Pfizer Inc. (PFE - Get Rating) has reported a decline in revenue this year, as sales of its COVID-related products have started to fall. The pharmaceutical giant is currently undergoing a transitional phase as it steers away from its highly successful coronavirus vaccine and COVID antiviral drug, Paxlovid, now that the world displays indications of recovery from the pandemic.

While the U.S. Food and Drug Administration has authorized Pfizer’s updated COVID vaccines, the company expects only 24% of the U.S. population, or about 82 million people, to receive COVID-19 shots this year.

PFE plans to launch a cost-cutting program if its vaccine and antiviral treatment do not meet expectations in the coming months due to waning demand. Pfizer CFO David Denton said the outlook for vaccine rates this year got a significant “haircut.”

As the demand for COVID-19 vaccines falls due to the receding pandemic, it might be prudent for potential shareholders to monitor the trends over the next few months before making any investment decision. Let’s delve into the key financial metrics to understand why an immediate stock purchase may not be optimal.

Analysing Pfizer Inc.’s Financial Performance: 2020-2023 Trends and Fluctuations

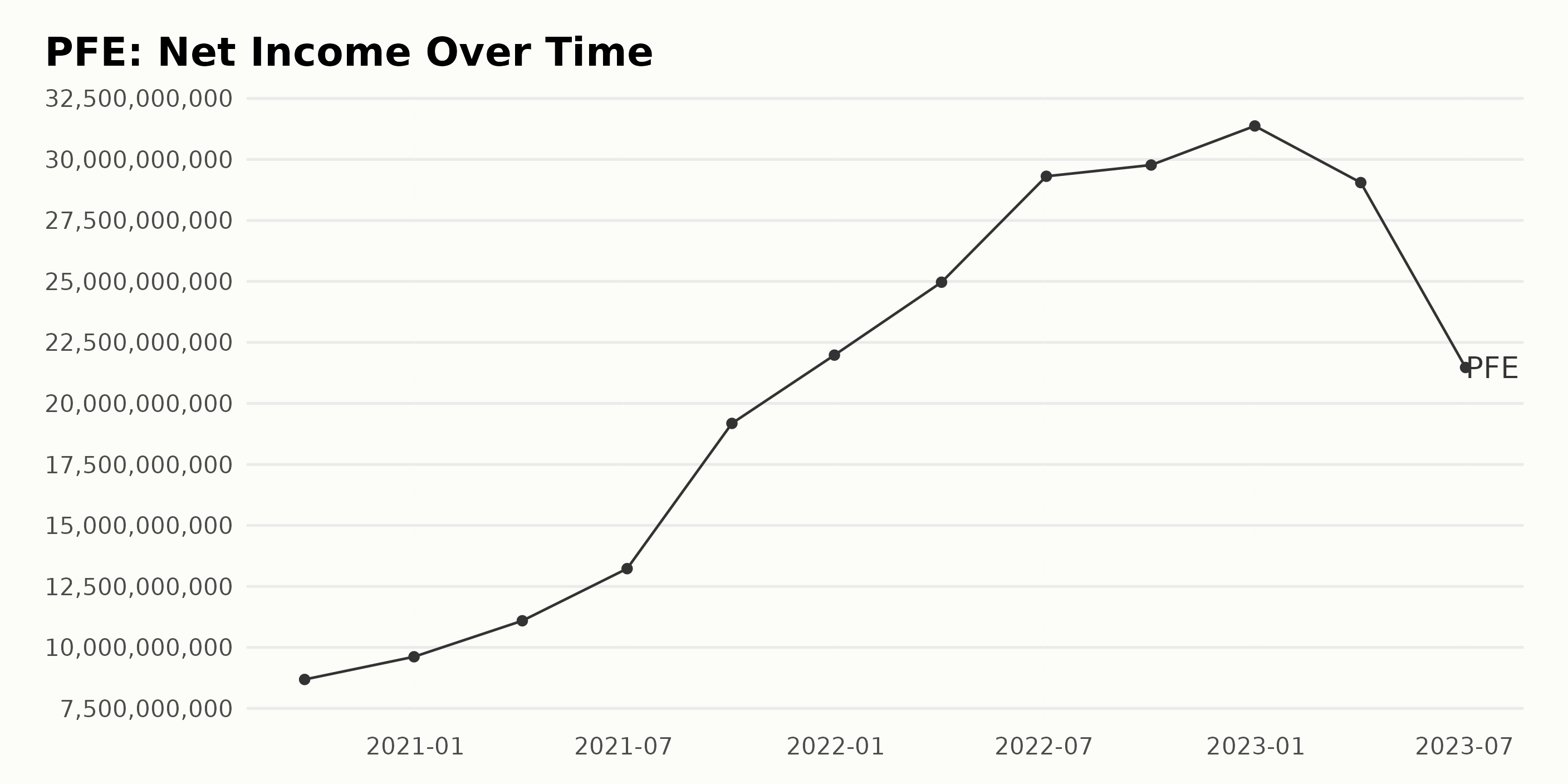

The trend and fluctuations of PFE’s trailing-12-month net income from 2020 to 2023 indicate a general upward growth, punctuated by some variability.

- Starting at $8.68 billion in September 2020, the company’s net income increased consistently until December 2022, where there was a slight decline from $31.37 billion in September to $29.05 billion in April 2023.

- The most significant increase occurred between July 2021 and October 2021, when net income jumped from $13.23 billion to $19.18 billion before continuing to climb to peak at $31.37 billion in December 2022.

- However, the upward trend came to an end in 2023 when figures witnessed a considerable decline within four months from $29.05 billion in April to $21.47 billion in July.

Overall growth from the starting value in September 2020 to the last value in July 2023 saw a percentage increase of approximately 247%. Recent data from 2022 onwards reveals an incline followed by a sharp decline, drawing greater attention to impending trends for net income in the future.

