There’s an old saying “the house always wins” and the leading Chicago Board of Options Exchange (CBOE) is the largest house in the derivatives trading game.

As such it stands to gain — if trading activity and volatility increases. And with the real possibility of the trade war creating daily headlines for months to come, one can expect trading volume, especially the type of hedging done with options, to increase.

Earlier this month, the CBOE reported earnings that beat on top and bottom line. But, it lowered full-year guidance. The numbers were also sharply below last years Q1. But, it was a tough comparison as that period included the steep sell-off in February 2018 that drove volatility and trading volume higher.

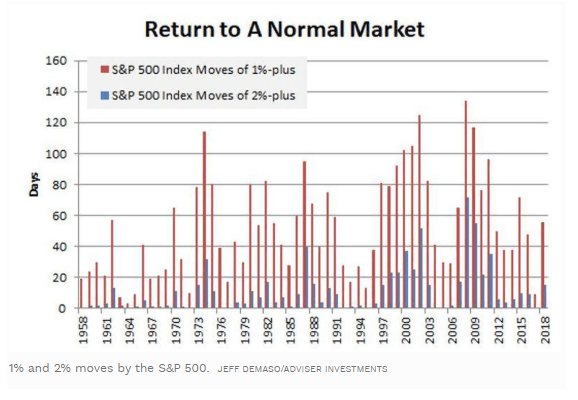

In a prior article, I discussed how the spike in volatility in the beginning of February, which caused the implosion of VIX related ETPs, probably was the harbinger to the market entering a higher volatility environment, or more accurately, representing a return to normal after years of artificially low volatility.

Indeed, as 2018 closed out, the market underwent violent swings with 2%-plus price moves occurring on an almost-daily basis. Then, during the first few months of 2019, as the market rallied volatility declined. But, that appears temporary.

The dramatic shift from most of 2017/2018 was actually a return to a more normal trading environment. From a historical perspective, it was 2017, with the fewest 1%-2% daily price moves since 1964, that was the anomaly.

The key attraction to the CBOE is a global marketplace in which most products from stocks to currencies to commodities are listed and trade on multiple exchanges, the CBOE has exclusives on two key products, S&P 500 options and VIX futures and options.

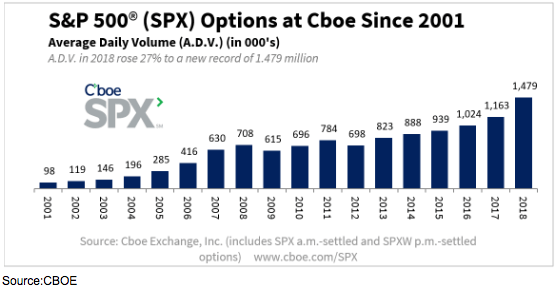

In 2018, the CBOE had record volume with daily trading volume of S&P 500 options, surging 27% to a new record of 1.479 million contracts. This continued a winning streak that saw option volume grow by over 20% annually over the decade.

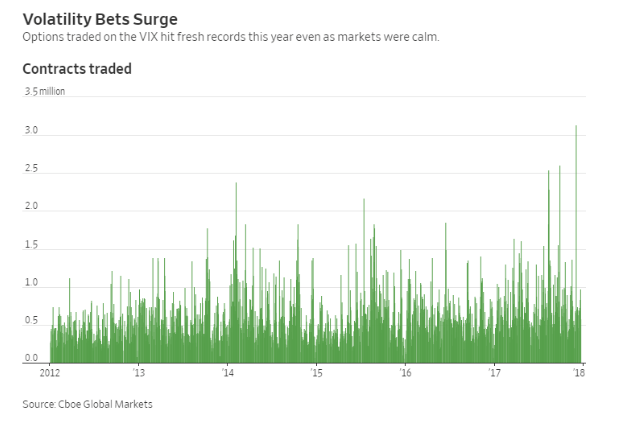

The Volatility Index (VIX) and all the related volatility products have enjoyed even more explosive growth with 80 % average annual growth over the past five years. And trading volume continues to increase even as volatility declined as selling premium became a favored income generation play. But, the desire and need to hedge comes to the forefront.

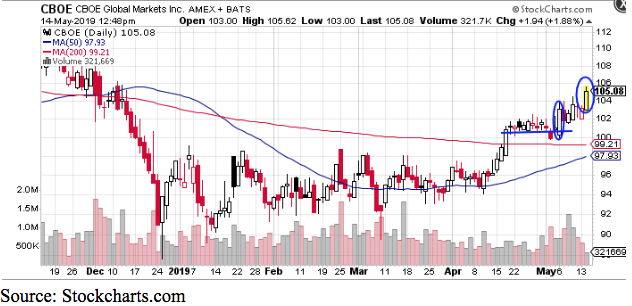

From a technical perspective, the CBOE chart looks very constructive; after holding support above $100 level following the earnings report it is now breaking out to new highs.

With continued uncertainty over interest rates, trade tariffs and technological disruption expect volatility to remain elevated. And for trading looking to profit or protect from the price swings to continue to increase. Which should, in turn, drive the CBOE’s share price higher.

About the Author: Steve Smith

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More...

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!