Juniper Networks, Inc. (JNPR - Get Rating) anticipates weak third-quarter revenue as the company is facing some near-term order weakness sparked by lower spending by cloud computing clients within a volatile economic landscape.

Regardless, the company had surpassed the consensus revenue estimate in the last reported quarter, supported by higher demand and increased product backlog. Impressively, JNPR also exceeded the Street EPS estimate by 6.9%.

“While we expect revenue to be challenged over the next few quarters, we remain committed to delivering greater than 100 basis points of non-GAAP operating margin expansion in 2023,” said Juniper’s CFO, Ken Miller.

As a provider of network management software for leading firms such as AT&T Inc. (T) and BlackBerry Limited (BB), JNPR is well-positioned for robust long-term growth. Consequently, JNPR could be a prominent addition to your portfolio to capitalize on the industry’s prospects.

Currently seeming to trade at a discount, JNPR presents a viable entry point for prospective investors. In terms of forward Price/Sales, JNPR is currently trading at 1.60x, 38.8% lower than the industry average of 2.62x. Likewise, the stock’s forward Price/Book multiple of 2.03 is 48.3% lower than the industry average of 3.92.

Let’s delve further into JNPR’s key financial metrics trends to comprehend why buying this stock could be worthwhile.

Assessing Juniper Networks’ Financial Performance: Fluctuations and Growth Across Key Metrics (2020 – 2023)

The trailing-12-month net income trend for JNPR over the specified period shows notable fluctuations, with some distinct upward and downward shifts. Overall, however, there appears to be a positive growth trend.

- From September 2020 through December 2020, JNPR’s net income fell from $395.4 million to $257.8 million, indicating a downward trend.

- During the first months of 2021 (from January to June), the net income declined, reaching a low of $206.3 million in March 2021. But, it increased slightly to $207.1 million by June 2021.

- A sharp decrease was observed in September 2021, reaching $150.6 million.

- By the end of 2021, the net income rebounded significantly to $252.7 million.

- In 2022, JNPR’s net income displayed substantial growth, peaking at $423.5 million in September, a significant increase compared to the same period of the previous year.

- The net income continually soared in the final quarter of 2022, peaking at $471 million in December.

- The highest net income reported was in March 2023, recording a value of $500.7 million, demonstrating a solid start to the year.

- However, there was a slight decline in June 2023, with the net income decreasing to $411.7 million.

Comparing the first value ($395.4 million) with the last value ($411.7 million), JNPR’s net income demonstrates an overall growth rate of just over 4% over this approximately three-year timeframe. This indicates that despite the considerable fluctuations during specific periods, JNPR experienced a general upward trend in net income through the course of this series.

The given series illustrates the fluctuating trailing-12-month revenue trend of JNPR. The data spans from September 2020 to June 2023. An analysis of this series shows an overall upward trend in revenue over this period with notable fluctuations.

- Starting in September 2020, JNPR posted a revenue of $4.43 billion.

- By the close of 2020, December 31, there was a minimal but steady increment raising the revenue to $4.45 billion.

- The upward trend continued through 2021, with the revenue reaching $4.74 billion by December 31.

- In 2022, there was a more remarkable growth, with revenue peaking at $5.3 billion by December 31. Notably, the growth between the third and fourth quarters of 2022 was the largest observed during this period, with a spike from $4.93 billion in September to $5.3 billion in December.

- The first half of 2023 showed an encouraging continuation of this growth trend, with revenue reaching a series high of $5.67 billion by the end of June.

Based on the first value of $4.43 billion in September 2020 and the last value of $5.67 billion in June 2023, the calculated growth rate is approximately 28%. Overall, the data points to a positive trajectory in terms of revenue for JNPR. Despite occasional fluctuations, the recent years have shown consistent growth, and the future projects even higher revenue values.

