KKR Real Estate Finance Trust Inc. (KREF): Price and Financial Metrics

KREF Price/Volume Stats

| Current price | $9.62 | 52-week high | $14.12 |

| Prev. close | $9.56 | 52-week low | $9.09 |

| Day low | $9.54 | Volume | 581,200 |

| Day high | $9.67 | Avg. volume | 597,032 |

| 50-day MA | $9.79 | Dividend yield | 9.98% |

| 200-day MA | $11.54 | Market Cap | 666.80M |

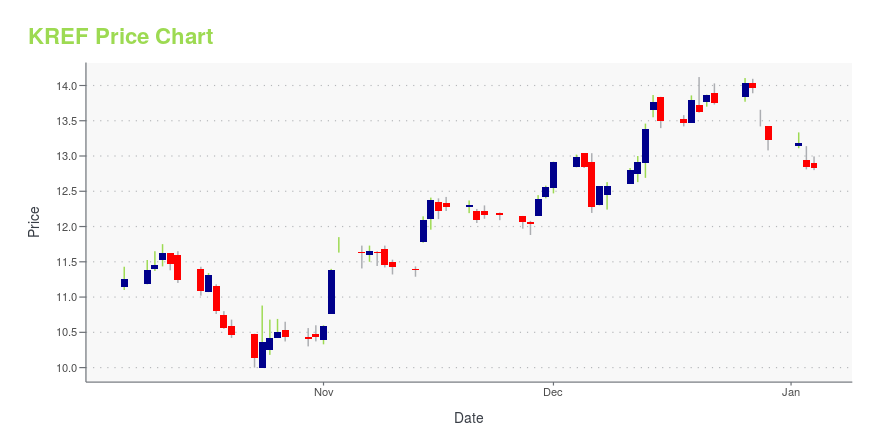

KREF Stock Price Chart Interactive Chart >

KKR Real Estate Finance Trust Inc. (KREF) Company Bio

KKR Real Estate Finance Trust Inc., a real estate finance company, focuses primarily on originating and acquiring senior mortgage loans secured by commercial real estate assets. It has elected to be taxed as a real estate investment trust and would not be subject to federal corporate income taxes if it distributes at least 90% of its taxable income to its stockholders. The company was founded in 2014 and is based in New York, New York.

Latest KREF News From Around the Web

Below are the latest news stories about KKR REAL ESTATE FINANCE TRUST INC that investors may wish to consider to help them evaluate KREF as an investment opportunity.

KKR Real Estate Finance Trust Inc. (NYSE:KREF) is favoured by institutional owners who hold 58% of the companyKey Insights Given the large stake in the stock by institutions, KKR Real Estate Finance Trust's stock price might be... |

KKR Real Estate Finance Trust Inc. Declares Quarterly Dividend of $0.43 Per Share of Common StockNEW YORK, December 15, 2023--KKR Real Estate Finance Trust Inc. (the "Company" or "KREF") (NYSE: KREF) announced that the Board of Directors has declared a dividend of $0.43 per share of common stock with respect to the fourth quarter of 2023. The dividend is payable on January 12, 2024 to KREF’s common stockholders of record as of December 29, 2023. |

Investors in KKR Real Estate Finance Trust (NYSE:KREF) from five years ago are still down 6.3%, even after 12% gain this past weekIt's nice to see the KKR Real Estate Finance Trust Inc. ( NYSE:KREF ) share price up 12% in a week. But over the last... |

Kasa Living, Inc. Closes $70 Million Series C Funding Round Led by Citi VenturesKasa Living, Inc., the leading tech-powered hospitality brand, today announced the close of a $70 million Series C fundraise. Citi Ventures and FirstMark Capital led the all equity round with participation from new investors New York Life Ventures and Fireside Investments. All major existing investors including RET Ventures, Zigg Capital, and Ribbit Capital participated in the twice upsized and oversubscribed round. |

3 REITs That Just Beat Analysts' EstimatesReal estate investment trusts (REITs) have had a rough time this year, as higher interest rates and fears of a recession have weighed upon the share prices of the stocks. Analysts have been adjusting earnings estimates lower for some time. But REITs are reporting third-quarter earnings this week, and several are proving the consensus estimates wrong with better funds from operations (FFO) and revenue than expected. Take a look at three REITs that recently beat the Street estimates with improving |

KREF Price Returns

| 1-mo | -4.37% |

| 3-mo | -23.59% |

| 6-mo | -2.22% |

| 1-year | 1.79% |

| 3-year | -36.73% |

| 5-year | -20.11% |

| YTD | -25.43% |

| 2023 | 9.15% |

| 2022 | -25.89% |

| 2021 | 26.25% |

| 2020 | -2.82% |

| 2019 | 16.15% |

KREF Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching KREF

Want to do more research on KKR Real Estate Finance Trust Inc's stock and its price? Try the links below:KKR Real Estate Finance Trust Inc (KREF) Stock Price | Nasdaq

KKR Real Estate Finance Trust Inc (KREF) Stock Quote, History and News - Yahoo Finance

KKR Real Estate Finance Trust Inc (KREF) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...