Upstart Holdings, Inc. (UPST) in San Mateo, Calif., operates a cloud-based artificial intelligence (AI) lending platform in the United States. It recently reported solid first-quarter earnings results, with a 156% year-over-year increase in revenues to $310 million.

However, the company cut its full-year revenue forecast to $1.25 from $1.40 billion on concerns about declining lending activity due to aggressive interest rate increases and rising default rates.

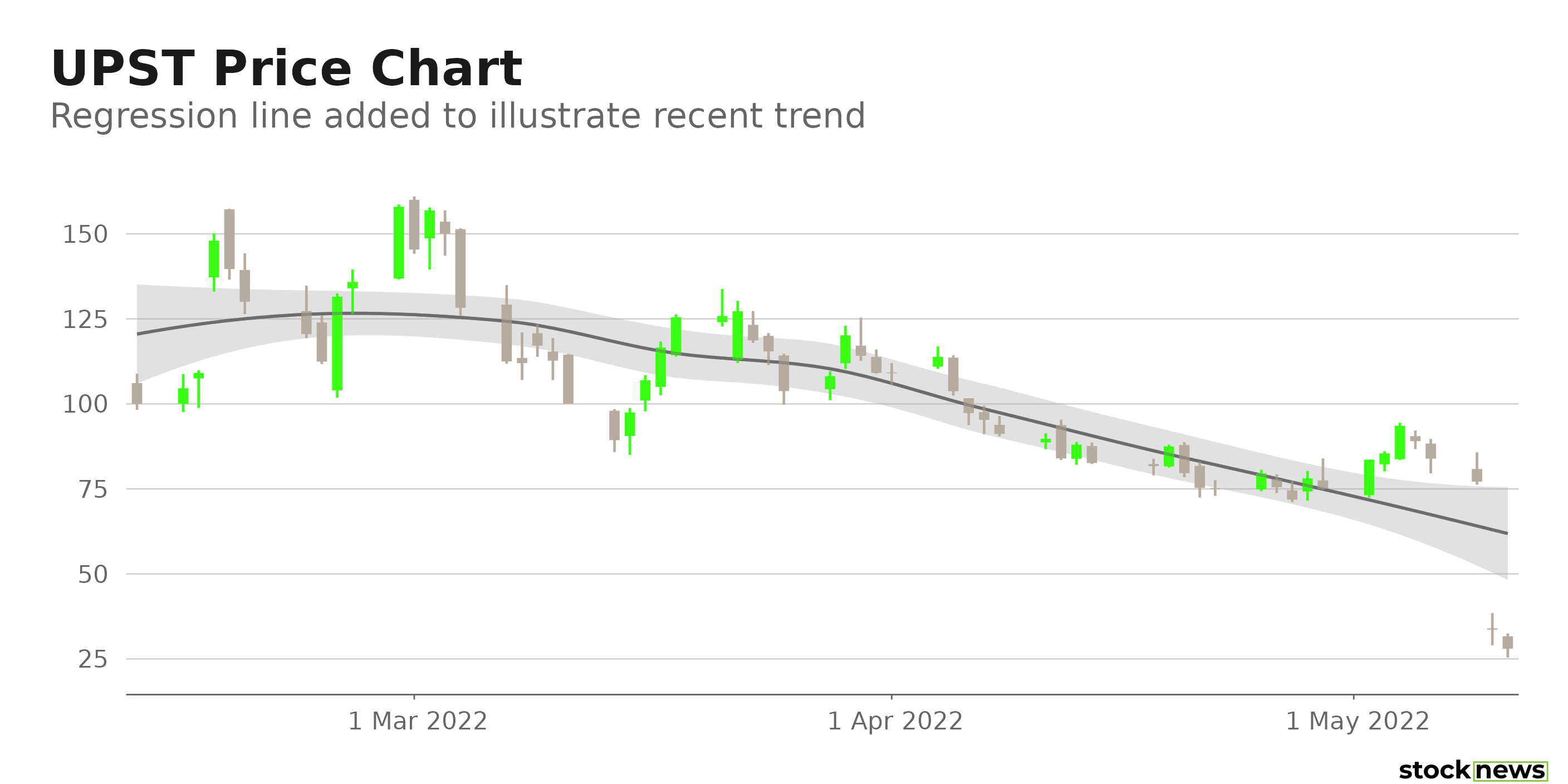

Atlantic Equities downgraded UPS to Neutral from Overweight and lowered the price target from $245 to $45, owing to the company’s use of the balance sheet to supplement loan origination. The stock has declined 68.8% in price over the past month to close yesterday’s trading session at $28. In addition, it is currently trading 93% below its all-time high of $401.49, which it hit on Oct. 15, 2021. So, UPST’s near-term prospects look bleak.

Here is what could influence UPST’s performance in the coming months:

Low Profitability

In terms of trailing-12-month net income margin, UPST’s 15.19% is 48.4% lower than the 29.44% industry average. Likewise, its 0.94% trailing-12-month CAPEX/Sales is 39.4% lower than the 1.55% industry average. Furthermore, the stock’s 15.82% trailing-12-month EBIT margin is 37.7% lower than the 25.41% industry average.

Stretched Valuation

In terms of forward EV/EBIT, UPST’s 109.36x is 878.2% higher than the 11.18x industry average. Likewise, its 3.25x forward P/B is 196.2% higher than the 1.10x industry average. Also, the stock’s 16.43x forward non-GAAP P/E is 62.2% higher than the 10.13x industry average.

POWR Ratings Reflect Bleak Prospects

UPST has an overall D rating, which equates to Sell in our POWR Ratings system. The POWR Ratings are calculated by accounting for 118 distinct factors, with each factor weighted to an optimal degree.

Our proprietary rating system also evaluates each stock based on eight distinct categories. UPST has a C grade for Quality, which is in sync with its lower-than-industry profitability ratios.

