Geopolitical unrest has placed a spotlight on energy security, prompting governments to prioritize the development of renewable energy sources and nuclear power. Considering this, NuScale Power Corporation (SMR) is an obvious topic of discussion: SMR made its stock market debut last year and is trading below its 50-day and 200-day moving averages of $9.27 and $11.23, respectively.

Despite significant revenue growth, the company’s bottom line remains in the red. Although turning profitable may take some time, let’s discuss some of its key metrics.

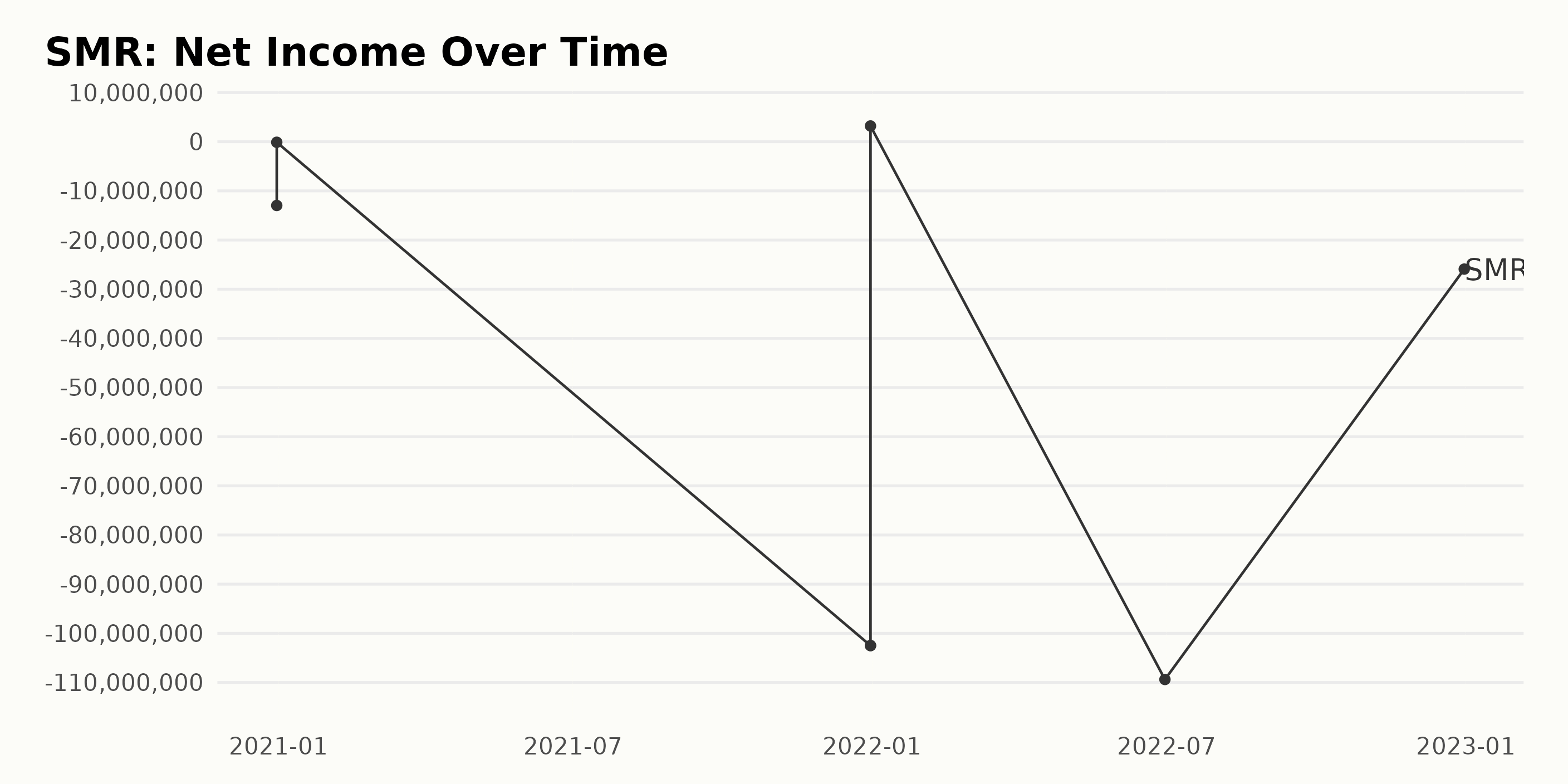

Volatile Financial Trends of SMR Over the Last 3 Years

The trend for SMR’s net income has been volatile over the last three years, with wide fluctuations taking place. In December 2020, SMR experienced a net loss of $12.97 million. Then in December 2021, this increased to a net loss of $102.49 million. There was a jump to a positive value of $3.20 million in June 2022, followed by another sharp fall to a net loss of $25.91 million by the end of the year. Overall, this represents a growth rate of negative 138%.

