Diversified financial services company Fifth Third Bancorp (FITB - Get Rating) in Cincinnati, Ohio, operates through the broad segments of Commercial Banking; Branch Banking; Consumer Lending; and Wealth & Asset Management. The company operates full-service banking centers and ATMs in various states.

Recently, analysts at Bank of America Corp. (BAC) published a ‘Buy’ rating for FITB’s stock. UBS Group also issued a ‘Buy’ rating on the stock. However, Robert W. Baird lowered FITB’s rating to ‘Neutral’ from ‘Outperform’, while Morgan Stanley (MS) lowered its rating to ‘Equal from ‘Overweight’ last month. More broadly, 10 equity research analysts have rated FITB with ‘Hold,’ while eight rated it ‘Buy.’

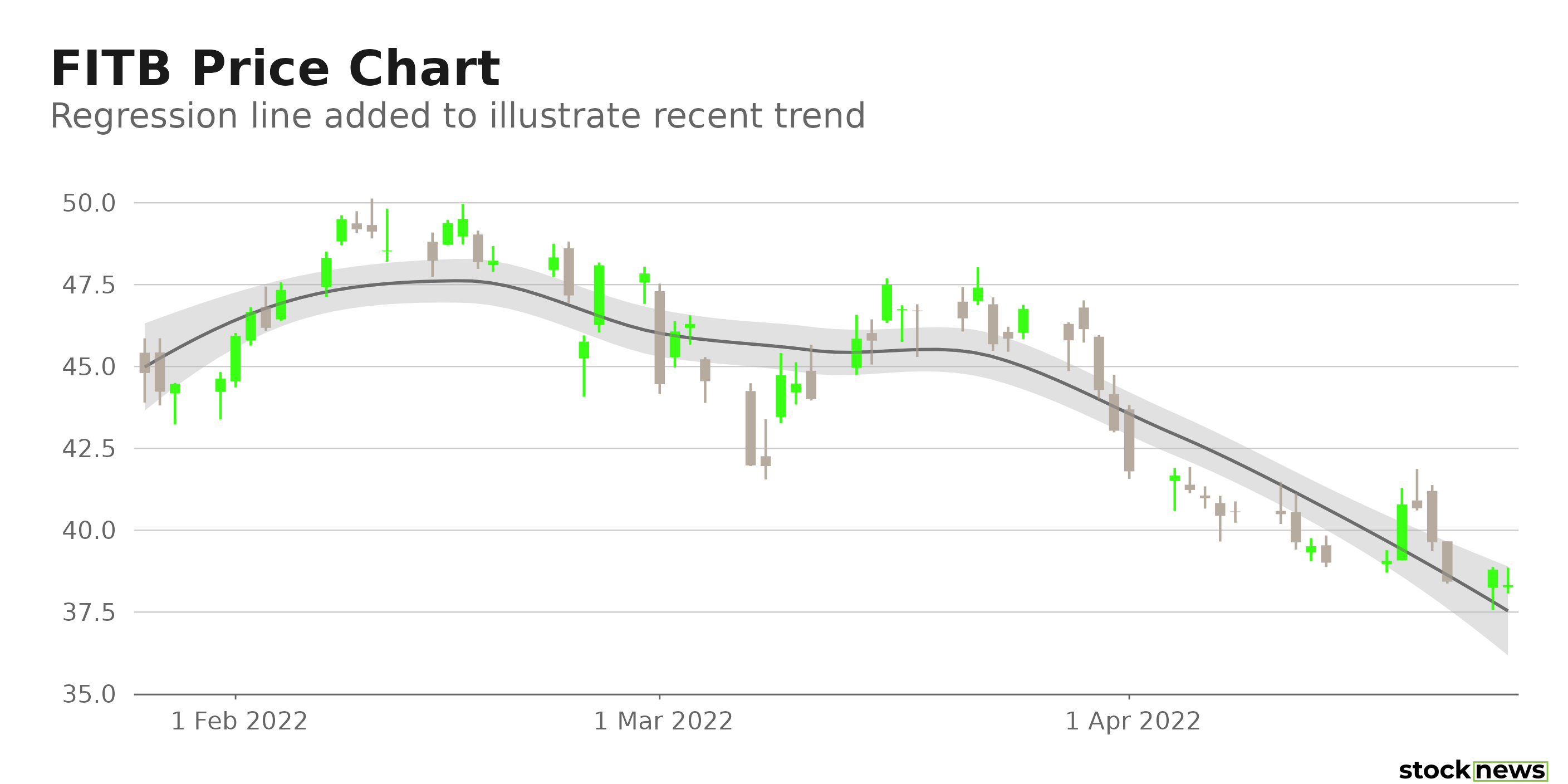

FITB’s stock has gained 1.2% in price over the past year to close yesterday’s trading session at $38.80. However, the stock has declined 10.9% year-to-date. It is currently trading 23.4% lower than its 52-week high of $50.64.

Here is what could shape FITB’s performance in the near term.

Mixed Growth Prospects

FITB’s revenue and EPS have grown at a 4.8% and 2.8% CAGR, respectively, over the past three years. The $0.89 consensus EPS estimate for the current quarter (ending June 30, 2022) indicates a 5.3% year-over-year decrease. Furthermore, analysts expect its EPS for the current year (fiscal 2022) to decline 2.9% from the prior year to $3.62. However, its EPS is expected to increase 4.1% from the prior-year quarter to $0.97 for the next quarter (ending September 2022).

The Street’s revenue estimates for the current quarter, next quarter, and current year of $2.09 billion, $2.19 billion, and $8.46 billion, respectively, reflect a year-over-year improvement of 7.3%, 10.8%, and 7.1%.

Mixed Valuations

In terms of its forward P/E, FITB is trading at 10.71x, which is 1.6% lower than the 10.88x industry average. The stock’s 0.80 forward non-GAAP PEG multiple is 24.1% lower than the 1.06 industry average.

FITB’s 3.13 forward Price/Sales multiple is 3.4% higher than the 3.03 industry average. In terms of its forward Price/Book, the stock is trading at 1.38x, which is 22.4% higher than the 1.12x industry average.

