- Gasoline is a seasonal commodity, and it is now in the offseason

- Distillate products are year-round fuels despite following heating oil, a product that implies strength during the coldest months

- Valero Energy Company (VLO) follows refining spreads and is trading at a bargain-basement price

- Marathon Petroleum Corporation (MPC) is a processing company that also follows crack spreads and reflects their low levels going into the winter season

The price of crude oil has been sitting at the $40 per barrel level since June. Crude oil remains the energy commodity that powers the world. Consumers all over the world require crude oil each day. They drive cars powered by gasoline. They fly on airplanes and ride on other modes of transportation powered by fuels. They purchase goods that come to the market by modes of transport that require diesel and other fuels. We are all direct or indirect consumers of crude oil in our daily lives.

Few people purchase crude oil directly. However, purchases of oil products are commonplace. Crude oil moves from production points to refineries that process the fossil fuel into gasoline and distillate products. Exploration and production companies have a direct interest in the price of crude oil. The higher the price of the energy commodity rises, the more money they tend to earn. During bearish markets, capital costs cause them to lose money when the price of petroleum drops below its production cost.

Refineries buy crude oil at market prices. Therefore, they have no exposure when it comes to high or low prices. They sell the products at market prices without exposure to the level. However, refineries take a significant risk when it comes to the margin between the input and the output or the refining spread. Whether you hear it called the refining margin, processing, or crack spread, it is all the same.

The differential serves as a real-time indicator for refinery earnings and a barometer for the demand for crude oil, which is the primary input in the process. Higher crack spreads lead to more demand for crude oil. They also create higher profit levels for those companies that process crude oil into products. Valero Energy Corporation (VLO - Get Rating) and Marathon Petroleum Corporation (MPC - Get Rating) are two of the US’s leading five oil refiners. The other three are Exxon Mobile (XOM - Get Rating), Phillips 66 (PSX), and Chevron Corporation (CVX - Get Rating). The crack spreads and overall weakness in oil-related shares have been weighing on VLO and MPC share prices.

Gasoline is a seasonal commodity, and it is now in the offseason

As we are now halfway through October, it will not be long before the cold winds of winter begin to blow. The coming months are the offseason for gasoline demand as the number of pleasure trips decline.

The gasoline crack spread tends to move lower during the winter months, reflecting the demand for the energy product. However, in 2020, the price of the processing spread is substantially lower in mid-October as it was at the same time in 2019.

Source: CQG

As the chart highlights, the gasoline refining spread was trading at the $8.15 per barrel level on Friday, October 16. At this time in 2019, the range in the crack spread was from $13.47 to $15.07 per barrel. The odds favor a continuation of lower levels in the gasoline processing spread over the coming weeks and months based on seasonal factors.

Distillate products are year-round fuels despite following heating oil, a product that implies strength during the coldest months

While the heating oil crack spread’s name implies strength during the winter months, it is also a proxy for other distillate products like diesel and jet fuels. Therefore, the processing spread for distillates displays far less seasonality than the gasoline crack spread. Meanwhile, the heating oil crack spread was trading at less than one-third the level at the same time in 2019 at the end of last week.

Source: CQG

On Friday, October 16, the distillate processing spread was at the $8.61 per barrel compared to a range from $26.71 to $28.42 in mid-October 2019.

The bottom line is that refining crude oil into oil products is suffering under the weight of processing spread levels.

VLO and MPC are leading oil refiners in the United States. Their shares are trading at very low levels because of the weakness in refining margins. The demand for oil products will eventually return, making the current share levels a compelling value.