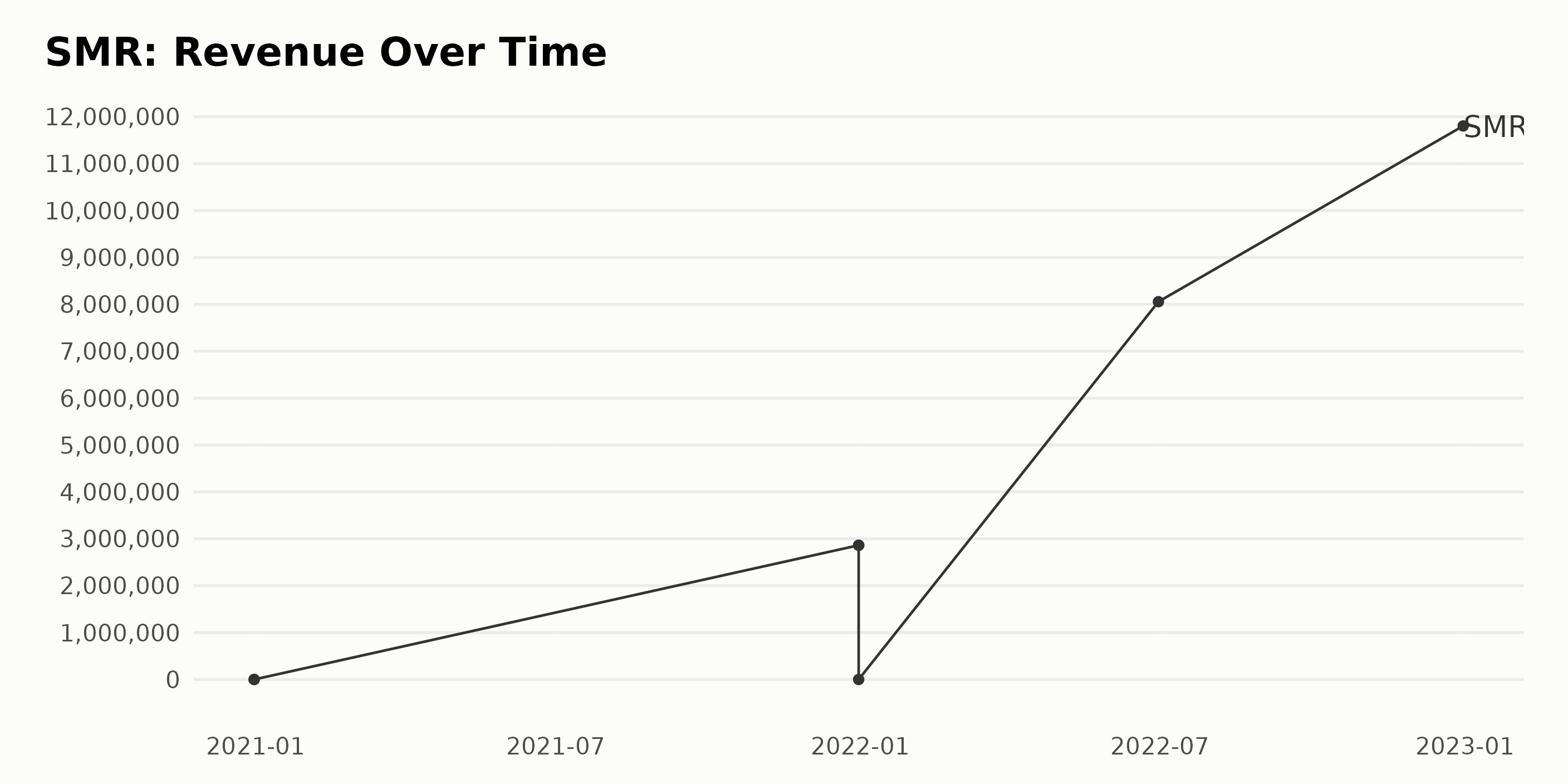

SMR’s revenue from December 2020 steadily increased to $1.18 million in December 2022. The growth rate is 1,181%, with the last value being 11 times higher than the first.