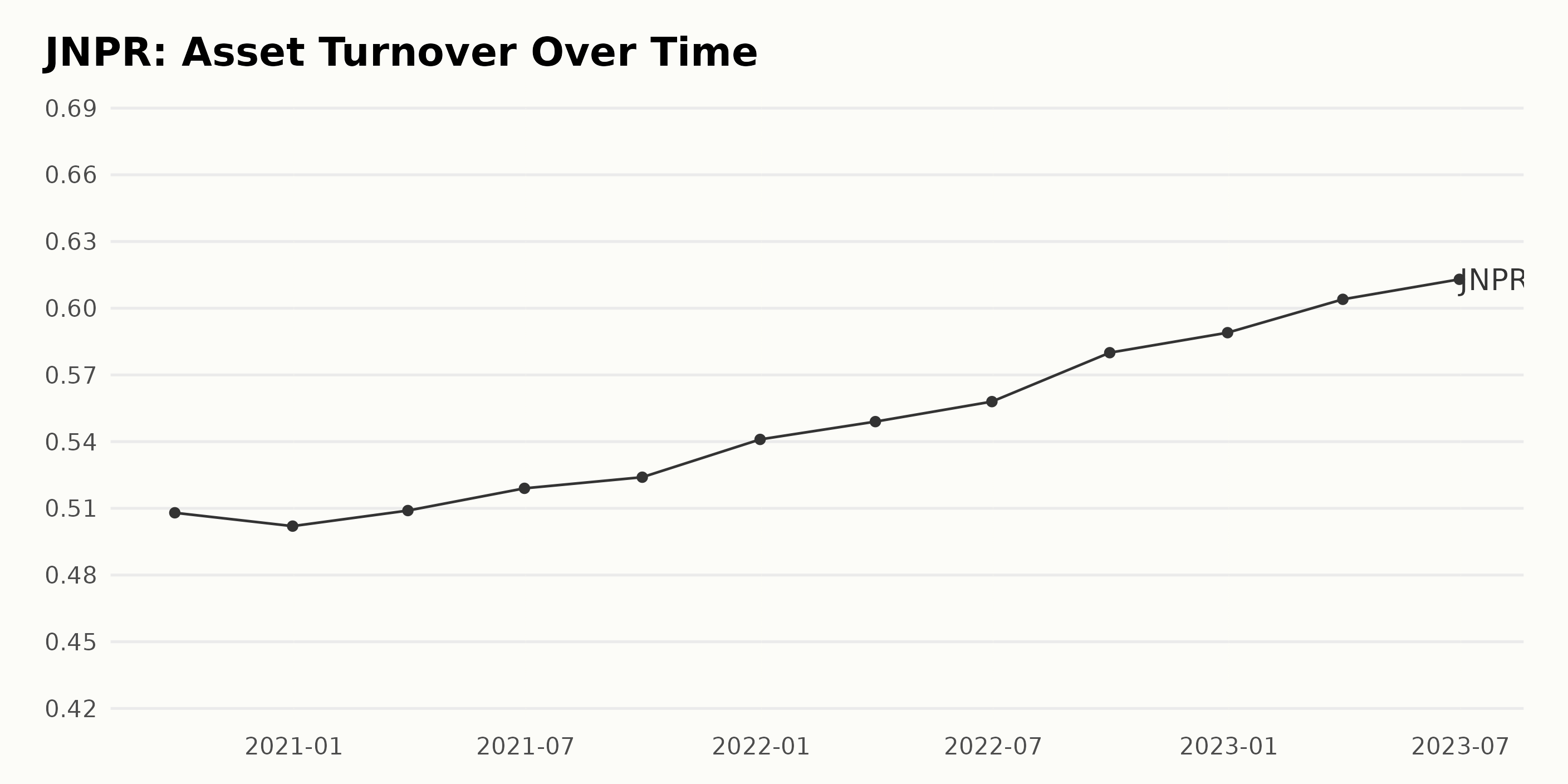

The trend in Asset Turnover at JNPR can be summarised as follows:

- From September 2020 to September 2023, there was a generally increasing trend in the Asset Turnover rate of JNPR. There are slight fluctuations alongside, but the overall pattern is towards growth.

- In detail, starting at 0.51 in September 2020, the Asset Turnover marginally decreased to 0.50 by December 2020.

- This was followed by a steady increase over the next quarters, reaching 0.61 by June 2023, representing a substantial improvement. The highest jump occurred between September 2022 and March 2023, rising from 0.58 to 0.60.

