Prospect Capital Corporation (PSEC - Get Rating) has taken a hit, with its stock currently trading below its 50-day and 200-day moving averages of $6.60 and $7.12, respectively. Moreover, on May 2, 2023, PSEC hit its 52-week low of $5.92.

The company’s first-quarter results added to the downward momentum, with Net Investment Income (NII) of $102.18 million or $0.21 per basic share, falling from $106.70 million or $0.23 in the previous quarter. Moreover, PSEC’s revenue missed analysts’ estimates, while its bottom line declined to negative territory.

Business Development Corporations (BDCs) like PSEC often benefit from higher interest rates, which translates to higher net interest income. However, they are prone to losses if the economy deteriorates, as some customers might face trouble paying off their debt.

So, with Statista predicting a 68.2% chance of an economic recession by April 2024, investing in PSEC is ill-advised right now. Key metrics such as the below add to the bearish argument.

Tracking Prospect Capital Corporation’s Financial Growth and Fluctuations

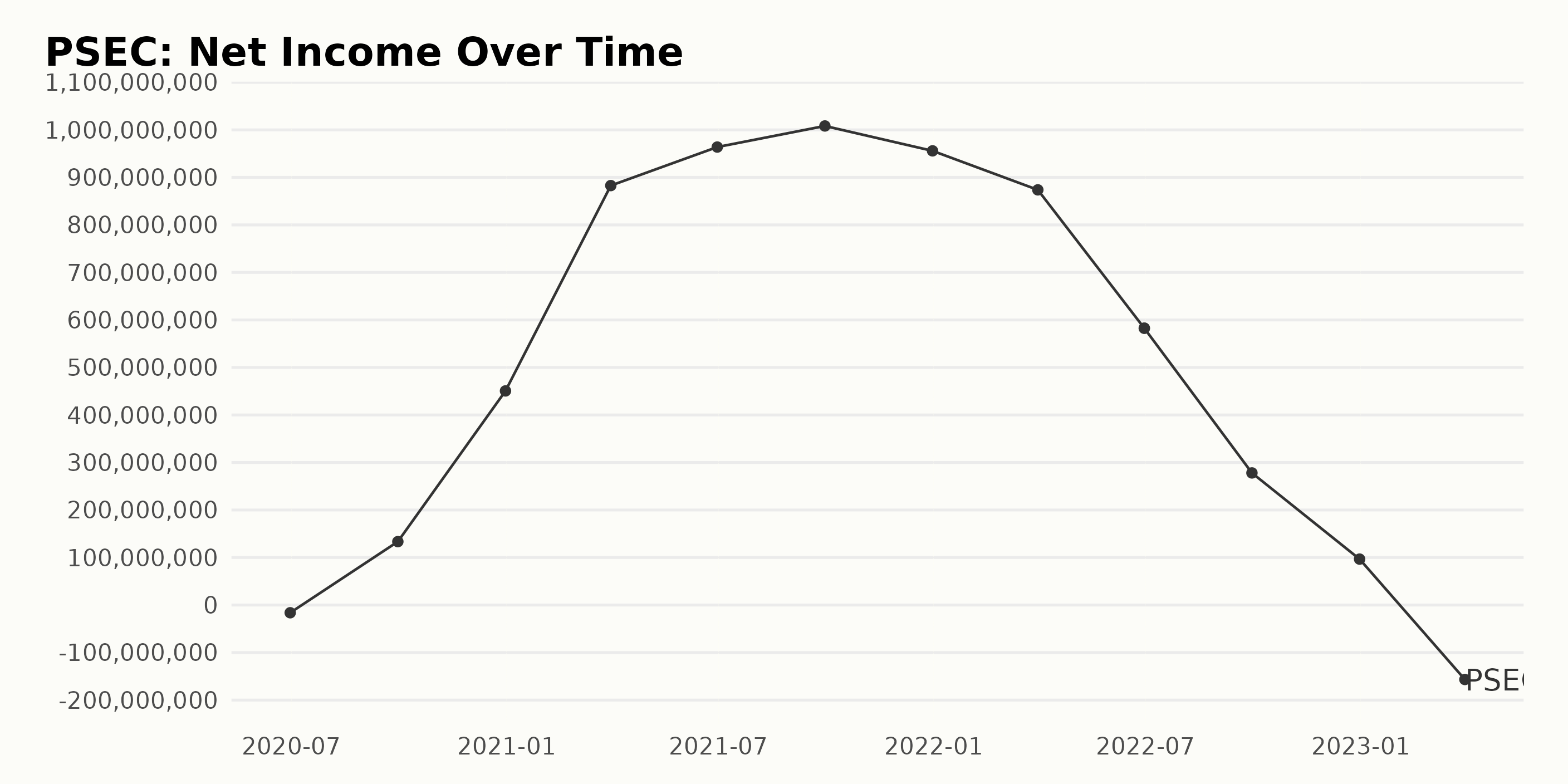

PSEC’s net income over the analyzed period has declined, with the most recent data point of negative $15.7 million on March 31, 2023, representing a substantial decrease from its initial value of negative $1.6 million on June 30, 2020. Fluctuations in net income over this time can mainly be seen in the reported values for December 31, 2021, and March 31, 2022, both of which saw significant dips compared to their respective prior quarters.