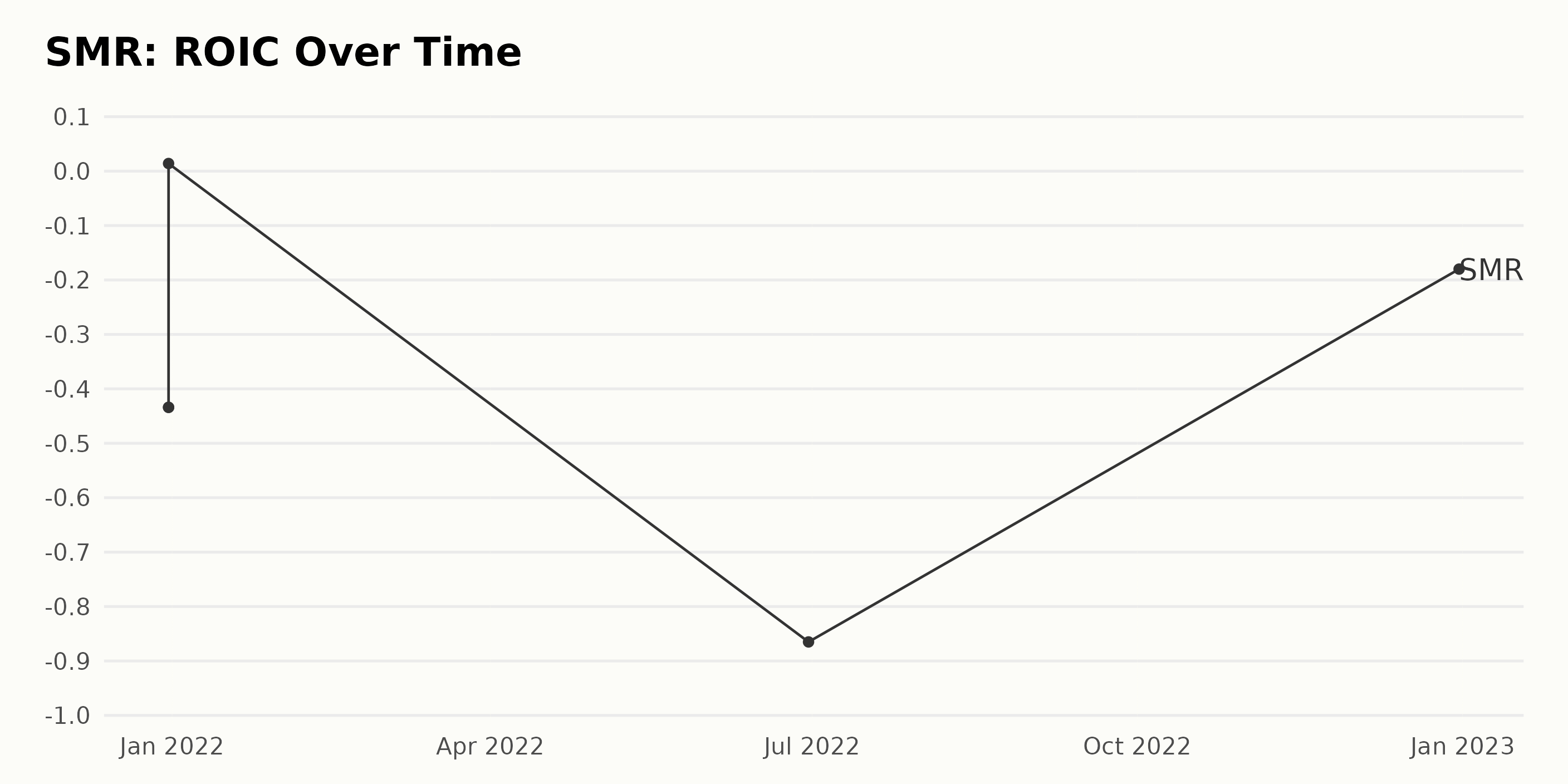

SMR’s ROIC has been fluctuating from December 2021 to December 2022. It started at negative 0.43 at the end of December 2021 and rose to 0.01 by June 2022, only to fall back to negative 0.18 by the end of December 2022. Overall, the ROIC has decreased by 58.4%.

