- Identifying value in technology stocks is no easy task

- An earnings record could be the best tool to make sure that a pullback does not turn into price carnage

- Spotify (SPOT) has not made money

- Shopify (SHOP) has a better record

- Caution in technology as we head into Q2

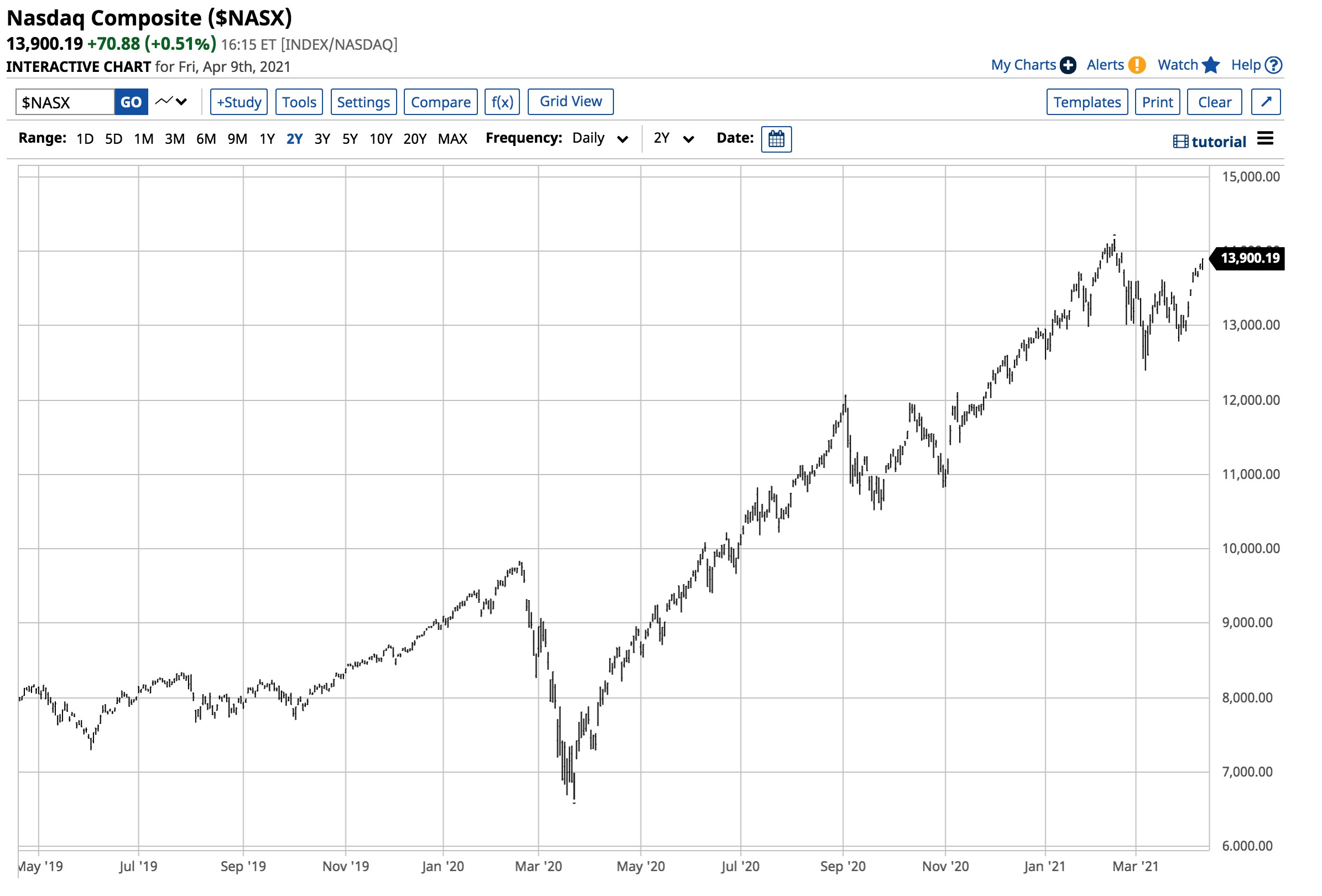

The S&P 500 has moved to a new all-time high above the 4,125 level. The Dow Jones Industrial Average is over 33,800. After making a record high at 14,167.15 on February 16, the NASDAQ has yet to make a new high. In 2020, the tech-heavy index posted a 43.64% gain. In Q1, it was 2.78% higher, but it lagged the S&P 500 and DJIA.

Source: Barchart

Source: Barchart

The chart shows the NASDAQ has not yet followed the other indices to new record territory. After last year’s dramatic rise, it is challenging to identify value in the technology sector.

As we head into Q2 2021, Shopify’s (SHOP - Get Rating) prospects look better than Spotify’s (SPOT - Get Rating). Even though the two stocks are not on the NASDAQ, they are technology companies.

Identifying value in technology stocks is no easy task

After incredible gains in the tech sector in 2020 and even higher share prices at the end of Q1, companies’ valuations are at sky-high levels. The global pandemic highlighted the importance of technology and drove a tidal wave of capital into the sector. Valuations have risen to incredible levels.

Apple’s (AAPL) market cap was over $2.23 trillion. Microsoft’s (MSFT) was north of $1.93 trillion. Amazon’s (AMZN) shares pushed the company’s value to over $1.698 trillion. Alphabet’s (GOOGL) was higher than $1.53 trillion, and Facebook’s (FB) value was approaching $890 billion at the end of last week.

SPOT was worth $53.3 billion; Shopify SHOP was over the $150 billion level.