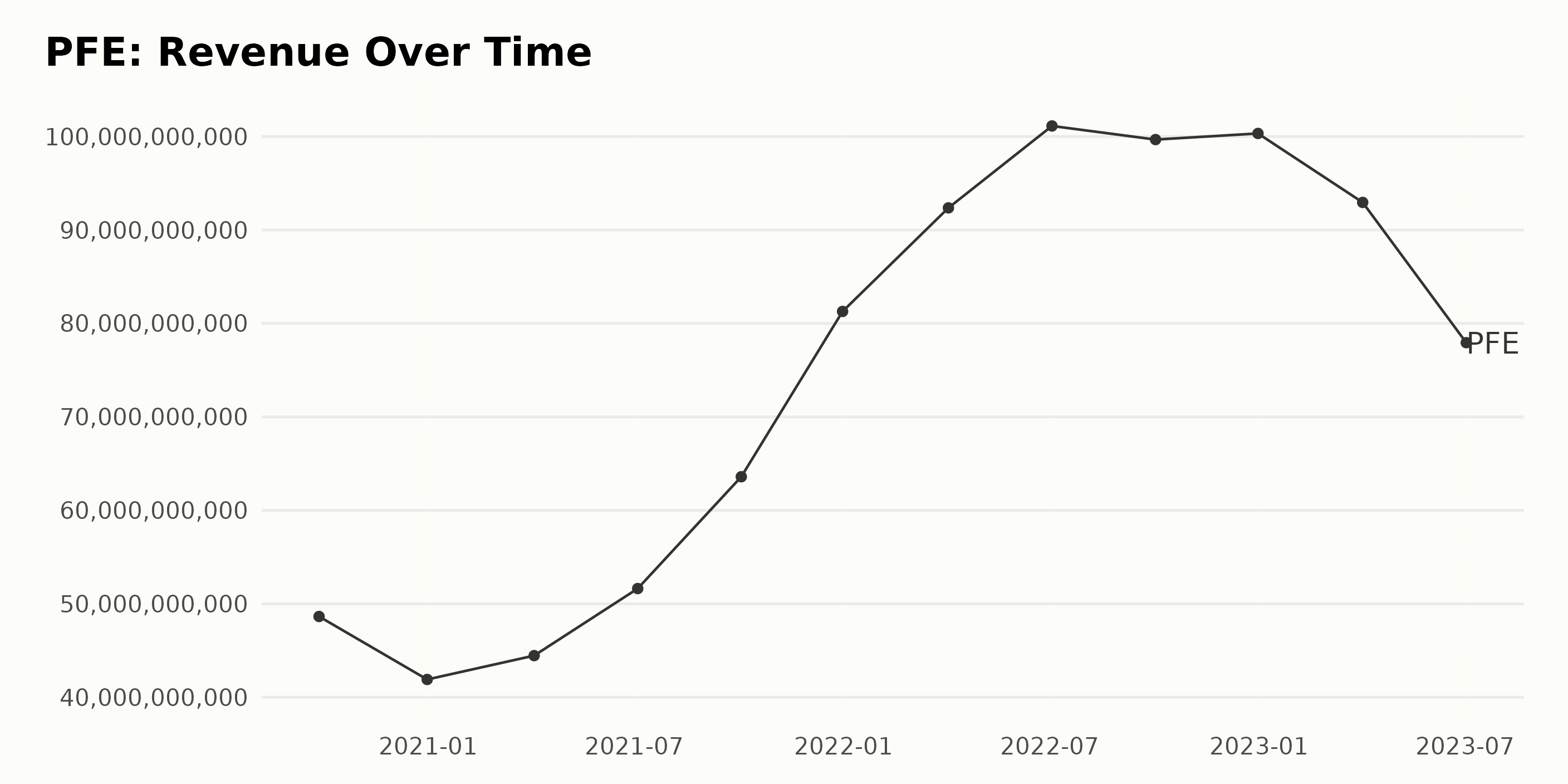

The trend and fluctuations in the trailing-12-month revenue of PFE can be understood as follows:

- The company’s revenue observed an upward trend from September 2020 up to around July 2022, followed by a subsequent decline into mid-2023.

- In September 2020, PFE reported a revenue of $48.65 billion.

- Revenue witnessed a decline to $41.91 billion by the end of 2020 but subsequently increased to $51.64 billion by July 2021 and further to $63.6 billion by October 2021.

- By the close of 2021, the revenue significantly rose to $81.29 billion, showing a robust growth pattern in that year.

- Growth momentum carried into 2022, with the revenue hitting a peak of $101.13 billion in July. However, revenue declined slightly to $99.68 billion in October 2022 before slightly recovering to $100.33 billion by the end of December 2022.

- However, in 2023, a clear shift in trend was very noticeable, as the first quarter saw revenue fall to $92.95 billion and further shrink to $77.94 billion by July.

Comparing the last value ($77.94 billion in July 2023) with the first value ($48.65 billion in September 2020) shows a growth rate of roughly 60.11% despite the recent dips. The recurring pattern and notable peaks and troughs suggest an evident cyclicality of financial performance in Pfizer’s operations, possibly driven by external market dynamics and internal factors. The emphasis on more recent data shows that despite solid growth between 2020 and 2022, recent months moving into 2023 reveal a diminishing trajectory for revenue, warranting attention to potential underlying issues.