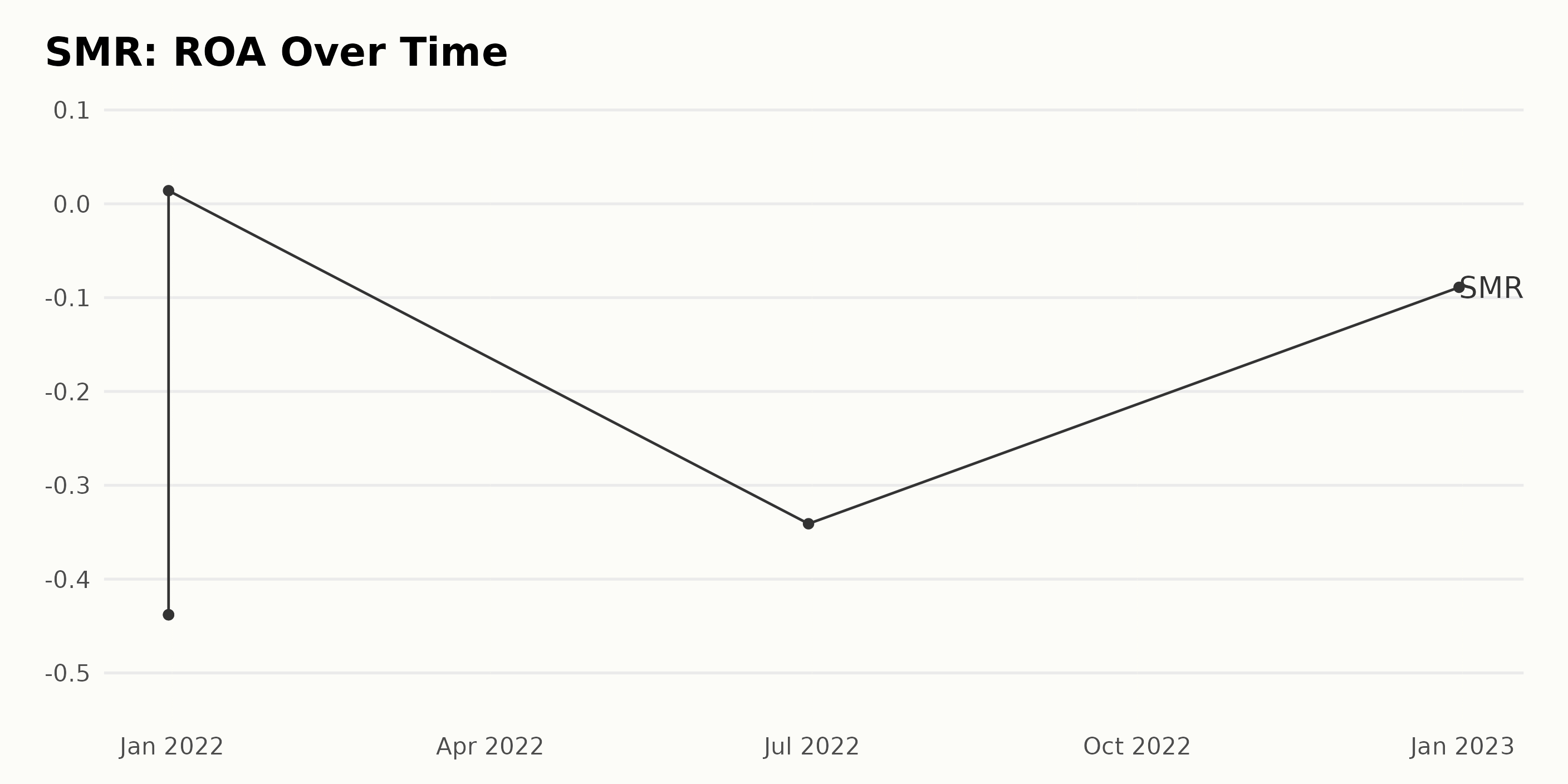

This series of data for SMR shows a downward trend in ROA from December 2021 (-0.44) to December 2022 (-0.09). There is, however, a positive increase halfway through the year in June 2022 (0.01). Overall, the ROA for SMR has decreased by 80.2% over the period.

