Zoom Video Communications, Inc. (ZM - Get Rating) in San Diego, Calif., is a video communication platform that connects people through video, phone, chat, and webinars and enables experiences across disparate devices and locations. Its products include Zoom Meetings, Zoom Phone, Zoom Chat, Zoom Rooms, Zoom Hardware-as-a-Service, Zoom Conference Room Connector, Zoom Events, Zoom Webinar, Zoom Developer Platform, Zoom App Marketplace, and Zoom Contact Center.

ZM’s services became instrumental in many people’s lives during the worst of the COVID-19 pandemic when venturing outdoors was restricted. But as in-person meetings resume and workers make their way back to their offices, ZM’s revenue growth may slow. Furthermore, ZM faces increased competition from other popular video conferencing platforms, such as Microsoft Corporation’s (MSFT) Microsoft Teams and Alphabet Inc.’s (GOOGL) Google Meet. However, the company is focusing on enhancing its customer experience and promoting hybrid work by bringing new products and innovative solutions that should enable them to grow.

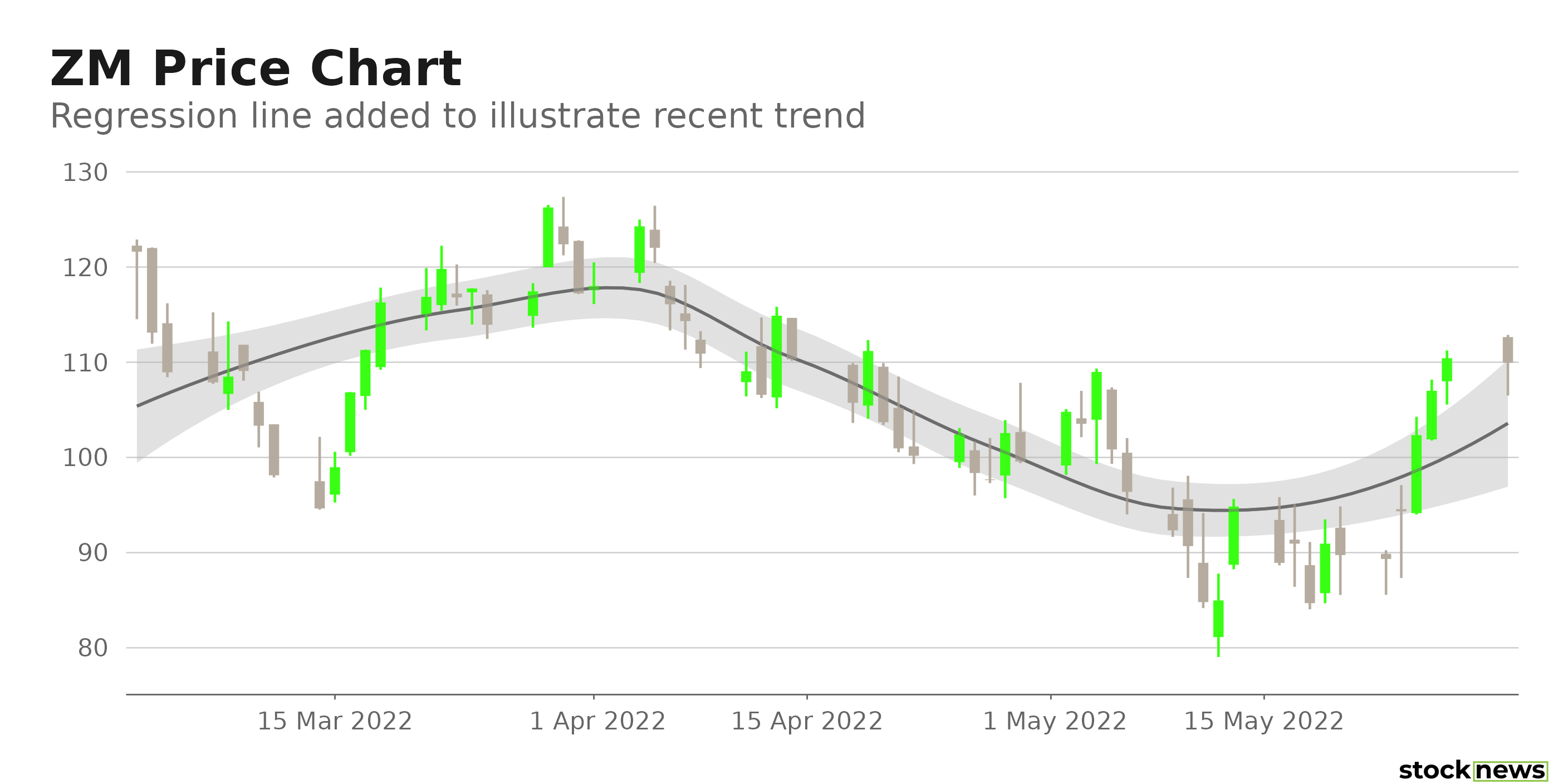

ZM’s shares have declined 49.8% in price over the past six months and 66.1% over the past year to close the last trading session at $110.42. It is currently trading 72.8% below its 52-week high of $406.48, which it hit on July 7, 2021.

Here is what could influence ZM’s performance in the upcoming months:

Mixed Financials

ZM’s revenue for the first quarter, ended April 30, 2022, increased 12% year-over-year to $1.07 billion. The company’s income from operations has declined 17.3% in price year-over-year to $187.06 million. Also, the company’s non-GAAP net income decreased 21.4% year-over-year to $315.78 million. In addition, its non-GAAP EPS came in at $1.03, representing a 21.9% decline year-over-year. Furthermore, its gross profit increased 17.4% year-over-year to $811.97 million.

Stretched Valuation

In terms of forward non-GAAP P/E, ZM’s 29.33x is 56.6% higher than the 18.73x industry average. Likewise, its 18.15x forward EV/EBITDA is 39.3% higher than the 13.03x industry average. And the stock’s 18.29x forward EV/EBIT is 11.3% higher than the 16.42x industry average.

Mixed Analyst Estimates

Analysts expect ZM’s EPS for the quarter ending July 31, 2022, to decrease 32.4% year-over-year to $0.92. However, its revenue for fiscal 2024 is expected to increase 13.4% year-over-year to $5.15 billion. It surpassed the Street’s EPS estimates in each of the trailing four quarters.

Higher-than-industry Profitability

