectual property portfolio is a key element of our strategy to support growth and establish a durable competitive advantage,” said George Palikaras, President and CEO.

Here is what could shape MMAT’s performance in the near term:

Bottom Line is in the Red

For its fiscal first quarter, ended March 31, 2022, MMAT’s total revenues increased 398.9% year-over-year to $2.97 million. However, its loss from operations increased 317.2% from its year-ago value to $17.41 million. In addition, its net loss and net loss per share were $18.43 million and $0.06, respectively, versus the prior-year quarter values of $44.16 million and $0.26.

The weighted average number of MMAT’s shares outstanding was 285.22 million for the quarter, compared to 168.86 million in the first quarter of 2021, indicating considerable stock dilution.

Furthermore, MMAT’s trailing-12-month net income and EPS stood at negative $65.27 million and $0.25, respectively. And its trailing-12-month EBITDA came in at a negative $46.72 million, while its operating income was negative $51.29 million. Also, trailing-12-month net operating cash flow and levered FCF totaled $51.12 million and $100.60 million, respectively.

Poor Profitability

MMAT’s 0.03% trailing-12-month asset turnover ratio is 95.4% lower than the 0.63% industry average. Also, its negative 40.55% ROE is substantially lower than the 7.81% industry average.

Furthermore, MMAT’s ROA and ROTC of negative 15.76% and 15.32% compare with the 3.48% and 4.80% industry averages, respectively.

Lofty Valuation

In terms of forward EV/Sales, MMAT is currently trading at 45.45x, which is 1,530.4% higher than the 2.79x industry average. Also, its 41.59 forward Price/Sales ratio is 1,446.7% higher than the 2.69 industry average.

Unfavorable POWR Ratings

MMAT has an overall F rating, which translates to Strong Sell in our proprietary POWR Ratings system. The POWR Ratings are calculated considering 118 distinct factors, with each factor weighted to an optimal degree.

The stock has an F grade for Quality, which is consistent with its bleak profitability.

MMAT also has an F grade for Value. Its stretched valuations justify this grade.

Among the 48 stocks in the C-rated Technology – Electronics industry, MMAT is ranked #46.

Beyond what I have stated above, one can also view MMAT’s grades for Sentiment, Growth, Momentum, and Stability here.

View the top-rated stocks in the Technology – Electronics industry here.

Bottom Line

While the company might be poised for substantial growth over the long run, its current bottom line positioning does not look great. Moreover, analysts expect the company’s EPS to remain negative at least this year. And although the stock managed a rally over the past month, the sustainability of the gains is questionable. Thus, I think it could be wise to wait for further development in the company’s business trajectory and avoid the stock now.

How Does Meta Materials Inc. (MMAT) Stack Up Against its Peers?

While MMAT has an overall POWR Rating of F, one might want to consider investing in the following Technology – Electronics stocks with an A (Strong Buy) rating: Wayside Technology Group, Inc. (WSTG - Get Rating), CTS Corporation (CTS - Get Rating), and Avnet, Inc. (AVT - Get Rating).

Note that AVT is one of the few stocks handpicked currently in the Reitmeister Total Return portfolio. Learn more here.

Want More Great Investing Ideas?

MMAT shares rose $0.02 (+1.19%) in premarket trading Thursday. Year-to-date, MMAT has declined -31.71%, versus a -16.08% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| MMAT | Get Rating | Get Rating | Get Rating |

| WSTG | Get Rating | Get Rating | Get Rating |

| CTS | Get Rating | Get Rating | Get Rating |

| AVT | Get Rating | Get Rating | Get Rating |