JD.com, Inc. (JD - Get Rating) is the second-largest online retailer in the People’s Republic of China, operating as an e-commerce company and retail infrastructure service provider. It offers electronics & home appliances and general merchandise products. The company sells its products directly to customers through its website and mobile applications. It operates primarily through the following segments – JD Retail, JD Health, and JD Logistics.

JD is one of the best performing stocks in 2020, with record revenue and income growth. In the second quarter that ended June 2020, revenue increased 33.8% year-over-year to $28.5 billion, primarily due to the 45.4% rise in the demand for general merchandise products. Non-GAAP EPS for the quarter came in at $0.5, growing 52.6% year-over-year.

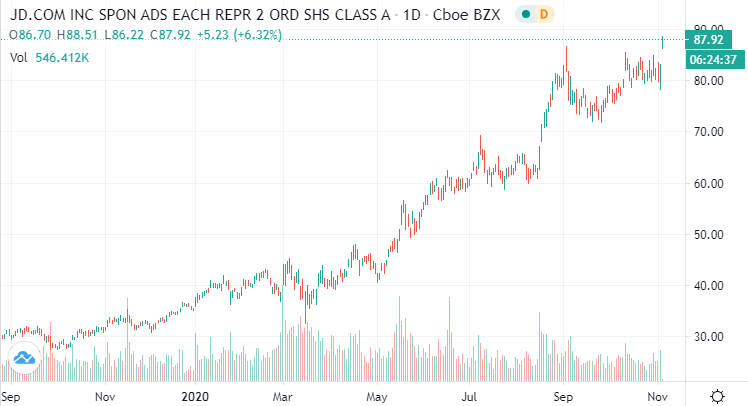

With the robust growth in the online-retail revolution, the stock has gained 134.7% year-to-date. This impressive performance and the potential upside based on a number of factors has helped it earn a “Strong Buy” rating in our proprietary ratings system.

Here is how our proprietary POWR Ratings system evaluates JD:

Trade Grade: A

JD is currently trading higher than its 50-day and 200-day moving averages of $78.78 and $57.71, respectively, indicating that the stock is in an uptrend. In fact, the stock’s 26.2% return over the past three months reflects this short-term bullishness.

JD has been witnessing an exponential increase in its customer base amid the pandemic with people preferring to order online. Annual active customer accounts increased nearly 30% to 417.4 million in the twelve months that ended June 2020 from 321.3 million in the comparable period last year. Mobile daily active users increased by 40% year-over-year in the same period.

Chart Provided by Trading View

Buy & Hold Grade: A

In terms of proximity to its 52-week high, which is a key factor that our Buy & Hold Grade takes into account, JD is well positioned. The stock is currently trading just 4.5% below its 52-week high of $86.58.

Looking at the past three years, the stock has grown more than 115%. JD’s top-line has increased at a CAGR of 28% in the same period by growing its e-commerce business, as well as incubating newer ventures like JD Digits. It has efficiently expanded its network into other Asian countries and also partnered with Walmart (WMT) in 2017 to further integrate its platforms, supply chains, and customer resources in China.

JD acquired a controlling stake in China’s supply chain management company Kuayue-Express Group Company in August 2020 to further bolster its logistics and make its supply chain more efficient. Moreover, JD plans to bring public its business units JD Digits, JD Logistics, and JD Health via initial public offerings in the near future.

Peer Grade: A

JD is currently ranked #13 out of 115 stocks in the China group. Other popular stocks in this group are Alibaba Group Holding Ltd (BABA - Get Rating), NIO Inc. (NIO - Get Rating), and Autohome Inc. (ATHM - Get Rating). While NIO beat JD by gaining 783.1% year-to-date, BABA and ATHM returned 34.6% and 25.4%, respectively, over this period.

Industry Rank: A

The China group is ranked #13 out of 23 StockNews.com industries. The companies in this group are headquartered in China. Despite the persistent trade war between the United States and China, the companies in the group are on an incredible run — growing fast as key industries in China have recovered significantly with the country’s excellent control over the deadly virus. Moreover, so far this year, China is the only economy in the world that has witnessed economic growth.

Overall POWR Rating: A (Strong Buy)

Overall, JD is rated a “Strong Buy” due to its impressive past performance, strength of its integrated business model, continued business growth, and short-and-long-term bullishness, as determined by the four components of our overall POWR Ratings.

Bottom Line

2020 has been a challenging year for US-listed Chinese stocks amid the pandemic, ongoing trade war, and the administrative threat of being delisted from the US exchanges. However, since the COVID-19 outbreak, JD has steadfastly leveraged its distinctive supply chain, technology capabilities, scale advantages and cost efficiency. Despite soaring so far this year, JD has potential to grow even further based on its favorable earnings and the overall growth of the global e-commerce industry.

Analyst sentiment, which gives a good sense of a stock’s future price movement, is pretty impressive for JD. The average broker rating of 1.17 indicates a favorable analyst sentiment. Of the 48 analysts that cover the stock, 39 have given it a “Strong Buy” rating. The consensus EPS estimate for 2021 indicates a 45.5% increase year-over-year. This outlook should keep JD’s price momentum alive in 2021.

Want More Great Investing Ideas?

Why is the Stock Market Tanking Now?

7 Best ETFs for the NEXT Bull Market

5 WINNING Stocks Chart Patterns

JD shares were trading at $87.50 per share on Wednesday morning, up $4.81 (+5.82%). Year-to-date, JD has gained 148.37%, versus a 7.19% rise in the benchmark S&P 500 index during the same period.

About the Author: Sidharath Gupta

Sidharath’s passion for the markets and his love of words guided him to becoming a financial journalist. He began his career as an Equity Analyst, researching stocks and preparing in-depth research reports. Sidharath is currently pursuing the CFA program to deepen his knowledge of financial anlaysis and investment strategies. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| JD | Get Rating | Get Rating | Get Rating |

| BABA | Get Rating | Get Rating | Get Rating |

| NIO | Get Rating | Get Rating | Get Rating |

| ATHM | Get Rating | Get Rating | Get Rating |