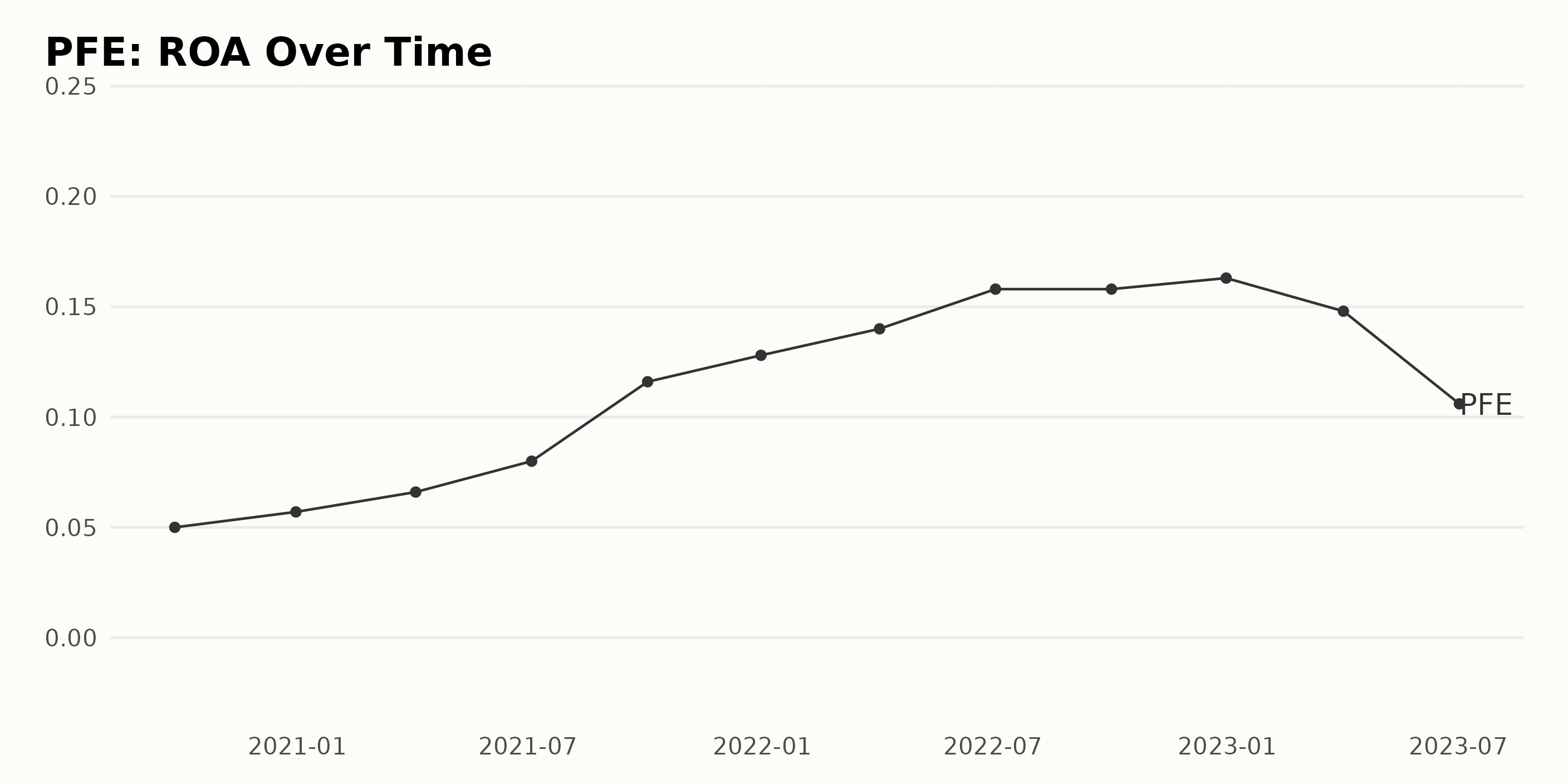

The trend of PFE’s Return on Assets (ROA) has generally been on a positive trajectory across the time series, with noticeable fluctuations. Here is an overview of the trend:

- Starting from September 27, 2020, the ROA was at 0.05.

- By December 31, 2020, the ROA had increased slightly to 0.057.

- From April 2021 to October 2022, there was a consistent upward trend, reaching 0.158 in October 2022.

- The ROA reached its peak at 0.163 on December 31, 2022.

- However, in 2023, there was a notable decrease in value, with ROA falling to 0.148 by April and then further dropping to 0.106 by July 2, 2023.

The overall growth rate in the ROA from September 2020 to July 2023 stands at approximately 112%. These fluctuations in ROA indicate the changes in profitability against the assets of Pfizer Inc. The drop in 2023 is significant and may reflect recent developments or events that have affected Pfizer’s asset profitability.