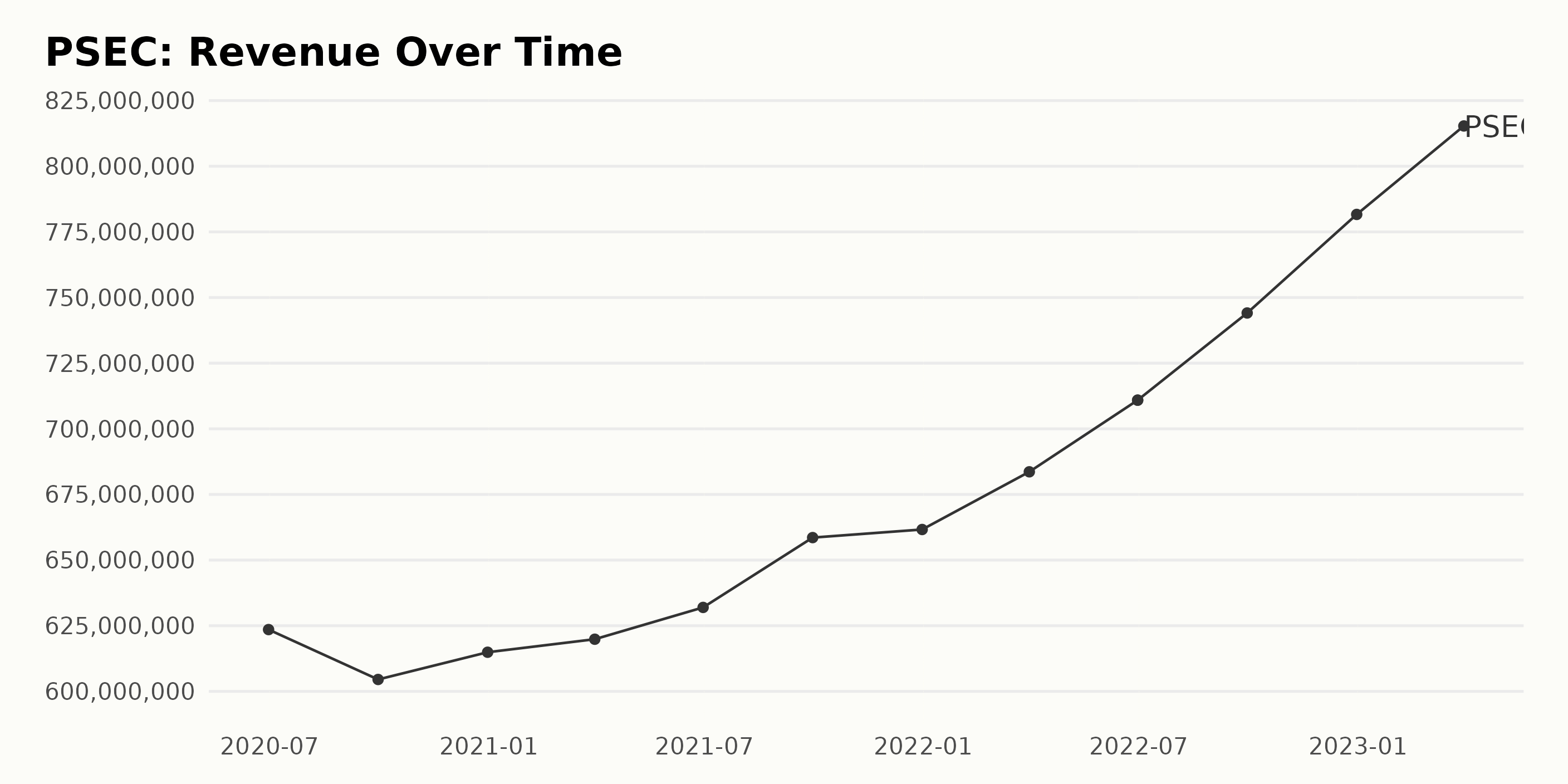

Overall, PSEC’s revenue has increased from $62.35 million on June 30, 2020, to $81.53 million on March 31, 2023, a growth rate of 30%. The revenue has seen shorter-term fluctuations since June 2020, with the lowest value of $60.45 million on September 30, 2020, and the highest value of $78.16 million on December 31, 2022.

