Millennials have been blamed for killing industries ranging from napkins to beer but they might be what has saved the stock market. Whether this proves to be savvy remains to be seen. A couple of weeks ago I warned how Barstool Sports founder David Portnoy, having become the face of a new breed of day traders, might be leading down a dangerous path of thinking stocks only go up and making money in the market is easy.

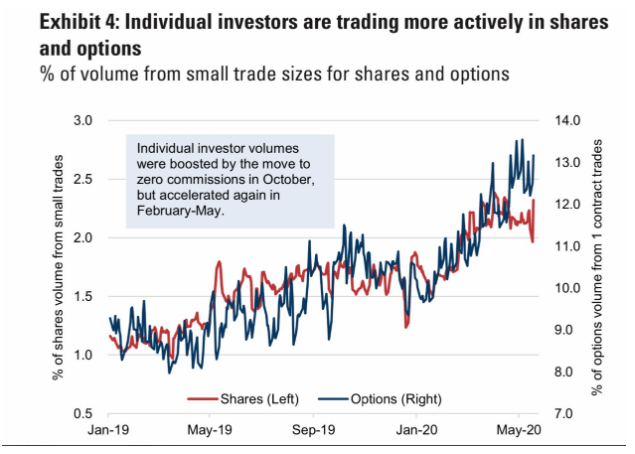

Well, so far Davey Day Trader and his merry men with Robinhood accounts have been making out like bandits. Data shows that not only did the activity of retail trading surge during the past two months, some of which was a function of being stuck at home with cash stipends coming in combined with across the board drop to zero commissions.

And they were not only diving headlong into stalwarts like “Apple (AAPL)” and “Microsoft (MSFT)” but also the most beaten-down sectors such as airlines, cruise ships with names such as “United Airlines (UAL)” and “Carnival Cruise (CCL)” being among the favorites. Their bullish optimism stands in stark contrast to the doom and gloom many of the legendary hedge fund managers such as Ray Dalio, Stanley Druckenmiller, and Bill Ackman were espousing near the March lows that ‘hell is coming’

And of course, there is Warren Buffet who swore off the airline industry having been burned by bad investment during the 1970s famously said, “ if a farsighted capitalist had been present at Kitty Hawk, he would have done his successors a huge favor by shooting Orville down,” but took large stakes in the major carriers in 2017 only to bail out the bottom last month for huge losses. That had everyone from Portnoy to President Trump crowing about his big mistake.

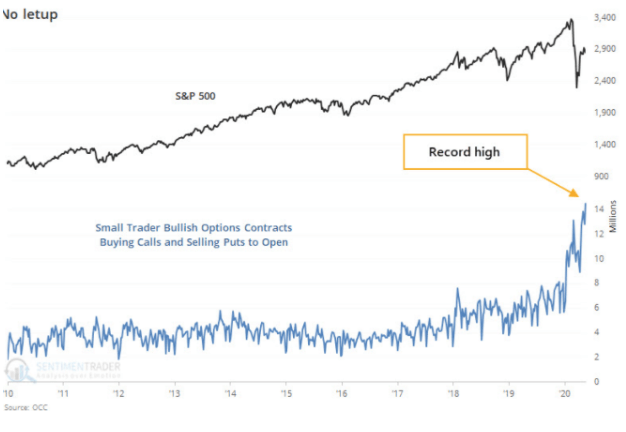

Is this all hubris before the fall? I don’t think we are getting near the froth and frenzy of the 1999 dot.com bubble but there are clear signs speculation is percolating.

This comes in the form of retail investors employing options, especially call options, to gain more leverage which has now reached record levels. Names such as UAL saw over 200,000 calls changed hands on June 3, the most in over a decade.

There is also a huge increase in volume and volatility in what might kindly be under-the-radar stocks but more colloquially known as message board pumps and dumps.

This ranges from the admitted fraudulently China-based coffee chain “Luckin (LK)” which had been halted for over a month as it faced Nasdaq delisting but has now seen its shares jump 400% in the past three days to rental car company “Hertz (HTZ)” which declared bankruptcy last week only to see the stock double by 100% today. Will this end up be another case of retail investors piling in only to find themselves being bag holders?

One thing that is certainly different this time is individual investors were stepping in to buy near the lows while the professional money managers appeared to be panicking. This may truly end up being the revenge of the little guy.

To learn more about Steve Smith’s approach to trading and access to his Option360 click here.

Want More Great Investing Ideas?

9 “BUY THE DIP” Growth Stocks for 2020

Bull Market or Bull S#*t? How to trade today’s stock market bubble and prepare for the return of the bear market.

7 “Safe-Haven” Dividend Stocks for Turbulent Times

SPY shares were trading at $320.23 per share on Friday afternoon, up $8.87 (+2.85%). Year-to-date, SPY has gained 0.08%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Option Sensei

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |