- Tesla is the leader, but it is in the stratosphere

- Blink Charging (BLNK) is a pick and shovel play

- Carbon-offset food delivery with Facedrive (FDVRF)

- Fisker (FSR)- SUVs in 2023

- NIO is a wild ride

On January 20, 2021, Joe Biden became the forty-sixth President of the United States. The transition of power from the Trump administration is likely to go down in US history as the most contentious period. Former President Trump faced a majority of Democrats in the House of Representatives over the last two years of his term, while Republicans held onto a slim majority in the Senate.

President Biden will have a majority of his fellow Democrats in the House and the Senate over the coming two years. Many policy shifts are on the horizon, including an initiative to address climate change. US energy policy is likely to undergo a substantial move towards cleaner and renewable fuels at the expense of hydrocarbon production and consumption.

The number of electric-powered automobiles on the road will rise over the coming years, replacing gasoline-powered vehicles. The markets have already reflected the change, with Elon Musk vying with Jeff Bezos for the world’s wealthiest person. Tesla (TSLA - Get Rating) shares exploded in 2020, and the bullish party is continuing in early 2021.

Four other companies are likely to participate as the addressable market for EVs continues to rise. Fisker (FSR - Get Rating) and NIO Limited (NIO - Get Rating) are EV makers. Blink Charging (BLNK - Get Rating) is a pick and shovel play, and Facedrive (FDVRF - Get Rating) is a rideshare company looking to capitalize on the trend towards battery-powered vehicles.

