- Lots of volatility in digital currencies

- Cyber street versus governments

- Tesla makes a $1.5 billion statement

- Square adds another $170 million to its $50 million initial purchase- Averaging up in Bitcoin

- These companies are making a bet

Tesla (TSLA - Get Rating) and Square (SQ - Get Rating) are technology stocks. TSLA has not only captured the EV market, but it has also become the automaker with the highest market cap in the world, with over 2.70 times the value of second-place Toyota (TM). SQ is one of two companies founded and run by Jack Dorsey. Mr. Dorsey is also the CEO of Twitter (TWTR - Get Rating), the controversial social media platform.

While TSLA, SQ, and TWTR are far different businesses, they all qualify as technology stocks. Meanwhile, that is not the only thing that TSLA and SQ have in common these days. Both companies have made substantial investments in Bitcoin and are accepting digital currencies as an alternative to traditional fiat currencies.

Tesla is now a carmaker, a revolutionary green energy EV pioneer, and a cryptocurrency play. Elon Musk is an engineer, visionary, and technology leader with at least two other emerging companies that will revolutionize travel. SpaceX is sending rockets into the sky while the Boring Company is tunneling under the earth to address pollution caused by traffic jams in major cities.

Square is a payments company that is embracing the cryptocurrency revolution. As Mr. Dorsey faces increasing pressure over Twitter’s media platform, he is quietly taking on the governments with his payments business by endorsing novel currency instruments that threaten the current control of the money supply.

TSLA and SQ’s investments in Bitcoin add another dimension to the company’s attraction for investors as they offer exposure to one of the greatest bull markets in history, Bitcoin. Warren Buffett calls Bitcoin “financial rat poison squared,” and Charlie Munger has said he doesn’t know what is worse, “Bitcoin at $50,000 or TSLA’s market cap at $1 trillion.” Musk and Dorsey, two visionaries, see the world differently. Their technology companies are on a path that could be extremely volatile over the coming months and years.

Lots of volatility in digital currencies

After making a high at $58,610 per token on February 22, Bitcoin’s price slipped. Ethereum, the second-leading cryptocurrency and the only other that trades on the futures exchange, moved to a peak of $2,012 on February 19 and was below the $1550 level at the end of last week.

Volatility in markets creates a paradise of opportunities for nimble traders with their fingers on the pulse of markets. However, high levels of price variance can be a nightmare for investors.