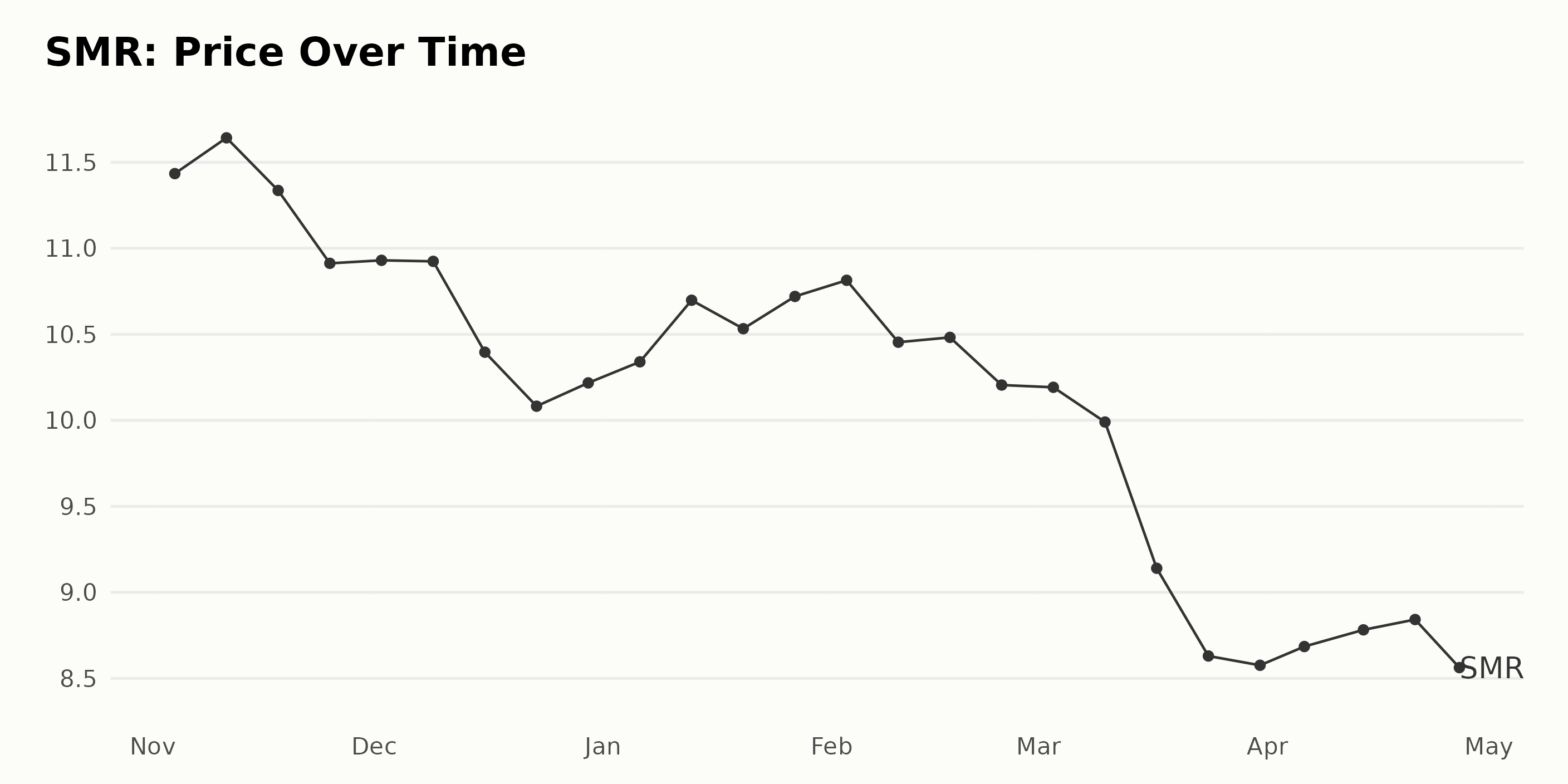

SMR Share Price Decline November 2022-April 2023

SMR’s share price trend from November 2022 to April 2023 is decreasing overall. The largest drop in value was from $11.434 on November 4, 2022, to $8.576 on March 31, 2023, a decrease of 25.4%. There has been an overall gradual decrease in the share price, with an accelerating rate of decline at the end of March 2023. Here is a chart of SMR’s price over the past 180 days.