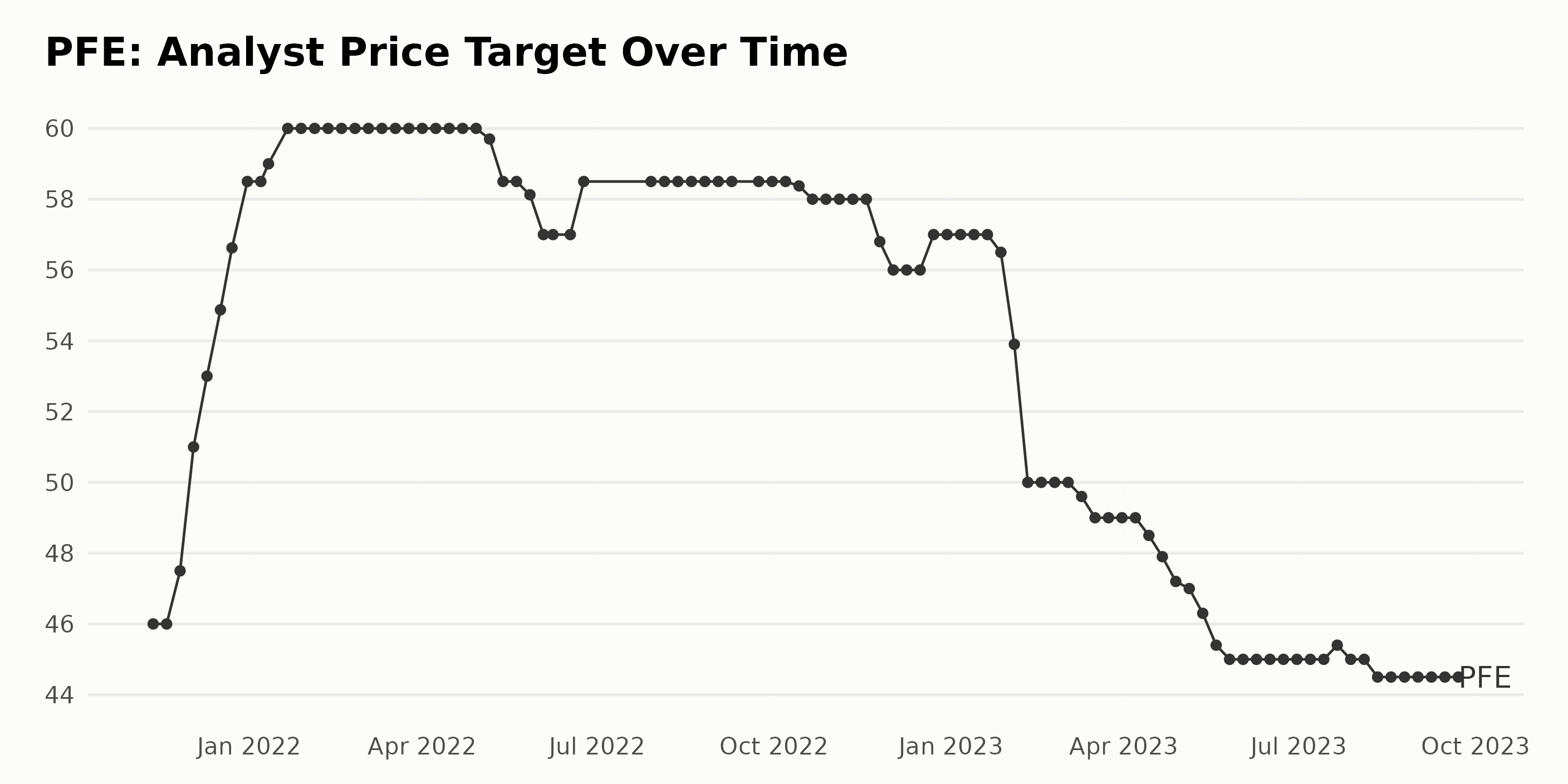

The Analyst Price Target data for PFE from November 2021 to September 2023 presents some notable patterns and fluctuations.

- Starting at a price of $46 on November 12, 2021, there was a general upward trend until reaching a peak of $60 on January 21, 2022. This represents approximately 30% growth.

- From January 2022 to May 2022, the price target remained fairly stable at $60. However, a slight decrease was observed at the beginning of May 2022, declining to around $59.7.