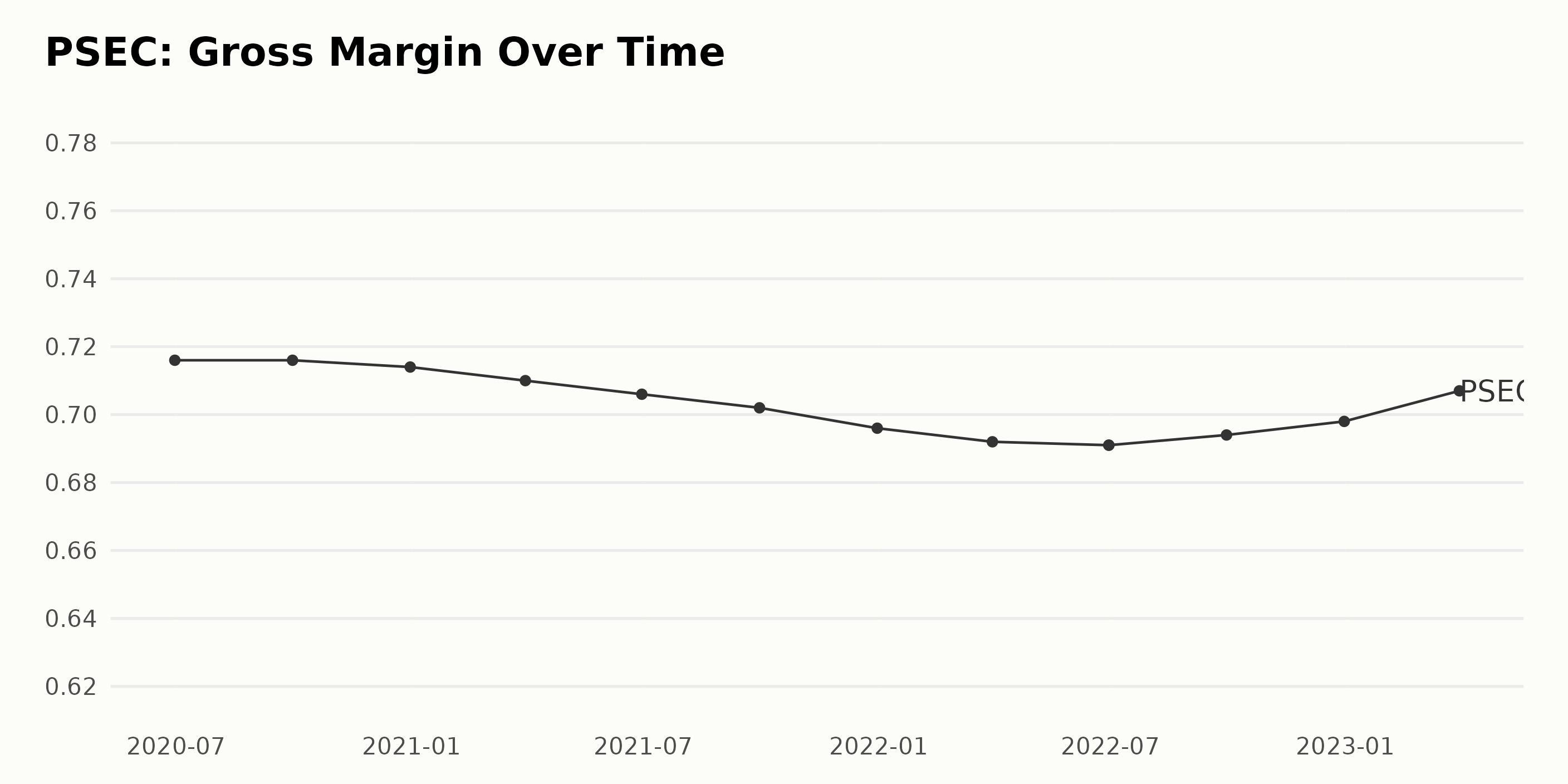

The trend of PSEC’s gross margin has fluctuated over the past two years, with the value decreasing from 71.6% in June 2020 to 69.8% in December 2021 before increasing to 70.7% in March 2023. The overall growth rate since June 2020 is negative 2.1%.

