PayPal Holdings, Inc. (PYPL - Get Rating) is a San Jose, Calif.-based digital payments company that enables digital payments on behalf of consumers and merchants. Its combined payment solutions comprise its Payments Platform, including PayPal, PayPal Credit, Braintree, Venmo, Xoom, iZettle, and Hyperwallet products and services.

In its last reported quarter, PYPL’s revenue increased 7% year-over-year. However, its net income and free cash flow declined from their year-ago levels. The stock has been under pressure due to multi-decade high inflation, which has impacted consumer spending on discretionary items. Furthermore, the company faces intense competition from Apple Inc.’s (AAPL) Pay and Block, Inc.’s (SQ) Cash app. The company has reduced its adjusted EPS forecast from $4.60 – $4.75 to $3.81 – $3.93. Also, it expects its revenue for fiscal 2022 to rise between 11% – 13%, down from its earlier 15% – 17% outlook.

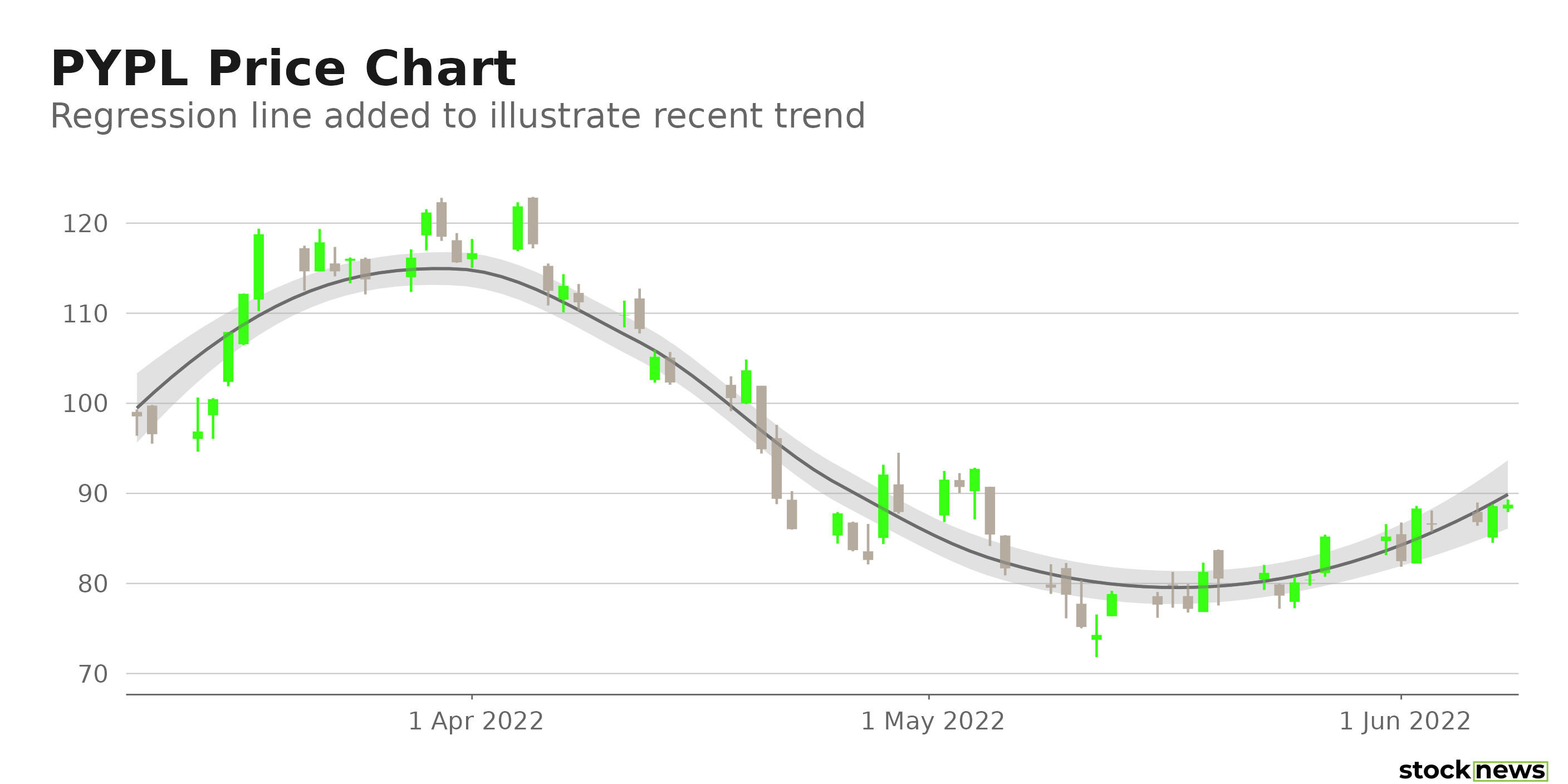

PYPL’s stock has declined 53% in price year-to-date and 66% over the past year to close the last trading session at $88.59. It is currently trading 71.4% below its 52-week high of $310.16, which it hit on July 26, 2021.

Here is what could influence the performance of PYPL’s in the coming months:

Mixed Financials

PYPL’s total payment volume (TPV) increased 13% year-over-year to $322.98 billion for the first quarter, ended March 31, 2022. The company’s net revenues increased 7% year-over-year to $6.48 billion. Also, its non-GAAP net income declined 29% year-over-year to $1.03 billion. Its adjusted EPS came in at $0.88, representing a decline of 28% year-over-year to $0.88. In addition, its net cash provided by operating activities declined 29% year-over-year to $1.24 billion.

Unfavorable Analyst Estimates

Analysts expect PYPL’s EPS for the quarter ending June 30, 2022, to decrease 24.3% year-over-year to $0.87.

Stretched Valuation

In terms of forward non-GAAP P/E, PYPL’s 22.70x is 21.6% higher than the 18.66x industry average. And its 1.86x forward non-GAAP PEG is 28.3% higher than the 1.45x industry average. Also, the stock’s 4.41x forward P/B is 8.6% higher than the 4.06x industry average.

Mixed Profitability

