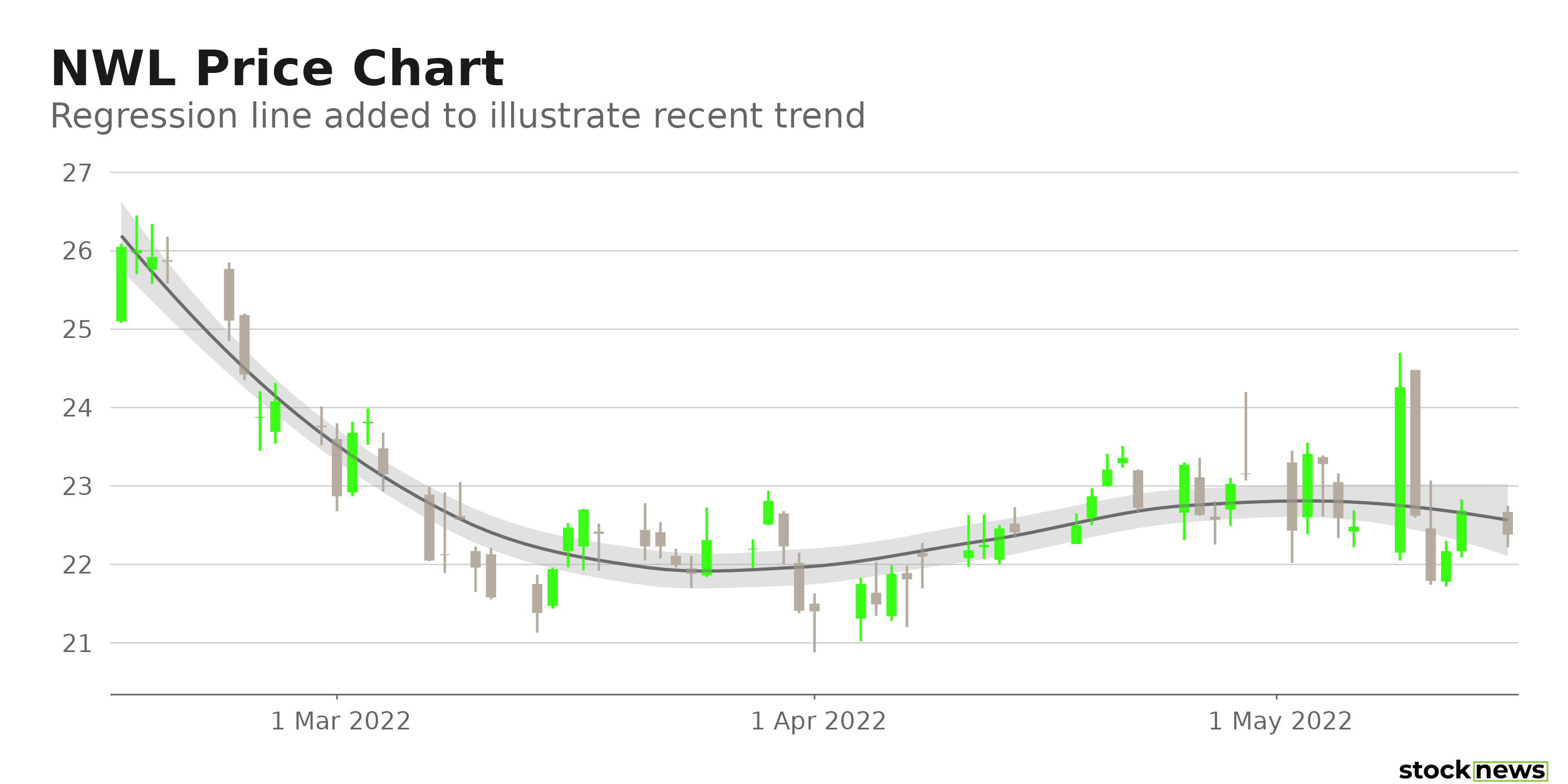

Newell Brands Inc. (NWL - Get Rating) in Atlanta, Ga., designs, manufactures, sources, and distributes consumer and commercial products worldwide. It operates in five segments: Commercial Solutions; Home Appliances; Home Solutions; Learning and Development; and Outdoor and Recreation. NEWL shares have slumped 21.6% in price over the past year to close the last trading session at $22.69. However, the stock has gained 3.9% in price year-to-date.

NEWL reported a robust first quarter this year, with its earnings surpassing the Street’s expectations. Also, its sales were ahead of the consensus estimate, with each segment’s performance better than anticipated. Furthermore, the company reaffirmed its full-year 2022 net sales and normalized earnings per share outlook of $9.93 billion – $10.13 billion and $1.85 – $1.93, respectively, bolstering the stock.

