Money transfers and payment services company Western Union Company (WU - Get Rating) in Englewood, Colo., is a global leader in international cross-border transfers and intra-country money movement. As a premier financial services provider, the company maintains strong operating cash flows and has strengthened its digital money transfer services significantly. Its Westernunion.com revenue rose 4% on a reported basis, driven by 7% cross-border revenue growth in the first quarter of 2022.

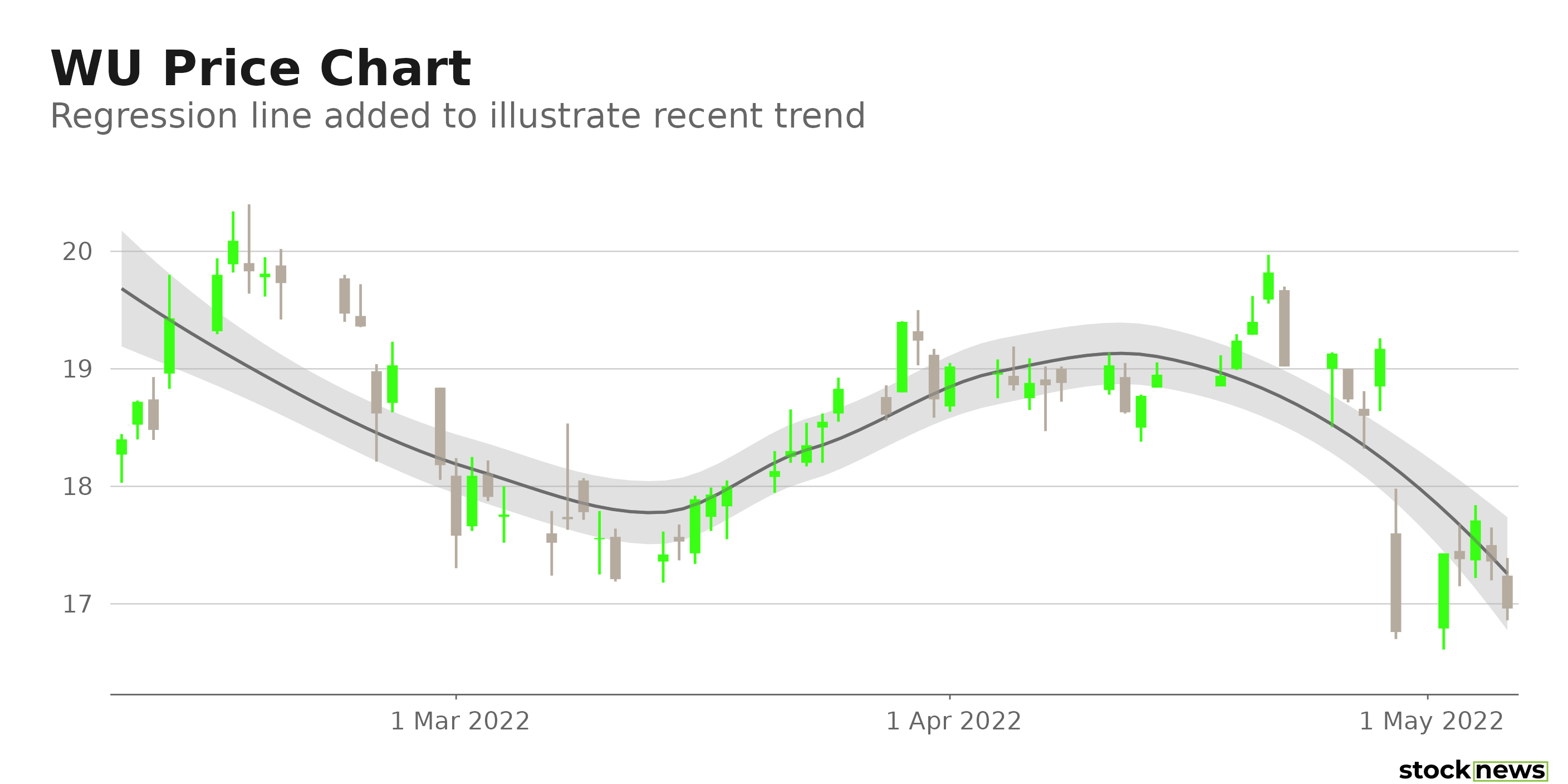

However, shares of WU have plummeted 8% in price over the past month and 2.7% year-to-date. This could be due primarily to the broader market hitting new lows last week and investors’ concern surrounding the fintech leader’s recent suspension of business in Russia and Belarus.