- The most recent figure from June 2023 reveals that the Asset Turnover is slightly higher at 0.61, indicating consistent positive progress.

The calculated growth rate over this period amounts to approximately 20.2%, implying a notable enhancement of this financial performance indicator.

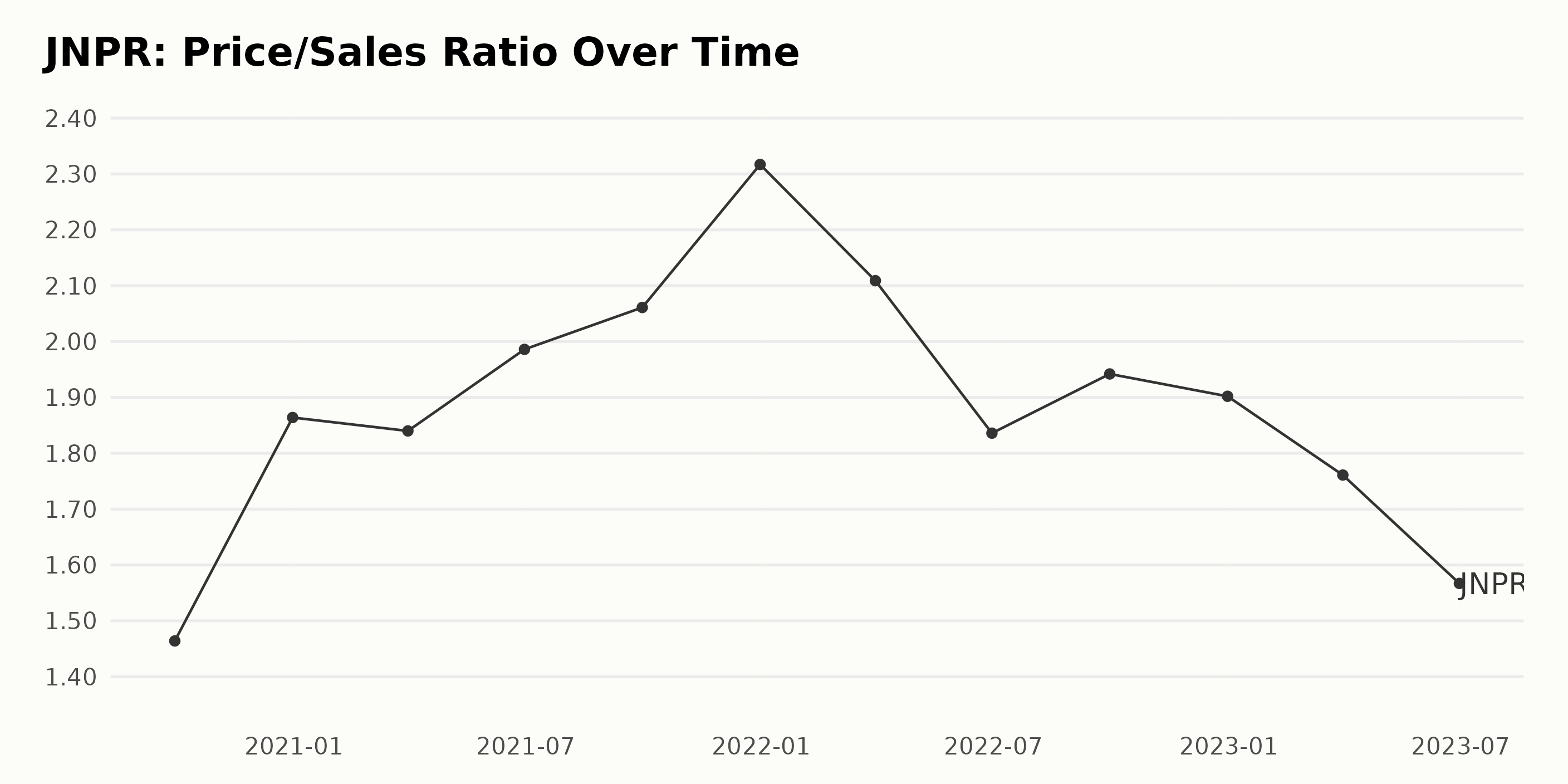

The Price/Sales Ratio (P/S) of JNPR has shown both ups and downs over the series of data provided, referencing from September 2020 to June 2023.