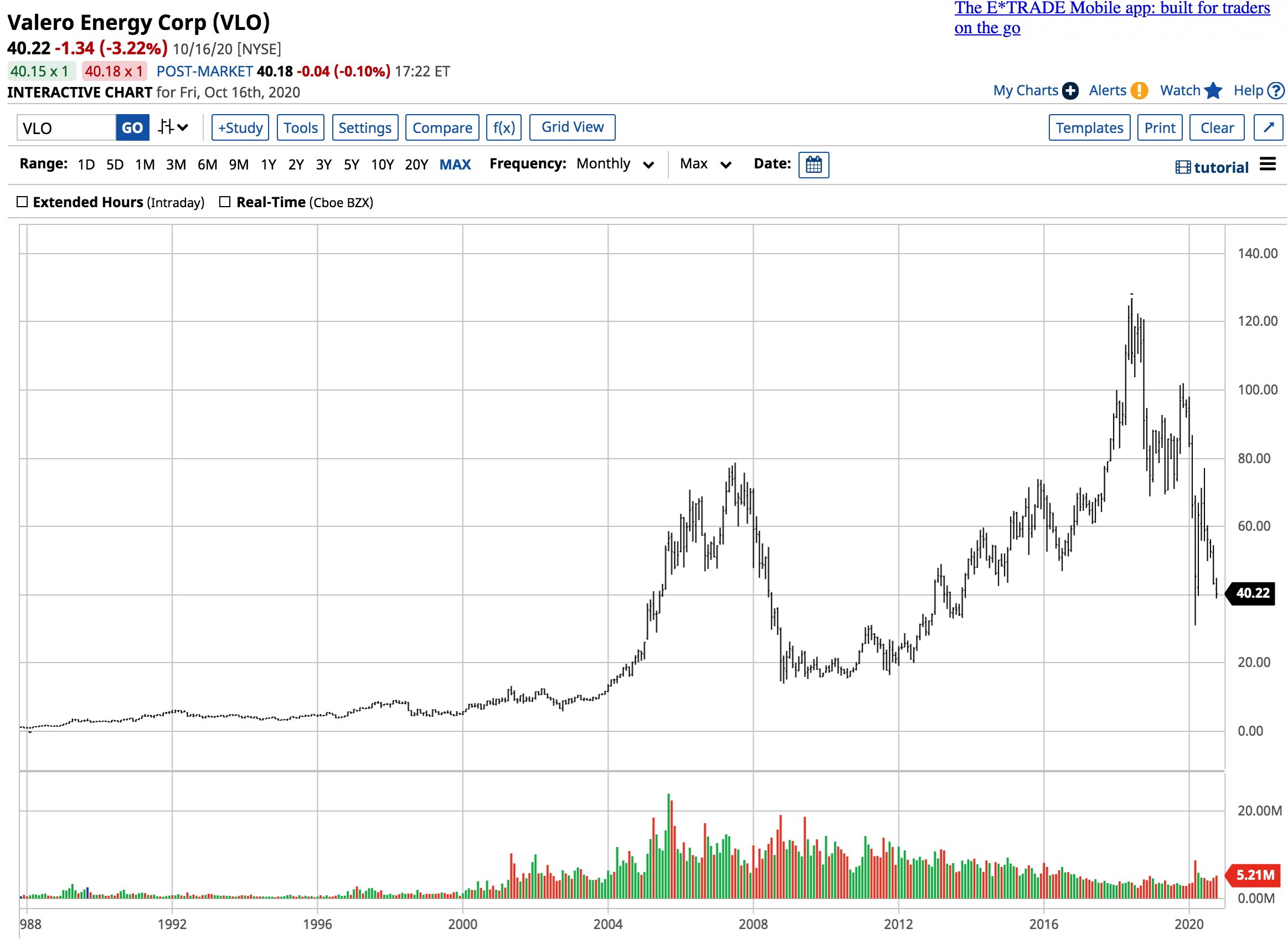

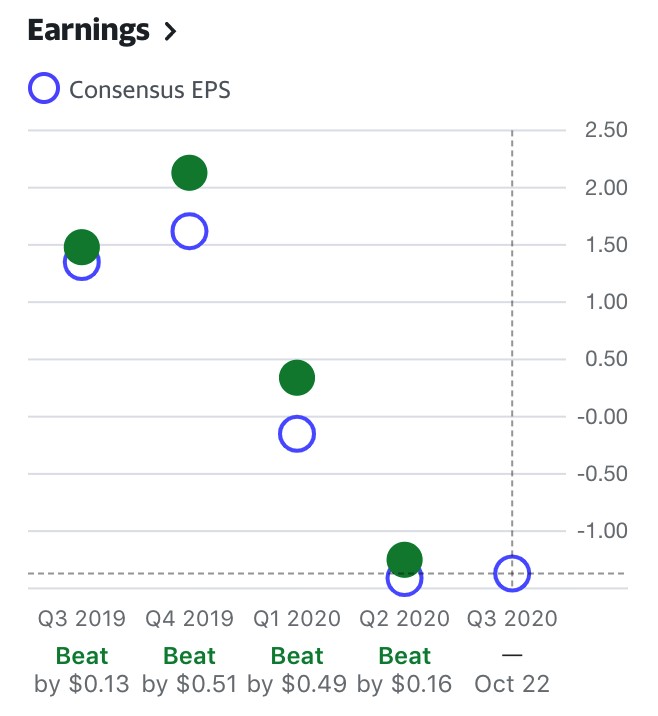

Valero Energy Company follows refining spreads and is trading at a bargain-basement price

VLO shares closed at $40.22 on October 16. The company has a market cap of $16.4 billion and trades an average of 4.36 million shares each day. The $3.92 dividend equates to a 9.75% yield on the stock. While the company could cut or eliminate the dividend in the current environment, VLO is likely to survive and make a comeback in the aftermath of the global pandemic that has weighed on oil product demand.

Source: Barchart

In October 2019, the low in VLO shares were at $81.30. At half the price in 2020, the company that refines crude oil into gasoline and other oil products has suffered as processing spreads have declined.

Source: Yahoo Finance

VLO has a consistent record of beating analyst EPS projections over the past four quarters. After losing $1.25 per share in Q2, the current estimates are for the company to lose $1.37 in Q3. VLO will report Q3 earnings this week on October 22. A survey of eighteen analysts on Yahoo Finance has an average price target of $65.61 per share, ranging from $48 to $83. At $40.22, the stock is almost $8 below the low end of the band and over $25 below the price target.

VLO is trading at a bargain price. For value investors who believe that crack spreads will eventually move higher, VLO offers a compelling opportunity.