- Subsequently, the price target experienced another drop in June 2022, descending to $57, and then showed considerable variation until August 2022, with values oscillating between $57 and $58.5.

- Consistent values at $58.5 can be seen from July 29, 2022, to October 7, 2022. Though, gradual decreases began occurring from mid-October 2022, settling at $56 by December 2022.

- Throughout January 2023, the PFE price target kept steady at $57 but began to fall in February 2023, hitting a low of $50 by mid-February.

- After fluctuating slightly between $49 to $50 from March 2023 to April 2023, the price target experienced a continuous drop until the end of May 2023, reaching a low point of $45.

- From June 2023 till mid-August 2023, the target price reinstated steady at $45, followed by a mild increase to $45.4 in late July. However, it fell back to $45 and then dropped further to $44.5 from August 11, 2023, till the end of the series.

When comparing the first value of $46 on November 12, 2021, with the last recorded value of $44.5 on September 22, 2023, we see a slight overall depreciation of approximately 3%.

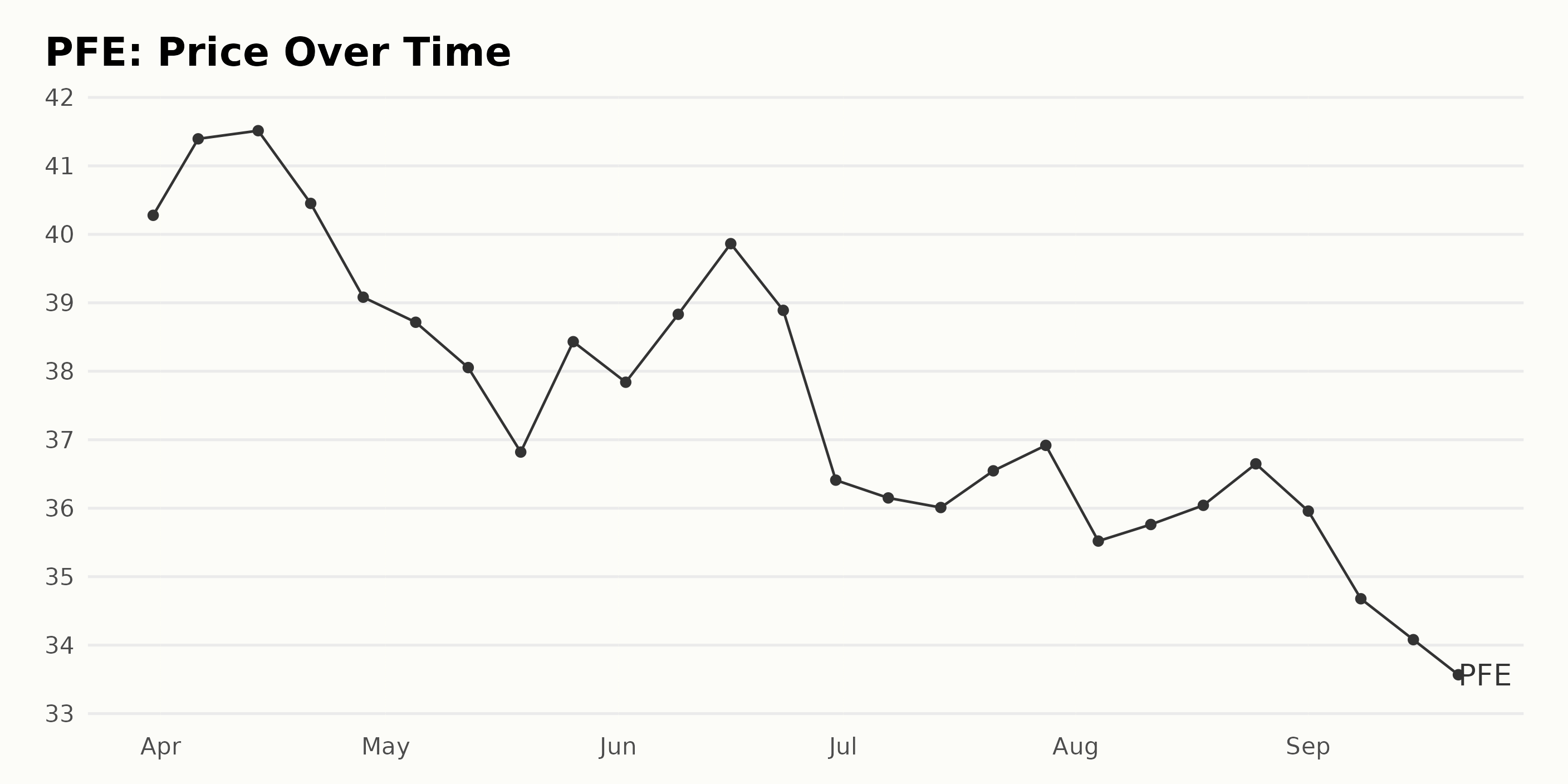

Analyzing Pfizer’s Fluctuating Share Price Trends from March to September 2023

Analyzing the data provided, the share price of Pfizer Inc. (PFE) has witnessed a fluctuating trend over the given period. Here are some key points in this regard:

- On March 31, 2023, the share price of PFE began at $40.28.

- The share price increased slightly to reach its first peak on April 14, 2023, at $41.51.

- This was followed by a downward trend up until May 19, 2023, where it reached a low of $36.82.

- There was a small uptick followed by dips and peaks, with June 16, 2023, seeing a high of $39.86 and June 30, 2023, dropping down again to $36.41.

- The prices stayed more or less stabilized around the $36 mark in July, with fluctuations within the approximately $36 – $37 range.

- The value reduced further overall in August with minor bumps, the lowest point being $35.52 on August 4, 2023, and finishing a little higher at $36.65 on August 25, 2023.

- In September, the share price saw a general overall decrease again, with its lowest value recorded at $33.57 on September 21, 2023. While the pattern reveals a general downtrend in the stock price spanning from March to September 2023, there is no clear acceleration or deceleration in the rate of change across these data points. Here is a chart of PFE’s price over the past 180 days.