- In September 2020, the P/S stood at 1.46, which significantly increased by the end of the year, reported as 1.86 on December 31, 2020.

- The trend continued upwards into the first half of 2021, peaking at 2.06 in September, a notable increase from the P/S value of 1.46 nearly a year ago.

- However, the ratio slightly dipped to 2.31 by the close of 2021.

- Starting in 2022, the P/S fluctuated substantially with a discernible downward trajectory, decreasing from 2.10 in March, dropping to 1.84 in June, increasing again to 1.94 in September, but then dropping again to 1.90 by the end of December.

- The downward trend persisted into 2023, with the P/S rate further dropping to 1.76 in March and 1.57 by June.

This represents a fall of 0.39 or a decrease of approximately 27% from the starting value in September 2020 to the most recent value in June 2023. In summary, although JNPR’s Price/Sales initially experienced an increase in the early periods under review, recent years show a mostly downward trend.

Analyzing Juniper Networks Inc.’s Stock Performance: A Six-Month Roller Coaster Ride in 2023

The share price data of JNPR from March 2023 to August 2023 displays an initial upward trend, followed by a general downward trend. Key Observations:

- In March 2023, the price increased consistently from $30.72 on March 3 to $33.44 on March 31.

- In April 2023, there was some volatility, with a peak at $34.09 (April 6) and then a fall to $30.33 by April 28.

- Over May 2023, there is a mild increase again, from $29.19 on May 5 to $30.63 on June 2.

- In June 2023, the price experienced a short-lived spike to $31.67 on June 16 but often traded below the $31 mark, closing at $30.65 on June 30.

- The trend decreased in July 2023, starting from $31.19 on July 7 to $29.26 on July 28.

- The downward trajectory continues into August 2023 with a fall to $27.69 on August 18 from $28.14 on August 4, before a slight recovery to $28.12 on August 24.

The growth rate increases through March, goes volatile in April, mildly improves in May, and significantly decreases through June, July, and August. Here is a chart of JNPR’s price over the past 180 days.

Analyzing Juniper Networks’ POWR Ratings: Growth and Quality

JNPR has an overall B rating, translating to a Buy in our POWR Ratings system. It is ranked #9 out of the 50 stocks in the Technology – Communication/Networking category.

Based on POWR ratings, the two most noteworthy dimensions for JNPR appear to be Growth and Quality.

- Growth: This dimension consistently holds one of the highest ratings, starting at 89 in February 2023. However, there’s a clear downtrend as it drops nine points to land at 80 from May through July 2023, eventually sliding further down to 77 by August.

- Quality: Remaining fairly steady, JNPR’s Quality score fluctuates slightly between 87 and 88 from February through August 2023. Despite minor changes, it consistently maintains high marks, demonstrating the strength of JNPR in this regard.

These figures project an image of high growth potential and dependable quality from JNPR.

How does Juniper Networks Inc. (JNPR) Stack Up Against its Peers?

Other stocks in the Technology – Communication/Networking sector that may be worth considering are PC-Tel Inc. (PCTI - Get Rating), Cisco Systems Inc. (CSCO - Get Rating), and Eutelsat Communications S.A. (ETCMY - Get Rating) — they have better POWR Ratings.

What To Do Next?

Get your hands on this special report with 3 low priced companies with tremendous upside potential even in today’s volatile markets:

3 Stocks to DOUBLE This Year >

Want More Great Investing Ideas?

JNPR shares were trading at $28.03 per share on Friday morning, up $0.14 (+0.50%). Year-to-date, JNPR has declined -11.03%, versus a 15.18% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| JNPR | Get Rating | Get Rating | Get Rating |

| PCTI | Get Rating | Get Rating | Get Rating |

| CSCO | Get Rating | Get Rating | Get Rating |

| ETCMY | Get Rating | Get Rating | Get Rating |