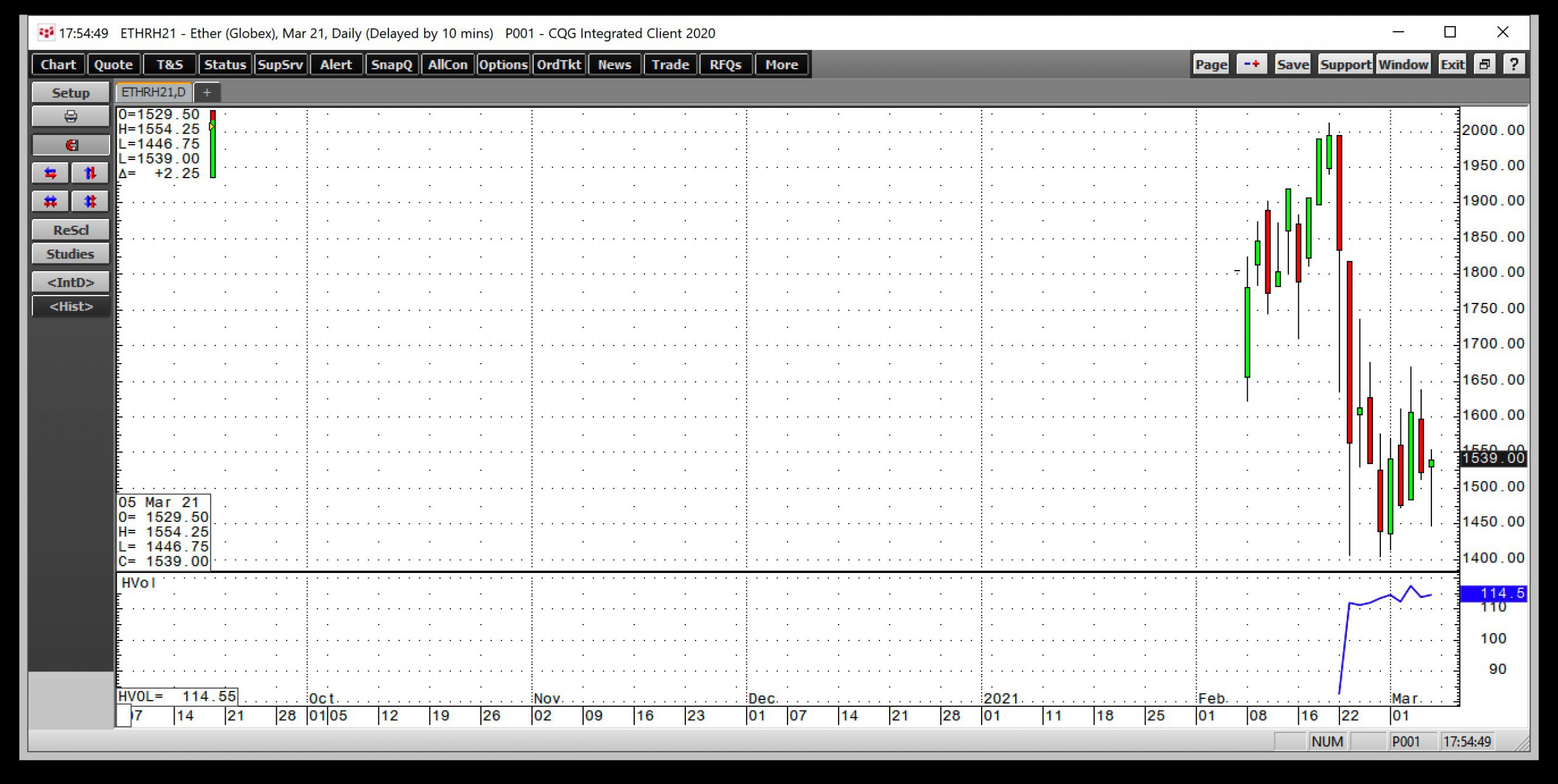

Source: CQG

Source: CQG

The daily chart highlights that daily historical volatility was at the 100.4% level in the Bitcoin futures market.

Source: CQG

Source: CQG

Daily price action in Ethereum futures had the metric at 114.5% as of Friday, March 5.

Bitcoin has attracted some high-profile investors over the past months. When volatility is rising with the price, the investments are looking golden. However, corrections can be nerve-wracking for investors with hundreds of millions or billions of dollars at risk.

Cyber street versus governments

We have all heard about the ongoing conflicts between Wall Street and Main Street that began with the 2008 global financial crisis. The financial press continues to stoke the conflict between the “Wall Street Elite” and the “Main Street Rebels” with stories about Reddit, Robinhood, and squeezing shorts in GameStop (GME) and other stocks with substantial short interest. Meanwhile, the financial arena’s real story is the declining faith and credit of central banks and governments. Over the past months, the US bond market has been dropping despite quantitative easing that amounts to $120 billion in monthly asset purchases.

Moreover, a parabolic bull market in the burgeoning digital currency asset class is a direct challenge to the status quo when it comes to controlling the money supply. Bitcoin, Ethereum, and the other over 8,650 digital currencies are beyond central bank and government control. “Wall Street versus Main Street” is a media smokescreen for “Cyber Street versus Governments.”

Cryptocurrencies are children of technology. Technology leaders are embracing the digital means of exchange instruments while central bankers, traditional economists, and politicians are far behind the eight-ball. The rise of tokens is the fall of fiat money. Some of the brightest innovators of our lifetime support “Cyber Street,” which is a rejection and challenge to the financial status quo.

