Space company Rocket Lab USA, Inc. (RKLB - Get Rating) in Long Beach, Calif., operates as a provider of launch services and space system solutions for the defense and space industries. The company’s offerings include spacecraft engineering and design services, spacecraft components, and the design and manufacture of small- and medium-class rockets.

RKLB’s stock plunged on its latest semi-successful mission. The company launched the “There and Back Again” mission recently after several weather-related postponements. RKLB is working on making its Electron rocket reusable. However, during the mission the rocket’s booster was cut loose by the helicopter that snagged the parachute line and it fell into the Pacific Ocean. It was then recovered and loaded onto a recovery vessel to be transported back and analyzed.

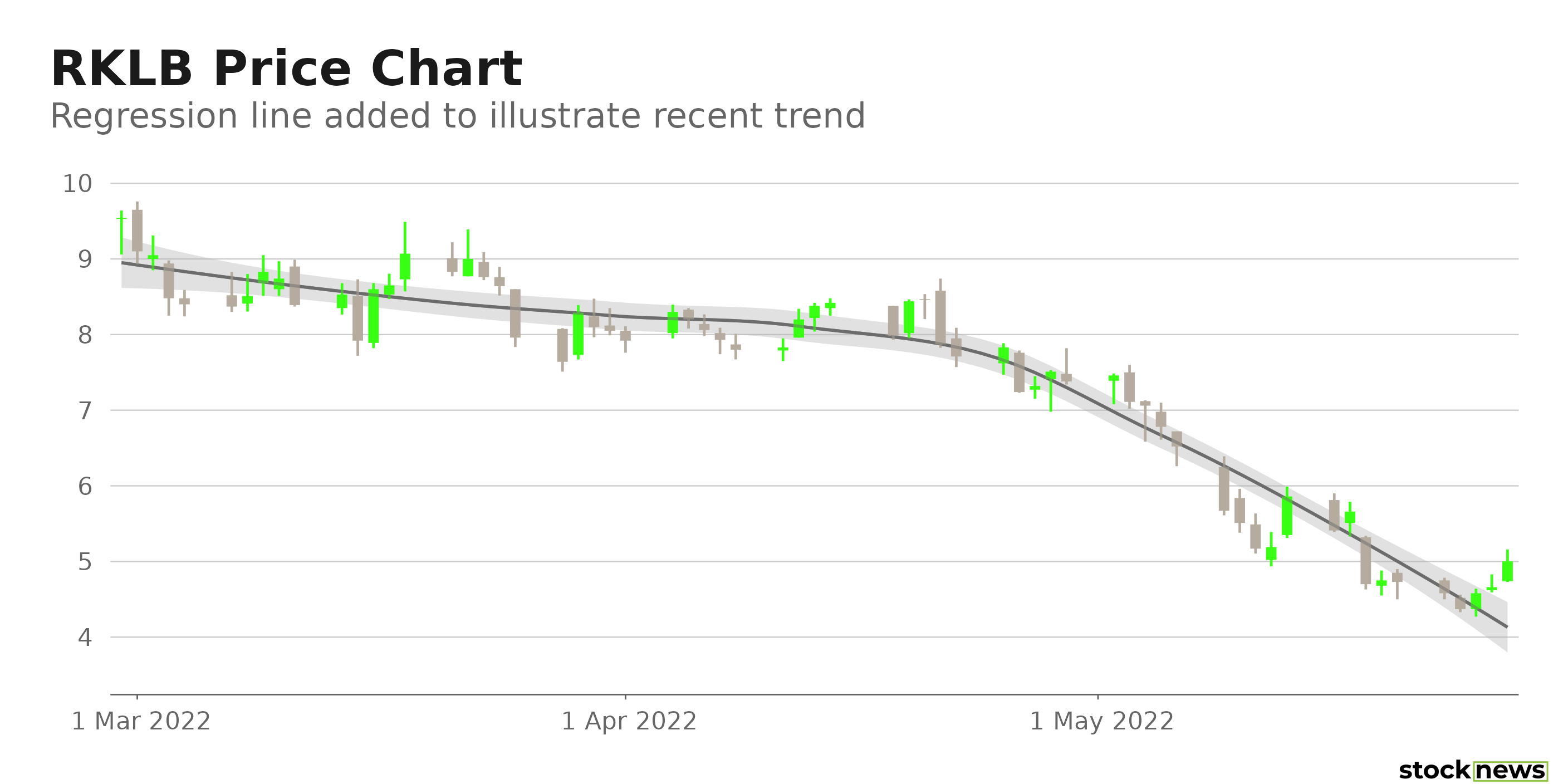

RKLB’s stock has declined 62.1% in price year-to-date and 35.6% over the past month to close yesterday’s trading session at $4.66.

Here are the factors that could affect RKLB’s performance in the near term:

Bleak Bottom Line

For its fiscal first quarter, ended March 31, RKLB’s revenues increased 123.7% year-over-year to $40.70 million. However, its net loss rose 68.2% from the prior-year quarter to $26.71 million. Its net loss per share attributable to RKLB came in at $0.06. And its non-GAAP operating loss increased 5% from the same period in the prior year to $11.30 million.

Stretched Valuations

In terms of its forward EV/Sales, RKLB is currently trading at 7.44x, which is 363.3% higher than the 1.61x industry average. The stock’s 10.05 forward Price/Sales multiple of is 682.9% higher than the 1.28 industry average. And in terms of its forward Price/Book, it is trading at 3.14x, which is 21.9% higher than the 2.58x industry average.

Negative Profit Margins

RKLB’s 0.51x trailing 12-month gross profit margin is 98.3% lower than the industry 29.51% average. Its negative 126.61% and 151.21%, respective trailing 12-month EBITDA margin and net income margin are considerably lower than their 13.38% and 6.76% industry averages of.

Its trailing 12-month ROE, ROTC, and ROA of negative 46.40%, 15.08%, and 12.12% compare with their 14.60%, 7.23%, and 5.41% industry averages of .

POWR Ratings Reflect Bleak Prospects