Tesla is the leader, but it is in the stratosphere

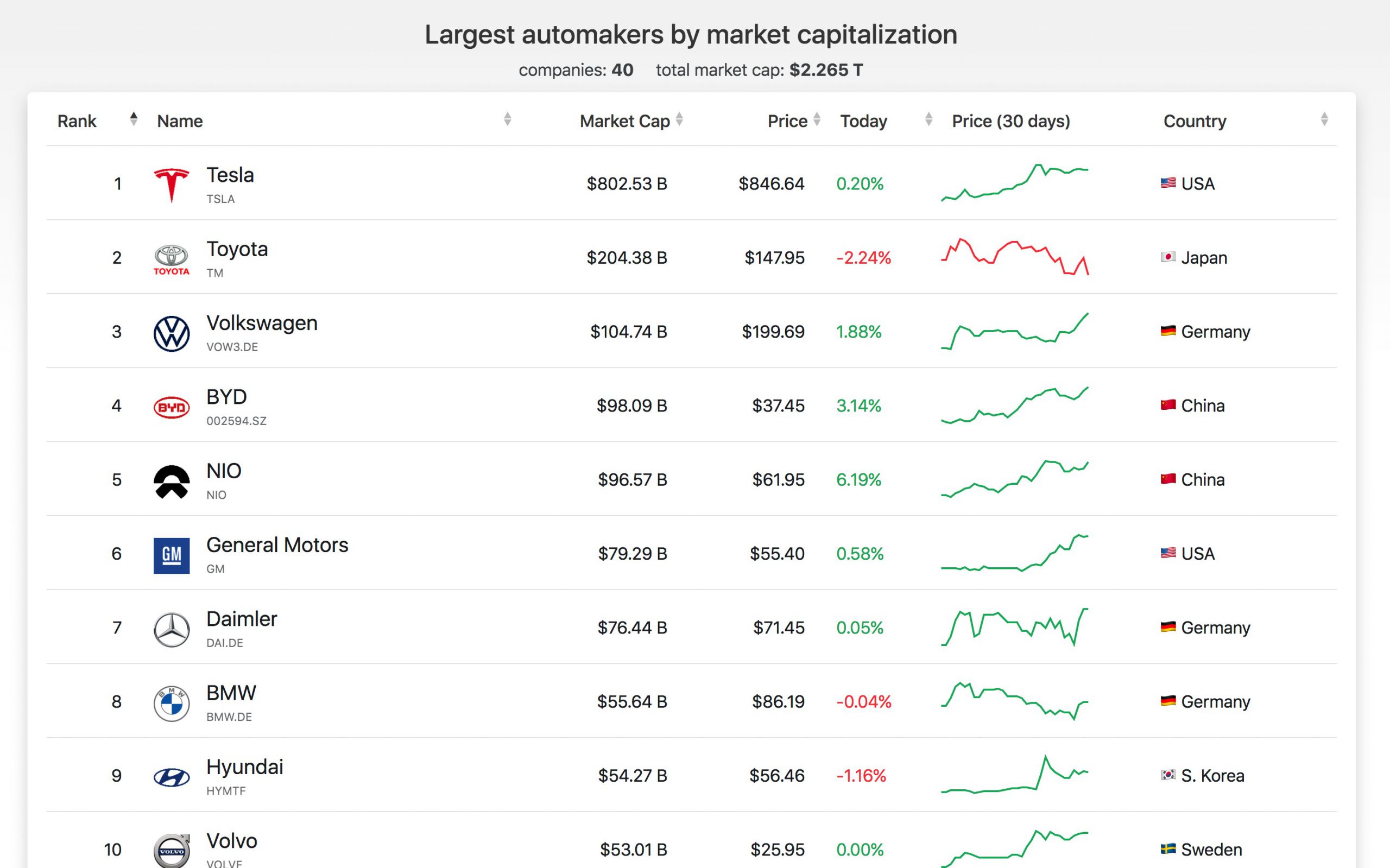

Telsa shares have been a bullish beast. The company that many analysts believed would run out of cash now leads the EV manufactures and has the leading market cap of all automakers worldwide by almost four-fold.

Source: https://companiesmarketcap.com/automakers/largest-automakers-by-market-cap/

Toyota, the world’s second-leading carmaker’s market cap was below $204.5 billion at the end of last week. Tesla’s was over $802.5 billion. Elon Musk and Jeff Bezos have been exchanging places as the world’s wealthiest person with each tick of the stock market over the past week.

Source: Barchart

Source: Barchart

The chart shows that TSLA was trading at $83.67 at the end of 2019. The shares ended 2020 at $705.67. In January 2021, the EV maker reached a high of $884.49 and was trading above the $846 level at the end of last week. TSLA shares are in the stratosphere as they defy all rational fundamental logic.

The stock’s trajectory is an example of how the trend is always your best friend in markets, and prices tend to move far higher than any analyst believes possible during bull markets. Many of those analysts expected TSLA’s bankruptcy at the end of 2019. Instead, they got a ten-bagger in one-year.

I believe Elon Musk is a modern-day DaVinci or at least the Thomas Edison of our time. His engineering skills and insights have also given birth to two untraded private companies, The Boring Company and SpaceX. Mr. Musk has embraced combining technology with political trends, essential requirements, and an inventive spirit. He would likely be the first to admit that the price of TSLA shares is at a stratospheric valuation at over the $846 level.

Meanwhile, the EV market will continue to expand, and there are other investment options out there to consider.