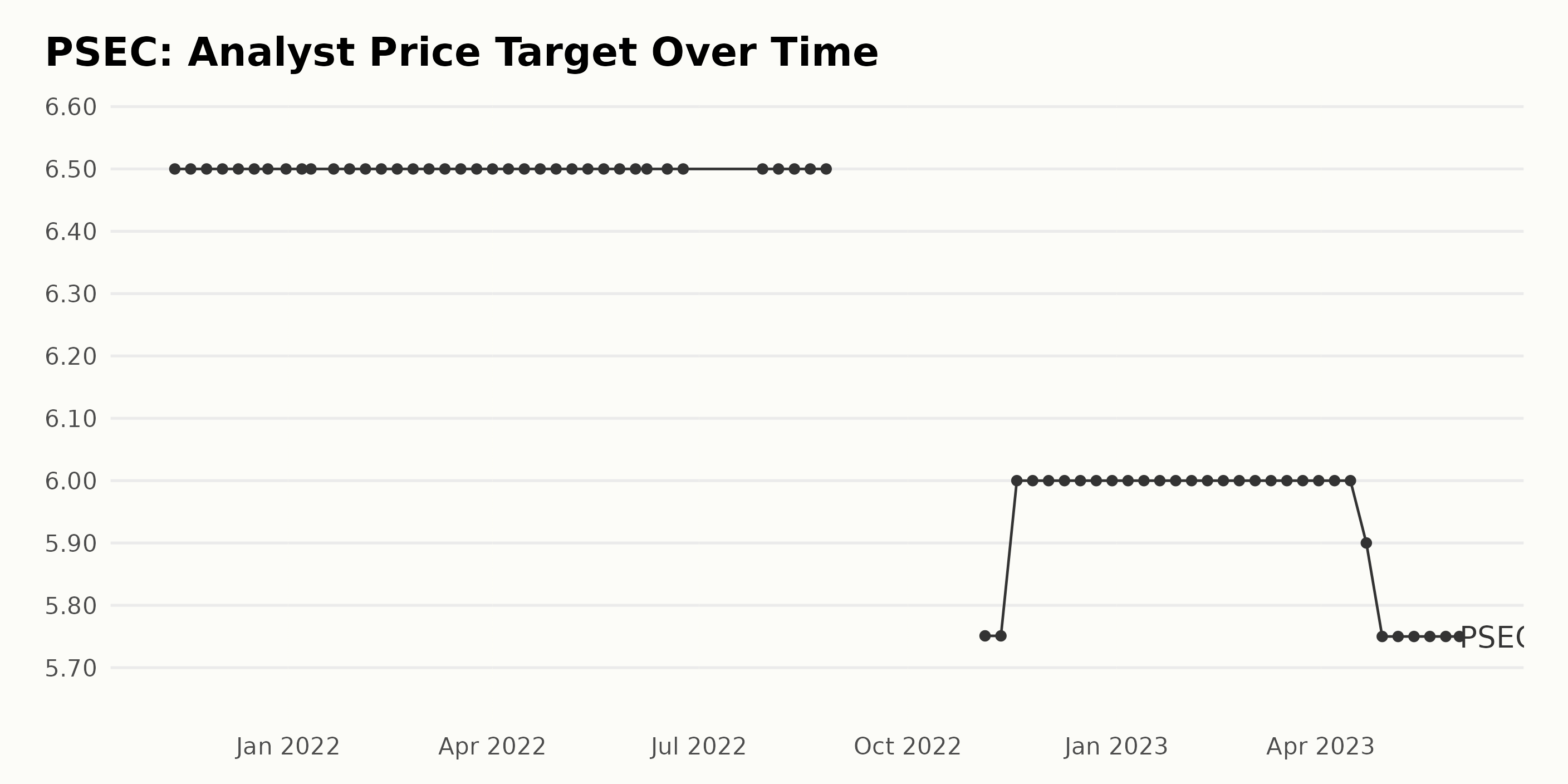

PSEC’s Analyst Price Target has remained consistent at $6.50 for the entire data series. As of June 1, 2023, the value is $5.75. This shows a growth rate of negative 11.9% from the first data point in the series on November 12, 2021. Overall, the trend of the series is relatively flat, with no fluctuations noted.