In terms of trailing-12-month gross profit margin, PYPL’s 45.38% is 9.9% lower than the 50.38% industry average. And its 0.35% trailing-12-month asset turnover ratio is 45.5% higher than the 0.64% industry average. Furthermore, the stock’s trailing-12-month ROCE and ROA came in at 17.89% and 4.72%, respectively, compared to the 7.95% and 3.46% industry averages.

POWR Ratings Reflect Bleak Prospects

PYPL has an overall D rating, which equates to Sell in our POWR Ratings system. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

Our proprietary rating system also evaluates each stock based on eight distinct categories. PYPL has a D grade for Sentiment, which is in sync with its expected decline in EPS for fiscal 2022.

PYPL is ranked #41 out of 49 stocks in the D-rated Consumer Financial Services industry. Click here to access PYPL’s ratings for Growth, Value, Momentum, Stability, and Quality.

Bottom Line

Multi-decade high inflation and rising competition are expected to keep PYPL under pressure. The company has slashed its revenue and earnings guidance. Furthermore, it is currently trading at a stretched valuation. Thus, we think it could be wise to avoid the stock now.

How Does PayPal Holdings, Inc. (PYPL) Stack Up Against Its Peers?

PYPL has an overall POWR Rating of D, equating to a Sell rating. Therefore, one might want to consider investing in other Consumer Financial Services stocks with a B (Buy) rating, such as EZCORP, Inc. (EZPW - Get Rating), Regional Management Corp. (RM - Get Rating), and OneMain Holdings, Inc. (OMF - Get Rating).

Want More Great Investing Ideas?

PYPL shares were trading at $88.64 per share on Wednesday morning, up $0.05 (+0.06%). Year-to-date, PYPL has declined -53.00%, versus a -12.32% rise in the benchmark S&P 500 index during the same period.

About the Author: Dipanjan Banchur

Since he was in grade school, Dipanjan was interested in the stock market. This led to him obtaining a master’s degree in Finance and Accounting. Currently, as an investment analyst and financial journalist, Dipanjan has a strong interest in reading and analyzing emerging trends in financial markets. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| PYPL | Get Rating | Get Rating | Get Rating |

| EZPW | Get Rating | Get Rating | Get Rating |

| RM | Get Rating | Get Rating | Get Rating |

| OMF | Get Rating | Get Rating | Get Rating |