In terms of trailing-12-month net income margin, ZM’s 29.92% is 448.8% higher than the 5.45% industry average. And its 25.44% trailing-12-month EBITDA margin is 91.1% higher than the 13.31% industry average. Furthermore, the stock’s trailing-12-month EBIT margin of 24.19% is significantly higher than the 8.22% industry average.

POWR Ratings Reflect Uncertainty

ZM has an overall C rating, which equates to a Neutral in our POWR Ratings system. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

Our proprietary rating system also evaluates each stock based on eight distinct categories. ZM has a D grade for Growth, which is in sync with its EPS for fiscal 2023, which is expected to decline 25.6% year-over-year to $3.74.

ZM is ranked #39 out of 81 stocks in the Technology – Services industry.

Click here to access ZM’s ratings for Value, Momentum, Stability, Sentiment, and Quality.

Bottom Line

Given the resumption of working in company offices, work travel, and in-person meetings, ZM’s user base is expected to decline in the near term. The stock is currently trading below its 100-day and 200-day moving averages of $121.48 and $189.44, respectively, indicating a downtrend. Thus, we think it could be wise to wait for a better entry point in the stock.

How Does Zoom Video Communications (ZM - Get Rating) Stack Up Against its Peers?

While ZM has an overall POWR Rating of C, one might want to consider investing in the following Technology – Services stocks with an A (Strong Buy) and B (Buy) rating: Fujitsu Limited (FJTSY - Get Rating), Information Services Group, Inc. (III - Get Rating), and Sanmina Corporation (SANM - Get Rating).

Note that III is one of the few stocks handpicked by our Chief Growth Strategist, Jaimini Desai, currently in the POWR Stocks Under $10 portfolio. Learn more here.

Want More Great Investing Ideas?

ZM shares were trading at $109.74 per share on Tuesday afternoon, down $0.68 (-0.62%). Year-to-date, ZM has declined -40.33%, versus a -12.49% rise in the benchmark S&P 500 index during the same period.

About the Author: Dipanjan Banchur

Since he was in grade school, Dipanjan was interested in the stock market. This led to him obtaining a master’s degree in Finance and Accounting. Currently, as an investment analyst and financial journalist, Dipanjan has a strong interest in reading and analyzing emerging trends in financial markets. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| ZM | Get Rating | Get Rating | Get Rating |

| FJTSY | Get Rating | Get Rating | Get Rating |

| III | Get Rating | Get Rating | Get Rating |

| SANM | Get Rating | Get Rating | Get Rating |