Headquartered in Moncton, Canada, OrganiGram Holdings Inc. (OGI - Get Rating) produces and sells cannabis and cannabis-derived products. It offers medical cannabis products, including cannabis flowers, cannabis oils, and vaporizers for civilian patients and veterans; adult-use recreational cannabis under the Edison Cannabis Co., Trail Blazer, SHRED, SHRED’ems, Big Bag O’ Buds, and Monjour brands; and cannabis edibles products and concentrates. The company also engages in the wholesale shipping of cannabis plant cuttings, dried flowers, blends, pre-rolls, and cannabis derivative-based products to retailers and wholesalers for adult-use recreational cannabis.

Amid calls for the legalization of marijuana for medical and recreational use, the U.S. House of Representatives passed legislation last month, dubbed the Marijuana Opportunity Reinvestment and Expungement Act, which was passed in the previous year but did not move forward in the Senate. The legislation removes marijuana from the list of scheduled substances under the Controlled Substances Act and eliminates criminal penalties for an individual who manufactures, distributes, or possesses marijuana. This is expected to drive the demand for marijuana for medical and recreational use. According to cannabis data experts at BDSA Analytics, global cannabis sales will surpass $61 billion in 2026, growing at a 16% CAGR. However, not all cannabis stocks are well placed to capitalize on the industry tailwinds.

