With stock indices raging back to levels prior to the pre-COVID 19 levels many people are wondering if this is a time to look at value stocks.

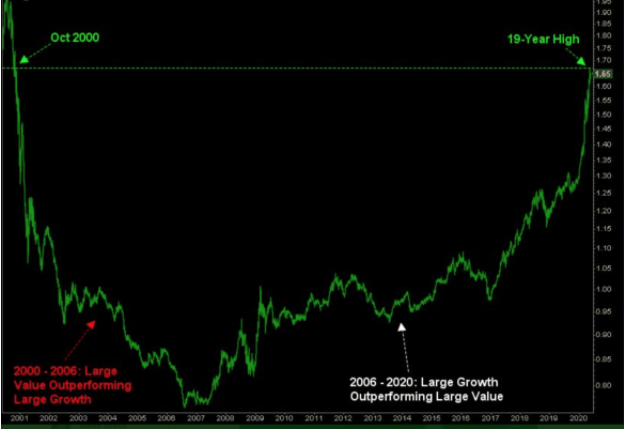

It has been well documented that growth has outpaced value for over a decade with technology leading the way. The tech-heavy is “Nasdaq 100 (QQQ)” is only 3.5% away from the all-time high hit February while the broader “S&P 500 (SPY - Get Rating)” is still some 10% away. Meanwhile the “Russell 2000 (IWM)” is

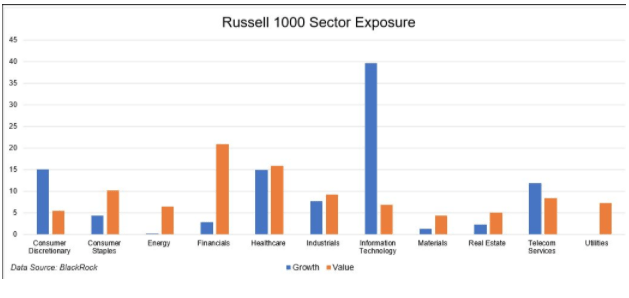

The main reason for the disparity is the QQQ is heavily weighted with large-cap tech/growth stocks while the IWM is saddled with value stocks that come from sectors such as energy and regional banks.

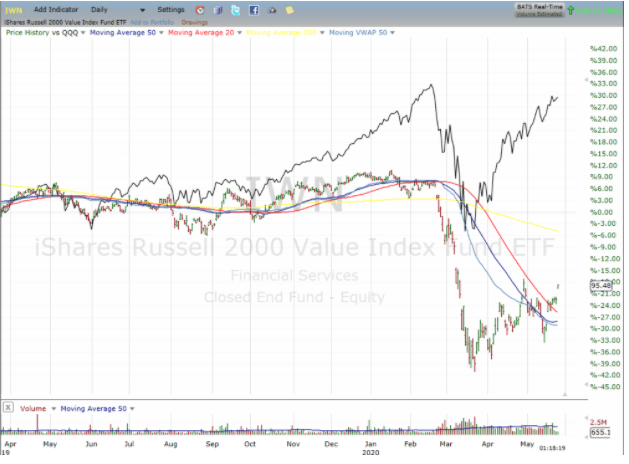

When we drill down and compare the “Russell 2000 Value (IWN) to the QQQ you see the separation began in earnest last year and then went into overdrive when the virus hit. Again, the explanation is simple; the QQQ is filled with stay at home plays such as “Amazon (AMZN) and “Netflix (NFLX)” while the IWN has a ton of energy like “Chesapeake (CHK).”

So, the question is, is value a bargain or a trap?

Before trying to answer that question we need to acknowledge that the assignation of ‘value’ versus ‘growth’ can be somewhat fluid. “Apple (AAPL) is widely held in both value and growth funds, the former pointing to its relatively low p/e and cash-rich balance sheet, the latter focusing on the revenue growth.

The theory of value is simple. Stock prices drift away from underlying values in the short term and drift back towards underlying values in the long term. When the divergence between the price and the underlying value is wide enough, value investors bet on it closing. They anticipate mean reversion.

In reality earnings tend to continue to deteriorate, it ends up being a multiple expansion that drives value stocks to recover in terms of price performance. Another important element is sector exposure. Again you can see tech is far and away from the largest component of growth.

The reality is this a secular trend, it’s been about 10 years since Marc Andreessen declared software is eating the world, and like other technology-driven revolutions that means certain industries will never revert to cyclical growth, or even survive, in coming years.

Some sectors such as energy will probably continue to lag, but other areas that were hit by the specific and temporary impact of COVID such as travel such as hotels like “Marriott (MAR)” or some restaurant dependent food distributors like “Sysco (SYY)” look like bargains to me. On the other hand, while the future looks bright for Shopify and Zoom, which now has market capitalization than the five major airlines put together, it can then maintain the growth that warrants current levels. And this is why this game is so hard. We have to balance the knowledge of what worked in the past with the uncertainty of what’s going to work tomorrow.

To learn more about Steve Smith’s approach to trading and access to his Option360 click here.

Want More Great Investing Ideas?

9 “BUY THE DIP” Growth Stocks for 2020

7 “Safe-Haven” Dividend Stocks for Turbulent Times

SPY shares were trading at $301.35 per share on Tuesday afternoon, up $5.91 (+2.00%). Year-to-date, SPY has declined -5.82%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Option Sensei

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| Get Rating | Get Rating | Get Rating |