SoFi Technologies, Inc. (SOFI) provides various financial services, operating through three segments: Lending; Technology Platform; and Financial Services. The company’s revenue has grown at 50.8% and 24.6% CAGRs over the past three and five years, respectively.

However, the company’s trailing-12-month net income margin and ROCE of negative 14.68% and 5.46% are significantly lower than the respective industry averages of 25.80% and 11.08%. Moreover, analysts expect its EPS to remain negative in the current and next year.

The stock closed its last trading session at $5.21, lower than its 50-day moving average of $5.55 and 200-day moving average of $5.63.

Let’s look at some of SOFI’s key financial metrics to understand why it’s best avoided now.

Tracking SOFI’s Financial Performance Over Time

The series of Price/Sales data for SOFI shows a downward trend with fluctuations over time. The most recent value for the Price/Sales ratio on March 31, 2023, was 3.006, with a decrease of 87.8% from the first value on December 31, 2020 (23.489). The fluctuations in the values can be seen between June and September 2022, when the ratio decreased from 5.451 to 3.295.

The revenue of SOFI has had a significant upward trend since December 31, 2020. Revenue has risen from $565.53 million to $1.71 billion, representing a growth rate of 202% as of March 31, 2023.

In that time, the revenue has occasionally fluctuated, including a dip from December 31, 2021 ($984.87 million) to March 31, 2022 ($1.12 billion). Revenue has consistently increased over the past two and a half years.

SOFI’s ROA has fluctuated between -0.14 on June 30, 2021, and -0.01 on March 31, 2023. Overall, this trend suggests an improvement in ROA from the beginning to the end of the series, with a growth rate of 0.13.

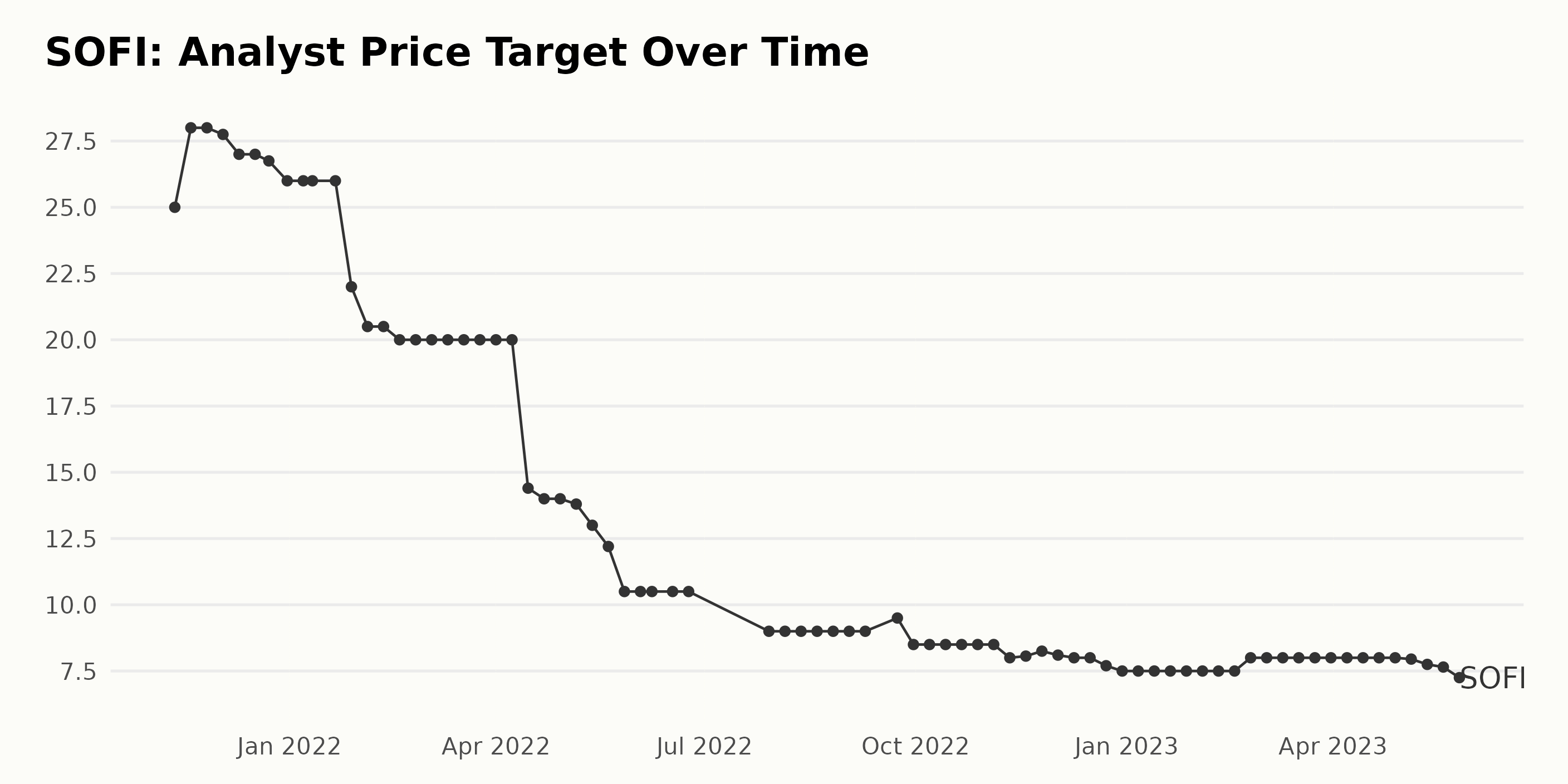

The SOFI analyst price target has decreased since Nov 2021, falling 21.1% from $25 in November 2021 to $7.3 in May 2023. The greatest decrease was observed from January 2022 to February 2022, when the price target dropped 11.5%. The price target has been fluctuating and is currently at its lowest point of $7.25.

SOFI Share Price Jumps About 13% in 5 Months

The trend of SOFI share price is increasing. Between December 2, 2022, and May 25, 2023, the share price increased from $4.62 to $5.21, representing an increase of approximately 13%. Here is a chart of SOFI’s price over the past 180 days.

Analyzing SOFI’s POWR Ratings

SOFI’s latest POWR Ratings grade is D, equating to Sell in our proprietary rating system. The stock has had a consistent pattern of F’s (Strong Sell) followed by D’s (Sell) since December 2022. SOFI has a rank in the D-rated Financial Services (Enterprise) industry of #93 out of 102 stocks.

The POWR Ratings for SOFI indicate that the highest-rated dimensions are Growth, Momentum, and Sentiment. According to the ratings, SOFI’s growth rating began at 42 in November 2022, then steadily increased to reach an impressive 85 by May 2023.

The momentum rating saw little change from November 2022 to January 2023 but experienced a notable jump from 24 to 41 between April and May. Finally, SOFI’s sentiment ratings began at 45 in November 2022 and decreased to 30 in April 2023 before increasing to 35 by May.

How does SoFi Technologies, Inc. (SOFI) Stack Up Against its Peers?

Other stocks in the Financial Services (Enterprise) sector that may be worth considering are Jiayin Group Inc. (JFIN), CPI Card Group Inc. (PMTS), and Everi Holdings Inc. (EVRI) — they have better POWR Ratings.

The Bear Market is NOT Over…

That is why you need to discover this timely presentation with a trading plan and top picks from 40 year investment veteran Steve Reitmeister:

REVISED: 2023 Stock Market Outlook >

Want More Great Investing Ideas?

SOFI shares were trading at $5.47 per share on Friday afternoon, up $0.26 (+4.99%). Year-to-date, SOFI has gained 18.66%, versus a 10.24% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SOFI | Get Rating | Get Rating | Get Rating |

| JFIN | Get Rating | Get Rating | Get Rating |

| PMTS | Get Rating | Get Rating | Get Rating |

| EVRI | Get Rating | Get Rating | Get Rating |