The stock has an F grade for Stability, which is consistent with its 2.23 beta. In addition, UPST has a C grade for Growth and an F grade for Sentiment. This is justified because analysts expect its EPS to decline 48.4% in the current quarter and 22.3% in the current year.

The stock has a D grade for Momentum, which is consistent with its 88.6% loss over the past six months and 81.5% decline year-to-date.

UPST is ranked #82 among 105 stocks in the D-rated Financial Services (Enterprise) industry. Click here to access UPST’s ratings for Value.

Click here to check out our Cloud Computing Industry Report for 2022

Bottom Line

UPST is currently trading below its 50-day and 200-day moving averages of $97.52 and $179.64, respectively, indicating a downtrend. Moreover, its stock could continue declining in the near term due to heightened macroeconomic fears. Because the stock looks overvalued at the current price level, we think it best to avoid it now.

How Does Upstart Holdings (UPST) Stack Up Against its Peers?

While UPST has an overall POWR Rating of D, one might want to consider investing in the following Financial Services (Enterprise) stocks with an A (Strong Buy) or B (Buy) rating: Forrester Research, Inc. (FORR), Everi Holdings Inc. (EVRI), and Consumer Portfolio Services, Inc. (CPSS).

Want More Great Investing Ideas?

UPST shares fell $0.81 (-2.89%) in premarket trading Thursday. Year-to-date, UPST has declined -81.49%, versus a -17.05% rise in the benchmark S&P 500 index during the same period.

About the Author: Nimesh Jaiswal

Nimesh Jaiswal's fervent interest in analyzing and interpreting financial data led him to a career as a financial analyst and journalist. The importance of financial statements in driving a stock’s price is the key approach that he follows while advising investors in his articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| UPST | Get Rating | Get Rating | Get Rating |

| FORR | Get Rating | Get Rating | Get Rating |

| EVRI | Get Rating | Get Rating | Get Rating |

| CPSS | Get Rating | Get Rating | Get Rating |