Elanco Animal Health Incorporated (ELAN - Get Rating) in Greenfield, Ind., is an animal health company that innovates, develops, manufactures, and markets products for pets and farm animals.

The pet care industry has achieved solid growth over the past couple of years owing to rising pet adoptions amid pandemic-driven remote lifestyles and increased spending on pet food, care, and grooming. Furthermore, the development of efficient and quick diagnostic devices, viable drugs and vaccines, and ancillary services have boosted the industry’s performance. According to a Fortune Business Insights report, the global animal health market is expected to reach $67.56 billion by 2026, growing at a 6.3% CAGR.

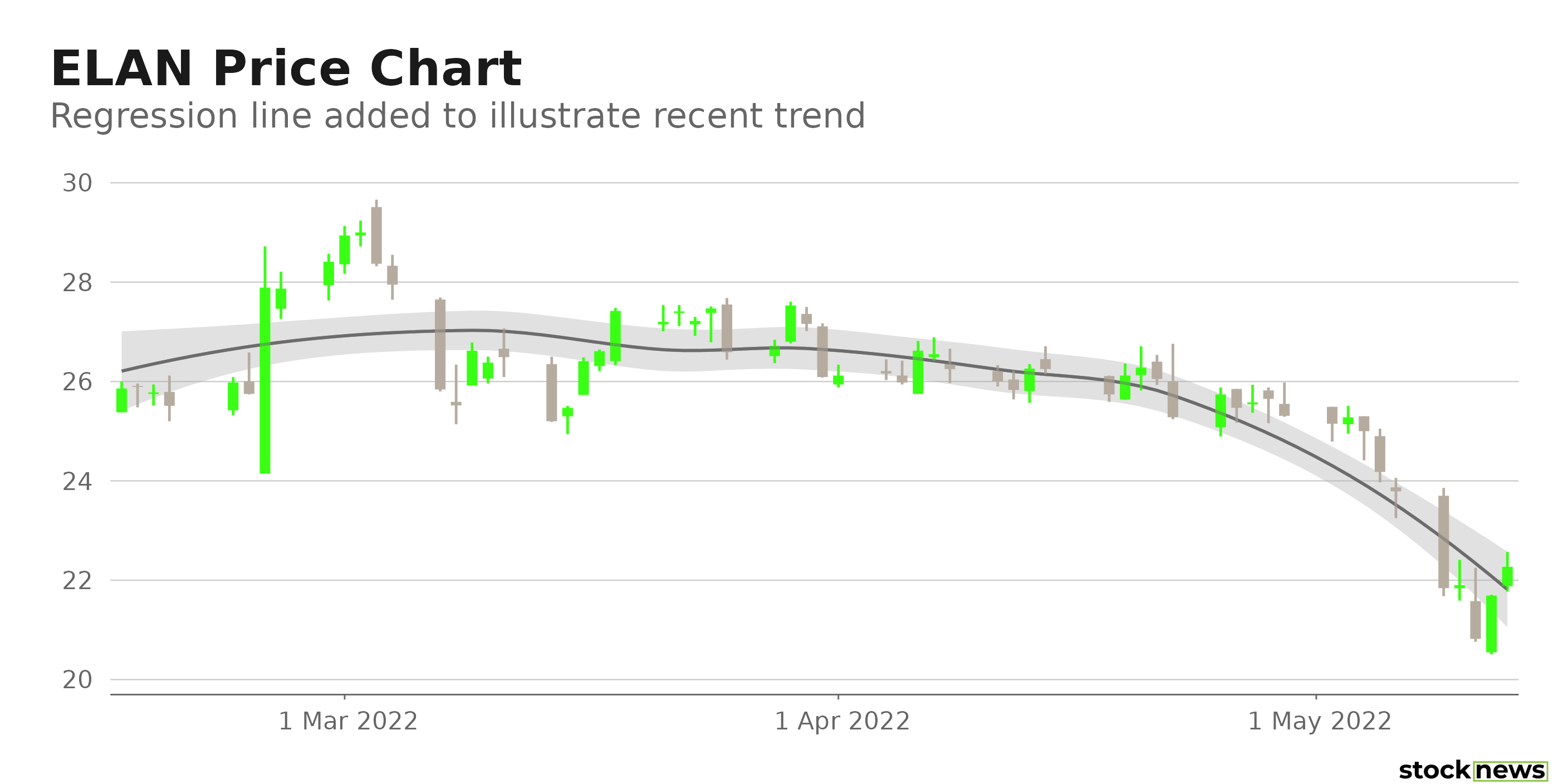

However, ELAN has not been able to capitalize on the industry’s growth. The stock has declined 21.5% in price year-to-date and 34.4% over the past year to close its last trading session at $22.27. The stock is currently trading 40.6% below its 52-week high of $37.49, which it hit on July 29, 2021.