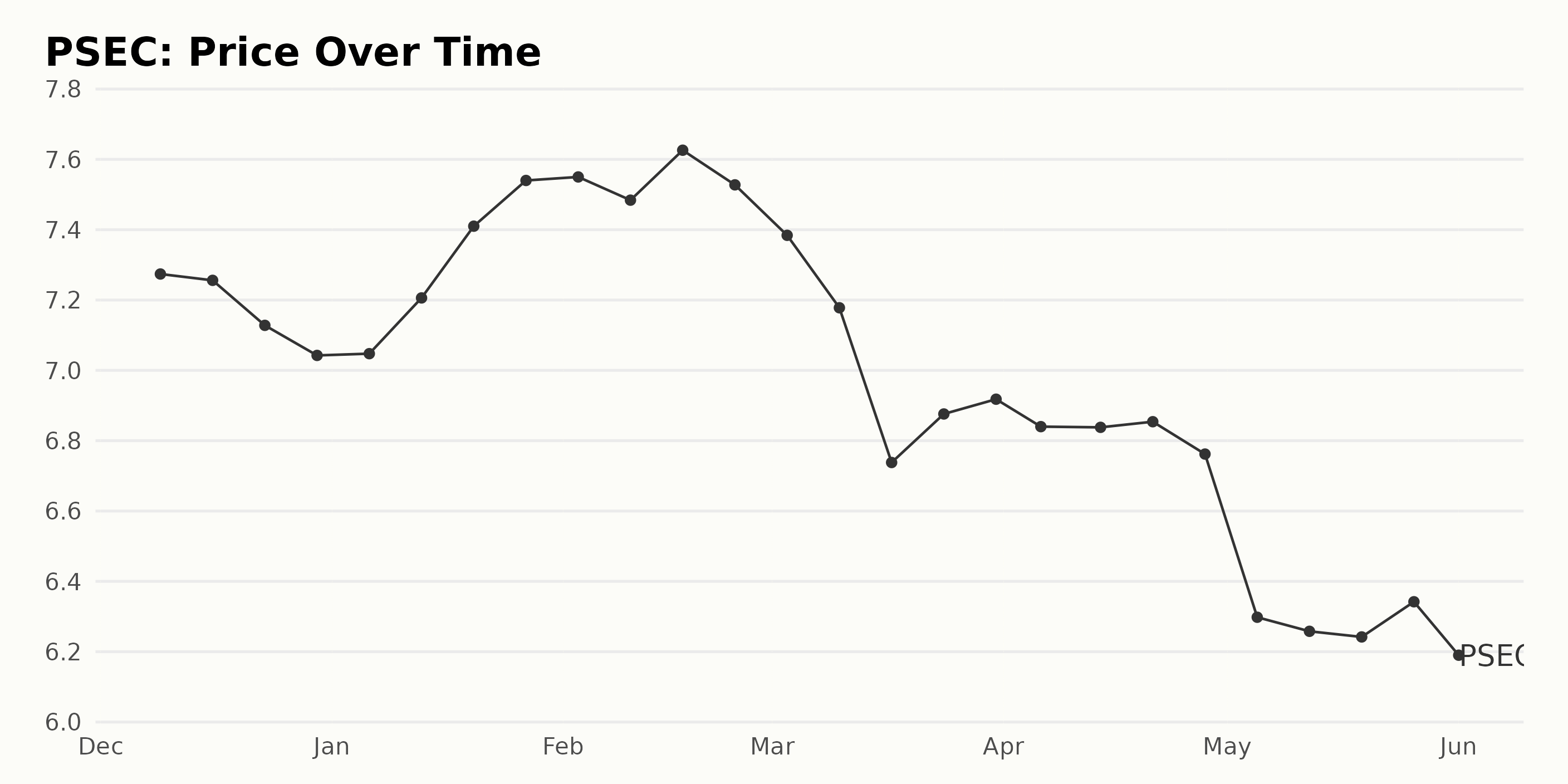

PSEC Share Price Decreasing from December 2022-May 2023

PSEC’s share prices decreased from December 2022 to June 2023. The share price began at $7.27 on December 9, 2022, and steadily declined to $6.16 on May 31, 2023. Here is a chart of PSEC’s price over the past 180 days.