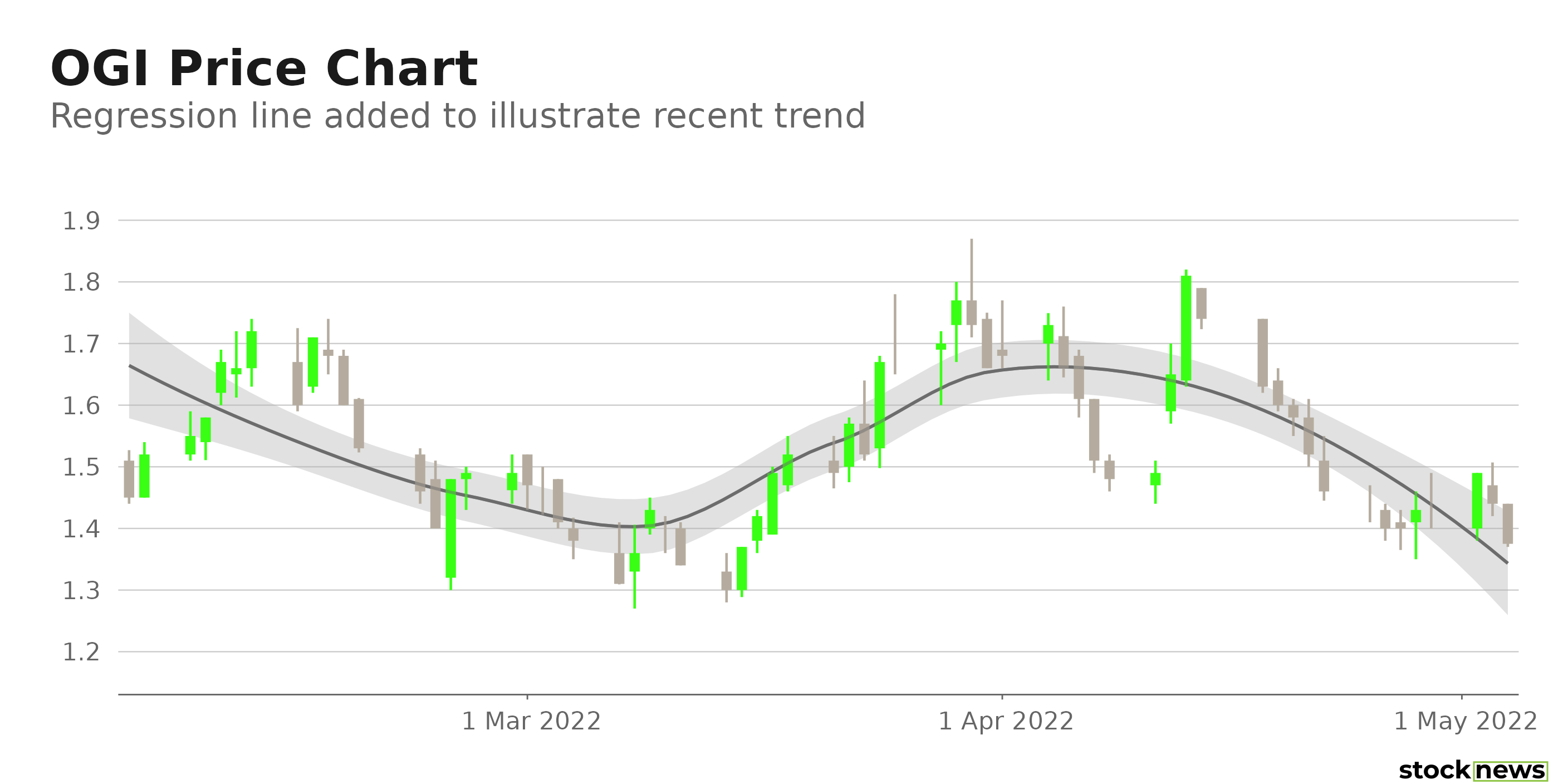

OGI stock has declined 38.2% in price over the past six months and 43% over the past year to close the last trading session at $1.44. The stock is down 59% from its 52-week high of $3.52, which it hit on June 9, 2021.

Here is what could influence OGI’s performance in the upcoming months:

Disappointing Financials

OGI’s cash and short-term investments declined 18% to $150.74 million for the second quarter, ended Feb. 28, 2022, compared to the fiscal year ended August 31, 2021. The company’s net loss narrowed 93.9% year-over-year to $4.04 million. And its selling, general, and administrative expenses increased 36% year-over-year to $13.99 million.

Low Profitability

In terms of trailing-12-month gross profit margin, OGI’s 14.10% is 74.4% lower than the 55.18% industry average. Its trailing-12-month EBIT and EBITDA margins are negative versus the 1.05% and 4.29% respective industry averages.

POWR Ratings Reflect Bleak Prospects

OGI has an overall F rating, which equates to a Strong Sell in our POWR Ratings system. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

Our proprietary rating system also evaluates each stock based on eight distinct categories. OGI has an F grade for Momentum. The stock is currently trading below its 50-day and 200-day moving averages of $1.52 and $1.99, respectively, which justifies the Momentum grade.

OGI has a D grade for Quality, which is in sync with its 0.22% trailing-12-month asset turnover ratio, which is 37.1% lower than the 0.35% industry average.

Furthermore, the stock has a D grade for Stability, consistent with its 1.14 beta.

OGI is ranked #168 out of 169 stocks in the F-rated Medical – Pharmaceuticals industry. Click here to access OGI’s growth, Value, and sentiment ratings.

Bottom Line

Given the legalization of marijuana nationwide, cannabis stocks are expected to witness solid growth in the long run. However, despite the industry’s bright prospects, OGI is not likely to perform well due to its weak financials and lower-than-industry profitability. So, we think it could be wise to avoid the stock now.

How Does OrganiGram Holdings Inc. (OGI) Stack Up Against Its Peers?

OGI has an overall POWR Rating of F, which equates to a Strong Sell rating. Therefore, one might want to consider investing in other Medical – Pharmaceuticals stocks with an A (Strong Buy) or B (Buy) rating, such as Merck & Co., Inc. (MRK - Get Rating), Novo Nordisk A/S (NVO - Get Rating), and GlaxoSmithKline plc (GSK - Get Rating).

Want More Great Investing Ideas?

OGI shares were trading at $1.37 per share on Wednesday morning, down $0.07 (-4.86%). Year-to-date, OGI has declined -21.71%, versus a -12.38% rise in the benchmark S&P 500 index during the same period.

About the Author: Dipanjan Banchur

Since he was in grade school, Dipanjan was interested in the stock market. This led to him obtaining a master’s degree in Finance and Accounting. Currently, as an investment analyst and financial journalist, Dipanjan has a strong interest in reading and analyzing emerging trends in financial markets. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| OGI | Get Rating | Get Rating | Get Rating |

| MRK | Get Rating | Get Rating | Get Rating |

| NVO | Get Rating | Get Rating | Get Rating |

| GSK | Get Rating | Get Rating | Get Rating |