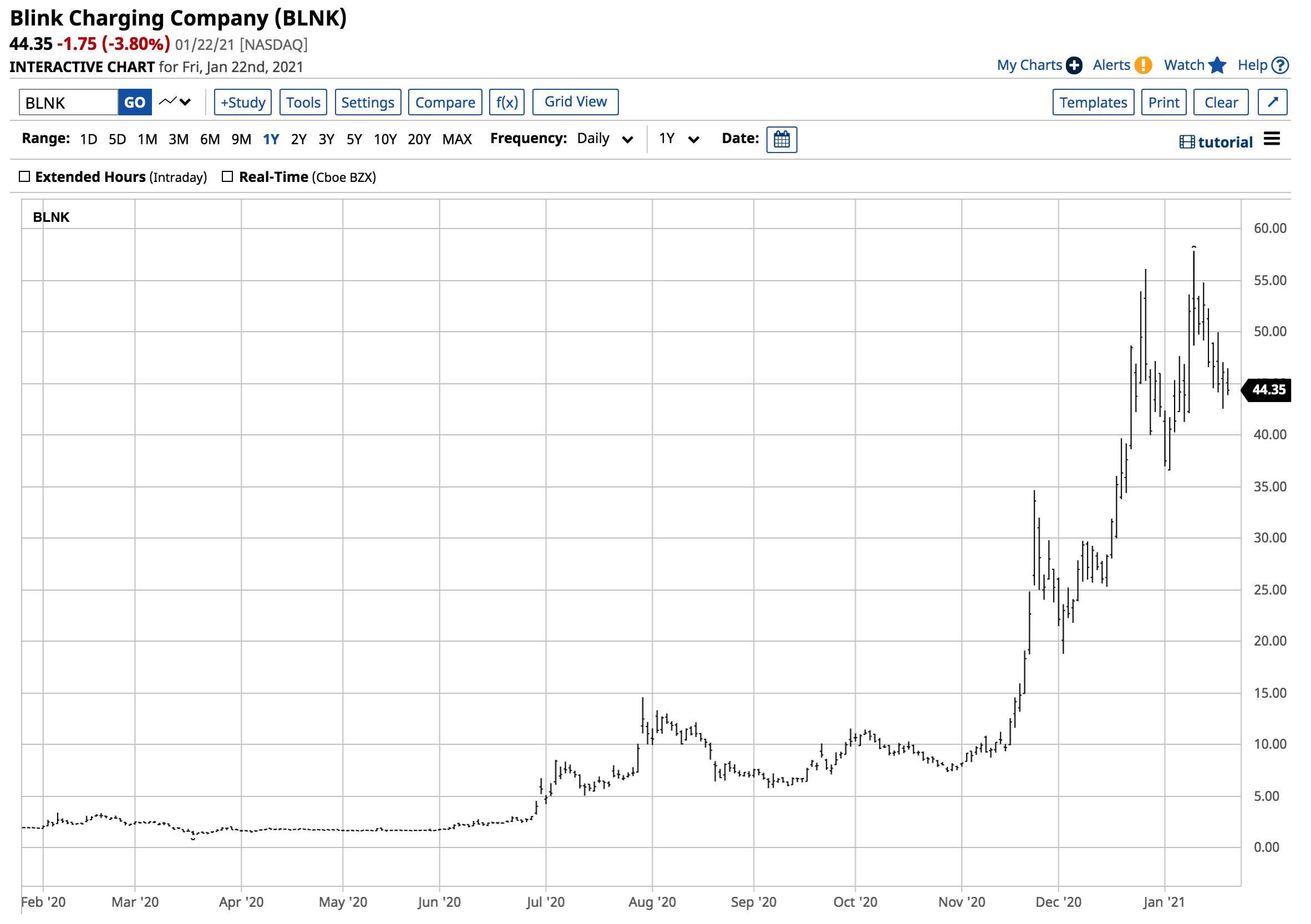

Blink Charging (BLNK) is a pick and shovel play

BLNK has been around since 2009, with headquarters in South Florida. In 2010, the shares rose to a reverse-split adjusted $3,750. Ten years later, in March 2020, they reached rock bottom at $1.25.

BLNK, through its subsidiaries, owns, operates, and provides electric vehicle charging equipment and networked EV charging services in the United States. As of the end of 2019, the company had just under 14,800 charging stations. In early 2021, the number reached over 23,000.

On January 12, BLNK raised $221.4 million, selling 5.4 million shares of its common stock at $41 after BLNK took off after reaching the $1.25 low in March.

Source: Barchart

Source: Barchart

As the chart shows, the rise in BLNK shares was even more impressive than TSLA’s as the stock reached a high of $57.85 on January 12. At over $44 at the end of last week, the stock was above the most recent public offering price.

