It’s very dangerous and scary trying to catch a falling knife or to pick a bottom in this stock market. But, with the “SPDR Trust (SPY - Get Rating)” off some 30%, and many individual stocks down 50% or more, it’s time for investors, especially younger ones with a longer-term horizon, to start nibbling.

The rational approach is to use some form of dollar-cost averaging. Let’s say deploying 10%-20% of your capital for each 5% decline in the market or a stock price. It also makes sense to employ an option strategy that takes advantage of the record level of the VIX which has huge premiums across the options market.

The strategy I like is covered call strategy. It’s one of the most popular options strategies, especially among investors that don’t consider themselves ‘options traders.’

It’s a way for owners, especially for buy and hold types, to generate income from the stocks they own. It also provides an immediate discount to the purchase price of shares from their current price.

Let’s look at a quick example using “Apple (AAPL)”, which is down 25% from its highs, before drilling down into the nuances of covered calls.

With AAPL currently trading at $245 per share, one could sell the April 270 strike calls for $13, meaning you’d collect $1,300 for every contract sold. Remember, each option represents 100 shares, so a covered position would be the purchase of 100 shares of the stock vs. selling one call.

In this example, your cost basis for AAPL is immediately reduced to $232, or a 5.3% discount to the current price. The 270 call is 10% out-of-the-money, meaning if shares were above 270 on the April 20th expiration date you could have the shares ‘called away’ and realize a 16% gain in just 30 days.

Last month when option premiums were much lower one would only get a 3% ‘discount’ by selling a call that was 10% out-of-the-money. Or, what I’d recommend and will describe below, is roll the AAPL calls to keep the shares and keep reducing the cost basis. And remember, AAPL pays a dividend of $3.10, which translates into a 1.5% yield — higher than any treasury bonds.

Let’s drill down into covered calls. When a trader writes a covered call, usually they are looking to sell theta decay, a component of premium. They often will not consciously understand that, but when quizzed, that is generally their objective. Selling premium can mean many things, but in this writing, we mean selling extrinsic value.

Extrinsic value is the component of an option price most influenced by time passing by, the underlying symbol price changes, and the buying and selling pressures of the option itself. Intrinsic value, the other component of an option price, is the actual value of the option at expiration; the real tangible value. The intrinsic value is only a function of the underlying symbol price and the option type (call or put). The intrinsic value of an at-the-money or out-of-the-money option is zero.

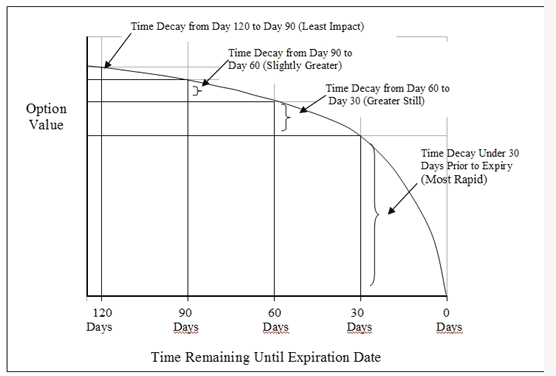

Near term premium is what is most often sold. Here is a graph showing how the value of the premium is not linear with time. An option will lose much less value over a day passing when it is 60 days from expiring than when it is five days. The risk with covered call writing is that the underlying symbol will appreciate, causing the buyer of the option to exercise it, or worse, depreciate, leaving the seller with a premium against a devalued underlying symbol. Selling near term premium optimizes the highest selling price with the least amount of time to wait for that price to decay. Our intention is to buy our call option back at a much lower price or let it expire worthless.Note, time decay or theta is not linear, it accelerates as the expiration date approaches.

The intention is to sell multiple cycles of premium against the underlying stock. Every cycle you sell premium against an underlying, and it expires worthless, lowers your investment. The profit of the previous cycle is subtracted from your investment. The profit of the current cycle over the lowered investment exponentially increases your return on invested capital. Each subsequent cycle, you have a lower cost basis while collecting an income of the option premium collected and dividends payout.

Aside from AAPL, some other blue-chip stocks one might consider for covered calls include “Microsoft (MSFT)” “Wal-Mart (WMT)” and “McDonald’s (MCD)” which all have solid balance sheets, pay a decent dividend, are likely to emerge from this crisis with even greater market share.

For those that want to be a bit more speculative might look at energy stocks that have been decimated. For example “Exxon (XOM)” which is down some 60% in the past two months and now offers a 10% dividend yield.

SPY shares were trading at $229.35 per share on Wednesday afternoon, down $23.45 (-9.28%). Year-to-date, SPY has declined -28.74%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Option Sensei

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |