Provident Bancorp, Inc. (PVBC): Price and Financial Metrics

PVBC Price/Volume Stats

| Current price | $9.34 | 52-week high | $11.52 |

| Prev. close | $8.64 | 52-week low | $5.76 |

| Day low | $8.66 | Volume | 46,900 |

| Day high | $9.35 | Avg. volume | 36,045 |

| 50-day MA | $9.15 | Dividend yield | N/A |

| 200-day MA | $9.63 | Market Cap | 164.94M |

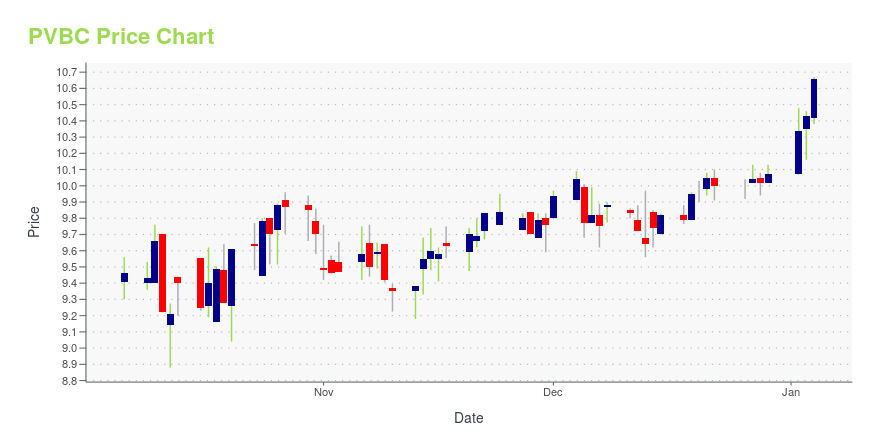

PVBC Stock Price Chart Interactive Chart >

Provident Bancorp, Inc. (PVBC) Company Bio

Provident Bancorp, Inc. operates as a holding company for The Provident Bank that provides various financial services to individuals and small businesses in Massachusetts and New Hampshire. The company was founded in 1828 and is based in Amesbury, Massachusetts. Provident Bancorp, Inc. is a subsidiary of Provident Bancorp.

Latest PVBC News From Around the Web

Below are the latest news stories about PROVIDENT BANCORP INC that investors may wish to consider to help them evaluate PVBC as an investment opportunity.

Provident Bancorp, Inc. Reports Results for the September 30, 2023 QuarterProvident Bancorp, Inc. (the "Company") (NasdaqCM: PVBC), the holding company for BankProv (the "Bank"), reported net income for the quarter ended September 30, 2023 of $2.5 million, or $0.15 per diluted share, compared to $3.5 million, or $0.21 per diluted share, for the quarter ended June 30, 2023. The Company reported a net loss of $35.3 million, or ($2.15) per diluted share, for the quarter ended September 30, 2022. Net income for the nine months ended September 30, 2023 was $8.0 million, or |

BankProv Adds Business Banking Expert To Support New ClientsBankProv (NASDAQ: PVBC), a future-ready commercial bank that offers technology-driven banking solutions to its clients, is pleased to welcome Tricia Abood to the organization as Vice President, Business Development Officer. Tricia brings a wealth of financial services knowledge and a proven track record in the industry. |

Provident Bancorp, Inc. Reports Results for the June 30, 2023 QuarterProvident Bancorp, Inc. (the "Company") (NasdaqCM: PVBC), the holding company for BankProv (the "Bank"), reported net income for the quarter ended June 30, 2023 of $3.5 million, or $0.21 per diluted share, compared to $2.1 million, or $0.13 per diluted share, for the quarter ended March 31, 2023, and $5.6 million, or $0.33 per diluted share, for the quarter ended June 30, 2022. Net income for the six months ended June 30, 2023 was $5.6 million, or $0.34 per diluted share, compared to $11.1 milli |

BankProv Hires New Vice President of Business DevelopmentBankProv (NASDAQ: PVBC), a future-ready commercial bank that offers technology-driven banking solutions to its clients, is pleased to welcome Lisa Gainty to the organization as Vice President of Business Development for Retail Banking. As an experienced industry professional with deep ties to the local business community, Lisa is already hard at work connecting new and existing customers with BankProv's suite of retail banking services. |

Provident Bancorp, Inc. Reports Results for the March 31, 2023 QuarterProvident Bancorp, Inc. (the "Company") (NasdaqCM: PVBC), the holding company for BankProv (the "Bank"), reported net income for the quarter ended March 31, 2023 of $2.1 million, or $0.13 per diluted share, compared to $2.7 million, or $0.16 per diluted share, for the quarter ended December 31, 2022 and $5.5 million, or $0.32 per diluted share, for the quarter ended March 31, 2022. |

PVBC Price Returns

| 1-mo | 8.48% |

| 3-mo | -17.42% |

| 6-mo | -5.37% |

| 1-year | 30.08% |

| 3-year | -40.51% |

| 5-year | -23.03% |

| YTD | -7.25% |

| 2023 | 38.32% |

| 2022 | -60.56% |

| 2021 | 56.45% |

| 2020 | -2.61% |

| 2019 | 14.85% |

Continue Researching PVBC

Here are a few links from around the web to help you further your research on Provident Bancorp Inc's stock as an investment opportunity:Provident Bancorp Inc (PVBC) Stock Price | Nasdaq

Provident Bancorp Inc (PVBC) Stock Quote, History and News - Yahoo Finance

Provident Bancorp Inc (PVBC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...