Unfavorable POWR Ratings

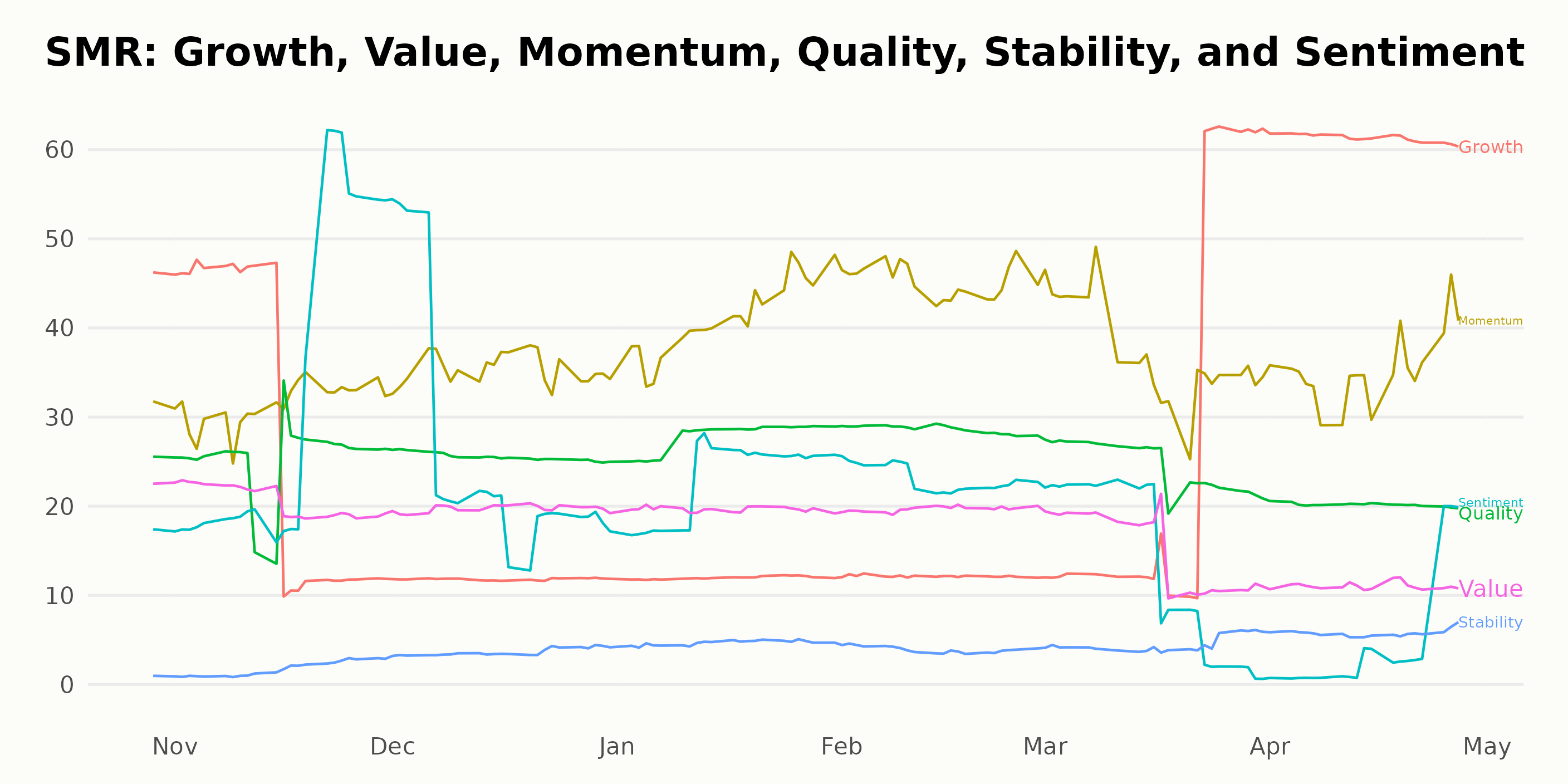

SMR has an overall rating of D, translating to a Sell in our POWR Ratings system. It was ranked last among the 64 stocks in the Utilities – Domestic category as of April 26, 2023.

It also has a D grade for Value, Stability, Sentiment, and Quality.

Stock to Consider Instead of NuScale Power Corporation (SMR)

Stock to Consider Instead of NuScale Power Corporation (SMR)

Other stocks in the Utilities – Domestic sector that may be worth considering are (BIPC), Genie Energy Ltd. Class B Stock (GNE), and FirstEnergy Corp. (FE) — they have better POWR Ratings.

The Bear Market is NOT Over…

That is why you need to discover this timely presentation with a trading plan and top picks from 40 year investment veteran Steve Reitmeister:

REVISED: 2023 Stock Market Outlook >

Want More Great Investing Ideas?

SMR shares were trading at $8.66 per share on Thursday morning, up $0.17 (+2.00%). Year-to-date, SMR has declined -15.59%, versus a 7.31% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SMR | Get Rating | Get Rating | Get Rating |

| BIPC | Get Rating | Get Rating | Get Rating |

| GNE | Get Rating | Get Rating | Get Rating |

| FE | Get Rating | Get Rating | Get Rating |