Mixed Profit Margins

FITB’s 31.99% trailing 12-month net income margin is 6.17% higher than the 30.13% industry average. On the other hand, its trailing 12-month ROE and ROA of 12.73% and 1.22%, respectively, are 0.13% and 8.40% lower than their 12.75% and 1.33%industry averages.

POWR Ratings

FITB has an overall C rating, which equates to Neutral in our proprietary POWR Ratings system. The POWR Ratings are calculated by considering 118 different factors, with each factor weighted to an optimal degree.

FITB has a Value, Sentiment, and Quality grade of C. This is justified by its mixed valuations, analyst sentiments, and profit margins.

In the 41-stock Midwest Regional Banks industry, FITB is ranked #28. The industry is rated C.

Click here to see the additional POWR Ratings for FITB (Growth, Momentum, and Stability).

View all the top-rated stocks in the Midwest Regional Banks industry here.

Bottom Line

FITB’s net interest income increased 1.6% year-over-year in its last reported quarter. However, its EPS has declined 26.9% from the prior-year quarter, and analysts expect its EPS to decline further in the current quarter. Furthermore, six of 11 Wall Street analysts have given the stock a Hold rating. Hence, I think it would be wise to wait for a better entry point in the stock.

How Does Fifth Third Bancorp (FITB) Stack Up Against its Peers?

While FITB has an overall POWR Rating of C, one might consider looking at its industry peers, Midland States Bancorp, Inc. (MSBI - Get Rating) and First Business Financial Services, Inc. (FBIZ - Get Rating), which have an overall B (Buy) rating.

Want More Great Investing Ideas?

FITB shares were trading at $38.30 per share on Tuesday morning, down $0.50 (-1.29%). Year-to-date, FITB has declined -11.48%, versus a -11.26% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| FITB | Get Rating | Get Rating | Get Rating |

| MSBI | Get Rating | Get Rating | Get Rating |

| FBIZ | Get Rating | Get Rating | Get Rating |