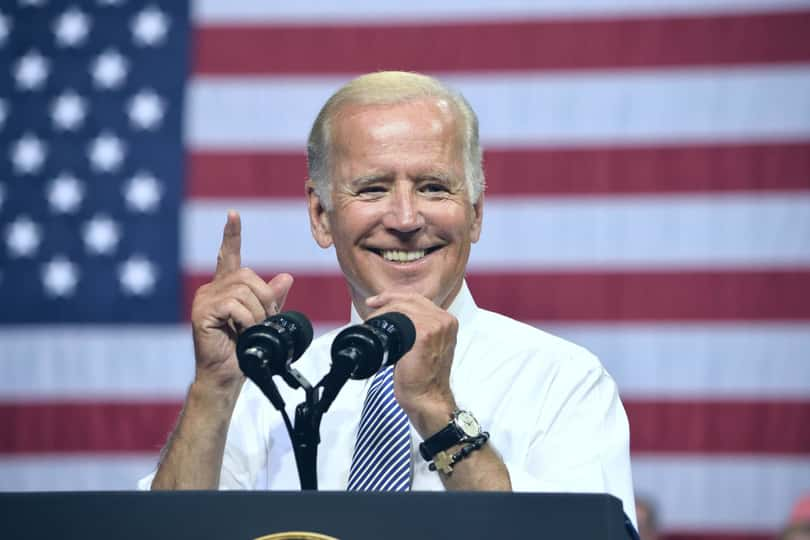

Currently, former Vice-president Joe Biden is leading President Donald Trump in the polls. The latest national poll conducted by Monmouth University finds Biden at 51% compared to Trump at 41%. Of course, there’s still a lot of time before the election, and there remain several uncertainties including the coronavirus, the state of the economy, and whether the polling will be inaccurate like 2016.

However, if the polls are correct and Biden wins, clean energy and infrastructure will be two of the sectors that see the biggest gains Biden has outlined a $2 trillion to invest in green energy and $1.3 trillion in infrastructure projects with the goals of reducing emissions and modernizing infrastructure.

Under a Biden administration, investors should focus on these industries to outperform. The Global X US Infrastructure ETF (PAVE - Get Rating), Invesco Solar ETF (TAN - Get Rating), iShares Global Clean Energy ETF (ICLN - Get Rating) are three ETFs that give exposure to these sectors.

Global X US Infrastructure ETF (PAVE - Get Rating)

PAVE is a passively-managed ETF investing in companies operating in the infrastructure-based companies. It closely follows the U.S. Infrastructure Development Index, as 80% of PAVE’s portfolio holdings correlate to the benchmark index. It has $227.76 million worth assets under management (AUM) invested in major holding companies such as Fastenal Co. (FAST), United Rentals, Inc. (URI), and Rockwell Automation, Inc. (ROK).

Biden has been an advocate of rebuilding the United States’ infrastructure from the beginning and has adopted it as a significant stance in his presidential bid. He aims to invest heavily to develop a ‘clean’ infrastructure base comprising sustainable and eco-friendly roads, bridges, electricity grids, water systems, and public healthcare.

PAVE’s expense ratio of 0.47% is slightly higher than its category average of 0.43%. It has returned 36.7% to its investors in the past three months, with 15.9% price returns in the past month itself. It pays an annual dividend of $0.09 per share, which yields 0.54%.

PAVE gained more than 75% since hitting its 52-week low of $9.77 on March 23rd.

How does PAVE stack up for POWR Ratings?

A for Trade Grade

A for Buy & Hold Grade

A for Overall POWR Rating.

You can’t ask for better. It is also ranked #15 out of 33 ETFs in the Industrial Equities ETFs.

Invesco Solar ETF (TAN - Get Rating)

TAN focuses on investing in stocks exclusively operating in the solar power industry. Apart from solar power companies, TAN also invests in American Depository Receipts (ADRs) and Global Depository Receipts (GDRs). It is a passively managed ETF with $1.06 million AUM and tracks the MAC Global Solar Energy Index. Its significant holdings are Solaredge Technologies, Inc. (SEDG), Sunrun, Inc. (RUN), and First Solar, Inc. (FSLR).

TAN has an expense ratio of 0.71% compared to a category average of 0.63%. Its price returns in the last three months are 60.8%, with a 21.1% return in the past month alone. Its price returns year-to-date is 61.3%. TAN pays $0.09 annually as dividends to its investors, which yields 0.18%.

TAN hit its 52-week low of $21.14 on March 19th and gained more than 145% in four months to hit its 52-week high of $52.06 on August 7th.

It’s no surprise that TAN is rated a “Strong Buy” in our POWR Ratings system. It also has an “A” in Trade Grade, Buy & Hold Grade, and Peer Grade. It is also ranked #1 out of 35 ETFs in the Energy Equities ETFs.

iShares Global Clean Energy ETF (ICLN - Get Rating)

As the name suggests, ICLN invests in companies involved in generating clean, renewable sources of power through wind energy, solar energy, hydroelectricity, and geothermal power. With $1.07 million assets under management, ICLN closely tracks the performance of S&P Global Clean Energy Index. Its significant holdings include Sunrun, Inc. (RUN), Solaredge Technologies, Inc. (SEDG), and Plug Power, Inc. (PLUG).

ICLN’s expense ratio is 0.46%, which is considerably lower than its category average of 0.63%. It has returned over 17% to investors in the last month, and over 45% in the past three months. ICLN’s year-to-date price gain is more than 34%. It pays an annual dividend of $0.14, which yields 0.85%.

The ETF has gained more than 95% to hit its 52-week high of $16.14 in August since hitting its 52-week low of $8.08 on March 19th.

ICLN is rated “Strong Buy” in POWR Ratings system, as the underlying companies have huge growth potential if Biden becomes the next President. It has an “A” in Trade Grade, Buy & Hold Grade, and Peer Grade. It is ranked #2 out of 25 in the Energy Equities ETFs.

Want More Great Investing Ideas?

9 “BUY THE DIP” Growth Stocks for 2020

How to Trade THIS Stock Bubble?

7 “Safe-Haven” Dividend Stocks for Turbulent Times

PAVE shares were unchanged in after-hours trading Wednesday. Year-to-date, PAVE has declined -1.99%, versus a 5.92% rise in the benchmark S&P 500 index during the same period.

About the Author: Aditi Ganguly

Aditi is an experienced content developer and financial writer who is passionate about helping investors understand the do’s and don'ts of investing. She has a keen interest in the stock market and has a fundamental approach when analyzing equities. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| PAVE | Get Rating | Get Rating | Get Rating |

| TAN | Get Rating | Get Rating | Get Rating |

| ICLN | Get Rating | Get Rating | Get Rating |