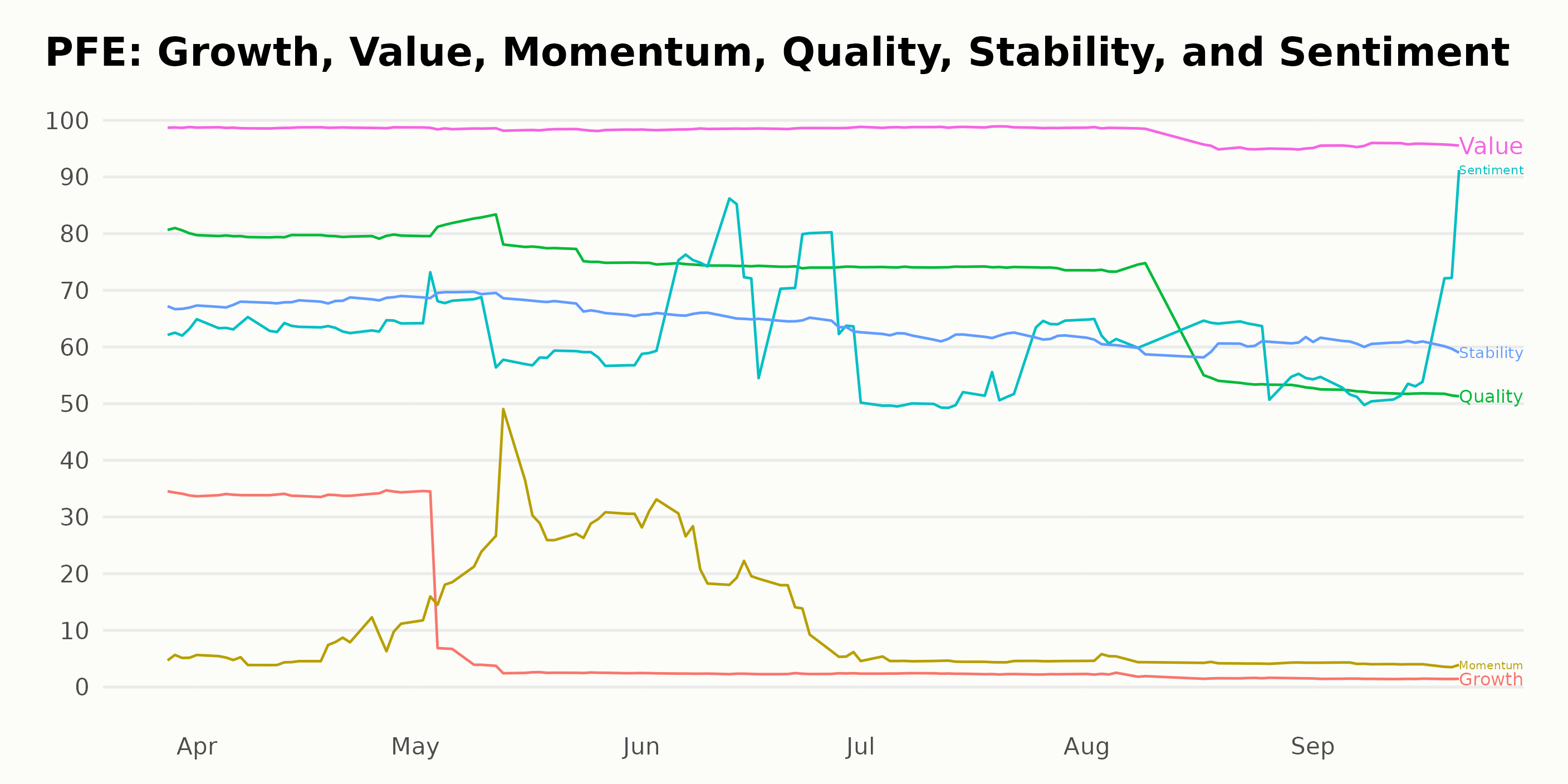

Assessing Pfizer Inc.’s Performance Across Quality, Stability, and Value in 2023

PFE has an overall C rating, translating to a Neutral in our POWR Ratings system. It is ranked #57 out of the 160 stocks in the Medical – Pharmaceuticals category.

Based on the given POWR Ratings for PFE, the three dimensions with the highest consistent ratings are Quality, Stability, and Value.

- Quality: This dimension has significantly high ratings throughout the period from March to September 2023. However, a gradual downward trend is observable. In March, the quality rating was 81, which marginally decreased to 80 by April and further declined steadily to reach a rating of 52 by September.

- Stability: For stability, the rating stayed around the mid-60s for most of the monitoring period. It began at 67 in March 2023 but saw a minute increment to 68 in April and May. Then it fell to 65 in June and continued descending until 61 in September. Overall, the stability rating demonstrated a slight declining trend.

