2019 was expected to be a stellar year for Initial Public Offerings (IPOs) as a stable full of private companies, including many well-known ‘unicorns,’ came to the public market.

But instead of being welcomed with buying that would catapult valuations into the stratosphere, investors took a hard pass sinking shares into the abyss. Some companies, most notably WeWork, failed to launch.

The first half of the year help promise as IPO’s of companies such as Beyond Meat (BYND), Zoom Technology (ZM) and CrowdStrike (CRWD) all saw their shares gain more than 100% in the first few months of trading, and while all are well off their highs they remain above the IPO price.

The same can’t be said for more recent listings such as Uber (UBER) Lyft (LYFT) and Peloton (PTON) which sank on their first day and continued on a downward path.

For example, Uber (UBER). Which was one of the most anticipated IPOs, has seen shares slide some 45% since the opening day and its market cap shrank to $45 billion, well below the projected $100 billion many believed it would achieve within the year.

All told, the Renaissance IPO ETF is up a modest 9% for the YTD, which is trailing the S&P 500 Index by 10 percentage points.

What is the main issue underlying the recent troubles? Pricing, valuation, and lack of profitability are the roots of the problem.

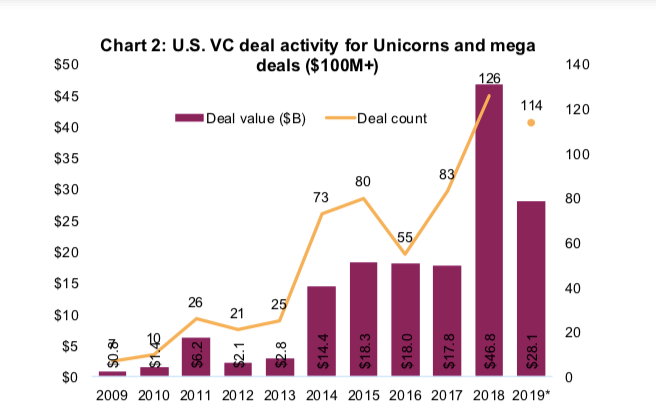

As venture capital and private equity funds became flush with cash , thanks to near-zero interest rates, startups were able to raise capital and stay private longer than companies had in the past.

Indeed, there had been a surge in not only the number of deals but also mega-rounds are those that raise over $100 billion.

In hindsight, it looks like venture capital firms were basically bidding against themselves and essentially creating a Ponzi scheme in which they were the biggest victims as the public markets refused to validate the unrealistic valuations.

The run-up of new IPOs earlier this year and subsequent underperformance is another example of how fast sentiment and investor behavior can pivot.

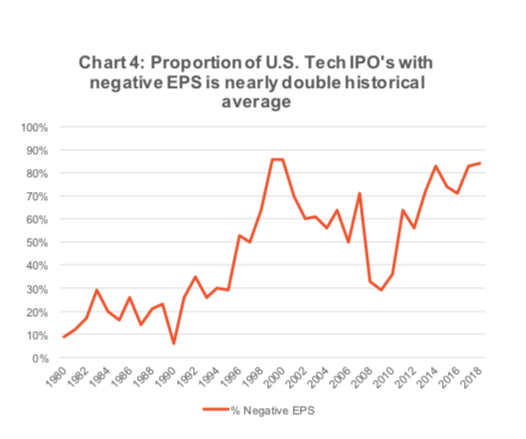

Probably the biggest shift was investors’ willingness to throw money at companies that are not profitable and have mounting losses.

The number of companies coming public with negative earnings per share (eps) was at the highest level since the 1999 dot.com days.

In addition to the cheap money, which provided the capital to pursue growth at any cost, it also seems like there became a misguided belief that technology can improve or ‘disrupt’ any industry.

The lesson is it’s important to stick to a disciplined investment approach focused on company fundamentals and future earning power and determining if those future earnings are worth more or less than what is being priced in the market.

BYND shares were trading at $81.44 per share on Wednesday afternoon, down $0.01 (-0.01%). Year-to-date, BYND has gained 23.86%, versus a 24.30% rise in the benchmark S&P 500 index during the same period.

About the Author: Option Sensei

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| BYND | Get Rating | Get Rating | Get Rating |