While the company’s strategic collaborations to expand its cross-border money transfer channels should bolster its revenue growth, a decline in retail money transfers because of the Russia-Ukraine war could negatively impact its balance sheet. Moreover, WU lowered its 2022 outlook because of the cessation of its operations in Russia and Belarus and other related impacts. Closing its last session at $16.96, the stock is trading 34.7% below its 52-week high of $25.98.

Here is what could influence WU’s performance in the coming months:

Strategic Collaborations

This month, WU agreed with PagaPhone SmartPay, a Mexican e-Wallet company, to enable users to send money using any of its channels, including WU.com, the mobile app, or retail locations to Mexico. The partnership should help the fintech company to cater to growing customer demand and capitalize on the surge in remittances in Mexico.

In addition, the payment services provider collaborated with SuperGIROS, which is part of the Acciones & Valores network, to offer Columbians more than 9,800 additional retail locations for global money movement and payments. This should help expand WU’s global network and allow it to serve more users.

Divestiture of Business Solutions and Suspension of Operations

In March, the financial services company completed the first closing of its divestiture of its Business Solutions unit. It expects to complete the second closing during the second quarter of 2022. While WU plans to deploy the proceeds from the sale strategically, exit costs related to the divestiture could make investors nervous about the stock’s prospects.

Also, the suspension of its Western Union operations in Russia and Belarus due to the ongoing war in Ukraine could negatively impact its profitability in the coming quarters.

Mixed Growth Estimates

Analysts expect WU’s revenues to decline 9.2% in the current quarter (ending June 30, 2022), 9.8% in 2022, and 0.6% next year. WU has an impressive earnings history; it beat the Street’s estimates in each of the trailing four quarters. But the company’s EPS is expected to decline 14.6% year-over-year to $0.41 in the current quarter and 31.7% from the year-ago value to $0.43 next quarter. However, WU’s EPS is expected to increase 6.8% per annum over the next five years.

Mixed Financial Performance

WU’s revenue declined 4% on a reported basis to $1.2 billion in the first quarter ended March 31, 2022. Although its digital money transfer revenues grew 5% on a reported basis, the company’s Consumer-to-Consumer (C2C) revenues declined 5% on a reported basis. Moreover, its cash and cash equivalents came in at $2.06 billion, compared to $2.28 billion in the first quarter of 2021. While its total segment operating income grew 10% year-over-year, the company’s revenues from Business Solutions fell 8% from the prior-year quarter to $89.1 million.

POWR Ratings Reflect Uncertainty

WU has an overall C rating, which translates to Neutral in our POWR Ratings system. The POWR Ratings are calculated by considering 118 distinct factors with each factor weighted to an optimal degree.

Our proprietary rating system also evaluates each stock based on eight distinct categories. WU has a C grade for Quality. The stock’s 43.3% trailing-12-month gross profit margin, which is 14.3% lower than the 50.5% industry average, is in sync with this grade.

Furthermore, the company has a Momentum grade of C, which is consistent with its price returns over the past month.

In terms of Sentiment Grade, WU has an F. This is consistent with analysts’ expectations that its revenue and EPS will decline in the current quarter.

In addition to the grades I have highlighted, one can check out additional WU ratings for Stability, Value, and Growth here. WU is ranked #28 of 50 stocks in the D-rated Consumer Financial Services industry.

Bottom Line

Surging digital money transfer demand and an expanding global network to serve a larger customer base have benefited the leading fintech company. However, WU’s declining C2C revenues and the divestiture of its Business Solutions segment have added uncertainties to its prospects. Furthermore, the halt of its services in Russia and Belarus could affect its profitability in the near term. Therefore, we think investors should wait for its prospects to improve before investing in the stock.

How Does Western Union Company (WU) Stack Up Against its Peers?

While WU has an overall C (Neutral) rating in our proprietary rating system, one might want to check out its industry peers with B (Buy) ratings: Atlanticus Holdings Corporation (ATLC - Get Rating), Regional Management Corp. (RM - Get Rating) and OneMain Holdings, Inc. (OMF - Get Rating).

Want More Great Investing Ideas?

WU shares fell $0.21 (-1.24%) in premarket trading Monday. Year-to-date, WU has declined -3.64%, versus a -13.13% rise in the benchmark S&P 500 index during the same period.

About the Author: Imon Ghosh

Imon is an investment analyst and journalist with an enthusiasm for financial research and writing. She began her career at Kantar IMRB, a leading market research and consumer consulting organization. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| WU | Get Rating | Get Rating | Get Rating |

| ATLC | Get Rating | Get Rating | Get Rating |

| RM | Get Rating | Get Rating | Get Rating |

| OMF | Get Rating | Get Rating | Get Rating |