The company will pay a $0.23 dividend on June 15, 2022, to common stockholders of record at the close of business on May 31, 2022. NEWL’s $0.92 annual dividend yields 4.05% at the current share price. The high yield could be appealing to income investors. But it is wise to analyze the sustainability of the payments. The company is currently earning enough to cover the payment, but its accounts for 115% of its cash flows, and paying out this much of its cash flow raises the prospect of a dividend cut in the future. Its dividend payouts have increased at a 3.9% CAGR over the past five years. On the other hand, NWL’s revenues have decreased at a 5.3% CAGR over the past five years, while its levered FCF declined at a 20.6% CAGR over the past three years, which isn’t great.

Here’s what could shape NWL’s performance in the near term:

Declining Cash Flows

For its fiscal first quarter, ended March 31, 2022, NWL’s net sales increased 4.4% year-over-year to $2.39 billion, while core sales grew 6.9% compared with the prior-year period. Its operating income rose 13% from its year-ago value to $217 million. Also, its net income came in at $234 million, reflecting a 162.9% increase year-over-year. The company’s earnings per share were $0.55 compared with $0.21 in the prior-year period, and its normalized earnings per share were $0.36 compared with $0.30.

However, its net cash from operating activities stood at negative $272 million, down substantially from its year-ago value of negative $25 million. NWL’s cash, cash equivalents, and restricted cash balance decreased 45% year-over-year to $379 million.

Mixed Profitability

NWL’s 31.13% gross profit margin is 14.1% lower than the 36.23% industry average, while its 3.63% levered FCF margin is 10.8% lower than the 4.07% industry average. Its ROA and ROTC of 5.05% and 6.87%, respectively, are 17.5% and 9% lower than the 6.12% and 7.56% industry averages.

However, NWL’s 18.35% ROE is 3.7% higher than the 17.70% industry average. Also, its 10.06% and 13.00% respective EBIT and EBITDA margins compared with the 9.21% and 12.49% industry averages.

Bleak Top Line Growth Prospect

Analysts expect the company’s revenues to come in at $2.57 billion in its fiscal second quarter, ending June 30, 2022, indicating a 5% decline year-over-year. Also, its revenues are expected to decline 6.8% in the following quarter, ending Sept. 2022 and 3.9% in its fiscal year ending Dec. 31, 2022.

In addition, the $0.47 consensus EPS estimate for the current quarter indicates a 15.4% year-over-year decline. However, its EPS is expected to grow 7% in the next quarter and 4.9% in the current year.

POWR Ratings Reflect Uncertain Prospects

NWL has an overall C rating, which translates to Neutral in our proprietary POWR Ratings system. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

The stock has a grade of C for Quality, consistent with its mixed profitability.

NWL also has a C grade for Sentiment. Mixed analyst sentiment about the stock justifies this grade.

Of the 63 stocks in the C-rated Home Improvement & Goods industry, NWL is ranked #20.

Beyond what I have stated above, you can also view NWL’s grades for Value, Growth, Momentum, and Stability here.

View the top-rated stocks in the Home Improvement & Goods industry here.

Bottom Line

NWL drove significant growth in its top and bottom lines in its last reported quarter, bolstering investors’ optimism. However, the combined headwinds of inflation, supply-chain disruptions, and uncertainty about consumer spending could hamper its growth trajectory. Analysts see its revenues declining in the coming quarters. Furthermore, its insufficient cash flow generation could make it unlikely that its dividends will grow in the future. Thus, I think it could be wise to wait for a better entry point in the stock.

How Does Newell Brands Inc. (NWL) Stack Up Against its Peers?

While NWL has an overall POWR Rating of C, one might want to consider taking a look at its industry peers, Acuity Brands, Inc. (AYI - Get Rating), which has an A (Strong Buy) rating, and Builders FirstSource, Inc. (BLDR - Get Rating) and Select Interior Concepts, Inc. (SIC - Get Rating), which have a B (Buy) rating.

Note that BLDR is one of the few stocks handpicked by our Chief Growth Strategist, Jaimini Desai, currently in the POWR Growth portfolio. Learn more here.

Want More Great Investing Ideas?

NWL shares were trading at $22.46 per share on Monday morning, down $0.23 (-1.01%). Year-to-date, NWL has gained 3.84%, versus a -15.46% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| NWL | Get Rating | Get Rating | Get Rating |

| AYI | Get Rating | Get Rating | Get Rating |

| BLDR | Get Rating | Get Rating | Get Rating |

| SIC | Get Rating | Get Rating | Get Rating |