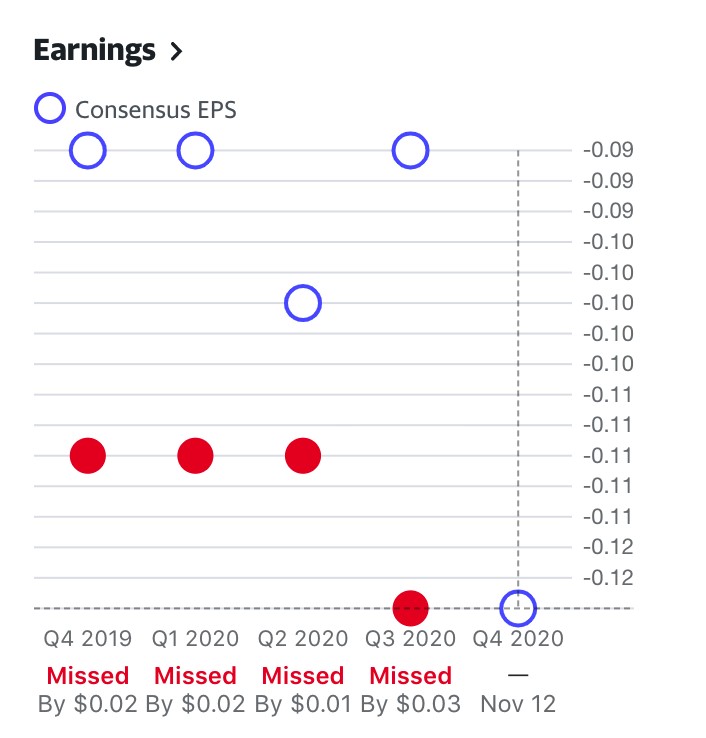

Source: Yahoo Finance

The chart shows that BLNK consistently posted losses and underperformed analyst estimates over the past four quarters. However, the company is a pick and shovel play for the EV market, which created impressive gains. BLNK is a highly speculative stock, but so was TSLA a few short years ago. At the $44.35 level, BLNK’s market cap was just below $1.85 billion.

Carbon-offset food delivery with Facedrive (FDVRF)