Value is in the eyes of the beholder, but profits go a long way in justifying the stock prices and potential for future earnings. The pandemic lifted these company’s value, but it could be a mirage if money’s overall purchasing power is falling.

An earnings record could be the best tool to make sure that a pullback does not turn into price carnage

The parabolic rise in share prices is only sustainable if the technology companies can continue to show earnings growth. Over the coming quarters, a disappointing report on either the revenue or earnings side could knock a substantial portion of market caps off technology companies in a heartbeat.

Each quarter, the market will hold its breath as earnings come out. The higher share prices rise, the more the chance of a dramatic correction in the sector. It is not a question of if a sudden downdraft in technology stocks will occur; it is when. The bottom line is that earnings growth will cushion any selloff during a correction in the sector.

In March 2020, we learned that no company is exempt from a massive market cap haircut when the market turns south. We must be highly selective when choosing technology stocks in the current environment. Earnings could separate the winners from losers after a period when any tech stock with a ticker experienced parabolic gains.

Spotify (SPOT) has not made money

SPOT is a Swedish music streaming company that delivers commercial-free music and ad-supported services to subscribers. At the $283 level at the end of last week, SPOT’s market cap was just below the $50 billion level. Over 1.6 million shares change hands on average each day.

Source: Yahoo Finance

Source: Yahoo Finance

The chart shows that SPOT has not reported a profit over the past four consecutive quarters and has only beat analyst estimates once. SPOT will report Q1 2021 EPS on April 28. The consensus estimate is for another loss of 49 cents per share.

Source: Yahoo Finance

Source: Yahoo Finance

The revenue trend is positive, but SPOT continues to lose money, with losses rising from 2018 through 2020. A survey of twenty-one analysts on Yahoo Finance has an average price target of $321.02 for SPOT, with forecasts ranging from $200.01 to $428.03.

Source: Barchart

Source: Barchart

After reaching a record high of $387.44 on February 22, SPOT shares have made lower highs and lower lows and were at the $279.20 level on April 9.

Shopify (SHOP) has a better record

SHOP market cap was nearly three times Spotify’s (SPOT) at the end of last week. At the $1227.30 per share level, SHOP had an over $150 billion market cap. SHOP is a cloud-based e-commerce platform that competes with AMZN. The Canadian company trades an average of roughly 1.22 million shares each day.

Source: Yahoo Finance

Source: Yahoo Finance

SHOP makes money. The company has reported positive EPS and beat analyst estimates over the past four consecutive quarters. Analysts currently expect EPS of 71 cents when the company reports in early May.

Source: Yahoo Finance

Source: Yahoo Finance

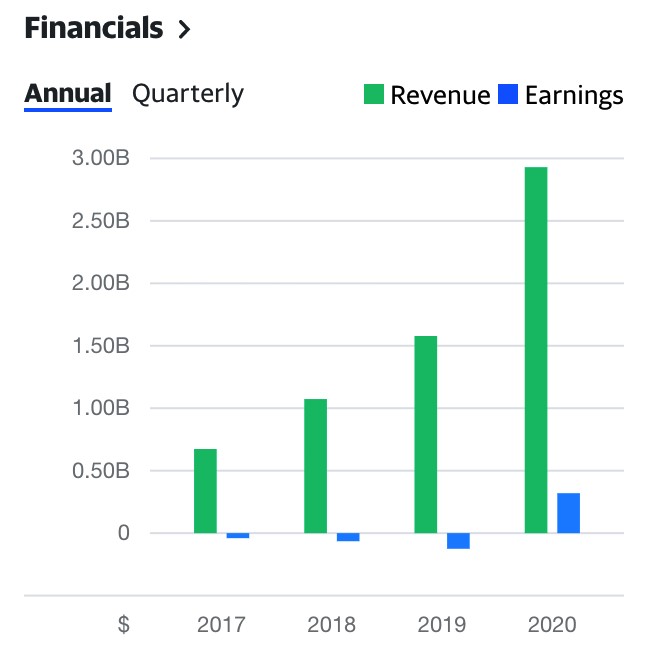

SHOP’s revenue trend has been positive from 2017 through 2020. Earnings had been trending lower from 2017 through 2019, but the company turned the corner in 2020 and began to profit. A survey of thirty-three analysts on Yahoo Finance has an average price target of $1438.50 for SHOP shares, with forecasts ranging from $800 to $1900.

Source: Barchart

Source: Barchart

SHOP shares reached a high of $1499.75 on February 10, 2021 and pulled back to the $1227.30 level on April 9.

Caution in technology as we head into Q2

SPOT, the music streaming company and SHOP, the e-commerce enterprise, are very different businesses. However, both have benefited from the flood of capital into the technology sector. I favor SHOP as the company is putting up profits. At the end of last week, SPOT shares were 27.9% lower than the all-time February high, while SHOP was 18.2% lower. The corrections since February favor the company that is justifying its share price with earnings.

If technology stocks are heading for a correction, choosing companies with positive revenue and earnings trends could cushion any blow to the sector. Bull markets tend to move to prices that can be illogical, unreasonable, and irrational. Gravity can be a powerful force and will weigh heavily on those companies that have not proven they can make money during the next correction.

Want More Great Investing Ideas?

SHOP shares were trading at $1,202.74 per share on Monday morning, down $24.56 (-2.00%). Year-to-date, SHOP has gained 6.25%, versus a 10.29% rise in the benchmark S&P 500 index during the same period.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SHOP | Get Rating | Get Rating | Get Rating |

| SPOT | Get Rating | Get Rating | Get Rating |