Here is what could influence ELAN’s performance in the upcoming months:

Poor Financials

ELAN’s total revenue declined 1.3% year-over-year to $1.22 billion for the first quarter ended March 31, 2022. The company’s adjusted EBITDA decreased 1.1% year-over-year to $339 million. Also, its adjusted EPS came in at $0.36, representing a 2.7% decline year-over-year. In addition, its adjusted net income came in at $177 million, representing a 2.7% decline year-over-year.

Stretched Valuation

In terms of forward non-GAAP P/E, ELAN’s 18.95x is 0.8% higher than the 18.80x industry average. Also, its 14.25x forward EV/EBITDA is 10.1% higher than the 12.93x industry average. And the stock’s 35.29x trailing-12-month EV/EBIT is 65.2% higher than the 21.36x industry average.

Favorable Analyst Estimates

Analysts expect ELAN’s EPS and revenue for the quarter ending Sept. 30, 2022, to increase 36.8% and 6.4%, respectively, year-over-year to $0.26 and $1.15 billion. It surpassed the Street’s EPS estimates in each of the trailing four quarters. Its EPS is expected to increase 13% per annum over the next five years.

Higher-than-industry Profitability

In terms of trailing-12-month gross profit margin, ELAN’s 57.67% is 4.3% higher than the 55.24% industry average. And its 23.19% trailing-12-month EBITDA margin is 525% higher than the 3.71% industry average. Furthermore, the stock’s 9.75% trailing-12-month EBIT margin is significantly higher than the 0.58% industry average.

POWR Ratings Reflect Uncertainty

ELAN has an overall C rating, which equates to a Neutral in our POWR Ratings system. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

Our proprietary rating system also evaluates each stock based on eight distinct categories. ELAN is currently trading below its 50-day and 200-day moving averages of $25.69 and $29.18, justifying its D grade for Momentum.

ELAN is ranked #52 out of 167 stocks in the F-rated Medical – Pharmaceuticals industry. Click here to access ELAN’s Growth, Value, Stability, Sentiment, and quality ratings.

Click here to checkout our Healthcare Sector Report for 2022

Bottom Line

Rising pet adoptions during the pandemic have led to surging demand for animal health products. Although analysts expect ELAN’s topline and earnings to grow, its weak fundamentals and stretched valuation might keep the stock under pressure in the near term. Thus, it could be wise to wait for a better entry point in the stock.

How Does Elanco Animal Health Incorporated (ELAN) Stack Up Against its Peers?

While ELAN has an overall POWR Rating of C, one might want to consider investing in the following Medical – Pharmaceuticals stocks with an A (Strong Buy) and B (Buy) rating: Merck & Co., Inc. (MRK - Get Rating), Novo Nordisk A/S (NVO - Get Rating), and Johnson & Johnson (JNJ - Get Rating).

Want More Great Investing Ideas?

ELAN shares rose $0.31 (+1.39%) in premarket trading Monday. Year-to-date, ELAN has declined -21.25%, versus a -15.19% rise in the benchmark S&P 500 index during the same period.

About the Author: Dipanjan Banchur

Since he was in grade school, Dipanjan was interested in the stock market. This led to him obtaining a master’s degree in Finance and Accounting. Currently, as an investment analyst and financial journalist, Dipanjan has a strong interest in reading and analyzing emerging trends in financial markets. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| ELAN | Get Rating | Get Rating | Get Rating |

| MRK | Get Rating | Get Rating | Get Rating |

| NVO | Get Rating | Get Rating | Get Rating |

| JNJ | Get Rating | Get Rating | Get Rating |