Once upon a time, there were two giant tech companies that battled for dominance in providing Fortune 1,000 businesses in what was then called ‘enterprise services’ software.

Their names are SAP (SAP) and Oracle (ORCL) and their shares enjoyed a meteoric rise in the years leading 1999 dot.com boom. And, while they certainly didn’t go bust, in fact, both stocks are neared all-time highs. The performance, since the 2009 financial crisis low, has lagged both the broader market and the slew of new cloud-based firms that have come on the scene since.

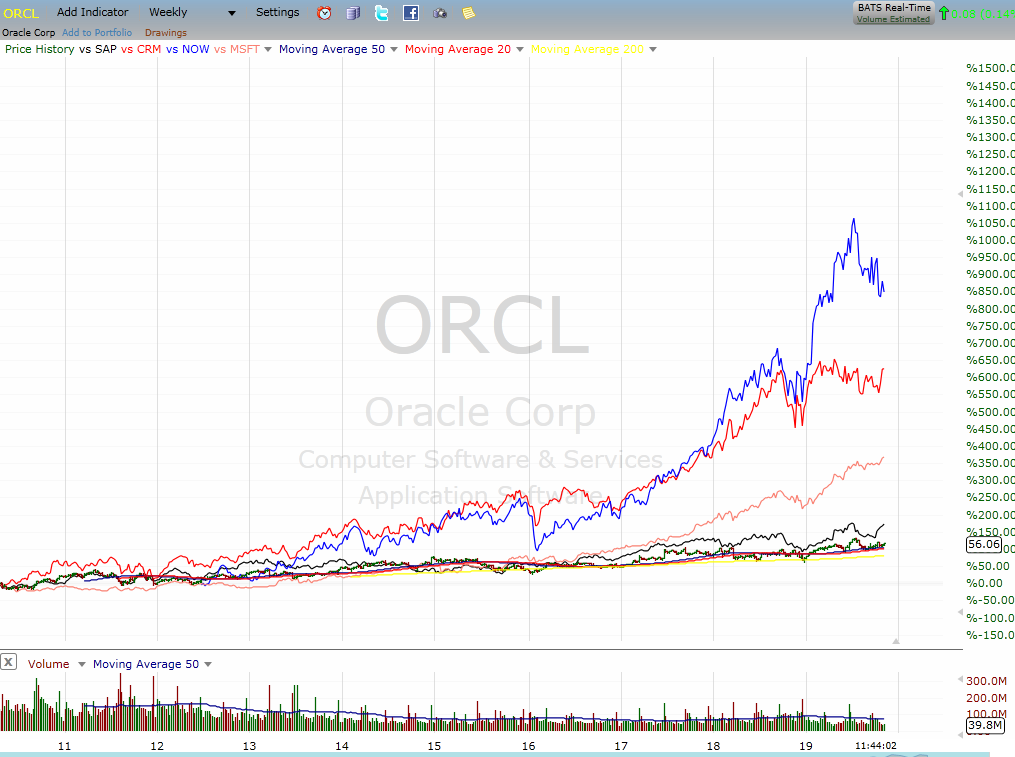

Companies like Salesforce (CRM) and Service Now (NOW) which were built as ‘cloud-native’ and even other legacy tech companies like Microsoft (MSFT) have stolen their thunder by taking market share and investment dollars; SAP and ORCL had become lumbering, sleepy giants.

You can see the stock performances of these three ran away from SAP and ORCL over the past 10 years.

But based on recent moves and the quarterly earnings report, it looks like Oracle has finally woken up to embrace the cloud services model and plans on being a major competitor in the space.

Recent plans to hire 2,000 workers and aggressively expand its cloud-computing services to more locations around the world confirm its focus. The company will open more than 20 cloud storage data centers, enabling more customers to safely store their information.

Sad news last month came with the death of Mark Hurd, who was the Co-CEO until he stepped aside last month for health reasons. Larry Ellison, Oracle’s original founder, will take over responsibilities along with CEO with Safra Catz.

The push into cloud was heralded by Hurd — so his presence will be missed. But, the company has already seen the future and is now one of the fastest-growing cloud companies.

At a conference held 3 years ago, Hurd predicted that cloud computing would “eat the world within 10 years.” It recently partnered with Microsoft to share between the two cloud platforms in order to compete against Amazon web services.

This is a slide from that conference highlighting the future importance of the shift to cloud computing.

The company reported a first-quarter profit of 80 cents a share meeting estimates. and almost three-fourths of its revenue now coming from cloud services.

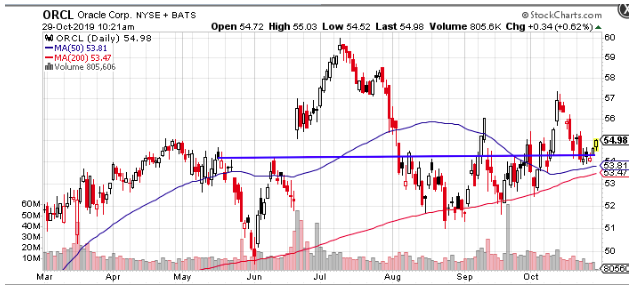

The software sector has come under pressure of late. But, Oracle held comparatively well against the sector as its rock bottom low PE of just 13x forward eps kept it insulated from the rotation out of growth/momo names.

The stock pulled back, filling a gap near the $53-$54 level and it now looks ready to turn higher.

I’m playing this using a diagonal call spread in which I’m buying the January 52.5 calls and selling the December 57 calls for a net debit of $3.10.

This will carry me through the next earnings report scheduled for mid-December with the flexibility to make adjustments to lock in gains and reduce cost basis should the stock work higher heading into the report.

ORCL shares were trading at $56.29 per share on Friday afternoon, up $0.31 (+0.55%). Year-to-date, ORCL has gained 26.80%, versus a 25.10% rise in the benchmark S&P 500 index during the same period.

About the Author: Option Sensei

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| ORCL | Get Rating | Get Rating | Get Rating |