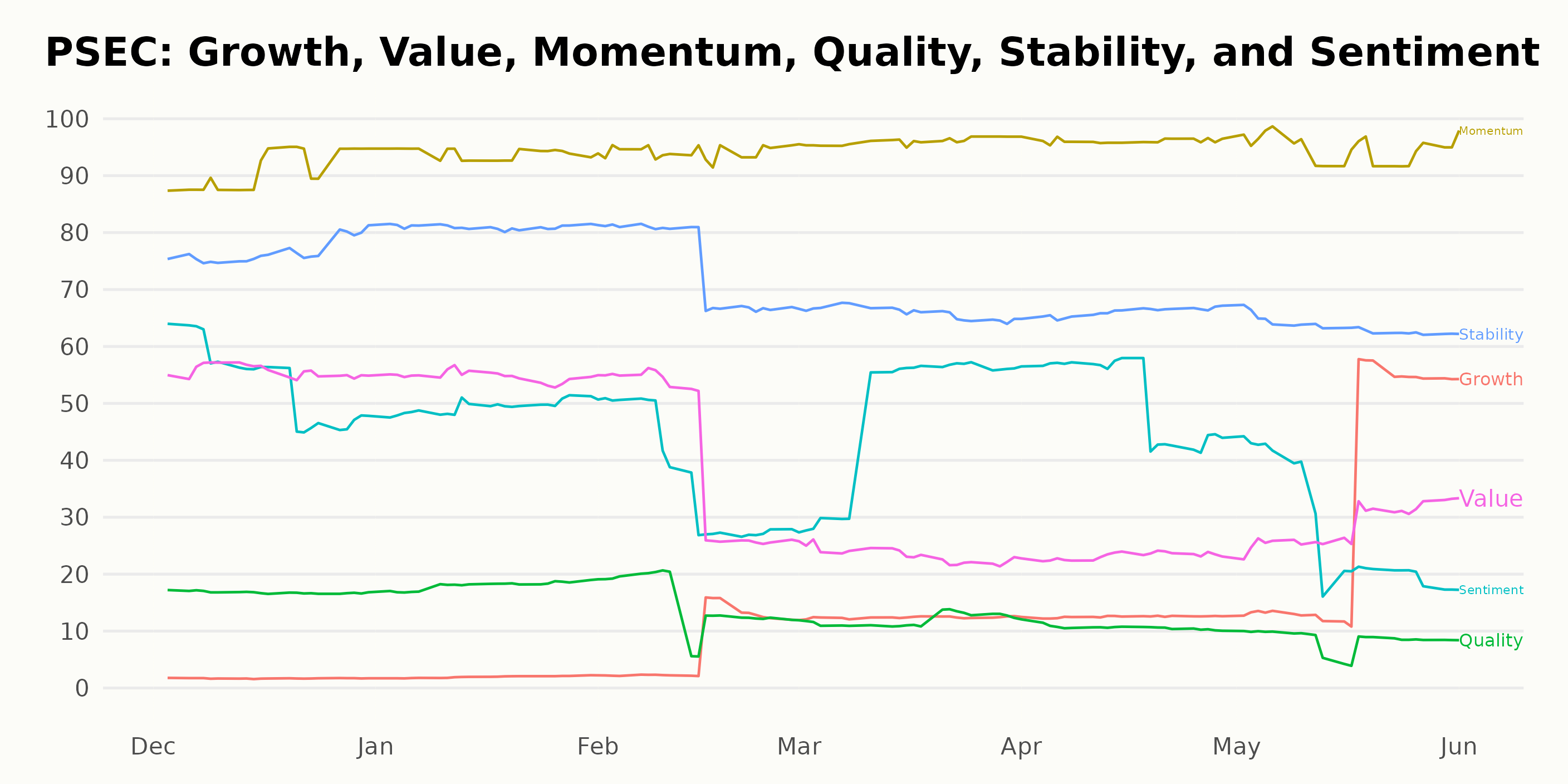

PSEC’s POWR Rating Analysis

PSEC has an overall rating of D, translating to a Sell in our POWR Ratings system. It is ranked #29 out of 35 stocks in the Private Equity category. PSEC also has a D grade for Sentiment and Quality.

Stocks to Consider Instead of Prospect Capital Corporation (PSEC)

Other stocks in the Private Equity sector that may be worth considering are WhiteHorse Finance Inc. (WHF - Get Rating), Saratoga Investment Corp New (SAR - Get Rating), and IRSA Inversiones Y Representaciones S.A. (IRS - Get Rating) — they have better POWR Ratings.

Discover 10 widely held stocks that our proprietary model shows have tremendous downside potential. Please make sure none of these “death trap” stocks are lurking in your portfolio:

Want More Great Investing Ideas?

PSEC shares were trading at $6.22 per share on Thursday afternoon, up $0.06 (+0.97%). Year-to-date, PSEC has declined -7.12%, versus a 10.75% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| PSEC | Get Rating | Get Rating | Get Rating |

| WHF | Get Rating | Get Rating | Get Rating |

| SAR | Get Rating | Get Rating | Get Rating |

| IRS | Get Rating | Get Rating | Get Rating |