- Value: Pfizer consistently witnessed the highest ratings in the Value dimension. Starting at an outstanding 99 in March, it maintained this score until July 2023, after which it slid down to 96 in August and stayed consistent until September. Despite the minor drop, Value remains the highest-rated dimension for Pfizer throughout these months.

These ratings offer crucial insights into Pfizer Inc.’s performance across these dimensions during the year 2023.

Stocks to Consider Instead of Pfizer Inc. (PFE)

Other stocks in the Medical – Pharmaceuticals sector that may be worth considering are Novartis AG (NVS - Get Rating), Novo Nordisk A/S (NVO - Get Rating), and SANTEN PHARMACEUTICAL CO., LTD. (SNPHY - Get Rating) — they have better POWR Ratings.

What To Do Next?

Discover 10 widely held stocks that our proprietary model shows have tremendous downside potential. Please make sure none of these “death trap” stocks are lurking in your portfolio:

Want More Great Investing Ideas?

PFE shares were trading at $32.64 per share on Friday afternoon, down $0.21 (-0.64%). Year-to-date, PFE has declined -34.30%, versus a 14.66% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| PFE | Get Rating | Get Rating | Get Rating |

| NVS | Get Rating | Get Rating | Get Rating |

| NVO | Get Rating | Get Rating | Get Rating |

| SNPHY | Get Rating | Get Rating | Get Rating |