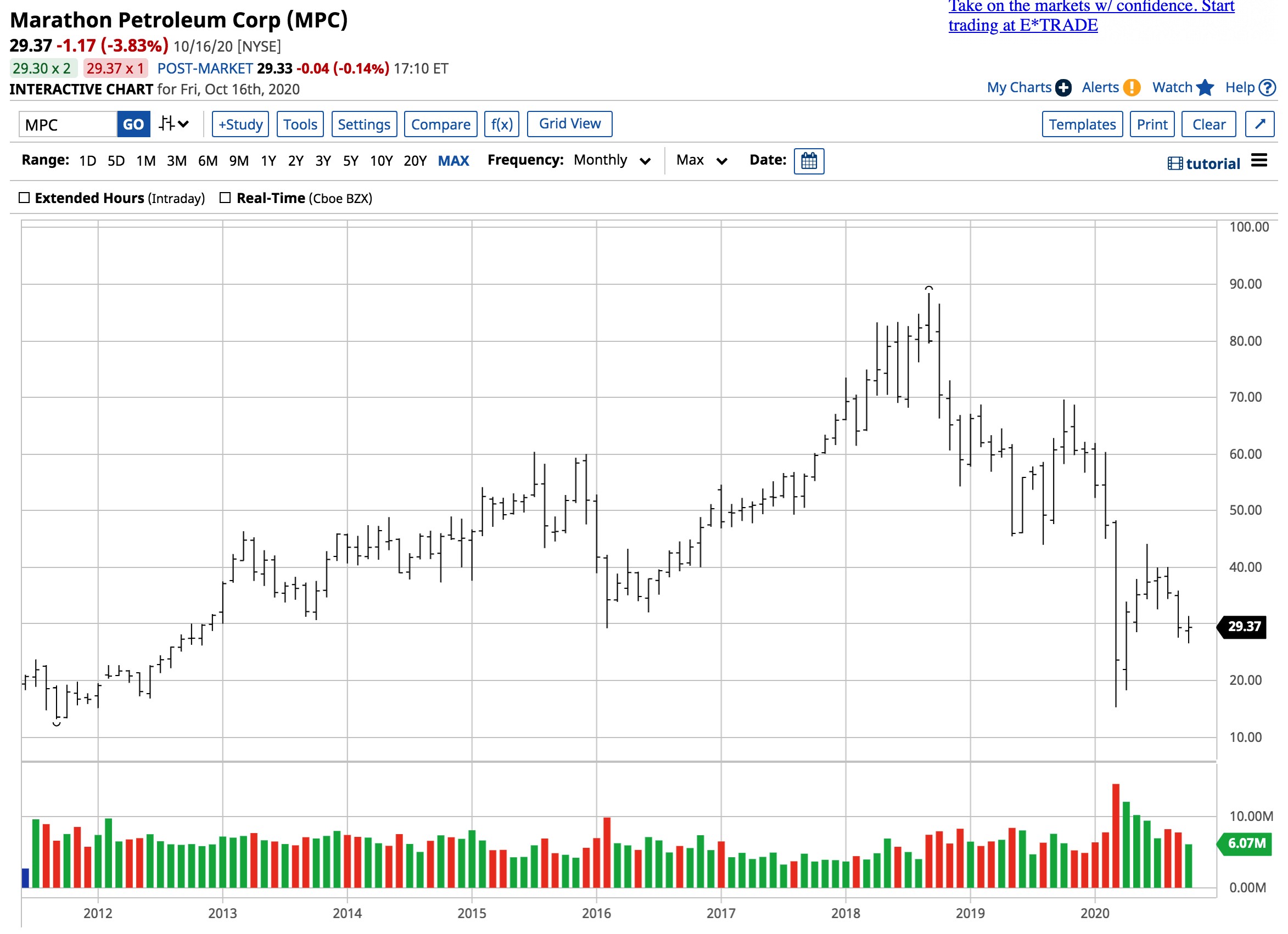

Marathon Petroleum Corporation is a processing company that also follows crack spreads and reflects their low levels going into the winter season

MPC shares closed at $29.37 at the end of last week. The company has a market cap of $19.111 billion and trades an average of over 7.3 million shares each day. The $2.32 dividend equates to a 7.90% yield on the stock. MPC could also decide to lower or eliminate the dividend, but the stock also offers incredible value at its current level.

Source: Barchart

In October 2019, the low in MPC shares were at $58.24. At under half the price in 2020, MPC is another refiner that continues to feel the impact of the low level of refining spreads.

Source: Yahoo Finance

Like VLO, MPC has a solid record of beating analyst EPS projections over the past four quarters. After losing $1.33 per share in Q2, the current estimates are for the company to lose $1.43 in Q3. A survey of fourteen analysts on Yahoo Finance has an average price target of $46.14 per share, ranging from $32 to $66. At $29.37, the stock is $2.63 below the low end of the band and over $16 below the price target. MPC will report its third-quarter earnings on November 2.

Crack spreads reflect the demand problems that continue to face the oil product markets. An end to the global pandemic in 2021 could boost refining margins and VLO and MPC shares. In a stock market where value is challenging to locate, these two companies offer both the potential for substantial growth and high dividend levels. Even if the yield goes to zero because of an extended period of pressure in refining margins, the potential for capital growth is reason enough to consider adding these companies to your portfolio.

Want More Great Investing Ideas?

Top 11 Picks for Today’s Market

7 Best ETFs for the NEXT Bull Market

5 WINNING Stocks Chart Patterns

VLO shares rose $0.08 (+0.20%) in premarket trading Monday. Year-to-date, VLO has declined -54.93%, versus a 9.86% rise in the benchmark S&P 500 index during the same period.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| VLO | Get Rating | Get Rating | Get Rating |

| MPC | Get Rating | Get Rating | Get Rating |

| XOM | Get Rating | Get Rating | Get Rating |

| Get Rating | Get Rating | Get Rating | |

| CVX | Get Rating | Get Rating | Get Rating |