RKLB’s POWR Ratings reflect this bleak outlook. The stock has an overall F rating, which equates to a Strong Sell in our proprietary rating system. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

RKLB has a Value grade of F, which is in sync with its lofty valuations. The stock also has an F grade for Quality, consistent with its bleak profit margins.

In the 77-stock, C-rated Air/Defense Services industry, it is ranked #73.

Click here to see the additional POWR Ratings for RKLB (Growth, Momentum, Stability, and Sentiment).

View all the top stocks in the Air/Defense Services industry here.

Bottom Line

Its solid top-line growth did not translate to bottom-line improvement in its last reported quarter. Furthermore, its profit margins are in the red. And the stock is currently trading below its 50-day and 200-day moving averages, indicating an overall downtrend. Hence, we think the stock might be best avoided now.

How Does Rocket Lab USA, Inc. (RKLB) Stack Up Against its Peers?

While RKLB has an overall POWR Rating of F, one might consider looking at its industry peers, Moog Inc. (MOG.A - Get Rating), which has an overall A (Strong Buy) rating, and Textron Inc. (TXT - Get Rating) and General Dynamics Corporation (GD - Get Rating), which have an overall B (Buy) rating.

What To Do Next?

If you would like to see more top stocks under $10, then you should check out our free special report:

What gives these stocks the right stuff to become big winners?

First, because they are all low-priced companies with explosive growth potential, that excel in key areas of growth, sentiment and momentum.

But even more important is that they are all top Buy rated stocks according to our coveted POWR Ratings system, Yes, that same system where top-rated stocks have averaged a +31.10% annual return.

Click below now to see these 3 exciting stocks which could double (or more!) in the year ahead:

Want More Great Investing Ideas?

RKLB shares were trading at $5.00 per share on Friday afternoon, up $0.34 (+7.30%). Year-to-date, RKLB has declined -59.28%, versus a -12.90% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| RKLB | Get Rating | Get Rating | Get Rating |

| MOG.A | Get Rating | Get Rating | Get Rating |

| TXT | Get Rating | Get Rating | Get Rating |

| GD | Get Rating | Get Rating | Get Rating |