Tesla makes a $1.5 billion statement

On February 8, TSLA filed with the SEC that it purchased $1.5 billion worth of Bitcoin. Aside from the filing, TSLA announced it would accept Bitcoin as a payment method for its EV products.

After reaching a high of $43,650 per token on January 8, 2021, the leading digital currency fell back just below the $30,000 level in late January. On Friday, February 5, Bitcoin was at the $38,470 level. Some of the selling came on the back of comments by the European Central Bank President Christine Lagarde and US Treasury Secretary Janet Yellen.

The government officials expressed concern about the nefarious uses of cryptocurrencies in areas like money laundering and the international drug trade and called for regulations. Meanwhile, concerns about the rise of digital currencies are more likely because of the challenge they pose to control of the global money supply. Controlling the world’s purse strings is a critical factor for maintaining political and economic power over citizens.

Tesla’s announcement on February 8 lit a bullish fuse under Bitcoin, pushing the cryptocurrency’s price to a high of $58,610 on February 22.

Elon Musk had been tweeting about Bitcoin, Dogecoin, and other cryptocurrencies. The tweets by one of the world’s most respected innovators and entrepreneurs have supported the prices. When Mr. Musk put his money where his mouth is, Bitcoin soared to a new peak.

TSLA is now a fintech and digital currency play given its Bitcoin investment. The company is also a carmaker, clean energy, and a technology stock. When it comes to value, Mr. Musk is pushing all of the most high-profile buttons.

Square adds another $170 million to its $50 million initial purchase- Averaging up in Bitcoin

Jack Dorsey maintains a much lower profile than Elon Musk. Mr. Musk is CEO at three companies, but only one is publicly traded. Mr. Dorsey is the CEO and founder of two high-profile public companies, SQ and TWTR.

In September 2020, when Bitcoin was around the $11,000 per token level, SQ announced a $50 million investment in the digital currency, saying it would begin processing payments in the cryptocurrency. The initial $50 million more than quadrupled in value when Mr. Dorsey’s SQ decided to average up. In late February, the company invested another $170 million, increasing its average purchase price to around the $25,000 level. SQ now owns 8,807 Bitcoins. At the $52,000 level at the end of last week, its stash is worth a cool $458 million. Not bad for a $220 million investment that was first made only six months ago.

These companies are making a bet

At the end of last week. Square’s market cap was at the $98.397 billion level, so the Bitcoin investment is under one-quarter of one percent. Tesla’s market cap was at the $573 level, so its digital currency investment is near SQ’s on a percentage basis.

While the investments are high-profile, support the digital currency asset class, and are a direct challenge to the political and economic status quo, they represent a very tiny percentage of their company’s market caps. Mr. Musk and Mr. Dorsey are no strangers to controversy or rocking the boat with disruptive technologies. It is clear which side of the “Cyber Street versus Governments” standoff the two innovators support.

It has been a mistake to bet against either Elon or Jack. Their companies will now attract new investors that view the stocks as fintech, and a Bitcoin play in addition to their underlying successful businesses.

Elon Musk and Jack Dorsey are the poster boys for disruptive technology. Expect both to continue rocking the boat to upset the status quo.

Want More Great Investing Ideas?

9 “MUST OWN” Growth Stocks for 2021

How to Ride the 2021 Stock Market Bubble

5 WINNING Stocks Chart Patterns

K.I.S.S. for the March Stock Market

TSLA shares were trading at $586.24 per share on Monday afternoon, down $11.71 (-1.96%). Year-to-date, TSLA has declined -16.92%, versus a 3.18% rise in the benchmark S&P 500 index during the same period.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| TSLA | Get Rating | Get Rating | Get Rating |

| SQ | Get Rating | Get Rating | Get Rating |

| TWTR | Get Rating | Get Rating | Get Rating |