Further evidence that a recession isn’t coming soon (most likely late 2020 or early 2021 at the earliest), comes from the bond market, which has been the most accurate recession predictor yet discovered. The bond market is driven by large institutional money flows, from things like asset managers, pension funds, insurance companies, and sovereign wealth funds. These are the people whose job it is to keep a pulse on the US and global economy and protect billions of people’s money during such downturns.

The way the bond market warns us about recessions is via the yield curve, which is the difference between short and long-term bond yields. When short-term yields exceed long-term ones, the curve is said to be inverted. According to a study by the San Francisco Federal Reserve an inverted yield curve has “correctly signaled all nine recessions since 1955 and had only one false positive, in the mid-1960s, when an inversion was followed by an economic slowdown but not an official recession.”

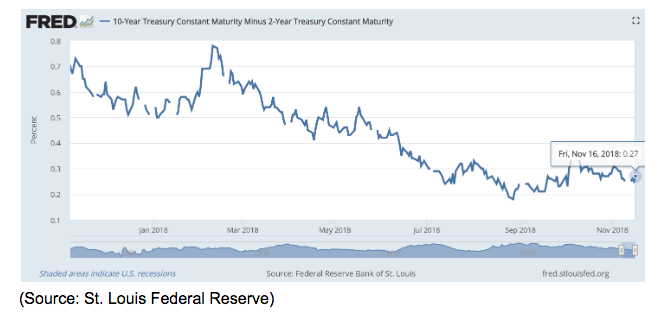

Specifically, when the 2-year and 10-year yield curve inverts, 90% of the time within six to 24 months a recession begins (average lead time 17 months). The 2/10 yield curve has indeed been falling (flattening) for years now. BUT in the last few weeks, despite falling long-term yields (flight to safety) the curve has actually remained stable.

In fact, the 2/10 yield curve (there are actually dozens of yield curves), bottomed on August 18th at 0.18% and has since recovered to 0.27%. More importantly, in recent weeks, it’s actually been stable, despite 10-year yields falling. Why is that so significant? Because while it’s normal for long-term rates to fall when stocks decline (flight to safety), it’s NOT normal for the 2-year yield to decline. Not when it’s been rising rapidly for over a year on expectations that the Fed would continue hiking (five or six more times per the latest dot plot).

About the Author:

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!