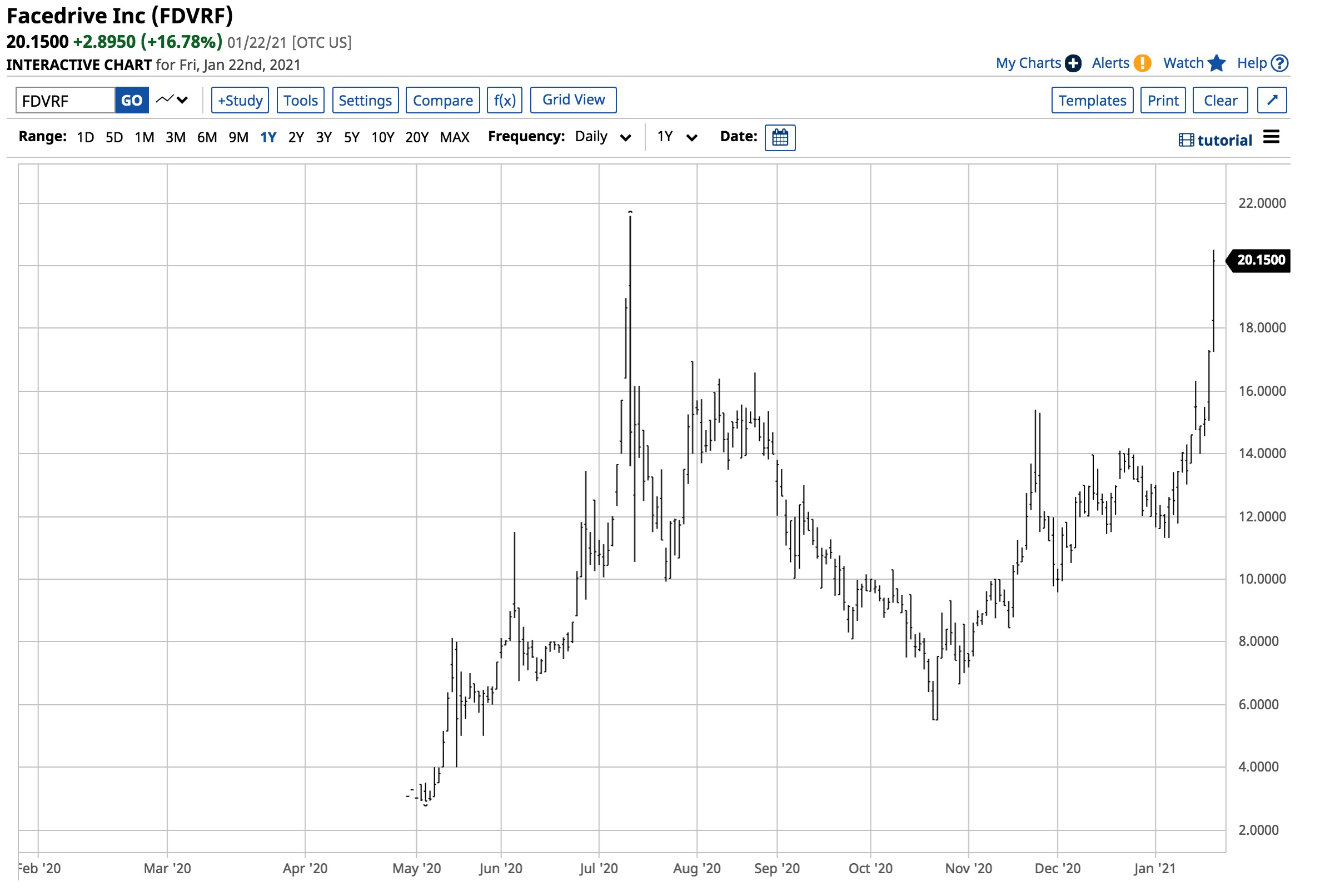

FDVRF is a Canadian company that operates as a ride-sharing platform using TraceSCAN, a COVID-19 contact tracing app. The company operates in five segments, including ridesharing, an e-commerce platform, food delivery, a social platform, and heath, which operates the contact tracing. FDVRF’s “people-and-planet first” technology ecosystem uses EVs for deliveries.

Source: Barchart

Source: Barchart

The chart highlights that FDVRF shares moved from $3.07 in late April 2020 to a high of $21.58 in mid-July. After falling to $5.50 in late October, the stock rebounded to the $20.15 level at the end of last week. Facedrive has a market cap of $1.9 billion and could attract lots of investment interest based on its green energy mission.

Its business combines consumer requirements with technological solutions that address climate change. FDVRF is a technology company that could find success in the US as the political landscape shifts.

Fisker (FSR)- SUVs in 2023

FSR designs and makes electric vehicles and mobility solutions. The company’s headquarters are in lovely Manhattan Beach, California. FSR’s pre-IPO price was at $10 per share, valuing the company at $2.9 billion in 2020.

Source: Barchart

Source: Barchart

The stock traded to a high of $23.63 on November 27 and was trading at the $14.86 level at the end of last week. FSR’s market cap was $4.12 billion, with an average trading volume of nearly 13 million shares. The growth of the EV sector and speculative frenzy could push the manufacturer’s shares much higher in 2021.

NIO is a wild ride

While FSR is an emerging publicly traded company NIO is a Chinese EV maker with headquarters in Shanghai. NIO stands a reasonable chance of challenging TSLA in China, but owning NIO involves Chinese stock market risk. Meanwhile, NIO shares rose from $4.02 at the end of 2019 to $48.74 at the end of 2020.

Source: Barchart

Source: Barchart

The chart shows that the bullish price action continues in 2021, with NIO trading to a high of $66.99 on January 11 and closing at the $61.95 level at the end of last week. NIO has been in business since 2014.

Source: Yahoo Finance

Source: Yahoo Finance

According to Yahoo finance, after missing analyst estimates in Q4 2019, NIO beat the forecasts over the past three quarters. However, the company continues to report losses. The current projections for Q4 2020 are for a smaller loss of nine cents per share.

At $61.95, NIO’s market cap stands at $96.574 billion. The trend in the stock remains higher.

While TSLA is in the stratosphere, the EV sector and related plays are likely to attract buying throughout 2021. I would be a buyer of companies like NIO, FSR, FDVRF, and BLNK on any price weakness compared to the recent highs. While none likely have the potential for a TSLA-like move this year, a greener energy path and investors looking for environmentally friendly companies are likely to support the sector over the coming months.

Want More Great Investing Ideas?

9 “MUST OWN” Growth Stocks for 2021

How to Outperform the Stock Market?

7 Best ETFs for the NEXT Bull Market

5 WINNING Stocks Chart Patterns

TSLA shares were trading at $877.50 per share on Tuesday morning, down $3.30 (-0.37%). Year-to-date, TSLA has gained 24.35%, versus a 2.83% rise in the benchmark S&P 500 index during the same period.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| TSLA | Get Rating | Get Rating | Get Rating |

| FSR | Get Rating | Get Rating | Get Rating |

| NIO | Get Rating | Get Rating | Get Rating |

| BLNK | Get Rating | Get Rating | Get Rating |

| FDVRF | Get Rating | Get Rating | Get Rating |