But in recent weeks both the 10-year and two-year yield have been falling, in lockstep. This means the bond market is now saying, via billions in institutional fund flows, that it’s expecting the following:

- Slower economic growth in the coming years (as we expected)

- Weaker than expected long-term inflation (now 2%, The Fed’s long-term target)

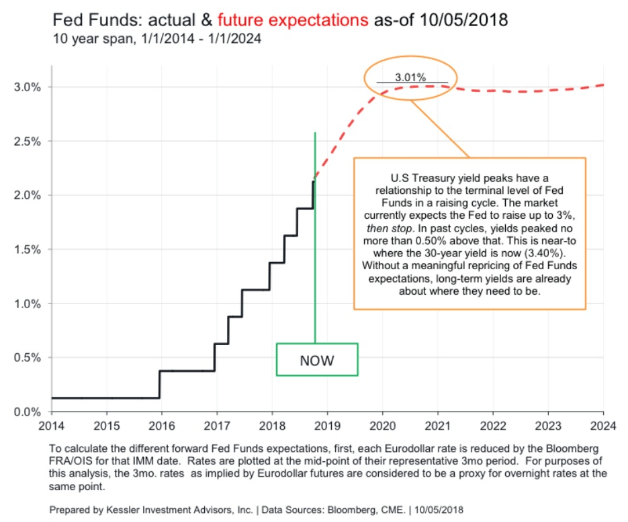

- Fed ending rate hiking cycle in just 3 more increases (not five or six)

- NO yield curve inversion and NO impending recession

(Source: Kessler Investment Activities, Inc.)

In fact, the bond futures market, also where billions of dollars are at stake, is signaling that the Fed will only hike three more times. That would put the Fed Funds rate at 3%, the Fed’s best estimate of the neutral interest rate (neither accelerates nor drags on growth). Several Fed officials, including Chairman Jerome Powell himself, have indeed indicated that the Fed is only committed to getting us to that estimated neutral rate. Beyond that, the Fed’s interest rate decisions will come down to what the economic and inflation data says it should do based on the best available evidence.

Okay, so maybe we’re not headed for a recession next year, or even in 2020 or 2021, but what about the alarming decrease in analysts earnings forecasts for 2019? Surely that justifies stocks at least crashing into a bear market right? Actually, it doesn’t. That’s because since 2002 the annualized growth rate of the S&P 500’s earnings has been 7.5%. So even 9% growth, following 21% growth in 2018, would not be a disaster. In fact, it would be significantly above average growth.

What if those forecasts keep falling to below 7.5%? Well, then reasonable stock valuations are what is likely to prevent a bear market. What? Aren’t stocks in a bubble? Actually, the forward PE on the S&P 500 is now 15.2, which is between the five year average of 16.5 and the 10 year average of 14.5 (which includes the Great Recession when stocks fell 57%).

About the Author:

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!